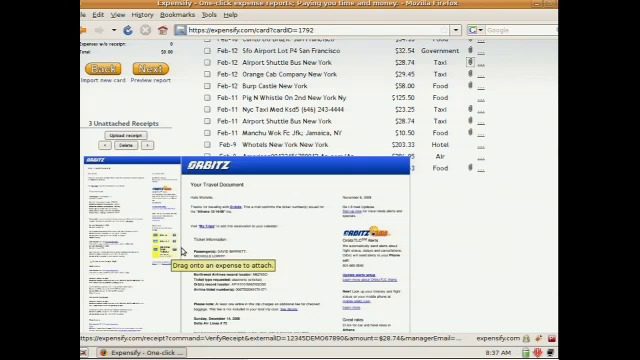

How they describe themselves: Expensify does expense reports that don’t suck. We do this by importing expenses *and receipts* directly from your credit card, submitting one-click PDF expense reports via email, and reimbursing entirely online, all for free. Core features include automatic importing for 92% of US credit cards, Expensify Guaranteed eReceipts (IRS-ready, paperless receipts) for imported expenses, and electronic reimbursement from or to any checking account or credit card. And last but not least, we offer the award-winning Expensify Prepaid MasterCard(r), “the corporate card for everyone else”. All these features, and did we mention it’s free?

What they think makes them better: Expensify has without question the most comprehensive paperless receipt solution available. We start with Expensify Guaranteed eReceipts for imported expenses, meaning you can literally throw away 80% of the paper receipts stuffed into your pockets. For the remaining email receipts, simply forward to [email protected] and we’ll permanently archive as full-color PDFs. And for those few paper receipts that remain, just take a picture with your cameraphone and send it in. Whether eReceipts or card importing or our clean UI, Expensify’s core focus is not on the back office, but on people who file expense reports and hate them.

Contacts:

Bus. Dev., Sales & Press: David Barrett, Founder, [email protected], 801-860-0540

How they describe themselves: If you follow the news you know consumer debt is the biggest social challenge facing America today, affecting 45% of households. You may also think you know the best solutions to help these borrowers, but you’d be wrong. Contrary to popular belief, for most people the biggest challenges to getting out of debt aren’t insufficient cash flow, high interest rates, or lack of a spending plan. The biggest challenges that borrowers face are the complexities of tracking 10-30 debt accounts and creating and following a pay-down plan. DebtGoal.com, is the only online tool that meets these borrower needs, enabling users to organize their debt and create and track a personalized, dynamic debt reduction plan. To simplify this process and to save time, DebtGoal automates two of the most time-consuming steps: updating financial information and making payments. We recognize that nothing ever goes strictly according to plan, so the DebtGoal program dynamically changes to accommodate real world events like credit card slip-ups or missed payments. In addition, DebtGoal.com is the only solution to provide personalized recommendations to accelerate debt reduction by advising them how to negotiate lower rates with lenders, restructure debt, and find sources of cash. Customers following the DebtGoal program can save tens of thousands of dollars in interest by optimizing payments, without paying more than they do today.

What they think makes them better: DebtGoal.com is the only company focused on addressing the most pressing goal (according to CNN) of the massive lower / middle financial market of Americans that fall into the unprofitable and unaddressed market space between financial distress (debt settlement, credit counseling, or bankruptcy) and mass affluence with investable assets. DebtGoal.com combines a unique blend of finance and behavioral psychology to build an application that is fun to use, teaches positive behavior, and improves rather than destroys a user’s credit.

Contacts:

Bus. Dev. & Sales: Steve Richmond, [email protected], 415-722-9018

Press: Jackie Volovich, Matter Communications, 415-984-6281, [email protected]

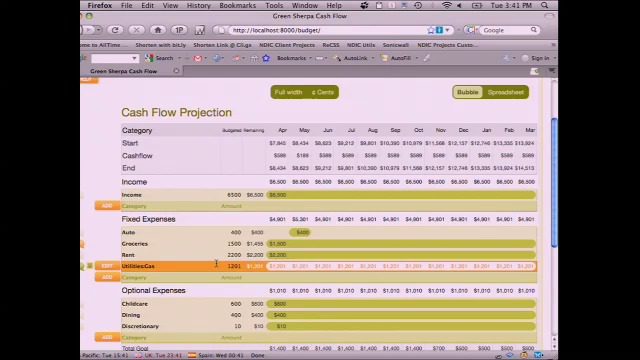

How they describe themselves: Green Sherpa is remaking the online personal financial management market with a product that is forward looking, answering in real time the questions “how am I doing and can I afford this.” In this current economic environment, where individuals and families are stressed about their financial health, Green Sherpa is the product to bring clarity and peace of mind to consumers. The initial target market is mid-income households that bank online. In the U.S., 70% of the time, women are managing the household finances. In other countries, this percentage is higher.

