There is no video available for this presenter.

Contacts:

Bus. Dev., Press & Sales: Greg Isenberg, CMO, [email protected], 514-755-4679

Finovate is part of the Informa Connect Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

There is no video available for this presenter.

Bus. Dev., Press & Sales: Greg Isenberg, CMO, [email protected], 514-755-4679

How they describe themselves: Afiniate transforms mobile banking applications into mobile engagement platforms. Current mobile banking applications miss the boat. Customers want more than the ability to view balances and transfer funds, and banks want to leverage the mobile channel to better engage and upsell their customers. Afiniate proactively provides a customer with guidance and advice from their bank to achieve their financial goals and provides the bank with the ability to upsell and cross-sell their products and services based upon the information that they know about the customer.

How they describe their product/innovation: OnTheGo! transforms a generic mobile banking app into a pocket-sized Personal Finance Coach through the concept of Engagement Through Action. OnTheGo! augments the existing mobile capabilities with personalized Calls to Action that are tailored to each customer’s specific financial goals and situation. Each Call to Action provides contextual guidance, advice, and recommendations based upon the bank’s products and services to resolve the situation directly from the customer’s smartphone. In addition, OnTheGo! allows banks to direct specific upselling and cross-selling messages to the customer based upon the customer’s profile, preferences, or financial situation.

Bus. Dev.: Ram Singh, Co-Founder, [email protected], 202-957-3102

Press & Sales: David Singh, Co-Founder, [email protected], 415-297-0120

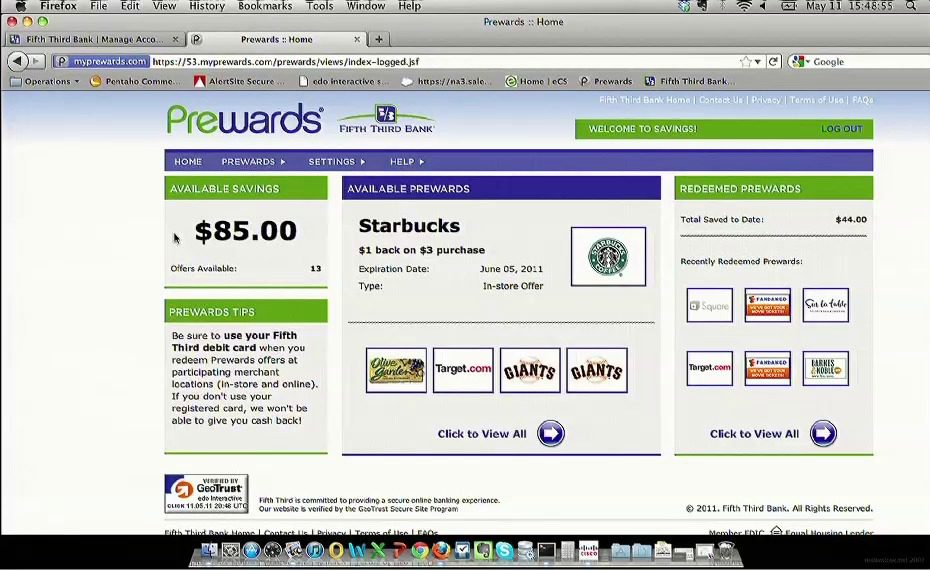

How they describe themselves: edo Interactive is a technology company that leverages a unique consumer experience and a robust data asset (built on consumer transactions) to transform the deals and incentives marketplace for consumers and merchants of all sizes. edo provides consumers instantly redeemable, personalized offers, and empowers merchants with targeted audiences and transaction-driven insights that drive relevance and results.

How they describe their product/innovation: Prewards are the first and only digital incentives linked to consumers’ payment cards (or mobile wallet) where the incentive can be redeemed in real-time without POS integration (or training) for the merchant. There is no friction at the POS – no clipping, no printing, and no need to hand a smartphone to a clerk. Consumers simply swipe their card (as they do now) at the POS, and within seconds receive confirmation of their redemption (and have funds deposited into their account).

