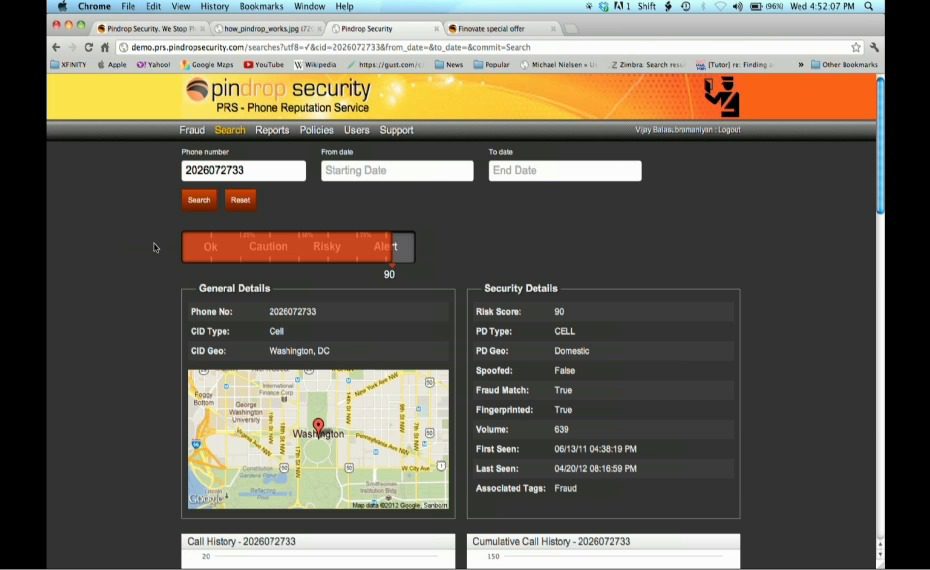

How they describe themselves: Pindrop Security provides enterprise solutions that help prevent phone-based fraud. Its acoustical ďŹngerprinting technology detects fraudulent calls and authenticates legitimate callers, helping customers eliminate ďŹnancial losses and reduce operational costs. Pindropâs breakthrough technology is the ďŹrst of its kind to ďŹngerprint individual phone calls, providing veriďŹcation of caller provenance. Recently named one of the 10 Most Innovative Companies at the 2012 RSA conference, Pindropâs solutions help companies feel more conďŹdent in the security of phone-based ďŹnancial transactions.

How they describe their product/innovation: Pindrop Securityâs Phone Fraud Call Analyzer is the first technology of its kind to uniquely identify callers, regardless of spoofed Caller ID data or other deception attempts. Pindrop is able to provide a âcall thumbprintâ based on over 160 characteristics of the call to provide accurate and actionable information on where the call is coming from and the type of device. In addition, the call is matched against Pindropâs database of over 40,000 known fraud callers. This information can allow financial institutions to improve identification of fraud callers, block or reroute calls and save time and money in call centers.

Pindrop Securityâs Phone Fraud Intelligence Service (PFIS) provides access to the most accurate and complete database of phone numbers associated with fraud. The PFIS is used by Fraud investigation teams, law enforcement, and intelligence to quickly evaluate call provenance as part of their anti-fraud decision process, including supporting caller validation, caller investigations and fraud forensics. This allows organizations to look for ongoing attacks from known fraudsters as well as to prevent future attacks.

The data is accessed via the PFIS portal, which provides detailed information both on specific number queries and on the worst offenders on a variety of criteria. PFIS can be accessed via a web-based portal or integrated into your systems through our API.

Contacts:

Bus. Dev. & Sales: Johnny Baker, VP Sales & Business Development, [email protected]

Marketing & PR: Matt Anthony, VP Marketing, [email protected]

How they describe themselves: Our goal is to address financial management and literacy through âGamificationâ and our flagship product, Portfolio Football, is a true âgame changer.â A first of its kind, Portfolio Football plays on the popularity of football and the adoption of fantasy sports into the lives of millions. It makes financial management competitive, fun, and easy to understand, while providing users with a powerful tool for personal finance and portfolio management.

