How they describe themselves: Finsphere was founded on the powerful vision that a mobile phone can be used as a proxy for an individual’s identity. Based on its “Mobile as Identity” vision, Finsphere developed the Identity Security Services platform, a sophisticated, expert rule-based and predictive analytics engine surrounded by a core set of identity authentication services. Through its analytics platform and leveraging rich mobile network operator data beyond just mobile location, Finsphere’s goal is to enable wireless carriers to unlock the value of customer data in all industry segments.

How they describe their product/innovation: A suite of solutions that includes fraud management services for financial institutions and online merchants, access management services for enterprise and cloud computing environments, and PinPoint, a consumer focused fraud protection service for financial services providers. Finsphere’s Identity Security Services platform provides the basis for expanding the solution sets to monetize wireless data across industry segments worldwide.

Contacts:

Bus. Dev.: Robert Boxberger, President, [email protected]

Press: Jeff Brennan, Chief Privacy Officer, [email protected]

Sales: Dave Tiezzi, Senior Vice President Global Sales, [email protected]

How they describe themselves: Fiserv is the world’s most successful provider of digital banking and payment solutions to financial institutions. In particular, Fiserv leads the market with solutions that enable:

- Person-to-person and small business payments

- Bill presentment and payment

- Online banking and personal financial systems

- Mobile banking, payments, and alerts

How they describe their product/innovation: Mobiliti M-Cash is a complete bank-driven personal payments platform. It allows leading financial institutions to set up their own mobile-centric P2P brand and enable:

- Consumer to consumer payments

- Consumer to business payments

- Consumer payments to online retailers

Contacts:

Bus. Dev. & Press: Serge van Dam, VP of Market Development, [email protected], +44 208 133 1246

Sales: Alan Birch, Sales Director of UK, Europe, Middle East & Africa, [email protected], +44 208 833 3129

How they describe themselves: Handpoint specialises in payments on smartphones, tablets, and handhelds – enabling merchants to accept all card payments (MSR, EMV, and NFC) in a totally secure way. Handpoint has a complete end-to-end payment solution covering mobiles, tablets, and PCs and a fully PCI-DSS certified payment Bureau (gateway) for both authorisations & settlements. The company was established 12 years ago and has a global customer base including some well-known brands. Our key market is Europe. Handpoint also white labels its payment solutions to financial institutions and currently over 200,000 transactions go daily through our systems, equating annually up to $10B US worth of transactions.

How they describe their product/innovation: Handpoint Headstart is the first totally secure mobile Chip & PIN payment solution for tablets and smartphones. With our Platform-as-a-Service solution, acquiring banks and MNOs can offer small/micro merchants card payments on smartphones and tablets under their own brand name. The Handpoint Headstart solution supports magstripe (MSR), Chip & PIN, Chip & signature, and contactless NFC payments (2012). Handpoint Headstart payment solution is not only a mobile solution, it is also a Full-Commerce solution meaning that it works on many different devices, for example smartphones, tablets, mobile terminals, and PCs (tills) in an online and an offline world.

Contacts:

Bus. Dev.: David Gudjonsson, CEO, +44(0)1223 597 909

Press: Erla Osk Asgeirsdottir, Marketing Manager, +354 510 3300

Sales: Thordur Heidar Thorarinsson, CFO, +354 510 3300

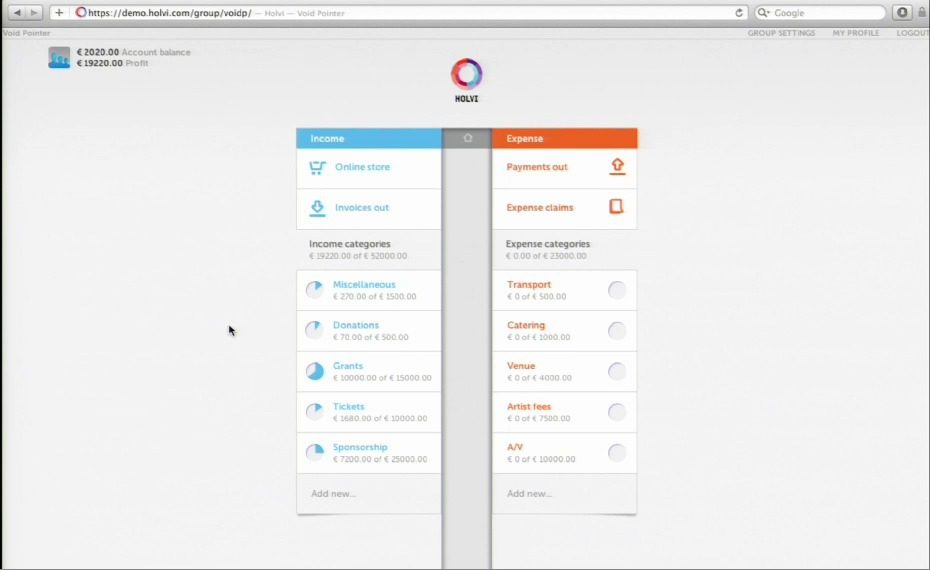

How they describe themselves: Holvi replaces the plain old bank account with a current account built from the ground up for group activities. We help our customers collect more money, better understand their finances, and save time for their core activities. Customers include event organisers, sports clubs, and student associations. Our customers can do all their banking with Holvi, without needing another bank account. We are regulated as a payment services provider by the Finnish Financial Supervisory Authority (FIN-FSA), and we have the necessary banking partnerships in place to operate payment accounts for our customers on a pan-European basis.

How they describe their product/innovation: The Holvi.com group account is a merchant account, accounting software and a group current account, all rolled into one. With the Holvi account, our customers have an online banking service specifically targeted for their needs. The core technology innovation is automated bookkeeping and meaningful, social connectivity through rich metadata associated with payment transactions. Using Holvi, our customers have radically better tools for managing their money and raising funds online.

Contacts:

Bus. Dev.: Tuomas Toivonen, [email protected], +358 400 616 499

Press & Sales: Kristoffer Lawson, [email protected], +358 40 731 2273

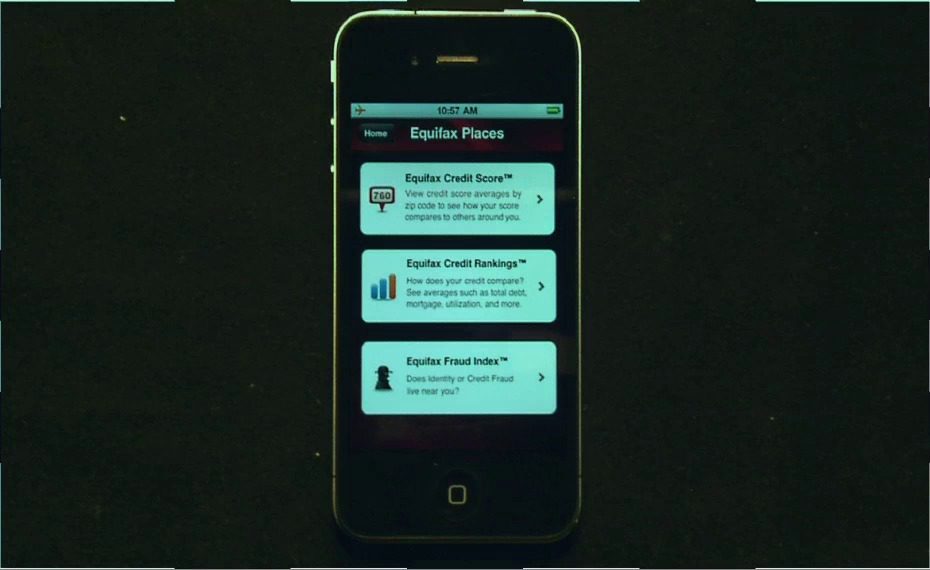

How they describe themselves: Equifax’s direct-to-consumer business unit, North America Personal Solutions (PSOL), is a leading provider of personalized online consumer credit, debt and identity protection solutions.