Bus. Dev.: Alex Gershman, General Manager, Strategic Partnerships, [email protected], 615-297-6080 x135

Press: Jonathan Dyke, COO, [email protected], 615-297-6080 x130

Sales: Mark Marinacci, Chief Revenue Officer, [email protected], 312-550-6275

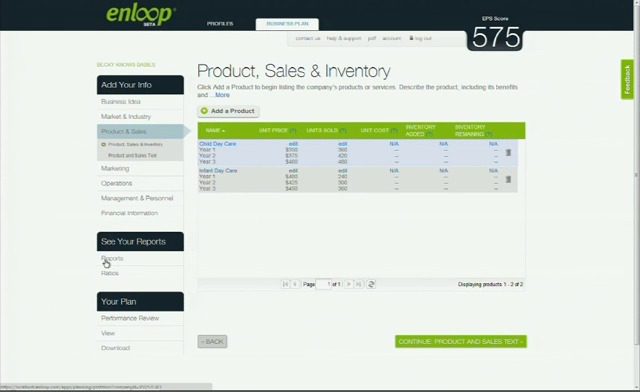

How they describe themselves: Enloop is a free online service that anyone can use to automatically generate a business plan and immediately know its potential for success through a powerful predictive scoring algorithm. Business owners and entrepreneurs can use Enloop’s automated and affordable system to vet a business idea – or improve the performance of an existing venture. At the same time, underwriters can quickly gauge the venture’s risk by viewing the company’s financial performance metrics to efficiently evaluate leads, improve deal flow and reduce due diligence costs. Partner opportunities include data aggregation, highly-qualified lead generation and sales funnel expansion, and efficient SMB targeted marketing.

How they describe their product/innovation: Enloop’s patent-pending, first-to-market Business Planning and Scoring System is a game-changing platform that alters how ventures are planned, funded and managed. The system’s innovative features include easy-to-use tools that automatically create customized business plans for any business, including a predictive score and a financial ratio review that evaluates how the business compares to its industry peers. Expert guidance is provided at each step, including recommendations on improving under-performing ventures. All text and GAAP-compliant financial forecasts are automatically prepared using Enloop’s AutoWrite system. Fully formatted business plans and financial metrics reports are generated on-the-fly for users to download or share.

Bus. Dev., Press & Sales: Cynthia McCahon, CEO, [email protected], 415-722-7882

How they describe themselves: eWise, a privately held technology company with offices in Denver (Colorado), London (UK), Shenzhen (China) and Sydney (Australia), develops and markets online payment, account aggregation, personal financial management (PFM) and eAuthentication solutions to financial institutions in Australia, Asia, Europe, North America, and the United Kingdom. eWise is best known for its role in establishing Online Banking ePayments (OBeP) networks around the world. The company is the exclusive network provider for the NACHA Secure Vault Payments network in the US, they are partnering with VocaLink to offer eWise payo in the UK, and eWise has also been working with the International Council of Payment Network Operators (ICPNO) since it was established in 2008 to develop common standards and rules for global interoperability between Online Banking ePayments networks.

How they describe their product/innovation: Secure Vault Payments/eWise payo allows consumers to make payments using their existing secure online bank account when shopping or paying bills online, does not require set-up or registration with a third-party payments entity and presents familiar interface to facilitate online payment awareness of funds availability. Merchants are offered improved sales conversion rates, real time authorization of guaranteed ACH payment, and repeat transactions. Secure Vault Payments/eWise payo helps financial institutions to recapture revenue being lost to alternative payment providers while also encouraging consumers to move to online banking, replacing more costly branch and telephone alternatives.

Bus. Dev. & Sales: Dean Seifert, SVP, [email protected], 303-601-6057

Press: Christine Bevilacqua, SVP, [email protected], 303-256-6259

How they describe themselves: Expensify does expense reports that don’t suck! Expensify does this by importing expenses and receipts right from a credit card or bank account, catching cash expenses with mobile apps, creating PDF expense reports and reimbursing reports up to $10,000 entirely online.

How they describe their product/innovation: Expensify is announcing something so dramatic, so revolutionary, that history as we know it will end and the world born anew. Grab your credit cards and mobile phones (but leave your receipts and keyboards behind), it is the dawn of a new era in expense report automation.