What they think makes them better: Green Sherpa addresses the problems that other financial management applications ignore: the consumer’s financial future. Current solutions, including Quicken, Money and Mint, focus on financial recordkeeping. They can tell you where you’ve been but they lack good tools for helping you figure out where you are going financially. Financial peace-of-mind can only come when you know that you are all set for next month or the next year. Green Sherpa has all the features to track financial history, but it is the only application that offers Personal Cash Flow Management and online collaboration with a spouse or trusted advisor.

Contacts:

Bus. Dev. & Sales: Masen Yaffee, CEO, [email protected]

Press: Erin Lozano, COO, [email protected]

How they describe themselves: Home-Account is an intelligent web-based mortgage buying subscription service helping America’s 75 million homeowners take control of their largest asset and use it to insure their financial security. The service grades and analyzes the homeowner and their mortgage, presents scenarios to improve their mortgage and then pinpoints the best realistic mortgage option in the market.

What they think makes them better: Home-Account provides “always on” information on the best mortgage for you, as well as your credit score and overall financial health for a minimal fee. The web-based services grade and analyze the homeowner and his/her mortgage and presents scenarios to improve their financial situation’s impact on their mortgage. The product pinpoints the best and most realistic mortgage options that each consumer qualifies for and recommends which mortgage is best. Ongoing Home-Account membership is easy. You enter your profile, answer a questionnaire and respond to ongoing personalized alerts, which include specific suggestions for best lenders and rates to finance with.

Contacts:

Bus. Dev. & Sales: Mark H. Goldstein, CEO, [email protected], 888-439-0222

Press: Brooke Hammerling, Brew Media Relations, [email protected], 212-677-4835

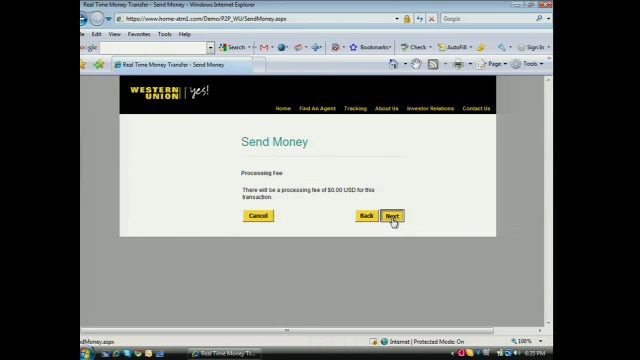

How they describe themselves: HomeATM is a suite of payment solutions that uniquely offers home-based “card present” credit card and PIN debit transactions. HomeATM owns a global patent for secure real time money movement. Leveraging our end-to-end encrypted PCI certified solution, a merchant or remitter could move funds from their bank account or open loop/closed loop payment card in real time –literally seconds. Utilizing HomeATM’s solution with a bank issued card (PIN debit or credit) removes the KYC/AML obligations as our methodology leverages the issuing bank’s KYC/AML protocol. No other payment solution can do P2P, B2B, and Mobile with the speed, security and cost effectiveness as HomeATM and HomeATM Mobile. HomeATM is EMV ready.

What they think makes them better:

- Hardware based End-to-End Encryption.

- 100% acceptance with all bankcards.

- Bank and Processor agnostic.

- Issued Patent for PIN on the Web.

- Mobile ready.

- Processes card present credit card and PIN Debit

- PCI certified device

Contacts:

Bus. Dev.: Mitchell Cobrin, COO, [email protected], 514-207-5000

How they describe themselves: OurCashFlow provides innovative and intuitive solutions for financial institutions who want to provide their customers personal and business financial management tools from their online banking site. OurCashFlow’s solutions helps financial institutions increase deposits, differentiate their offerings, reduce the cost of cross- selling efforts, and build deeper relationships with their customers.

What they think makes them better: OurCashFlow is the only PFM solution that actually teaches users how to create a budget. Highly accurate, automated transaction categorization significantly reduces the amount of effort users need to put into managing their finances.

Contacts:

Bus. Dev. & Sales: Conor Keane, CEO, [email protected], 303-618-1805

Press: Donna Tellam, marketing / Product Management, [email protected], 303-521-2426

How they describe themselves: Victrio is bringing to market advanced anti-fraud technologies that provide fraud managers with an unprecedented level of visibility into their fraud problem. Victrio´s technology is the only technology that can tie fraud attempts back to the person committing the fraud, and then provide warning when that person enters the customer´s fulfillment or account opening process. Because of this enhanced visibility into potential fraudsters, Victrio´s technology can help fraud managers deliver unprecedented fraud savings, reduce agent phone time and turn away fewer legitimate customers.

