How they describe themselves: FIS provides financial institution core processing and card issuer and transaction processing services, including the NYCE Network. FIS is a member of Standard and Poor’s (S&P) 500 Index and consistently holds a leading ranking in the annual FinTech 100 rankings.

What they think makes them better: FIS WealthCare Portal offers customers the opportunity to integrate critical components of managing personal finances for health related expenses with healthcare information. Banks have the ability to leverage the relationship with their retail health savings account customers as well as with their commercial customers by offering additional services as a ‘one stop shop’ for health and wealth management. With the FIS WealthCare Portal, banks have a branded, comprehensive, secure container for all consumer level health related communications and transactions, and they can begin to simplify the experience for people to manage their health and the overall cost of their care.

Contacts:

Bus. Dev.: John Reynolds, 651-361-2630, [email protected]

Laurie Knutson, 612-655-6767, [email protected]

Sales: James Susoreny, EVP, Business Development, 407-551-8487, [email protected]

Press: Marcia Danzeisen, SVP, Marketing and Corporate Communications, 904-854-5083, [email protected]

How they describe themselves: Fiserv, Inc. (NASDAQ: FISV) is the leading global provider of information management and electronic commerce systems for the financial services industry, driving innovation that transforms experiences for financial institutions and their customers. The Electronic Banking Services division enables financial institutions to optimize their online channel to drive profitable relationships, revenue and growth using a wide range of solutions including online banking, electronic billing and payment, online money management tools, mobile commerce solutions, security and fraud prevention services, and small business banking.

What they think makes them better: Fiserv and its Electronic Banking Services division are solely focused on delivering innovative online solutions to the financial services industry. We have built our solutions from ground up specifically for online financial services, and as a result, our consistent performance, reliability, industry-leading user experience, and security have garnered Fiserv the leadership position in online banking and bill pay services for many years. Our value proposition is leveraging years of expertise and a blue-chip client list to deliver best-of-breed online financial services that drive the best online experience for your customers and meet the stringent demands of financial institutions of all sizes.

Contacts:

Bus. Dev.: Tim Ruhe, VP, Bus. Dev., 703-885-4208, [email protected]

Sales: Craig Potts, SVP Sales, 678-375-3609, [email protected]

Press: Ann Cave, Sr. PR Manager, 678-375-4039, [email protected]

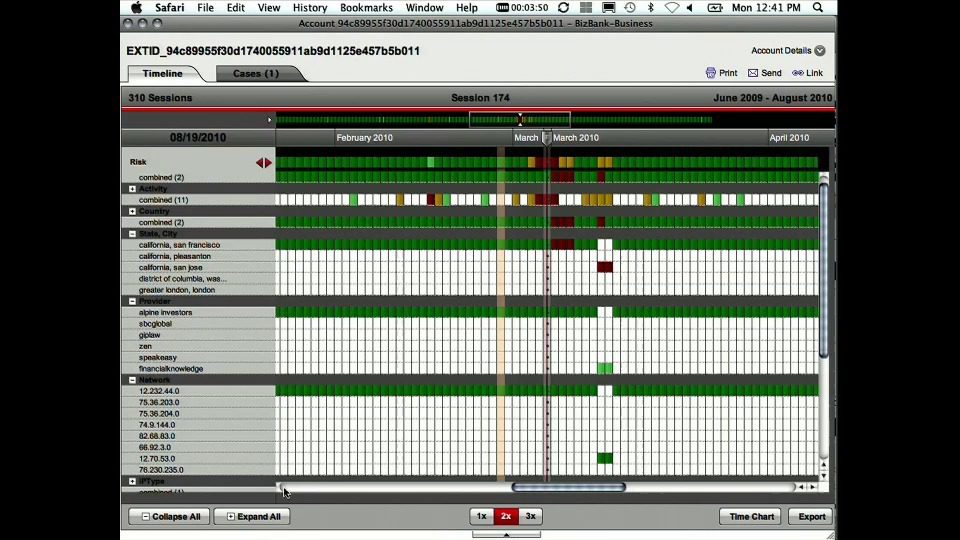

How they describe themselves: Guardian Analytics provides innovative solutions to prevent online banking fraud, helping financial institutions of all sizes protect their customers, their business and their reputation. Guardian Analytics’ FraudMAP uniquely uses predictive behavioral analytics to monitor individual activity from login to transaction and proactively detect suspicious behavior, before money leaves an institution. Forward-thinking institutions are bolstering their existing controls with FraudMAP for Retail Banking to protect consumer accounts and FraudMAP for Business Banking to protect their corporate accounts and ward off today’s sophisticated cyber crime. The company has deep market and technical expertise spanning data analytics, security, online banking, and fraud.

