How they describe themselves: Plastyc extends the lifetime value of prepaid cards by expanding their capabilities beyond checking accounts. With Plastyc’s BankingUP Platform, “prepaid is the new checking”:

– Account longevity of 2 years and beyond

– Volumes of direct deposited funds exceeding 75%

– Complete feature set including writing and depositing paper checks

– Built-in automated savings for emergencies

– Loyalty-building services such as cash-back rewards and direct top-ups of prepaid mobile phones

The platform is dimensioned for mass banking with a capacity of up to 10MM accountholders.

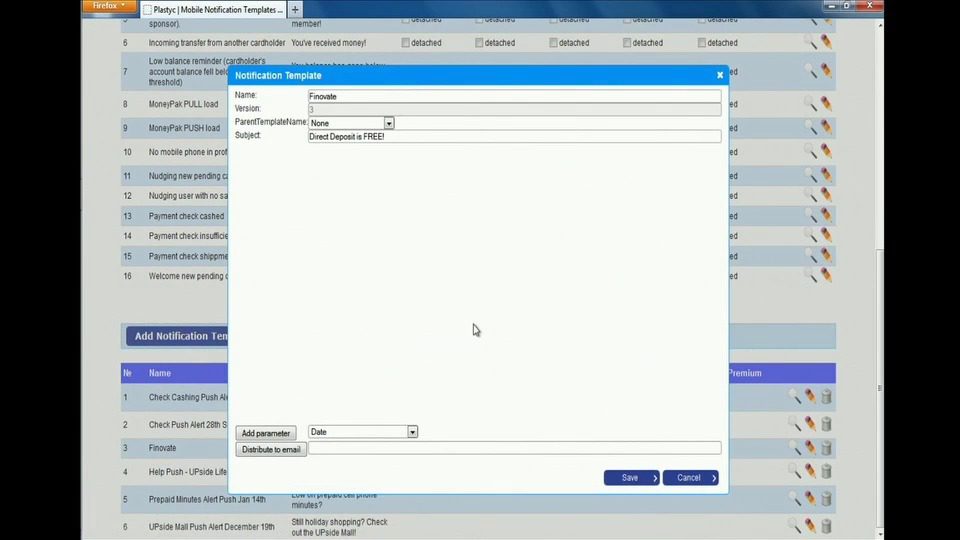

How they describe their product/innovation: Plastyc is demonstrating the administrator-facing side of the BankingUP platform, allowing issuing banks and program managers to:

– Monitor and analyze cardholders’ financial activity in real time;

– Monitor and analyze cardholders’ non-financial activity; e.g., usage of mobile apps and web,

customer support interactions;

– Communicate instantly with programmable subsets of cardholders via web inserts and

smartphone push notification for marketing/upselling and product alerts.

This is a departure from traditional batch mode financial-transactions only reporting obtained from processors.

Contacts:

Bus. Dev. & Sales: Colette Oliver, [email protected], 212-671-1015

Press: Lynda Radosevich, [email protected]

