How they describe themselves: Narrative Science is the leading provider of automated business analytics and natural language communication technology that helps organizations transform data into narrative insight. Its patented artificial intelligence engine, Quill™, automatically analyzes data and creates stories that are contextually relevant and personalized to any audience. Narratives can be produced in many formats, including business reports, articles, summaries, visualizations, headlines, and Tweets, allowing companies to improve decision-making, create new products, and optimize customer interactions. Solutions span multiple industries, including financial services, marketing and advertising services, research and information services, hospitality, government, education, and media and publishing.

How they describe their product/innovation: Narrative Science presents Quill for Financial Services, a suite of solutions that enables financial institutions the ability to automatically analyze, interpret and gain human insight from data at a speed and scale never before possible.

- A leading credit analytics firm is leveraging Quill to transform its data and risk assessment models into an investment report that combines both text and visualizations.

- Quill is automatically creating attribution summaries that provide internal stakeholders and their clients with insight into the reasons behind portfolio performance.

- Quill is creating personalized portfolio reviews for financial advisors and their clients. Advisors get the talking points they need for client conversations while their clients get clearly written account performance summaries.

Contacts:

Bus. Dev.: Rory Murray, VP Business Development, [email protected]

Press: Katy De Leon, Director Marketing, [email protected]

Sales: Chris Kraft, VP Sales, [email protected]

How they describe themselves: NICE Systems is the worldwide leader of intent-based solutions that capture and analyze interactions and transactions, realize intent, and extract and leverage insights to deliver impact in real time. NICE solutions enable organizations to improve customer experience, expand their business, increase operational efficiency, prevent financial crime, ensure compliance, and enhance safety and security.

How they describe their product/innovation: Mobile Reach converges mobile self-service and assisted-service to create the most personalized, effective, and efficient channel. It offers:

- ENGAGE: Intelligently finding engagement opportunities in self-service and directing customers to the best next step just at the right time.

- CONNECT: If needed, seamlessly connecting customers directly to the right agent, bypassing the IVR and transferring the context from the device to the agent desktop.

- COLLABORATE: Expanding customer interactions using multimedia collaboration tools (sending text, images, etc.).

Customers get the ultimate customer experience – as personalized, relevant, and as effective as possible.

Companies get more business, lower service costs, and higher mobile use.

Contacts:

Bus. Dev. & Sales: Assaf Frenkel, Head of Mobile Customer Service, [email protected], +972-9-775-3746

Press: Erik Snider, Corporate Communication Director, [email protected], +972-9-775-3252

How they describe themselves: OneID eliminates the need for usernames and passwords, while delivering a secure, compliant identity system that’s easy for your customers to use. OneID enables online transactions with a click or tap, instantly recognizing individuals through their unique digital identity. Combining advanced, military-grade cryptography and a distributed-cloud, OneID reduces fraud and eliminates the costs and risks associated with managing customer accounts and data.

How they describe their product/innovation: By combining a tap- and click-driven user experience with public key cryptography, OneID delivers convenience and security to consumers and providers alike.

Login: Single-click login, no password needed

Two-Factor Authentication: Customizable to meet different security requirements

Cross-Sell: Removes friction with single-click form filling

Top of Wallet: Increases purchase frequency with e-commerce deployment of OneID

Contacts:

Bus. Dev. & Sales: Casey Newton, VP Sales, [email protected], 415-322-8475

Press: Renee Deger, LewisPR, [email protected], (o) 415-432-2439, (m) 650-714-3911

How they describe themselves: OpenCoin is the company building the Ripple protocol, a virtual currency and distributed open source payment network – a simple way to send money to anyone on any platform. OpenCoin was formed by Chris Larsen, the Founder of disruptive financial technology companies E-LOAN and Prosper, and Jed McCaleb, the Founder of eDonkey and the world’s largest Bitcoin exchange Mt. Gox, to build a new virtual currency and distributed payment network that is fast, secure, and easy to use. OpenCoin envisions a new monetary system built on the Ripple protocol that empowers anyone, anywhere to trade any amount of money, in any currency for free and in complete confidence.

How they describe their product/innovation: At its core, Ripple is a distributed global ledger that creates a distributed open source payment network and the world’s first distributed currency exchange. Ripple solves the double spend problem through a process of consensus rather than Bitcoin’s concept of mining. Ripple furthers the Bitcoin mission with faster transactions (confirming in seconds not minutes) and a multi-currency design that allows for any currency to be traded within its exchange. In fact, Ripple is so versatile, its the best place to hold and use Bitcoins.

