How they describe themselves: Pandai.cn (盼贷网), which means ‘Hope’ and ‘Borrow’ when translated, strives to deliver the safest, most transparent and convenient channel for lenders to invest in borrowers in China. Through our robust credit risk system, we are able to deliver different niche loan products for different demographics (Taobao stores, short-term lending, SME loans, consumer loans, student loans, car loans, etc.), allowing Pandai to become the only destination in China to build credit. Pandai has also partnered with various e-commerce companies to provide customized niche products for their consumers in the past. Lenders on our platform garner 12-15% returns, where Pandai.cn protects defaults as well as delivers a high liquid product for our lenders.

How they describe their product/innovation: Peer-to-peer lending platform that connects borrowers with lenders through a robust credit risk management system that understands different customer demographics within China.

For our lenders:

- High fixed-income returns (12-15% p.a.) for lenders through investing as little as 100 RMB

- High liquidity through loan transfers on a homogenous platform

- Platform and borrower transparency through our convenient web platform

For our borrowers:

- Fair priced products based on borrower demographics risk profile

- Build credit over the long-term garnering lower priced loans

- Convenient online platform for application and payment

Moreover, with our robust credit management system and customized loan product design, Pandai.cn also is a platform for trying and testing alternative credit models.

Contacts:

Bus. Dev., Press & Sales: Roger Ying, CEO, [email protected]

How they describe themselves: Pendo Systems addresses the new era for global financial standards. As headlines remain dominated by crisis, financial markets must shift the paradigm of back office recordkeeping to adhere to and adopt new regulations to achieve transparency. Pendo’s BasisPoint was developed for global multi-national financial institutions, providing the first cross vertical, global investment accounting application to enter the market in over 20 years. Pendo focuses on the most critical piece of data within any financial institution: tax lot level accounting data. Data by its nature feeds every process in the global eco-system. BasisPoint focuses on granular data, exception processing, and sophisticated multi-jurisdictional functionality and reporting (i.e., IFRS, Basel II, GAAP) to achieve ultimate transparency. People, pivot tables, and legacy applications support the global markets investment accounting. Since the 1980’s the industry has adopted a complete global financial network and created countless new assets and regulations, but in the end we still fear the next failed institution and scandal. Together we can make sure it’s not you.

How they describe their product/innovation: Pendo has the first cross vertical global investment accounting cloud solution. We provide services to capital markets across banking, asset management, wealth management, insurance, and corporate treasury. The landscape today consists of products that are vertically focused on industry (mutual fund, investment management insurance, etc.) & regionally (Asia Pacific, Europe, US). This has caused firms to have silos of investment accounting data – resulting in the same asset being valued differently with a variation of up to 25 basis points. It also is the inhibitor to transparency as the ability to drill down & view total exposure to a given sector, industry, currency, or cost basis cannot be done in a single database and instantaneously. This is a problem that our product solves. BasisPoint solves the issues for the verticals and provides for complete multi-jurisdictional processing for capital markets firms (insurance, mutual fund, asset managers, wealth managers, pension funds, and corporations).

Contacts:

Bus. Dev.: Pamella Berwanger, Manager, [email protected],

973-735-5788

Press & Sales: Pamela Pecs Cytron, CEO, [email protected], 973-727-7853

How they describe themselves: Perfectsen is a pioneer in personal finance management (PFM) solutions in the Asian region. With local presence in Southeast Asia, Perfectsen helped a local bank with the largest online banking users in the region adopt PFM, to which the bank received rave reviews from customers.

Perfectsen aims to bridge the gap between expectations in customer experience and the restrictive banking IT policies. If they live up to their tagline, banking would not be a chore that we have to do, but rather something we want to do in the coming years.

How they describe their product/innovation: Retaining a customer is said to be 5 times cheaper than acquiring a new one. But the problem for banks has always been getting the right product in front of the right customer.

The Hook is a targeted ad platform that solves this problem. It helps banks to intelligently monetize web and mobile traffic by displaying the right products based on existing users’ needs, employing data points from its PFM and other sources.

With a single line of code and flexibility to self-host, integration is a breeze and e-banking as a profit centre is no longer a distant dream.