How they describe their product/innovation: Equifax Complete™ key features can be accessed via the Equifax Mobile App & include:

- Interactive Score Estimator & score monitoring

Contacts:

Bus. Dev. & Sales: Matt McAluney, VP Sales, [email protected], 678-795-7668

Press: Demitra L. Wilson, Director Public Relations, [email protected], 678-795-7885

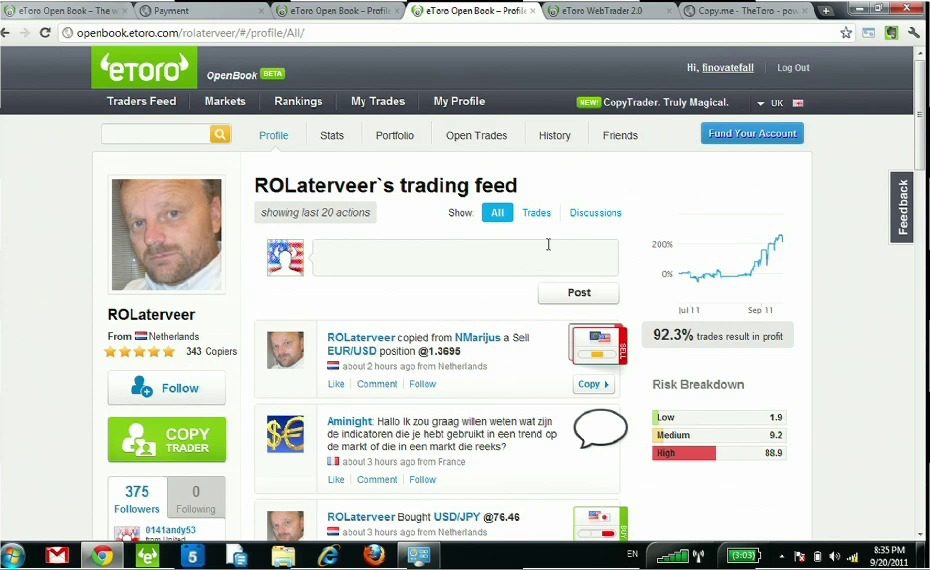

How they describe themselves: eToro is the world’s largest investment network, with over 1.75 million users in over 140 countries. eToro leads the social trading revolution through its community-powered network, enabling every investor to see, follow and automatically copy the actions of other investors in real time. eToro opens the financial markets to every individual making them accessible through a simple, transparent and more enjoyable way to trade currencies, commodities and indices online. A range of innovative trading platforms and eToro’s investment network facilitate information exchange between investors, accelerate knowledge sharing and shorten the learning curve for those who want to bring their trading experience to the next level.

How they describe their product/innovation: CopyTrader is a groundbreaking way to trade by automatically copying every trade made by a selected guru trader or by a people-based portfolio of top performing traders directly into the account of the copier. CopyTrader is the enabling feature for every network member to become a guru investor who indirectly executes trades for all investors copying him or her. Copy.Me is a one-stop shop for everyone to set up his own retail investment shop and present/market his trading skills to the entire world. Investment gurus are compensated for their ability to attract investors that copy from them.

Contacts:

Bus. Dev. & Press: Alon Levitan, Head of Strategic Marketing, [email protected]

Sales: Zvika Pakula, Chief Marketing & Sales, [email protected]