Contacts:

Bus. Dev.: Patrick Griffin, [email protected]; skype: griffinp9

Press: Michael Azzano, Cosmo PR, [email protected]

How they describe themselves: P2Binvestor is the first crowdfunded receivables finance company. We provide businesses with competitively priced working capital while offering the crowd returns of 7-12% APR. Our website is operational and open to Accredited Investors, average earnings are 9.5% APR.

How they describe their product/innovation: P2Binvestor has created a platform that allows investors to buy into a portfolio of business receivables and earn good returns. We give investors the ability to examine underwriting information about clients and choose which receivables portfolio to buy into. Investors own a percentage of every invoice in a portfolio and earn their returns in cash every month. Investors can liquidate part or all of their portfolios without fees with 60 days notice.

Contacts:

Bus. Dev. & Press: Krista Morgan, CMO, [email protected], 720-326-6939

Sales: R. Bruce Morgan, CEO, [email protected], 303-588-8185

How they describe themselves: Palo Alto Software was founded by Tim Berry in 1988. Tim was consulting for big players in the Silicon Valley, but felt that business planning shouldn’t be just for the “big guys,” so he set out to create business tools that were accessible and affordable for small businesses everywhere. Since then, Palo Alto Software has grown to 50 employees with the single goal of helping other small businesses grow and become successful. We now offer several software products and an extensive library of free expert content and tools at www.bplans.com to help small businesses succeed.

How they describe their product/innovation: LivePlan tells you how your business is doing. It creates budgets and forecasts to help you plan for success, allows you to put together a beautiful one-page pitch, and helps you track and manage your performance to ensure efficient growth. With its Quickbooks integration, LivePlan delivers business intelligence to small businesses everywhere. LivePlan has received the Top Ten Reviews Gold Award and been touted as, “an essential tool for launching a startup” by Inc.com. Fans include PC World, The Wall Street Journal, CNN Money, and Entrepreneur as well as over 70,000 customers.

LivePlan and MasterCard have now teamed up, and are helping small businesses and mid-market companies manage both their performance and daily operations. LivePlan is now offered through the MasterCard® Easy Savings Program and provides business intelligence through MasterCardbiz.com. Moving forward, the two companies will look to identify other areas in which their solutions can jointly provide value to business owners.

Contacts:

Bus. Dev.: Peter Thorsson, Business Development, [email protected]

Press: Lindsey Muth, Director Public Relations, [email protected]

Sales: Jason Gallic, Director Sales, [email protected]

How they describe themselves: PayNearMe Inc. was founded in 2009 and is headquartered in Sunnyvale, CA. The company operates a cash transaction network that allows consumers to pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation. Consumers make cash payments at local stores in the United States, starting with 7,000 7-Eleven® and 1,600 ACE Cash Express® stores.

How they describe their product/innovation: Powered by PayNearMe is a white-label treasure services product that any financial institution can offer to their merchants to enable them to accept cash payments from consumers at thousands of 7-Eleven and ACE Cash Express stores nationwide.

Contacts:

Press: [email protected], 650-469-1301

Sales: [email protected], 650-469-1321

How they describe themselves: Persint provides an online consumer analytics application leveraging existing aggregated account data to deliver a missing component to PFM – performance conclusions. Through Persint, consumers gain the context to answer the household questions of “where do I stand” (financially) and “what next” (solutions). Combining account data, peer-based exception analysis and performance scores, Persint’s analytics transform aggregated account data into objective, credible recommendations towards improving net worth, cash flow and risk management. The add-on application enables financial institutions to enhance their advisory position, gain actionable consumer intelligence and expand revenue. Becoming their advisor requires delivering objective advice.

How they describe their product/innovation: Persint’s consumer analytics application integrates with account aggregation and is designed to complement existing PFM. Leveraging public data sources mapped to conform to aggregation categorization, Persint delivers performance context through comparison to U.S. household peers. Just five demographic inputs can segment a household into one of over 100 unique peer groups. Other solution features include:

• performance navigation through color-coded decision trees

• data representative of all U.S. households

• local cost of living adjustments

• alternative peer group formation

• composite score based on net worth, cash flow and risk management

• performance classification and scoring system

• solution mapping of opportunities to actions

Contacts:

Bus. Dev., Press & Sales: Steve Cotton, CEO, [email protected]

How they describe themselves: Placecast is the world’s leading provider of location-based marketing and loyalty programs for mobile operators, payments companies and brands. The company’s ShopAlerts geofence marketing platform is specifically designed to use digital marketing on mobile devices to drive consumers into physical stores.