Contacts:

Bus. Dev., Press & Sales: ST Chua, CMO, [email protected], (m) +60173000168

How they describe themselves: Manilla.com is a free, award-winning service that helps you manage everything in your life in one place. Using just one password, you can track your financial accounts, household accounts and utilities, subscriptions, daily deals, and travel rewards, all through Manilla.com or the Manilla mobile apps.

Manilla securely retrieves and stores account documents, sends reminders to help avoid late fees, and gives you a complete overview of everything in your life – all through a clean, simple interface.

How they describe their product/innovation: Manilla.com is the free, award-winning service that helps you manage everything in your life in one place and has updated its features so that customers can seamlessly manages their lives even more easily than before.

Manilla has made improvements to its mobile apps (which have received 4+ star ratings and thousands of user reviews), upgrades to the way customers categorize their bills and accounts on Manilla, and improvements to its convenient add-account process that allows customers to manage all of their accounts on Manilla’s clean, streamlined interface.

Contacts:

Bus. Dev. & Sales: Chris Victory, VP Business Development & Advertising Operations, [email protected]

Press: Marc Karasu, VP Marketing, [email protected]

Allison + Partners, [email protected]

Sarah Kaufman, Marketing Manager, [email protected]

How they describe themselves: MoneyDesktop (MD) is redefining the way that millions of people interact with their finances by developing software technologies that drive the financial engagement between account holders and financial institutions. Through its award-winning PFM, MD is the leading provider of online and mobile money management solutions and has become the fastest-growing provider of its kind. By integrating directly into online banking, core, and payment platforms, MD allows financial institutions and payment providers to act as financial hubs to account holders. MD also offers tools to financial institutions that dramatically impact loan volume, user acquisition, and wallet-share. In 2 years, MD has grown to over 310 financial institution clients and established partnerships with 25 Online Banking/Core/Payment Network Partners.

How they describe their product/innovation: On average, industry percentages for online banking PFM user adoption and engagement perform far below what is possible. The problem: PFM has been implemented as a mere check-the-box add-on, thus diminishing its huge potential as THE core experience for complete money management. With this mindset, PFM in general has struggled to gain meaningful adoption largely because it has remained separate from the complete online banking experience – usually buried deep in a drop-down tab of optional services. A dividing line exists that separates PFM from the rest of the online-banking experience.

At Finovate, MoneyDesktop is officially erasing this dividing line and introducing a seamless PFM solution for the online banking and mobile channels. This will allow financial institutions to:

- Drive data aggregation with prominent visualizations that prompt users to add outside accounts – leading to even higher levels of loan volume through targeted cross-selling opportunities based on aggregated, user-specific account data.

- Drastically enrich the online banking experience with eye-catching data visualization that can be framed throughout the online banking interface.

- Fuse online and mobile banking with data visualization that is precise and consistent from desktop to mobile devices – giving users timely and rich financial insight when and where it matters most.

Contacts:

Press: Nate Gardner, [email protected], (801) 669-5534

Sales: Matt West, [email protected], (801) 669-5652

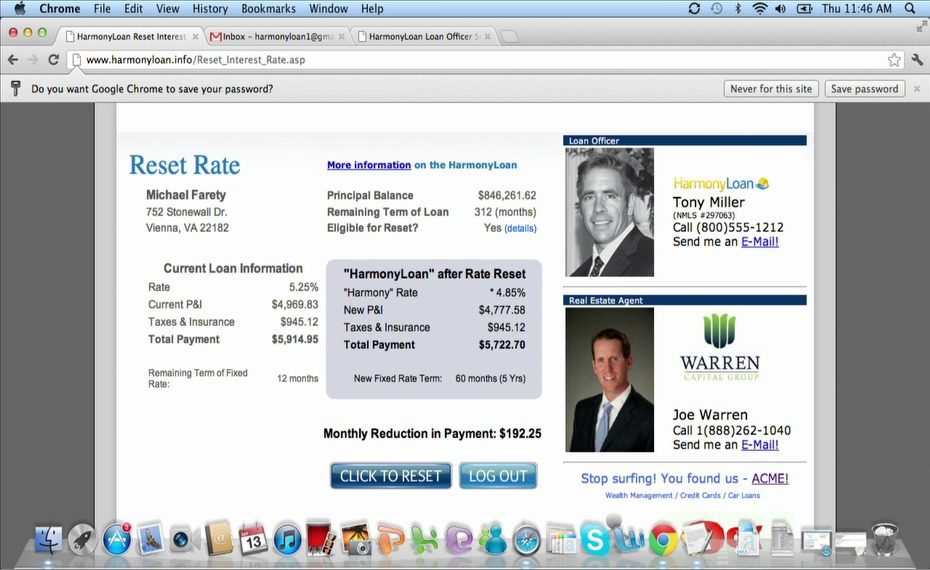

How they describe themselves: Mortgage Harmony Corp. is a financial services company founded in December 2008. The Company designs, develops, and distributes innovative residential mortgage products in a SaaS environment. The company’s cornerstone product, the HarmonyLoan™, is a consumer initiated interest rate-resetting mortgage with a recurring compensation structure to the loan officer (MARS — Mortgage Annuity Revenue Stream). The target market is the one trillion dollar single-family residential mortgage origination market.

How they describe their product/innovation: HarmonyLoan™ Central is a client-branded web-interface for borrowers to access their HarmonyLoan™. The product eliminates the need for the traditional refinance. With a single “click of the button,” a borrower can reset their mortgage rate with no fees, appraisal, credit check, underwriting, and no new amortization schedule. The financial institution eliminates back office processing costs and increases loan retention, all at a premium yield. The servicer reduces portfolio churn, and the loan originator creates a recurring revenue stream via our patented compensation method (No. 7292995). In other words, everyone wins.

Contacts:

Sales: Kevin Ziolkowski, SVP Business Development, (925) 292-4799

Investment Oppty/Press: Keith Kelly, CEO, [email protected], (703) 926-8626

Partnerships: Ray Crosier, President, [email protected], (703) 825-7330

How they describe themselves: MShift has developed mobile wallet and mobile payments capabilities as a natural evolution from mobile banking. Since 1999, MShift has been providing cutting edge Mobile Banking solutions for Mobile Web/Browser, downloadable Mobile Apps, and SMS/Text platforms. MShift’s mobile platform supports all combinations of Online Banking, MFA, Bill Pay, P2P Payments, Mobile Deposit, as well as other third-party services.

How they describe their product/innovation: At FinovateFall 2012, MShift presents AnyWhereMobile: a new payment network enabling Community Banks and Credit Unions to become the issuers of mobile wallets, and receive revenues from mobile payments. The AnyWhereMobile payment network will multiply the net Interchange income of both debit and credit transactions for Financial Institutions, simultaneously slashing Interchange fees for merchants by more than half. The technology behind the AnyWhereMobile initiative eliminates the majority of fraud losses for both issuers and merchants, and empowers merchants to generate additional rewards and discounts for consumers.

Contacts:

Bus. Dev. & Sales: Jeffrey Chen, VP Business Development, [email protected]

Press: Catherine Ptak, Director of MarCom, [email protected]

How they describe themselves: The mission of Ohpen is to change the world of investments. Ohpen provides a fully automated and integrated multilingual cloudbankingplatform for mutual funds investing and savings accounts. Ohpen uses the Platform for it’s retail brand and offers the Platform as a SaaS (Software as a Service) solution to other financial institutions.

The strategy of Ohpen is simple: exceed expectations. This applies to our clients, suppliers, partners and investors. We are not an average company, do not offer average services and do not want our employees to be average. Everything we do, we do differently and more innovatively, so we can have an impact on the people surrounding us.

One of the most important aspects within our company is the automation of processes, activities and services. Automating and integrating processes and proceedings keeps costs low. This focus on low costs will positively and strongly influence the cost/income ratio.

How they describe their product/innovation: Ohpen developed a fully automated and integrated multilingual cloudbanking platform for the operation, administration, reporting and distribution of mutual funds investing and savings accounts. The website as well as the mid and back office and CRM are integrated in one application. The idea behind the Platform is that it should be possible to offer unlimited scalability, availability, security and flexibility of services. In addition, profound automation of processes and services is key.

The Platform is being hosted in the cloud and therefore is not installed locally at the bank (as all old-fashioned financial institutions do). The choice for this hosting solution will result in a 90% cost reduction.

Use of the Platform will limit the number of employees needed to run day-to-day operations and decrease investment in hardware and software.