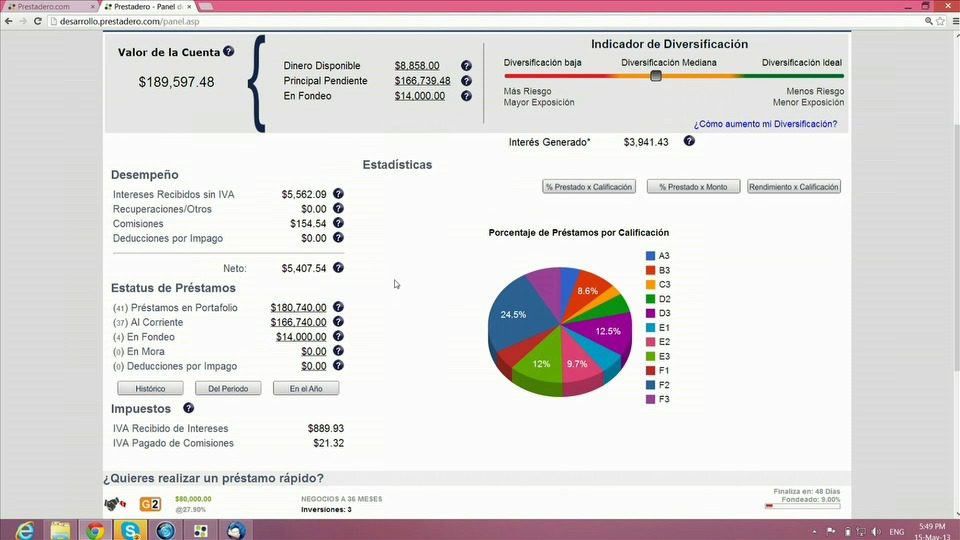

How they describe themselves: Prestadero is the first legally compliant and fully operational peer-to-peer lending platform for the Mexican market. We exploit the spread between high borrower rates in Mexico and the frugal returns available for investors in fixed-income securities. These spreads are some of the largest in a country with a stable economy and controlled inflation. For example, credit card APR’s can be as high as 90 or 100%, while fixed income returns offered by banks are lower than 4%. We offer loans from $10,000 MXN to $250,000 MXN and our borrower rates range from 8.90% to 28.90% a year. We are currently offering 15-17% returns in pesos for lenders using our platform.

How they describe their product/innovation: Prestadero uses its proprietary management software to originate loans in an extremely efficient way. Our platform allows us to parse out declined loans in seconds and determine rates for approved loans in less than 1 minute.

Our web interface allows lenders to view their entire portfolio in detail. Lenders can also view specific graphs and scorecards that allow them to make better investment decisions, even if they are not investment professionals. We provide lenders with tools, such as our “diversification index,” which quickly and comprehensibly lets them know their risk exposure depending on the diversification of their loans. Our software also enables lenders to select multiple loans at once by filtering through the user’s selected criteria. They can also choose to reinvest their returns based on the same or a different set of criteria.

Through their online account, borrowers have full control over their loan’s entire process, from filling out the application to paying it off completely. We also charge the borrower’s bank accounts directly when their payments are due, diminishing delinquencies and providing a better service for our customers. The entire process is streamlined and coded with peer-to-peer finance in mind, reducing human interaction on the back-end of the technology and providing more accurate, up-to-date information on our front-end.

Contacts:

Bus. Dev., Press & Sales: Gerardo Obregon, Founder & CEO, [email protected], +52 555 207 1261

How they describe themselves: Founded in 2000 as pure-play Internet, mBank became the 3rd largest retail bank in Poland by 2012. Consistently deemed as a financial sector innovator, mBank offers a full range of retail and SME financial products, and is recognized as one of the most admired consumer brands in Poland.

Efigence was founded in 1999 by the technology department of artegence.com and the largest Polish interactive communication company. Efigence specialize in financial markets innovations: web and mobile IB platforms with friendly UI/UX, currency trading tools, PFM tools and social and financial data aggregation tools for credit scoring – all combined in one, efficient financial platform.

How they describe their product/innovation: mBank – 1st established European bank to undergo a comprehensive, mass-scale, “Bank 3.0” revolution of its direct channels including modern UI/UX of transactional banking, PFM, video banking, transactional/real-time marketing, social channels, gamification and mobile banking. Our Finovate demo includes innovative transactional site and implementation of Facebook and real-time consumer gratification.

Contacts:

Bus. Dev. & Sales: mBank – Michał Panowicz, Head of “New mBank” Project, michal.panowicz@mBank.pl,

Jacek Iljin, VP Core Products, jacek.iljin@mBank.pl

Efigence – Bartłomiej Wyszyński, Partner & SVP Strategy, [email protected]

Press: mBank – Krzysztof Olszewski, [email protected], +48607354543

Efigence – Bartłomiej Wyszyński, Partner & SVP Strategy, [email protected], +48508020160

How they describe themselves: Meniga offers white-label personal finance management (PFM) and next generation online banking solutions to retail banks. It helps banks’ customers better manage their personal finances while helping banks realize business benefits through data mining, cross-sales, retention and customer satisfaction. To achieve true mass appeal, Meniga uses social curiosity, humor and gaming concepts to engage users to think about their money.