What they think makes them better: Many apparently unrelated fraud attempts are in fact perpetrated by the same person. Victrio’s proprietary patent-pending technologies allow customers to stop thousands of fraudsters – and allows Victrio to build the world’s largest database of fraudster voiceprints. By participating in the Victrio network, customers benefit by knowing who to stop before that fraudster attacks them.

Contacts:

Bus. Dev., Sales and Press: Tony Rajakumar, CEO, [email protected], 650-961-5290

How they describe themselves: FiLife debuted in June 2008 devoted to helping consumers solve their personal finance problems. FiLife combines community reviews, expert advice and a robust directory of financial products to give users a comprehensive, fun and informative experience. We are introducing a new, revolutionary tool that gives you unprecedented ability to swiftly sort and filter thousands of financial products to find the one that offers the best value to you. FiLife is a joint venture between Dow Jones and IAC, who have committed a substantial amount of capital, as well as their expertise and resources.

What they think makes them better: FiLife provides the most comprehensive directory of financial products with community ratings and reviews. The site also has authoritative experts who can provide personalized advice as well as vital content from our partners at The Wall Street Journal, MarketWatch and Barron’s. The site has fun and powerful tools that help you diagnose your financial life and find the best financial product for your situation.

Contacts:

Bus. Dev.: Dan Martin, Director of Business Development, [email protected], 212-293-4753

Press: Dave Kansas, President, [email protected], 212-293-4760

Sales: Kevin Van Lenten, VP, Lead Generation & Sales, [email protected], 212-293-4758

How they describe themselves: Fiserv provides information management and electronic commerce systems and services to businesses in two primary areas:

- Financial – Fiserv provides a comprehensive solution set of information technology products and services for banks, credit unions, leasing companies, lenders and savings institutions in the United States and throughout the world.

- Insurance – Fiserv offers specialized technology and services for the life, property and casualty, and workers’ compensation segments of the insurance industry.

What they think makes them better: MyMoney leverages Facebook’s Web 2.0 technologies and viral marketing capabilities to attract and retain account holders, and helps position the financial services industry to compete in tomorrow’s market. With MyMoney, prospects can easily search for and join a new financial institution online in a matter of minutes, directly from Facebook. Then, MyMoney leverages the viral marketing capabilities inherent in Facebook to notify the user’s friends of their actions. Existing account holders can conveniently manage their finances directly from Facebook. MyMoney gives the financial industry access to over 100 million people.

Contacts:

Bus. Dev.: David Reed, 248-828-1383, [email protected]

Press: Kirsten Gardner, 248-828-1409, [email protected]

Sales: Scott Bowen, 248-813-6773, [email protected]

Due to problems with this company’s demo, we are unable to show you this video. Please check out their website.

Contacts:

Bus. Dev., Press & Sales: Shashank Pandit, CTO, [email protected]

How they describe themselves: Expensr is a free online service that tracks users’ budget and spending habits, then shows them how they’re doing compared to their peers.

What they think makes them better:

Emphasis on community, customizable widget based structure of the interface and ease of use.

Contacts:

Business Dev., Press & Sales: Alla Oks, Marketing Director, [email protected]

How they describe themselves: Facilitas helps banks and CUs acquire customers, improve on-boarding experiences and build better customer relationships. Clients can have their accounts included in our search engine and customize their account-specific pages in our search results.

BankSwitcher helps people switch their automated transactions. Clients can leverage BankSwitcher in promotions on our search engine, point new customers to a co-branded websites and embed customized versions of BankSwitcher into their websites. Our search results are based on users’ zip codes, feature preferences and answers to a few questions about how they bank. We use these data to help clients understand why they win and lose business.

What they think makes them better: Our search engine is the only bank comparison tool that helps people find a new “everyday” bank or CU. We enable users to compare branch locations, interest rates, 12 different features and over 20 types of fees for each account. Users’ search criteria and actions are aggregated to help bankers “tune-in” to their market(s).

BankSwitcher is the only tool that addresses the #1 reason people don’t switch banks – it’s time-consuming to switch direct deposits, automatic withdrawals and online bill pay. We identify items to switch from a users’ banking activity and match it to our proprietary database of switching instructions and forms. We provide a Switching Checklist so consumers can easily migrate these items to a new bank.

Contacts:

Bus. Dev., Press & Sales: Rob Rubin, CEO, [email protected], 212-738-9396