What they think makes them better: FraudMAP provides instant and transparent protection for all online banking customers against the widest variety of threats, both current and emerging. Using Dynamic Account Modeling, FraudMAP builds predictive models of individual behavior, identifies suspicious online activity, and provides actionable alerts and rich investigation capabilities. Our approach automatically detects today’s – and tomorrow’s –threats, without requiring fraud rules development or maintenance. FraudMAP is not threat or pattern specific, and provides coverage across the widest variety of attacks. And because FraudMAP is hosted, financial institutions receive the best possible protection with fast time to implementation, low up-front investment, and the lowest total cost of ownership.

Contacts:

Bus. Dev.: Craig Priess, Founder and VP Bus. Dev. & Products, [email protected], 650-383-9212

Sales: Eric LaBadie, VP, Sales, [email protected], 650-383-9211

Press: Shannon Walsh, Account Manager, The Bateman Group, [email protected], 415-503-1818

How they describe themselves: In 1955, H&R Block was founded to help taxpayers complete their personal tax returns efficiently and accurately at fair prices. Over the decades, H&R Block expanded its physical footprint to over 10,000 professionally-staffed offices and extended sophisticated tax preparation to even the most common US taxpayers. Today, H&R Block prepares 1 of every 7 US personal tax returns, maintains a retail office presence within 5 miles of most Americans, and is an industry leader in digital tax preparation. H&R Block is one of the most recognized and trusted of all American corporate brands.

What they think makes them better: Today, taxes are more complex than ever and increasingly reside at the center of a consumer’s daily financial life. H&R Block’s TaxCenter is an integrated suite of applications running within a financial institution’s own website, designed to simplify and streamline a user’s tax management experience. TaxCenter combines H&R Block’s tax expertise with Yodlee’s breadth and depth of data aggregation capability to help consumers understand the impact of taxes on their personal finances, both throughout the year and at tax time. TaxCenter’s unique positioning within a Yodlee-powered financial institution’s website strengthens that financial institution’s relationship with their customer by integrating value-added services in a way that best fits with the delivery and promotion of services from within the financial institution.

Contacts:

Bus. Dev. & Sales: Jason Houseworth, VP Client Innovation, [email protected], 816-854-5106

Jonathan Heigel, Client Innovation, [email protected], 816-854-3779

Press: Gene King, Communications Manager, [email protected], 816-854-4672

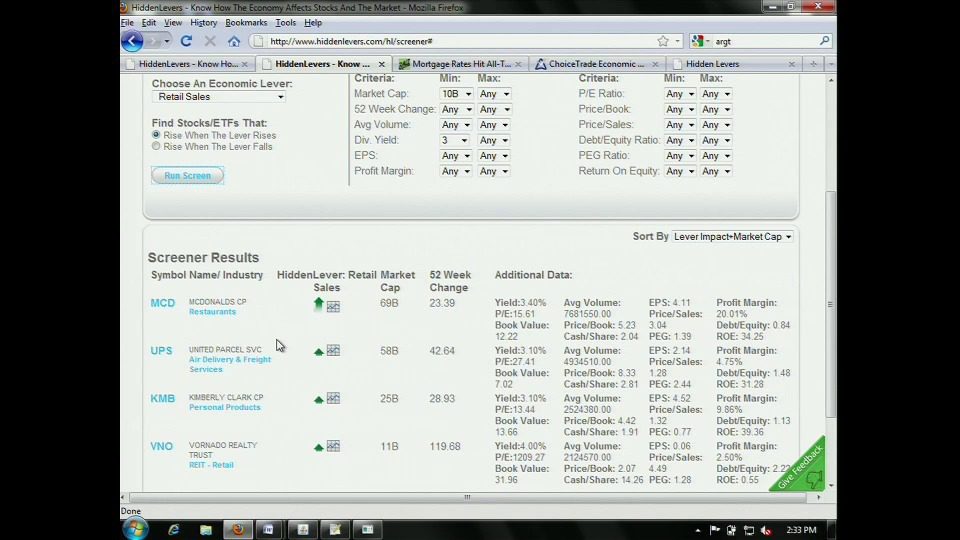

How they describe themselves: HiddenLevers offers investors a new approach to portfolio and stock analysis using economic data visualization. Our analytical tools include: an economic data center with charting functionality to compare stocks against macroeconomic indicators, a screener for discovering investing ideas based on macroeconomic trends, and scenario analysis to visualize the economic outcome of big picture events. Using these tools, as well as economic data and infographics, HiddenLevers serves a host of clientele: online brokerages, financial media sites, investment managers, institutional funds, and academic institutions.