ShopAlerts has transformed the mobile marketing industry, taking home the top prize for innovation awarded by the National Retail Federation. Placecast’s partners include Telefonica’s O2, AT&T, and some of the largest credit card companies in the world. Over 160 brands have run ShopAlerts programs including Starbucks, L’Oreal, The North Face, Kiehl’s, Subway, Pizza Hut, Kmart, HP, Chico’s White House Black Market, JetBlue and SC Johnson, with over 10 million opted in consumers receiving location-based offers every week.

How they describe their product/innovation: The ShopAlerts Wallet combines Placecast’s expertise in location-based marketing with the latest innovations in mobile commerce. Built in HTML5, the Wallet works on all smartphone platforms and offers customers a first-ever turnkey solution for launching personalized location-based mobile offers tied to mobile payments. There’s no app to build for marketers, and no app for consumers to download. Unlike other mobile wallet offerings, Placecast offers the Wallet as a white-label solution specifically built for credit card companies, mobile operators and retailers.

Contacts:

Bus. Dev. & Sales: Blair Swedeen, SVP Strategy & Business Development, [email protected]

Press: Sarah Din, Sr. Marketing Manager, [email protected]

How they describe themselves: Plastyc extends the lifetime value of prepaid cards by expanding their capabilities beyond checking accounts. With Plastyc’s BankingUP Platform, “prepaid is the new checking”:

– Account longevity of 2 years and beyond

– Volumes of direct deposited funds exceeding 75%

– Complete feature set including writing and depositing paper checks

– Built-in automated savings for emergencies

– Loyalty-building services such as cash-back rewards and direct top-ups of prepaid mobile phones

The platform is dimensioned for mass banking with a capacity of up to 10MM accountholders.

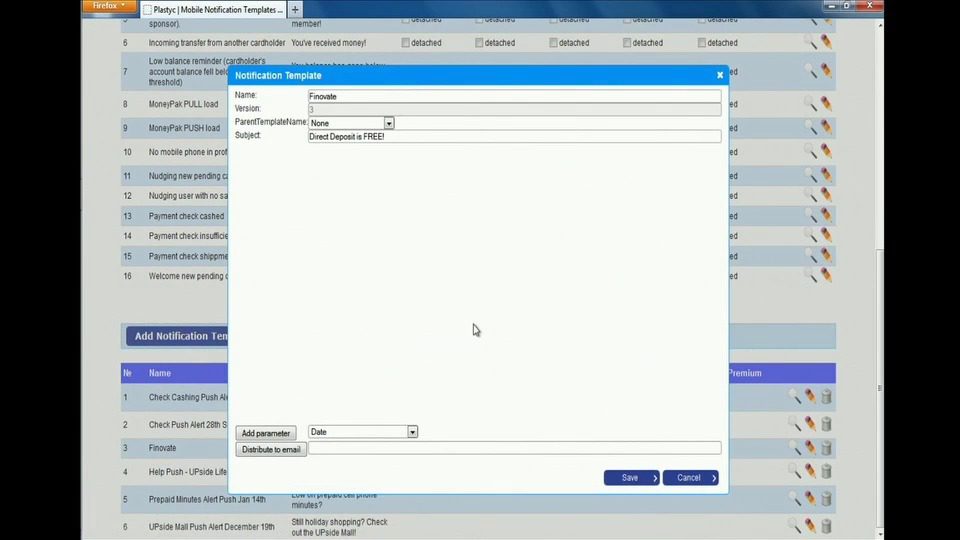

How they describe their product/innovation: Plastyc is demonstrating the administrator-facing side of the BankingUP platform, allowing issuing banks and program managers to:

– Monitor and analyze cardholders’ financial activity in real time;

– Monitor and analyze cardholders’ non-financial activity; e.g., usage of mobile apps and web,

customer support interactions;

– Communicate instantly with programmable subsets of cardholders via web inserts and

smartphone push notification for marketing/upselling and product alerts.

This is a departure from traditional batch mode financial-transactions only reporting obtained from processors.