Press: Meghan Young, [email protected]

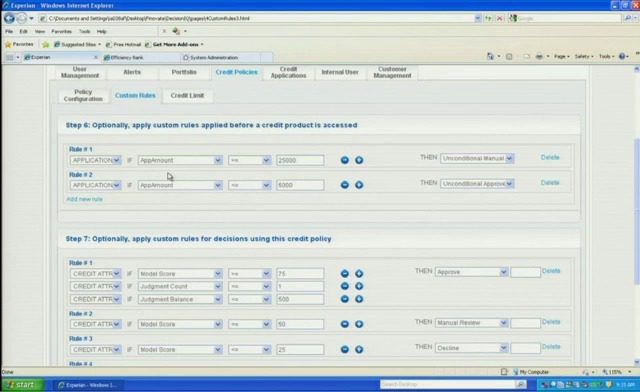

How they describe themselves: Experian Business Information Services provides data, analytics and tools to help organizations establish and strengthen their commercial customer relationships, enabling them to mitigate risk and improve profitability. The company’s business database provides comprehensive, third-party-verified information on U.S. companies of all sizes, with the industry’s most extensive data on the broad spectrum of small and midsize businesses. By leveraging state-of-the-art technology and superior data compilation techniques, Experian is able to provide market-leading tools, such as BusinessIQ(SM), that assist clients in processing new applications, managing customer relationships and collecting on delinquent accounts. For more information about Experian’s advanced business-to-business products and services please visit www.experian.com/b2b.

How they describe their product/innovation: DecisionIQ(SM) Premier helps clients maximize the efficiency of their commercial credit application processes. DecisionIQ(SM) Premier provides a rule-based credit policy management system that seamlessly delivers online credit applications and evaluates responses for credit decisioning. The credit application is deployed directly on a client’s website, providing easy access to their customers during the credit application process. DecisionIQ(SM) Premier leverages Experian’s broad commercial data assets and analytics to reduce risk, while streamlining credit decisioning. The offering is delivered through Experian’s new online portal, BusinessIQ(SM), which allows users to incorporate their application process with additional credit services such as portfolio management, fraud prevention and collections activities. For more information about Experian’s advanced business-to-business products and services, visit www.experian.com/b2b.

Bus. Dev. & Sales: Adam Fingersh, SVP Marketing and Products Business Information Services, 714-830-7707

Press: Roslyn Whitehurst, Senior Manager, Experian Public Relations, [email protected], 714-830-5578