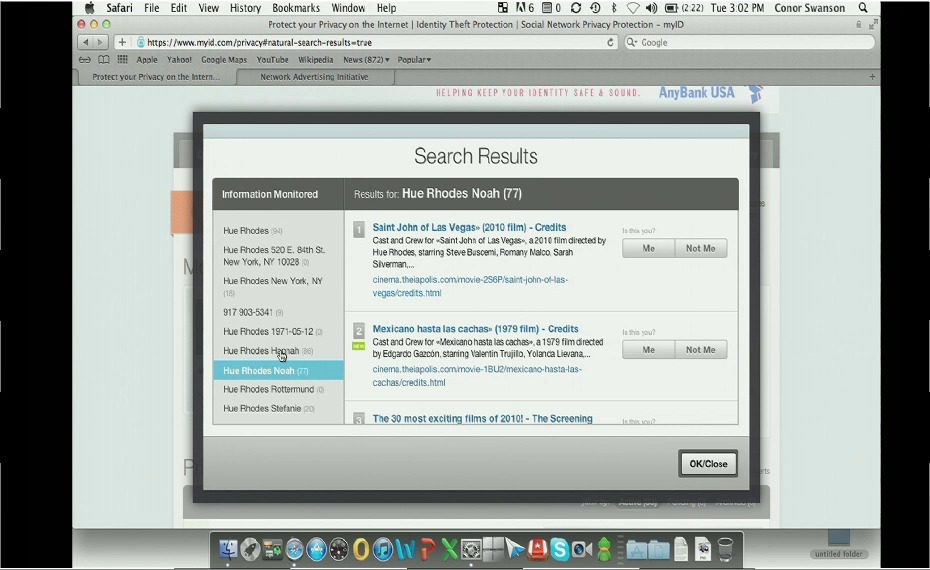

How they describe themselves: Experian Consumer Direct (ECD), part of the credit bureau Experian, is the leading provider of direct-to-consumer credit reports, scores and monitoring. Our comprehensive suite of identity management and personal information protection products includes: credit and non-credit monitoring, fraud alerts, social media monitoring, reputation management and child monitoring. Additionally, ECD provides these services to leading financial institutions and Fortune 100 companies across the U.S., enabling them to build brand loyalty and drive incremental revenue. Partners can also leverage our consulting and best practices to optimize their acquisition and product strategies. And our continued innovation allows us to proactively meet both partner and consumer needs. In fact, we were the first company to offer credit reports to consumers online and the first to offer fraud resolution services to consumers.

How they describe their product/innovation: myID.com, a part of Experian, monitors all facets of your identity, including personal privacy, financial information, your reputation and your safety. myID.com quickly alerts you to risks to your identity so you can take action and minimize the potential for damage. Unlike most identity theft software, myID.com helps you manage your entire identity, on social networks, on people page sites and offline through our financial monitoring system. myID.com helps consumers stay private and safe, and prevents identity theft by continuously scanning for personal information on public websites and databases. myID.com also provides real-time alerts if your private information becomes public, and investigates possible situations where your identity has been stolen. With myID.com, you can rest assured that your privacy, safety, finances and reputation are secure.

Contacts:

Bus. Dev.: Brian Cleaver, VP Business Development, [email protected],

O: 302-727-0800. C: 302-373-4050, F: 949-222-0582

Press: Amber Cisneros, Marketing Manager, [email protected], O: 949-567-3614, C: 949-981-0326, F: 949-222-0582

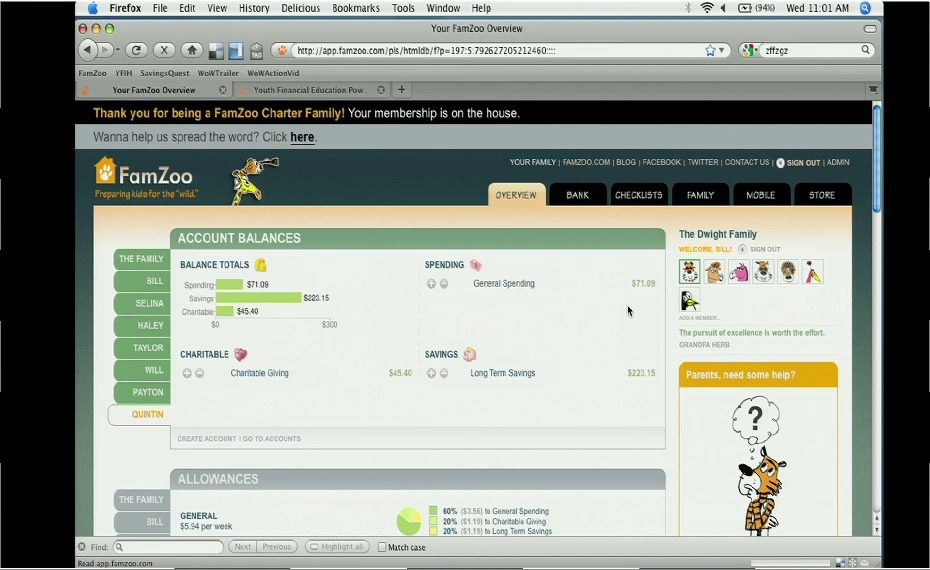

How they describe themselves: FamZoo.com is an online “Virtual Family Bank” that helps parents teach their kids good personal finance habits through regular practice in a friendly, learn-by-doing environment. Parents can customize their online Bank of Mom/Dad to match their unique money values and grow with their kids as they mature from youngsters to older teens. Options include:

- Online IOU accounts for each child to track spending, saving, and giving

- Automated allowance, chore rewards/penalties, and compound interest

- Interactive tools for budgets, savings goals, loans, and checklists

- Access via web, iPhone/Droid, or text message

How they describe their product/innovation: FamZoo Partner Edition allows credit unions, banks, financial advisors, and other financial organizations to offer a co-branded version of the FamZoo Virtual Family Bank to their client families. Using FamZoo Partner Edition, organizations can:

- Develop an ongoing relationship with next generation clients early on

- Provide a natural on-ramp to real world financial products

- Deliver innovative, hands-on youth financial education that is more effective than existing content and games.