What they think makes them better: By connecting macro-economic indicators with stocks and industries, HiddenLevers helps investors understand how different big-picture scenarios would impact their investments. HiddenLevers holds up the third pillar of investment research, focusing on economic analysis to augment fundamentals and technical research.

Contacts:

Bus. Dev., Sales & Press: Raj Udeshi, [email protected], 212-292-3147

How they describe themselves: Billeo’s PayDirect Assistant™ is a patent-pending product that gives users the choice to pay bills instantly via a credit card or checking account directly at the biller’s Web sites. Using PayDirect Assistant™ banks for the first time can enable such payments within their online bill pay service. Billeo’s technology connects users directly to the biller’s Web site and walks them through the bill paying process. The technology auto-fills all information needed to pay a bill, including user names, passwords, and card details allowing users to pay a bill with just a few clicks, while automatically saving the payment receipt/confirmation.

What they think makes them better: Today’s bank bill pay service doesn’t allow for same-day bill payments or pay bills with a card. Over 50 percent of a bank’s bill pay customers therefore pay bills directly at a service provider’s Web site. Billeo’s industry-leading technology platform now gives banks an unparalleled opportunity to meet the demands of these customers from within the bank bill pay service and capitalize on the revenue opportunity from card payments. Billeo’s ground breaking technology for the first time integrates ‘biller-direct’ bill payments within traditional bank-bill service, making it a one-stop, all inclusive bill pay service.

Contacts:

Bus. Dev. & Sales: Robin O’Connell, VP of Business Development, 408-512-2136, [email protected]

Press: Lauren Moreno, Account Executive, Atomic PR, 415-593-1400×224, [email protected]

Contacts:

Sales: Joe Cerbo, Sales Director, [email protected]

Press: Jonas Fischer, Marketing Director, [email protected]

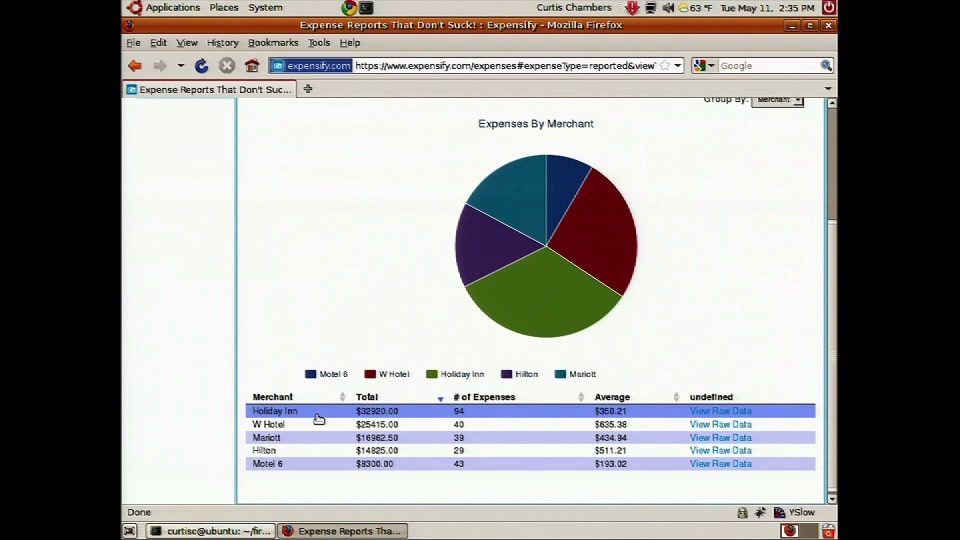

How they describe themselves: Expensify does expense reports that don’t suck! We do this by eliminating the need for paper receipts and manual data entry by getting all of the expense information directly from your credit card and creating eReceipts, digital equivalents of their paper counterparts, providing a plethora of mobile apps to capture receipt images for cash expenses, and online expense reimbursement to get money back in your pocket, faster! On the receiving end of expense reports? Set up an expense policy by connecting your QuickBooks company and receive properly categorized reports, ready to be exported and reimbursed with just a click.