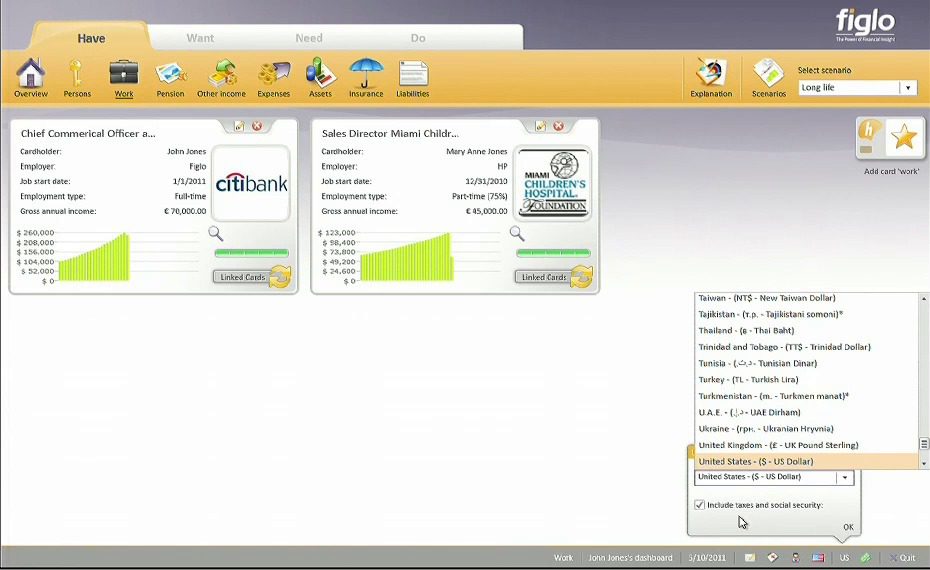

How they describe themselves: In 1996, the Figlo Group B.V. was founded in the Netherlands with the goal to make the personal financial future of individuals insightful and understandable. Figlo designs software to manage personal finances, that allows the advisor to offer client centric advice which supports all aspects of the financial advice process. Figlo is able to serve clients globally. Partners are appointed in Europe, North America, India, South East Asia & the Pacific region and South Africa. Major financial corporations such as ING, ABN AMRO and various local organizations have been using Figlo’s software for many years.

How they describe their product/innovation: The Figlo Platform offers insights in personal financial matters and is offered towards financial advisors for the benefit of consumers. The Figlo Platform is comprehensive and intuitive at the same time, as all possible scenarios are calculated in the blink of an eye. It represents over 15 years of experience and development from the clients point-of-view. Streamlining and monitoring financial advice based on our unique advice process: Have, want, need and do: Hawanedo. Based on these four steps, the entire advice process is delivered. In contrast to existing, complex financial advice software, Figlo stands out in simplicity and accessibility without handing in on the quality of in-depth financial advice. Figlo solutions can be used anywhere, anytime and on any device.

Bus. Dev.: Albert van den Broek, CEO Worldwide, [email protected]

Press: Ellen van Beek, Manager Corporate Communications, [email protected]

Sales: Sam Vassa, CEO North America, [email protected]

Video There is no video available for this presenter.

Bus. Dev.: Tim Ruhe, VP Business Development, [email protected], 703-885-4208

Press: Ann Cave, Sr. PR Manager, [email protected], 678-375-4039

Sales: Craig Potts, SVP Sales, [email protected], 678-375-3609

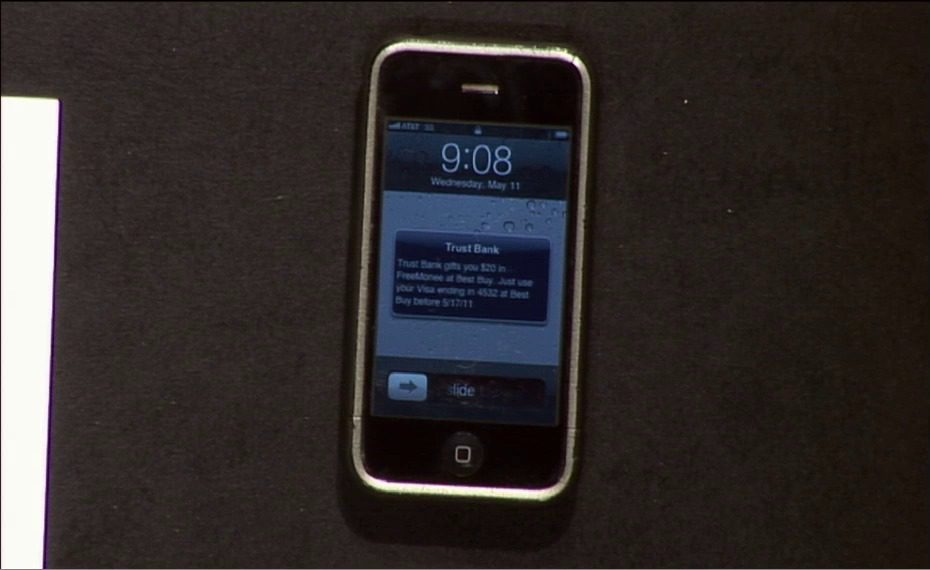

How they describe themselves: FreeMonee is the world’s first national gift network – we connect millions of credit and debit cardholders from the world’s largest financial institutions with national and local merchants. The merchants offer FreeMonee gifts – monetary incentives – to individual cardholders through the financial institutions. FreeMonee gifts function like a gift card on an individual’s debit or credit card, allowing consumers to purchase anything they want with the designated merchant, with no strings attached. FreeMonee anonymously matches consumers to the gifts using their proprietary Adaptive Matching Technology that analyzes card transaction data to identify the highest value consumers for merchants.