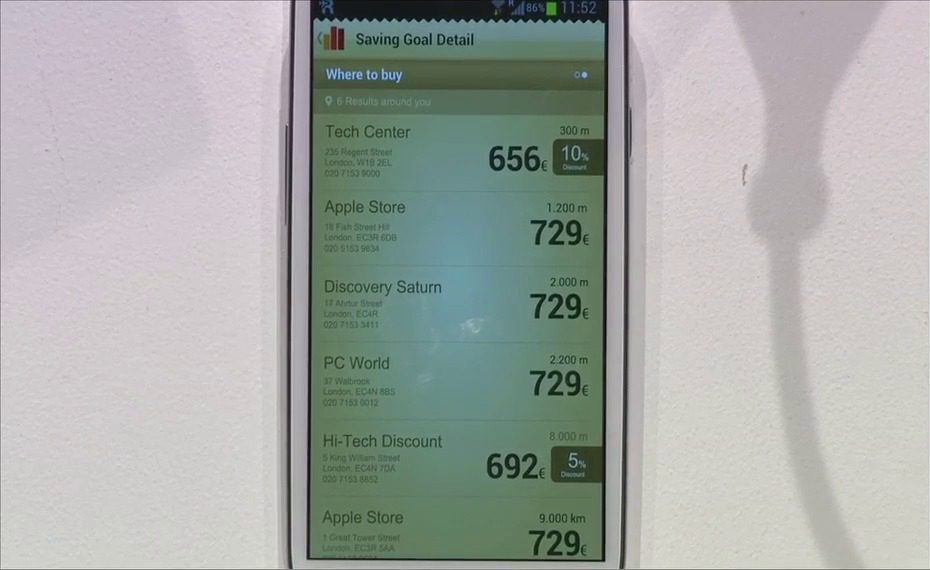

How they describe their product/innovation: “To buy or Not to buy” is a white-label module for mobile banking applications, that uses PFM functionality to empower and influence consumers at the point of sale or when considering buying something.

It allows users to check if they can afford what they are about to purchase or see how much closer to their savings goals they would get if they save the money and use it to feed their goal instead.

One unique aspect of this innovation is allowing users to leverage their social networks & direct messages to crowd-source the decision and instantly collect feedback before making the purchase. This fun and simple feature uses gamification to engage users and their network of friends.

Contacts:

Bus. Dev. & Press: Georg Ludviksson, CEO, [email protected], +46 767822146

Sales: Duena Blomstrom, VP Sales, [email protected], +46 708620578

How they describe themselves: Metaforic is a leading provider of security software for protection against malware and hacker attack. Metaforic offers real time security for firmware, OS and applications, specializing in providing high performance solutions for financial institutions, at the server end and in mobile applications.

Metaforic solutions directly prevent subversion, hacking, malware, tampering or other corruption by automatically immunizing applications with high security protection. This defeats custom malware and malicious hacking attacks at the application layer stopping threats such as repackaging, credential theft and communications eavesdropping.

How they describe their product/innovation: We have a product that protects mobile applications from unauthorized changes and subversion of the existing code. In effect, by using our solution, the financial institution has control over what the application does if it is compromised. It can quit, display a message, send a silent security alert to bank servers or any other behavior the developer cares to define. Critically, for financial institutions that have a lot of mobile developments underway, it can be integrated with existing developments at the end of the software development lifecycle, and it is an automatic process not requiring significant developer time or security expertise.