How they describe their product/innovation: Portfolio Football is a personal finance and portfolio management application based on the game of American football. Portfolio Football utilizes patent-pending technology and is the first financial management system to fully-integrate the concepts of football (or any team sport) with the concepts of finance. Portfolio Football relates a user’s personal financial situation to the scoreboard in a football game, thus enabling them to better understand and manage their personal finances. It also provides users with an easy-to-use tool that allows them to build and manage a fully diversified portfolio in the same way one would manage a fantasy football team.

Contacts:

Bus. Dev.: Aaron M. Barman, SVP Business Development, [email protected],

917-519-3224

Press: Courtney Harkness, Harkness Consulting, [email protected],

404-379-3496

How they describe themselves: ProfitStars is a leading software, solution, and technology innovator. Offering unmatched expertise, support, and customer service, we strive to meet you at the cross-section of your business challenges with solutions that address your unique needs. Our people and our solutions power the performance of the largest financial institutions in the world to the smallest community institutions, in addition to a wide variety of businesses. As a diverse, global division of Jack Henry & Associates (JHA), ProfitStars combines JHAâs solid technology background with the latest breakthroughs in four performance-boosting solution groups â Financial Performance, Imaging & Payments Processing, Information Security & Risk Management, and Retail Delivery. Trusted by more than 11,000 clients worldwide and ranked #1 in Remote Deposit Capture and #1 in Branch Image Capture by Celent, ProfitStars has been recognized again and again for leadership and innovation throughout the industry.

How they describe their product/innovation: Budget Manager is a distributed budgeting tool that allows budget administrators to easily obtain budget input from the front line and seamlessly incorporate those inputs into the PROFITstar ALM/Budgeting application. This newly redesigned browser based version enables users to construct and manage a more efficient budgeting process, including how to tackle more difficult items like salaries and fixed assets. Budget Manager provides for ongoing accountability and buy-in from all individuals throughout the organization. The application has reporting capabilities that allow for sharing of actual results throughout the budget year.

Contacts:

Bus. Dev.: Steve Tomson, Director of Sales, [email protected], 972-359-5108

Press: Jacquie Scheider, Sr. Marketing Manager, [email protected], 770-752-6410

Sales: Martin Webster, Sales Director, [email protected], 800-356-909

How they describe themselves: Meniga offers white-label mobile and web-based Personal Finance Management (PFM) and next generation online banking solutions to retail banks. It helps banks’ customers better manage their personal finances while helping banks realize business benefits through data mining, cross-sales, and improved retention and customer satisfaction.

To achieve true mass appeal and reach even people who usually avoid facing their finances, Meniga uses social curiosity, humor, and gaming concepts to engage users to think about their money. Menigaâs PFM Solution is offered by five European retail banks in Sweden, Norway, and Iceland where it is used by over 20% of households.

How they describe their product/innovation: Meniga is expanding its PFM Solution so that it completely merges with the traditional online/mobile bank, adding highly user-centric interfaces for several key online banking functions, such as bill-pay, alerts, and account presentation.

The interface de-emphasizes real accounts and actual balances and instead shows âuncommitted balanceâ and virtual accounts that are better aligned with how people think about their money. It allows users to automate routine tasks and includes an alert framework designed to bring peace of mind by alerting users before bills go unpaid or before any accountâs balance becomes too low to meet commitments and forecasted expenses.

Contacts:

Bus. Dev. & Press: Georg Ludviksson, CEO, [email protected], +46 767822146

Sales: Duena Blomstrom, Director of International Sales, [email protected], +46 708620578