Contacts:

Bus. Dev. & Sales: Colette Oliver, [email protected], 212-671-1015

Press: Lynda Radosevich, [email protected]

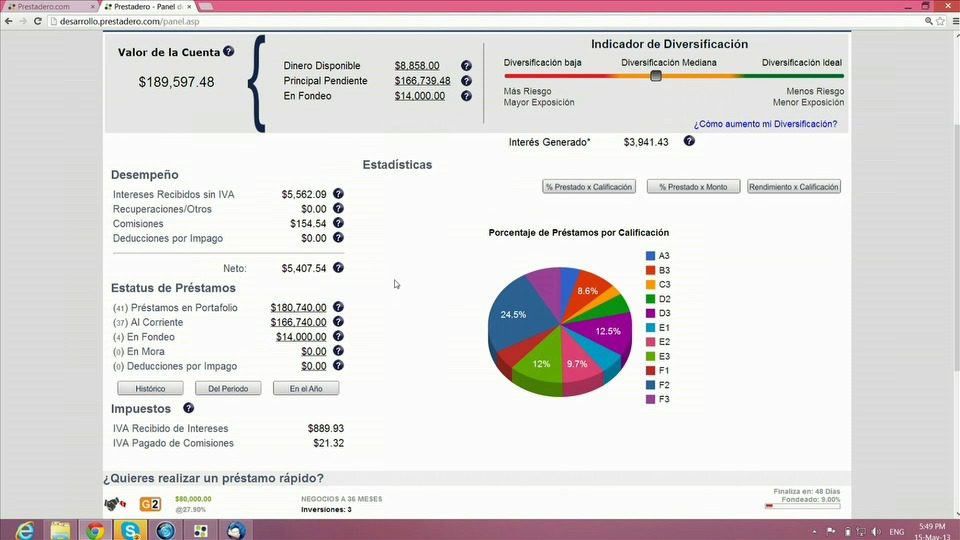

How they describe themselves: Prestadero is the first legally compliant and fully operational peer-to-peer lending platform for the Mexican market. We exploit the spread between high borrower rates in Mexico and the frugal returns available for investors in fixed-income securities. These spreads are some of the largest in a country with a stable economy and controlled inflation. For example, credit card APR’s can be as high as 90 or 100%, while fixed income returns offered by banks are lower than 4%. We offer loans from $10,000 MXN to $250,000 MXN and our borrower rates range from 8.90% to 28.90% a year. We are currently offering 15-17% returns in pesos for lenders using our platform.

How they describe their product/innovation: Prestadero uses its proprietary management software to originate loans in an extremely efficient way. Our platform allows us to parse out declined loans in seconds and determine rates for approved loans in less than 1 minute.

Our web interface allows lenders to view their entire portfolio in detail. Lenders can also view specific graphs and scorecards that allow them to make better investment decisions, even if they are not investment professionals. We provide lenders with tools, such as our “diversification index,” which quickly and comprehensibly lets them know their risk exposure depending on the diversification of their loans. Our software also enables lenders to select multiple loans at once by filtering through the user’s selected criteria. They can also choose to reinvest their returns based on the same or a different set of criteria.

Through their online account, borrowers have full control over their loan’s entire process, from filling out the application to paying it off completely. We also charge the borrower’s bank accounts directly when their payments are due, diminishing delinquencies and providing a better service for our customers. The entire process is streamlined and coded with peer-to-peer finance in mind, reducing human interaction on the back-end of the technology and providing more accurate, up-to-date information on our front-end.

Contacts:

Bus. Dev., Press & Sales: Gerardo Obregon, Founder & CEO, [email protected], +52 555 207 1261

How they describe themselves: Founded in 2000 as pure-play Internet, mBank became the 3rd largest retail bank in Poland by 2012. Consistently deemed as a financial sector innovator, mBank offers a full range of retail and SME financial products, and is recognized as one of the most admired consumer brands in Poland.

Efigence was founded in 1999 by the technology department of artegence.com and the largest Polish interactive communication company. Efigence specialize in financial markets innovations: web and mobile IB platforms with friendly UI/UX, currency trading tools, PFM tools and social and financial data aggregation tools for credit scoring – all combined in one, efficient financial platform.

How they describe their product/innovation: mBank – 1st established European bank to undergo a comprehensive, mass-scale, “Bank 3.0” revolution of its direct channels including modern UI/UX of transactional banking, PFM, video banking, transactional/real-time marketing, social channels, gamification and mobile banking. Our Finovate demo includes innovative transactional site and implementation of Facebook and real-time consumer gratification.

Contacts:

Bus. Dev. & Sales: mBank – Michał Panowicz, Head of “New mBank” Project, michal.panowicz@mBank.pl,

Jacek Iljin, VP Core Products, jacek.iljin@mBank.pl

Efigence – Bartłomiej Wyszyński, Partner & SVP Strategy, [email protected]

Press: mBank – Krzysztof Olszewski, [email protected], +48607354543

Efigence – Bartłomiej Wyszyński, Partner & SVP Strategy, [email protected], +48508020160