Contacts:

Bus. Dev.: Douglas Kinloch, VP Bus. Dev., [email protected]

Press: Angela Ausman, Marketing Director, [email protected]

Sales: Gareth Carroll, EU Sales, [email protected]

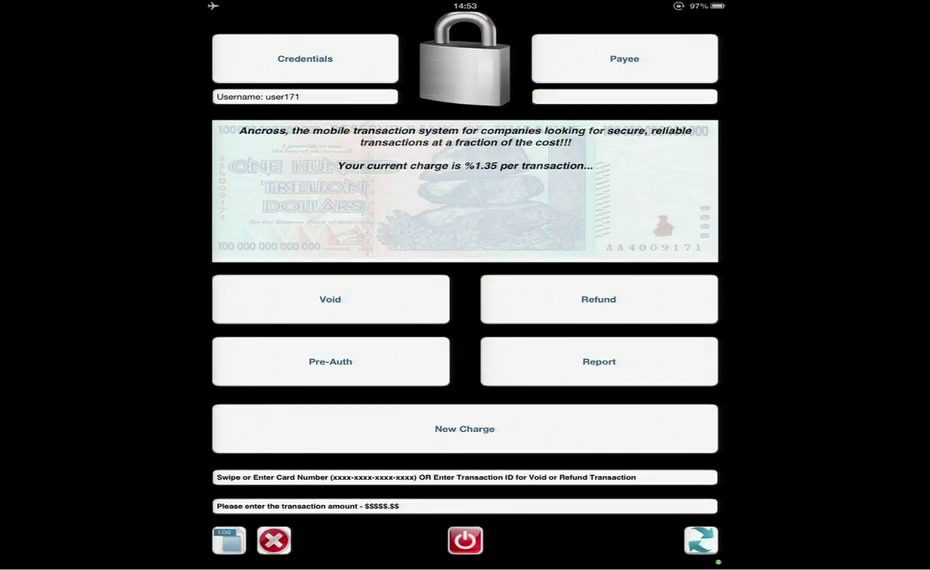

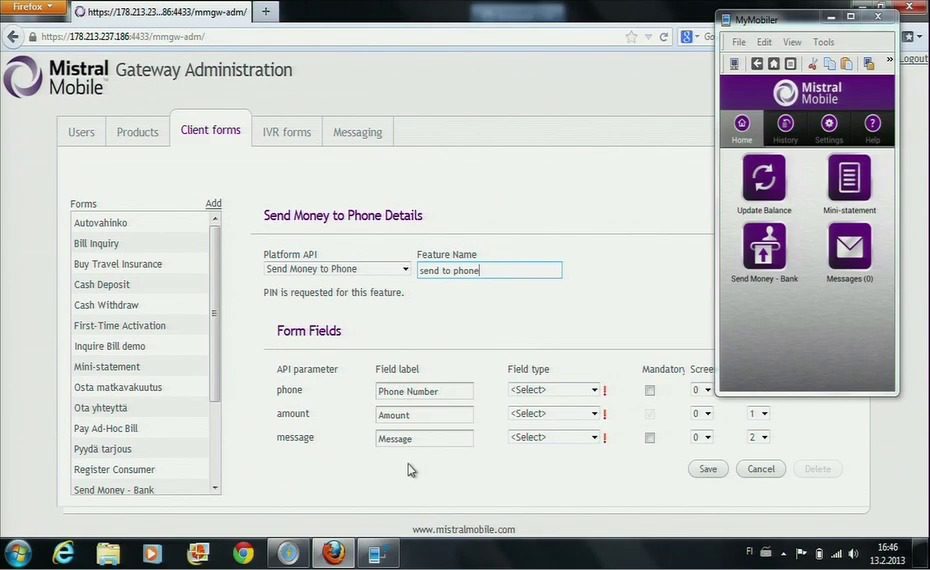

How they describe themselves: The mobile phone revolutionizes the economics of financial services on reaching, capturing and serving consumers by harnessing the 5B people who own a mobile phone today. Whether to enhance the convenience of an existing consumer or untapping tomorrow’s wealth, the mobile phone is the leapfrogging conduit to reach consumers. Mistral Mobile combines vast experience in mobile technologies with hands-on knowledge of how mobile financial services work, making it possible to leapfrog traditional approaches and drive the next wave of success in mobilized financial services. Mistral Mobile was founded by former Nokia mobile financial services leaders who fervently believe in both the commercial benefits of offering fully mobilized financial services as well as the socio-economic benefits these can bring to societies and individuals.