How they describe themselves: Payfone is a remote mobile commerce company that links mobile identity with the payment process to provide merchants with the easiest, most secure mCommerce checkout possible. Merchants and financial institutions rely on Payfone to power and secure mobile payments for their customers. Payfone is based in New York City with development centers in San Jose, CA and Denver, CO.

How they describe their product/innovation: Payfone’s 1 Touch Checkout™ drives frictionless commerce by retrieving the payment credential tied to the mobile number, thereby eliminating steps in the checkout process and driving higher conversion.

Contacts:

Bus. Dev. & Sales: Bill Murray, VP Sales, [email protected]

Press: Amy Masters, VP Marketing, [email protected]

How they describe themselves: PaySimple simplifies the way small businesses bill and collect payments and empowers them with technology to make their business more efficient. The cloud-based accounts receivable automation solution includes support for multiple payment types, across multiple payment channels (mobile, web, recurring, and invoice) all integrated with customer management. PaySimple also offers custom-branded programs for large enterprises looking to provide value-added solutions to their small business members. Partners in market today include American Express, JP Morgan Chase, Western Union, Jack Henry, ADP and Vantiv.

How they describe their product/innovation: Late payments and business growth challenges continue to plague small businesses. PaySimple has recently launched a get paid faster while you grow your business feature set. This new innovation ensures small businesses get paid faster through simple automation of early payment incentives and late payment penalties. In addition, the innovative features promote business growth by driving social engagement as a natural extension of the payments flow. The social features help businesses grow their social following and improve their online review presence to retain active customer engagements and become a more attractive option to new potential customers.

Contacts:

Bus. Dev.: David Sharp, VP Business Development, [email protected], (720) 544-6130

Press: Jenae Wiegert, VP Product, [email protected], (614) 216-5561

Sales: Kevin Brown, VP Customer Acquisition, [email protected], (303) 928-8564

How they describe themselves: PayTap is shared bill payment. It enables family & friends to contribute to bills online with the funds going directly to the biller. Users socialize their bills, aggregate financial resources and get them paid.

In 2010 the US spent $865B in P2P payments. Of that the largest use was $131B for financial support – family & friends helping to pay bills. That $131B represents 3 billion transactions of which 67% was cash and check.

How they describe their product/innovation: All of us have done it – asked or given help to family & friends to pay a bill. Its hard to ask and difficult to quickly respond. PayTap allows people to do what they currently do everyday but online and with significant advantages.

- Dramatically reduces the cost of moving money and takes a major step out of the process by having the funds go directly to the billing company (AT&T).

- Takes advantage of existing social networking (increases reach and speed).

- Gives visibility to all parties involved and allows them to keep track (who has paid) and avoids costly late fees.

- Users can choose any payment method – credit, debit, PayPal and bank transfer – without revealing their details to family & friends.

Contacts:

Bus. Dev. & Sales: Ken Killian, Director Business Development, [email protected],

(972) 345-6823

Press: Sarah Magee, Director Social Marketing, [email protected], (214) 563-8763

How they describe themselves: Personal Capital is wealth management for the Internet Age. The company’s online platform combines digital technology with highly personalized service to provide a holistic view of your unique financial picture. The free online dashboard presents all of your financial data in one place, including an assessment of your allocation, investment risk and fees. Clients with a minimum of $100,000 in investable assets are eligible to receive highly customized financial advice for a low fee. The company recently launched its iPad and iPhone apps, with never-seen-before features such as FaceTime video chat with a financial advisor and a Stock Options Tracker.

How they describe their product/innovation: Personal Capital will be demoing its free 401(k) fee calculator, which enables users to determine how much their 401(k) costs and what long-term fees they can expect to pay over time. The calculator has the potential to save investors hundreds of thousands of dollars over a lifetime. The company will also unveil the Personal Capital 401(k), an affordable, professionally managed alternative to a traditional 401(k). With the new 401(k) from Personal Capital, the service is a truly holistic financial solution for millions of Americans.

Contacts:

Bus. Dev.: Jim Del Favero, VP Product, [email protected]

Press: Matt Mirandi, Group SJR, [email protected]

Sales: Kyle Ryan, Sales & Service Director, [email protected], (925) 817-9966