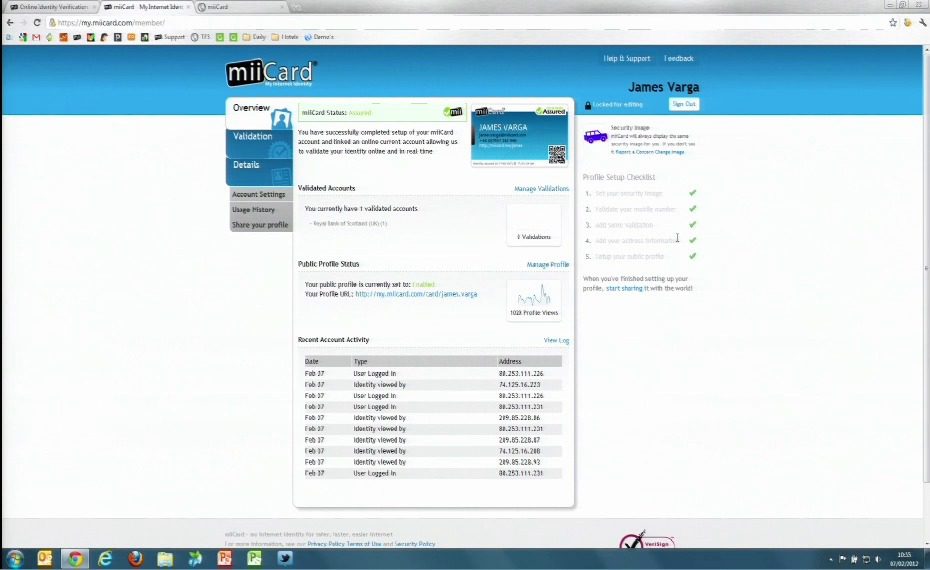

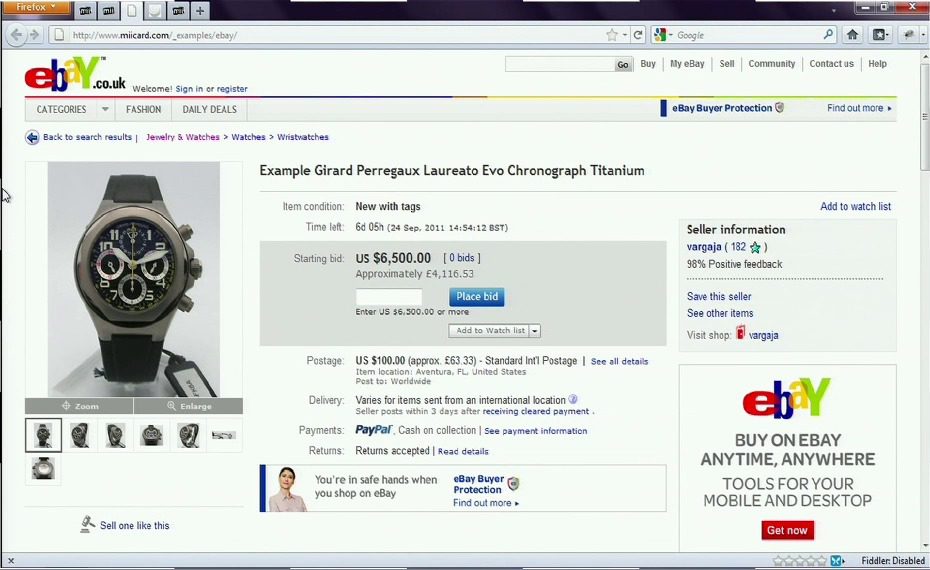

How they describe themselves: The inability to prove identity online to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulation is a massive barrier to trade. Seventy to ninety percent of financial transactions are terminated when the customer is required to provide physical proof of identity. Processing fees for opening a current account are ÂŁ50-ÂŁ80.

miiCard, My Internet Identity, allows a consumer to prove their identity to AML/KYC standard purely online, allowing a vendor to identify an individual with a level of assurance that supports the real-time online sale of regulated financial products or replaces the need for a âwet signatureâ reducing operational costs and increasing conversions.

miiCard creates trust, protects consumers, and fights against fraud, and will help us to realise the full potential of the digital economy by allowing us to do higher value business purely online.

How they describe their product/innovation: miiCard uses information only a user would know, accesses details to their online bank account, and creates a secure, encrypted link to this account which has already approved a primary identity check to meet AML/KYC regulations. miiCard utilizes Yodleeâs global account aggregation to provide validation weightings and traceability of source required by finance industry guidelines. Each point of validation is rechecked daily for accuracy and suitability. Vendors establish appropriate level of assurance requirements for their product/service. miiCard then allows those vendors to identify an individual with enough assurance to support the transaction, like the sale of a regulated financial product.