What they think makes them better: Expensify offers one-click expense import from the vast majority of banks and credit card issuers, mobile apps for the BlackBerry, Palm Pre, and Android to track expenses and upload receipts on the go as well as a full fledged expense report creation app for the iPhone, a strong integration with QuickBooks to import accounts and create expense policies, export expenses and reimburse online with QuickBooks check or direct deposit (ACH).

Contacts:

Bus. Dev. & Sales: David Barrett, Founder and CEO, [email protected]

Press: Melissa Roxas, Expensify Press and PR lead contact, [email protected]

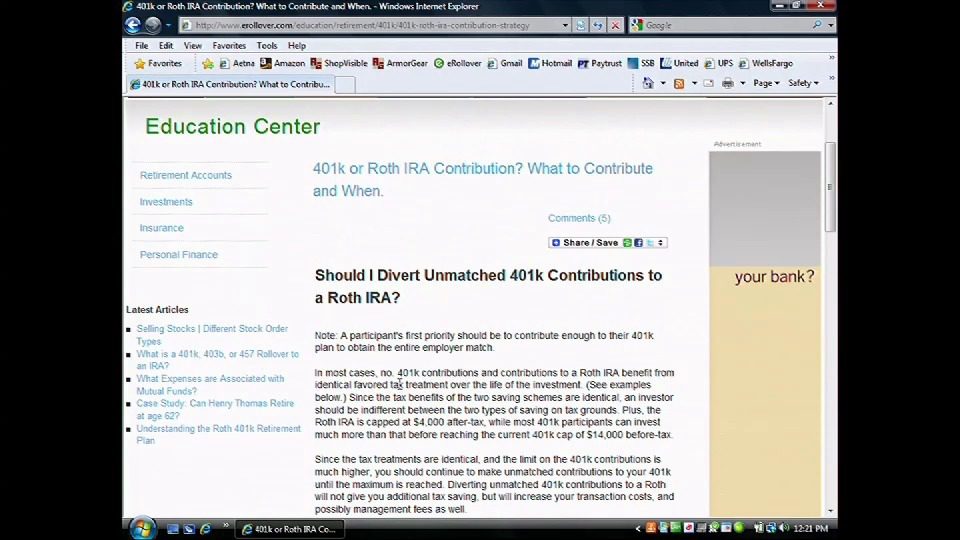

How they describe themselves: FiPath.com (www.FiPath.com), formerly eRollover.com, was formed in 2008 to fill a void in the availability of retirement planning information to the general public. The online platform provides aggregation and analytical tools that allow people to consolidate or rollover retirement accounts onto one, automated online platform. An Education Center provides easily accessible retirement fund content so members can take control of their retirement, and make educated decisions in managing their retirement funds from RSS feeds, web/podcasts, video’s, and news media accounts. A Financial Advisor Center provides access to thousands of well-informed professional financial advisors with an easy to use database for FiPath Members. FiPath is headquartered in Atlanta, GA.

What they think makes them better: Nobody else is exclusively in the retirement planning space, represented by $250B in new IRA rollover money projected in 2009, more than 64 million individual retirement accounts, and nearly $12T currently held in various retirement accounts. Despite those metrics, 46% of individuals do not have a financial advisor, even though many have at least 2 or 3 retirement accounts. Layoffs are creating demand for retirement education services, and there are over 10 million monthly Google searches for retirement topics.

Contacts:

Bus. Dev.: Corbett Gilliam, 678-923-2399, [email protected]

Sales: Mike Rowan, 404-455-7825, [email protected]

Press: David Andersen, 404-514-0424, [email protected]

How they describe themselves: Fiserv, Inc. (NASDAQ: FISV) is the leading global provider

of information management and electronic commerce systems for the financial services industry, driving innovation that transforms experiences for financial institutions and their customers. The Electronic Banking Services division enables financial institutions to optimize their online channel to drive profitable relationships, revenue and growth using a wide range of solutions including online banking, electronic billing and payment, online money management tools, mobile commerce solutions, security and fraud prevention services, and small business banking.

What they think makes them better: Fiserv and its Electronic Banking Services division are solely focused on delivering innovative online solutions to the financial services industry. We have built our solutions from the ground up specifically for online financial services, and as a result, our consistent performance, reliability, industry-leading user experience, and security have garnered Fiserv the leadership position in online banking and bill pay services for many years. Our value proposition is leveraging years of expertise and a blue-chip client list to deliver best-of-breed online financial services the drive the best online experience for your customers and meet the stringent demands of financial institutions of all sizes.