How they describe their product/innovation: Money Mobility Suite is the focal point of building a comprehensive mobile front-end for any financial service. Suite integrates to any financial services system such as core banking systems, payment processing systems or a stored value account system and provides fully secure communication between the system and the Money Mobility applications in the handsets. Suite provides fast time to market to deliver mobilization for various types of financial services. Most importantly, it provides remote management and configuration capabilities for all the applications through a single configuration management center and enables the financial service provider to instantly add or change features available for the users of the different financial services products.

Contacts:

Bus. Dev. & Sales: Ludwig Schulze, CEO, [email protected], +1 917 514 5027

Press: Peter Ollikainen, SVP Product Marketing, [email protected],

+358-50-4872668

How they describe themselves: Moven is the complete re-imagining of the banking experience for retail customers. It is a concept that appeals to both the banked and unbanked, but empowers customers in a way that could never be conceived by a traditional commercial bank. Moven creates a new way of engaging customers that will define retail banking for the future to come. At Moven, our aim is to be the service you choose to live better with your money. A revolutionary banking service that helps our customers spend, save and live smarter. Moven gives customers instant insights on their spending to improve their financial health over time. Moven is not a typical bank. We work with banking and payments partners, mobile manufacturers, consumer credit groups, social media partners, merchants and many others to understand how banking fits into the lives of individuals. We are the start of what banking will become.

How they describe their product/innovation: At FinovateEurope 2013, we are demonstrating the Moven mobile banking experience along with how CredScore® and our Spend, Save, Live tools will help consumers manage and improve their financial health. The demo will include features of the day-to-day mobile banking experience and the online platform.

Contacts:

Bus. Dev.: Brett King, CEO & Founder, [email protected]

Press: Geoffrey Bye, [email protected]

Sales: [email protected]

How they describe themselves: NICE Systems is the worldwide leader of intent-based solutions that capture and analyze interactions and transactions, realize intent, and extract and leverage insights to deliver impact in real time. NICE solutions enable organizations to improve customer experience, expand their business, increase operational efficiency, prevent financial crime, ensure compliance, and enhance safety and security.

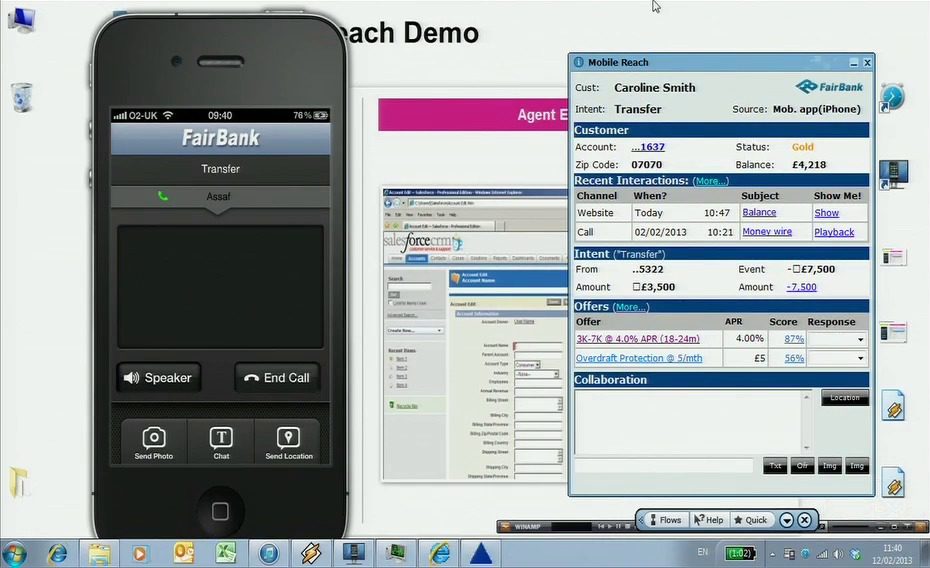

How they describe their product/innovation: NICE Mobile Reach complements mobile banking by intelligently bridging self-service and assisted-service, creating a service experience that is as smart as customers’ devices. The solution provides the following:

- ENGAGE: Understanding customer intents in real-time, and recommending to them – just at the right time and if relevant – the next step for fulfilling their needs.

- CONNECT: When needed, seamlessly connecting the customer directly to the right agent, bypassing the IVR and transferring the context from the mobile device to the agent desktop.

- COLLABORATE: Expanding customer interactions with agents beyond verbal discussions using multimedia collaboration tools, such as sending text, images, and documents.

- FEEDBACK: Once the service interaction is done, presenting a survey to the customer as a natural step of the interaction.

Result for the customer: Ultimate customer experience – as personalized, relevant, and as effective as possible.

Result for the enterprise: Boost in business results, reduced service costs, and higher mobile adoption.

Contacts:

Bus. Dev. & Sales: Ofer Mosseri, VP Solution Sales & Bus. Dev., [email protected],

+44 (207) 002-3189

Press: Erik Snider, Corporate Communication Director, [email protected], +972-9-775-3252

Additional Product Information: Assaf Frenkel, Head of Mobile Customer Service, [email protected], +972-9-775-3746

How they describe themselves: After years of hard work on building our technology and starting up our business, in the last three years we achieved great traction: our mobile banking product has been chosen by major international banks and has been awarded for the delivered user experience. Our solutions are based on open standards thus avoiding technology lock and allowing high interoperability. Our team is made of software engineers, digital interaction designers and graphic designers, 35 people in total, all having deep experience on mobile solutions.

How they describe their product/innovation: At Finovate we are launching a revolutionary approach to mobile finance with our suite of Enhanced Hybrid (TM) apps for mobile banking and mobile payment.

Not happy with HTML5 UX, neither with native app complexity? Enhanced Hybrid is the solution:

- User experience same as native apps

- Development “server side” instantly available cross platform

- Minimized testing effort thanks to a common codebase across all supported devices

- Multiplatform rollout without additional development costs

- Change management without publishing a new version on the app stores

Contacts:

Bus. Dev. & Sales: Stefano Andreani, CEO

Press: Alessandro Borghini, CCO

How they describe themselves: Paying bills using a mobile phone can be quite difficult. Manual data entry is cumbersome and often frustrating for smartphone users. PhotoPay develops an advanced technology that significantly improves bill payment experience using a mobile phone camera combined with efficient bill recognition algorithms and advanced data extraction techniques.

Our unique technology can be simply included as software library for iOS and Android-based mobile payment applications like mobile banking, mobile wallets, etc.