Contacts:

Bus. Dev. & Sales: [email protected]

Press: [email protected]

How they describe themselves: FeeFighters makes the process of choosing a merchant account provider as easy as shopping for a plane ticket online. In minutes, business owners can choose the best deal on credit card processing with a reverse auction marketplace that saves the average business owner 40 percent on payment processing.

How they describe their product/innovation: Samurai is a feature-rich gateway that provides ultimate flexibility at an affordable price.

With Samurai, you’ll be able to integrate payments on your site in minutes. Samurai boasts premium features such as intelligent routing, data portability, and gateway emulation. Send payments anywhere at a transaction level, meaning you can send a transaction where it makes the most sense financially. It’s also universally compatible, so you aren’t locked into a particular provider. Incredibly easy setup at a fantastic and simple price: $10/month + $0.10/transaction, no other costs.

Contacts:

Bus. Dev.: Sheel Mohnot, Director of Business Development, [email protected], 724-466-4668

Press: Stella Fayman, PR Queen, [email protected]

Sales: Marc Summe, Director of Sales, [email protected]

How they describe themselves: FreeMonee is the world’s only national gift network – we connect millions of credit and debit cardholders from the world’s largest financial institutions with national and local merchants. The merchants offer FreeMonee gifts – monetary incentives – to individual cardholders through the financial institutions. FreeMonee gifts function like a gift card on a debit or credit card, allowing consumers to purchase anything they want with the designated merchant, with no strings attached. The gifts are credited to the individual’s card account following the purchase. FreeMonee anonymously matches consumers to relevant gifts using their proprietary Adaptive Matching Technology that analyzes card transaction data to identify the highest value consumers for merchants.

How they describe their product/innovation: FreeMonee will demonstrate a powerful new extension of our gift platform that introduces a whole new way for consumers to interact with their financial institutions. The product draws on the power of FreeMonee’s analytics and scoring capabilities to create a new form of merchant search.

Contacts:

Bus. Dev.: Mark Uicker, Head of Business Development, [email protected]

Press: Deanna Decker, Account Manager, Allison & Partners, [email protected], 415-277-4929

How they describe themselves: Veterans from the payments industry founded Fuze Network to eliminate latency, cost and errors in payments. Their first target marketplace is the under-banked and un-banked consumer where an expansive list of products released in 2011 help the biller and retailer profitably deliver convenient services for this large and important consumer market. Fuze partners with retail payment networks, banks, credit card issuers, utilities, and other companies looking to expand their payment options and visibility to the cash-based customer.

How they describe their product/innovation: Swipe2pay enables customers to make payments at 17,000 banks and 100,000 retail locations nationwide. Swipe2pay permits cash preferred consumers to make a payment by simply swiping their card. Credit cards, store cards, gas cards and thousands more can be paid in cash at any participating location. This innovative service takes 99.9% of all cards, automatically enables over half a billion cards as well as over 300,000 card programs with a single software connection. For billers, Swipe2pay delivers error-free convenience at a lower per-payment cost with no exceptions or misapplied funds. Payment networks will see increased store traffic and new revenue streams; with no new start up costs or equipment to buy. Our services directly integrate into current infrastructure. Consumers will avoid late fees, stamps, money orders, and paperwork: all at a lower price.

Contacts:

Bus. Dev: Phil Skaggs, President, [email protected]

Sales: Taylor Edwards, Director Business Development, [email protected]

Press: Dave Wilkes, CEO & Founder, [email protected]

How they describe themselves: With Google Advisor, you enter information about what you’re looking for in a mortgage, credit card, CD, or checking and savings account. We show you a list of the offers that match your criteria, along with rates and contact information. Google Advisor is designed especially to help you make these difficult financial decisions easily, with:

- Speed: As you change your criteria, the results update instantly. You’ll still have a list of all your options in one place, so you can quickly compare different offers.

- Trust: By setting your own search criteria, you’re able to see only those offers and rates that apply to you, which means you can compare applicable offers without even contacting a provider first.

- Control: You only need to provide the minimum amount of information we need to show you offers that are right for you. You have full control over what you want to share, and which providers you choose to talk to—and you don’t have to submit any personal information until you want to.

Contacts:

Press: [email protected]