How they describe themselves: Fiserv is the world’s most successful provider of digital banking and digital payment solutions, exclusively focused on the banking sector. It has operations in every continent including a substantial team serving Asia from Singapore.

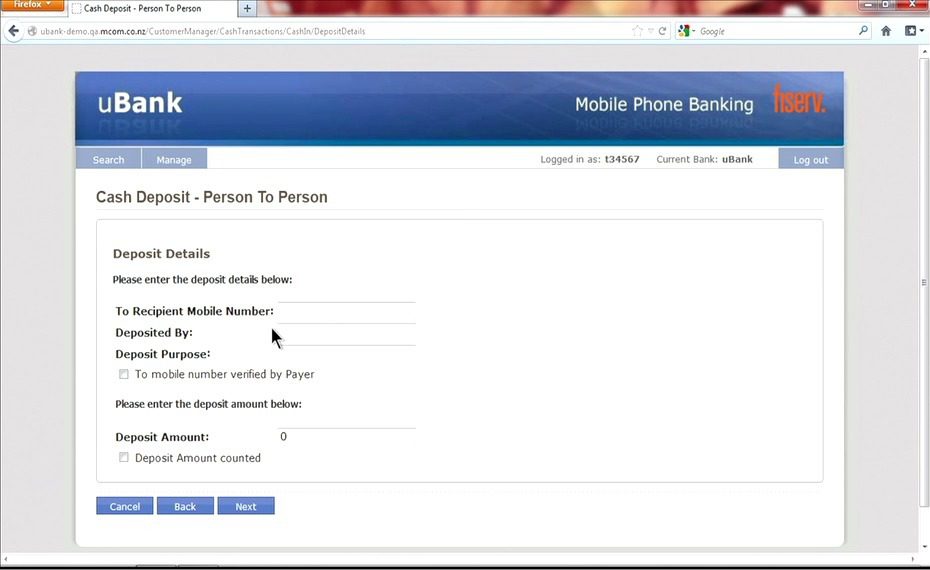

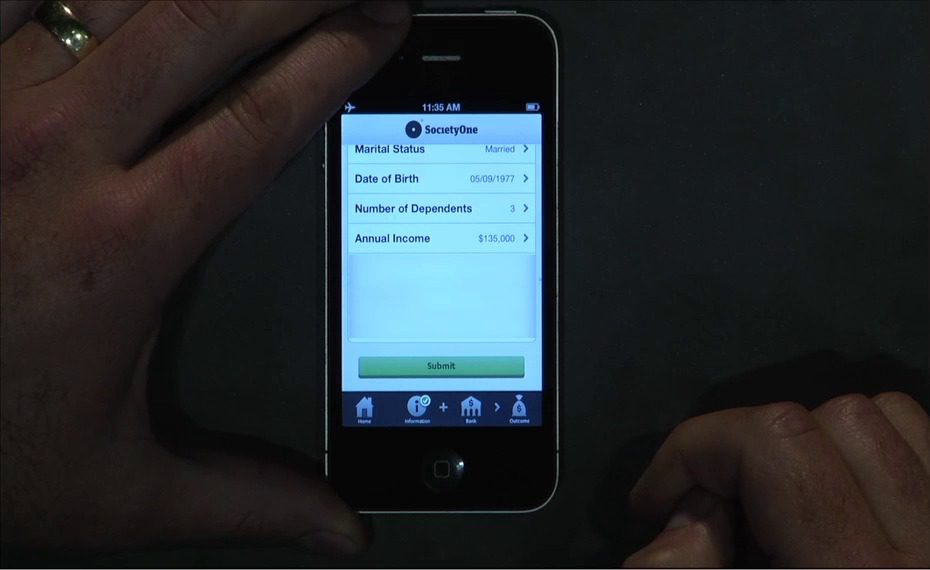

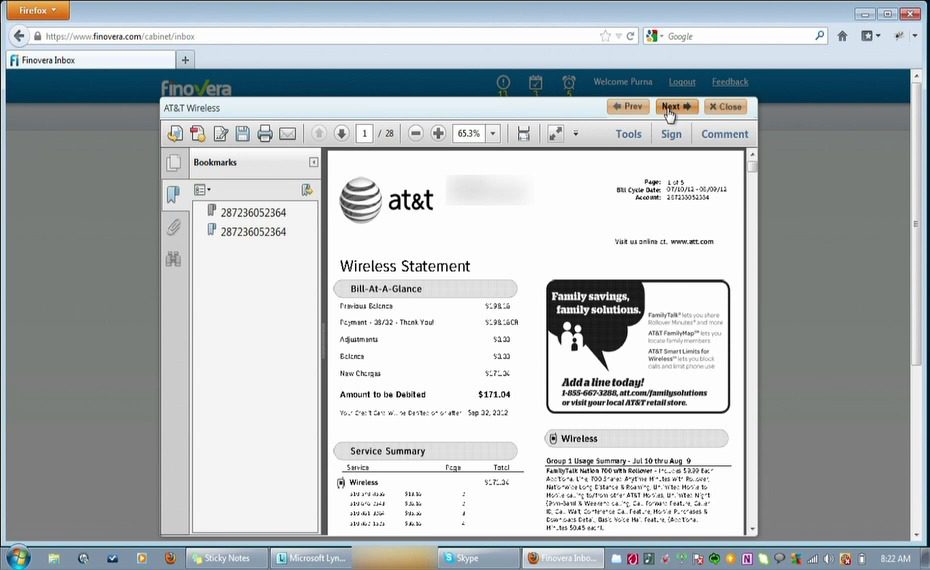

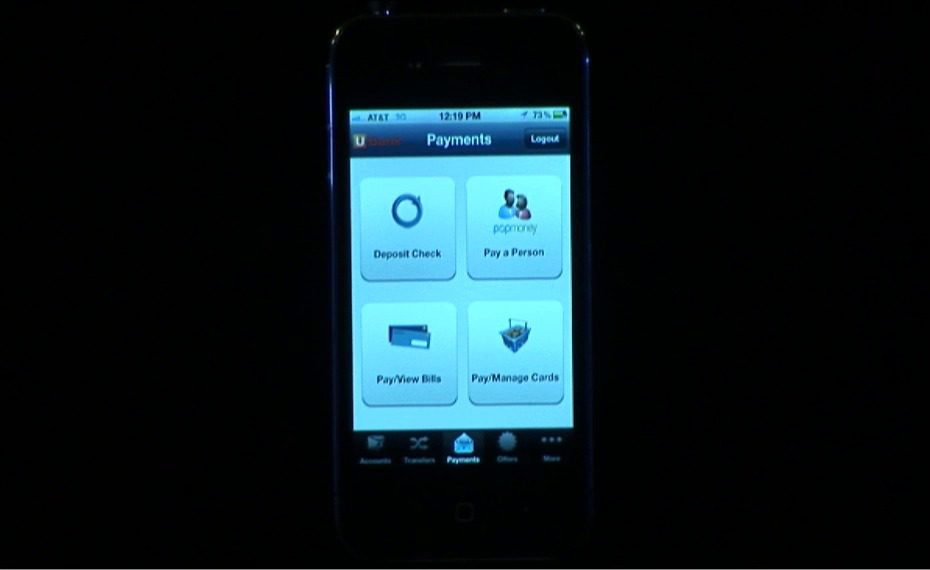

How they describe their product/innovation: Mobiliti from Fiserv is the world’s most deployed mobile banking and payments platform. Mobiliti Reach aims to make financial services simultaneously available to banked and unbanked consumers alike in emerging and fast-growing markets. It includes a comprehensive payments engine to enable person-to-person payments, bill presentment and payments, and top up and merchant payments.

Contacts:

Bus. Dev.: Serge van Dam, VP Mobile Solutions, [email protected], +64 4 889 2662

Press: Julie Smith, Corporate Communications, [email protected], (o) 412-577-3341, (m) 412-225-3182

Sales: Andrew Parker, Business Development Manager, Mobile Solutions, [email protected], +61 2 8003 5787