How they describe themselves: HelloWallet is a provider of independent, technology-based wealth-boosting services to employees of Fortune 500 companies and other large institutions. We help our members confront a wide variety of financial challenges, including how to boost savings contributions and debt payments, set appropriate goals, and select the right savings vehicles suited to their needs. Over an average of 3 months, we have achieved take-up rates 5x those of existing financial advice providers, found an average of $1,200 in savings for our members, and increased net wealth by $2,135, an equivalent of a 3% raise.

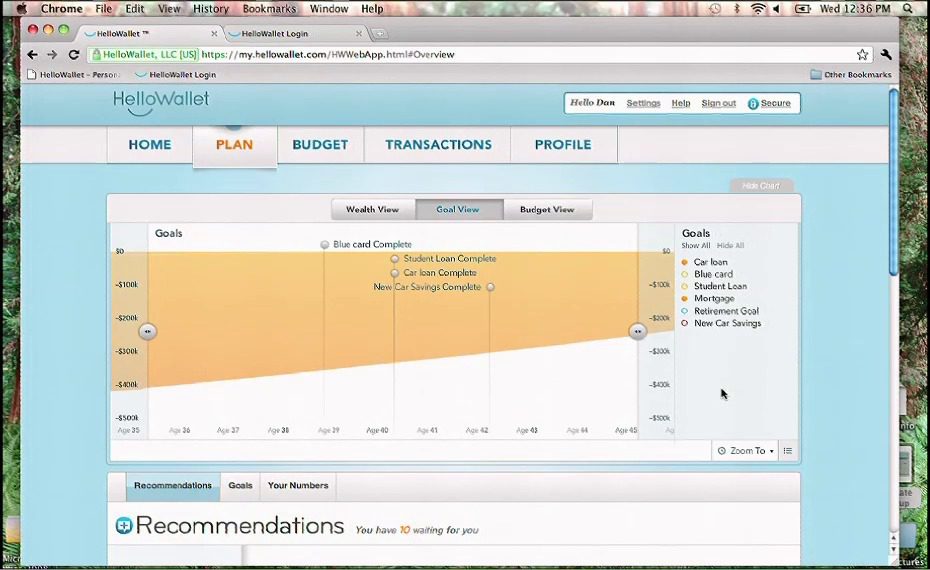

How they describe their product/innovation: HelloWallet is demoing the artificial intelligence we’ve developed to proactively influence and improve our members’ financial behavior. Using multi-imputation simulation technology, a stochastic optimization model, and research-informed behavioral strategies, HelloWallet provides its members with individualized, practical guidance to drive up savings and reduce debt. We will also showcase our data visualization technology that enables members to view their entire financial future, including important milestones, net wealth at different life-stages, and the future values of all of their assets and liabilities.

Contacts:

Bus. Dev., Sales: Hall Kesmodel, Head of Business Development, [email protected], 202-558-4649

Press: Geraldine Le Roux, Marketing Manager, [email protected], 202-558-4354