How they describe their product/innovation: FreeMonee, the world’s first gift network, enables merchants to profitably attract new customers and financial institutions to generate incremental customer-friendly revenue.

Bus. Dev. & Sales: Mark Uiker, Head of Business Development, [email protected]

Press: Jennifer De Laura, Director, Allison & Partners for FMN, [email protected], 415-277-4937

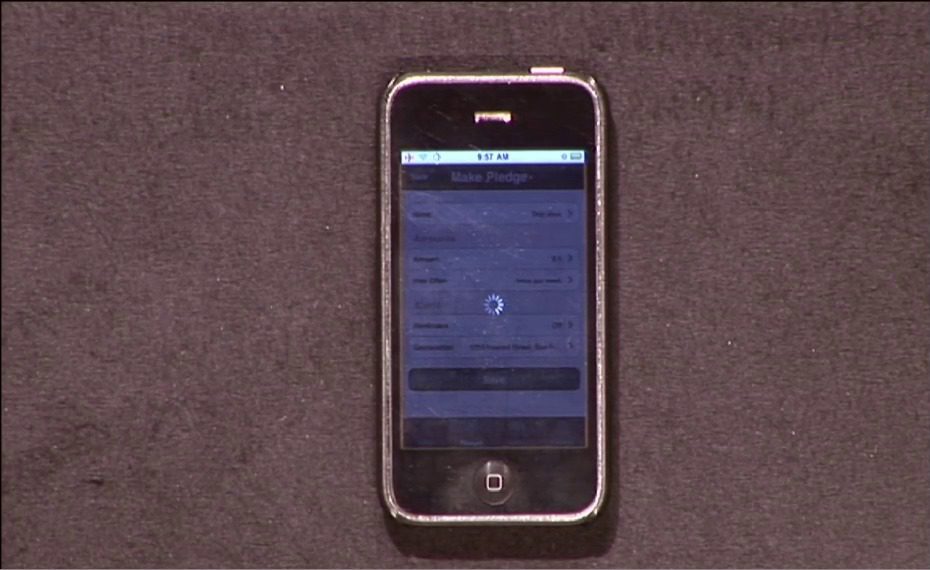

How they describe themselves: GoalMine is the simplest way to invest for life goals. Users create personal investing plans and then put them into practice starting with as little as $25, all in a way that’s easy to understand and use. Friends and family can even chip in with GoalMine’s sharing and gifting features.

Bus. Dev.: Rimmy Malhotra, CEO, [email protected], 212-731-0830 x104

Press: Meredith Kelsey, Director of Public Relations, MPOWER Labs, [email protected], 202-758-0177

How they describe themselves: Gold Bullion International (GBI) created the first ever technology/operations platform that allows retail investors to buy, store and trade allocated physical precious metals online through their existing wealth management platform. GBI set a new trend in physical precious metals investing by launching the first ever electronic bullion trading platform that provides its clientele with seamless order entry and execution, effective logistics management, and world-class client service. The trading platform serves as a synthetic exchange offering investors competitive pricing, greater transparency and improved liquidity. GBI allows investors to purchase physical metals as easily as buying a stock or bond through their broker.

How they describe their product/innovation: GBI will demo its state of the art technology platform that delivers a comprehensive, efficient and secure way for investors to purchase and store physical precious metals. When a broker places an order through their existing order entry platform, GBI bids this order out to its extensive dealer network to provide the lowest available price in the market. The purchased metals are then transported from the dealer’s vault to a storage facility at the customers’ discretion. These metals are subsequently audited by a big 4 accounting firm on a quarterly basis. Clients will own the physical metal in an allocated private account, which is verified with holdings and reported on a daily basis. Investors also have the option to take physical delivery of their precious metal holdings at anytime.

Bus. Dev. & Sales: Sunil Annapareddy, VP Sales & Business Development, 646-822-1273

Press: Div Malik, Vice President, [email protected], 646-822-1306