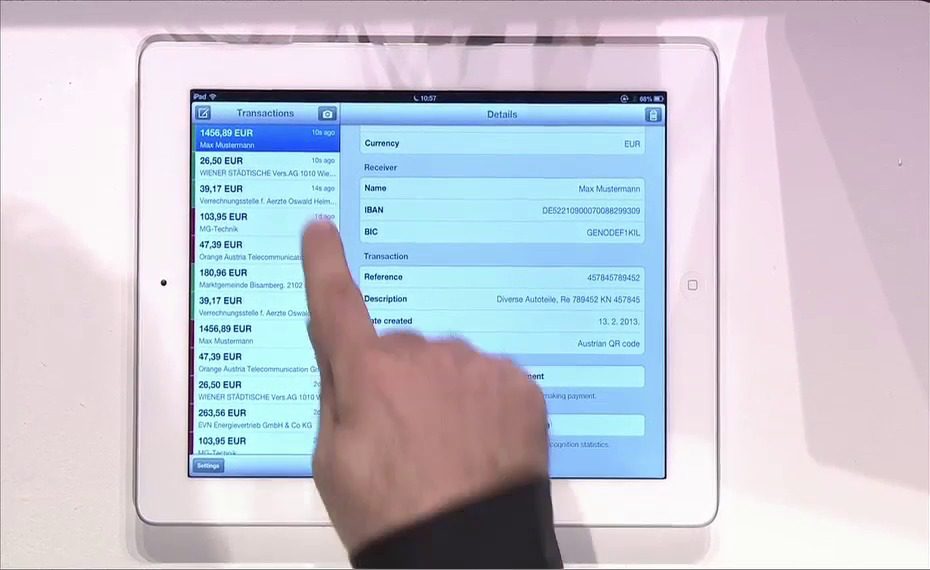

How they describe their product/innovation: PhotoPay and PDFpay are greatly improving the paper and electronic bill payment experience on mobile devices. PhotoPay uses a phone camera to extract payment data from paper bills and payment slips and PDFpay is used to extract payment data from bills and offers received electronically (in PDF, HTML or other electronic format), allowing very simple payment without manual data entry!

Our unique smartphone technology recognizes payment slips in real time and intelligently extracts payment data in a few seconds from paper or electronic bills. And users love it – it is much simpler and up to 10 times faster than typing payment data!

While PDFpay can work globally, PhotoPay currently works best in countries with standard payment slips (like Germany, Austria, Slovenia, Hungary and many other European countries). We are in the process of implementing nonstandard bill format support, which will enable even wider PhotoPay implementation.

Contacts:

Bus. Dev.: Damir Sabol, [email protected]

Press & Sales: Izet Zdralovic, [email protected]

How they describe themselves: Pockets United was founded mid-2011. All founders behind Pockets United have considerable start-up experience, while two already lived through a successful start-to-exit-cycle. Armin von Samson, former Head of Legal of PayPal Germany, joined our board as an advisor the beginning of 2012. Last fall, Pockets United was accepted into Wayra, Telefónicas global accelerator program. Partnerships with local retail banks will be of high relevance to expand in foreign markets in order to comply with regulatory requirements. We’re currently raising another seed round, proofing the concept, and preparing the rollout of our service all over Europe and Latin America.

How they describe their product/innovation: ‘Social’ is the next big thing in mobile payments, yet you cannot downgrade it to a simple on-top feature for existing PSPs nor banks. A category killer in this field must be social by design. This means cutting-edge user experience and fun to use in day-to-day scenarios. The space is hot. Carriers see their business threatened by all-encompassing data flats, while traditional banks and credit card companies see payment shifting to mobile devices, whose users are owned by carriers. Pockets United sits right in the center of this clashing zone, offering a helping hand to both sides and its users.

Contacts:

Bus. Dev., Press & Sales: Markus Stiefel, CEO, [email protected]

How they describe themselves: Metaforic is a leading provider of security software for protection against malware and hacker attack. Metaforic offers real-time security for firmware, OS, and applications, specializing in providing high performance solutions for financial institutions, at the server end and in mobile applications.

Metaforic solutions directly prevent subversion, hacking, malware, tampering or other corruption by automatically immunizing applications with high security protection. This defeats custom malware and malicious hacking attacks at the application layer stopping threats such as repackaging, credential theft, and communications eavesdropping.

How they describe their product/innovation: Metaforic is demonstrating our latest technology that can detect, respond, and report on a range of security threats to mobile financial applications. The product works on a per app basis at the application layer to inform operators of the real-time security state of the application and device.

For example, a Metaforic protected application can detect an application repackaged with a malicious payload, alert the institution if the app connects to its service, and mark any transactions with a higher risk profile. Another example is if the device is jail broken, it will be reliably reported.

Contacts:

Bus. Dev.: Douglas Kinloch, VP Business Development, [email protected]

Press: Angela Ausman, Marketing Director, [email protected]

Sales: Bruce Costello, VP Sales, [email protected]