Contacts:

Bus. Dev.: Tim Ruhe, VP, Bus. Dev., 703-885-4208, [email protected]

Sales: Craig Potts, SVP Sales, 678-375-3609, [email protected]

Press: Ann Cave, Sr. PR Manager, 678-375-4039, [email protected]

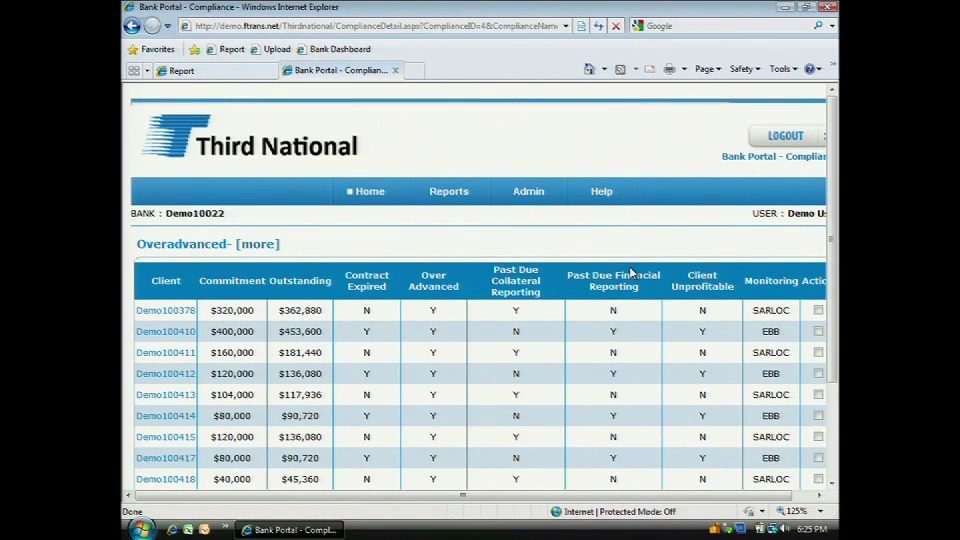

How they describe themselves: Ftrans outsources accounts receivable processes for B2B SMB sellers to mature the processes around credit administration and A/R processing. This involves providing ‘best practices’ solutions for credit administration, risk reduction, collections, and payment processing. Through partnerships with banks and financial intermediaries, including a direct funding capability, FTRANS provides funding institutions with continuous visibility into the A/R as collateral and enables financial institutions to manage risk and more efficiently lend against outsourced A/R, a $1.2T market. This enables SMBs to increase cash availability – by receiving payments on invoices in 2-5 days, reduce DSO and bad debt, and offer buyers more, flexible credit.

What they think makes them better: Ftrans has created several, unique innovations in A/R and credit management for the SMB market which were previously only available to large businesses. This breakthrough technology solution is web enabled and provided in a SaaS environment enabling low technical and behavior change by customers in order to realize benefits. Our technology and processes are patent pending given us not only first mover advantage but a defensible position. In addition, the platform enables banks to increase depository relationships, increase lending, and more effectively manage loans within the underserved SMB market, which represents a $1.2T lending opportunity.

Contacts:

Bus. Dev. & Press: Jim Lester, VP of Marketing, 678-268-4039, [email protected]

Sales: Kevin Kiernan, VP of Sales, 678-268-4032, [email protected]

How they describe themselves: GoalMine is the simple, social way to save and invest. It expands mutual fund investing to a new community of people. GoalMine allows customers to open mutual fund accounts with just $25 and with no prior financial knowledge required. Customers set up their real-life goals, fund their goals with a mutual fund, and then use fundraising features to let others give to their goals either online or using a convenient gift card.

GoalMine is a product of Gratio Capital, a New York City-based asset management company whose mission is to create asset-building products for people worldwide.

What they think makes them better: GoalMine makes mutual fund investing available to a new community of people who have been excluded from traditional investing channels. GoalMine is the first mutual fund investing program that:

- Has a $25 minimum initial investment (not the $2,500 industry average)

- Makes it possible to give mutual funds on a convenient gift card

- Is focused on real-life goals, not financial jargon

- Is socially networked, with fundraising features that allow users to track and share progress online and solicit help from friends and family

- Has a stored value card that is as easy to buy as groceries

Contacts:

Bus. Dev.: Rimmy Malhotra, CEO, 212-731-0830×104, [email protected]

Press: Meredith Kelsey, Director of Public Relations, MPOWER Labs, 512-531-1191,

[email protected]