Contacts:

Bus. Dev. & Sales: James Varga, CEO, [email protected], +44 (0) 7957 143 996

Press: Sarah Lee, Hot Tin Roof, +44 (0) 131 225 3875/+44 (0) 776 654 2110

How they describe themselves: Mootwin is a Mobile Application Platform editor that helps the bank/finance sector fix their mobile channel strategy and keeps their promise of total mobility. We provide optimum mobile services regardless of the network’s situation for a maximum user-experience.

Based on the company’s patented technology, Mootwin Foundation enables customers to create and manage highly connected applications, easily integrated into an existing enterprise’s IT. Completion of any transaction is carried out within short time. As a result of the original architecture of the applications, only changed data is pushed in real time onto the mobile device, avoiding systematic loading of the full page. Data and battery consumption is reduced, as is maintenance and subsequent development costs, enabling faster time-to-market and return on investment.

How they describe their product/innovation: Mootwin’s patented technology offers a âone stop shopâ value-added solution for all customer-centric mobile needs. It consists of one tier of native application on a mobile device and two tiers of transactional data access on the middleware platform (the Mootwin Foundation.). No sensitive data is stored in the device.

The value proposition is based on the ability to:

- Easily connect devices to enterprise information system

- Manage and guarantee secured, resilient and reliable link

- Complete any transaction

- Manage scalability

- Push real-time content

Contacts:

Press: Sophie Renault, Marcom Assistant, [email protected]

Sales: Claude Lemardeley, CEO, [email protected]

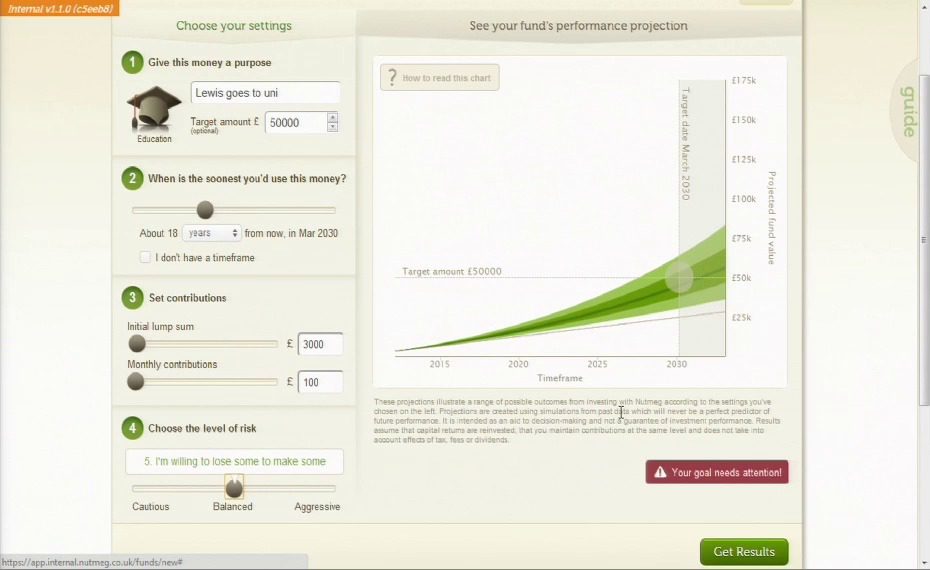

How they describe themselves: Nutmeg is an online investment manager that democratises saving and investing. We offer academically rigorous, diversified portfolios to people of all levels of wealth. Nutmeg is smart, fresh, straightforward and human. The simplicity of Nutmeg empowers the user by putting them in control of their money. Nutmeg translates what users tell us about their saving and investing ambitions and helps the user to achieve their goals for the lowest risk and volatility, through the application of the latest portfolio theory. Nutmeg is the product of twelve months design-led ethnographic research to discover how people think about, feel and treat money as a component of their everyday lives. The conclusions result in breakthrough ways of managing and facilitating savings and investments for retail clients, non-profits and corporations. Nutmegâs financial personality tests are a paradigm improvement in the level of understanding of tolerance for volatility, relative to current industry standard.

How they describe their product / innovation: Nutmeg makes saving and investing simple. Simply choose your investing goals, when you will need your money and how much you can invest. Nutmeg then assesses your personal circumstances, checking affordability and suitability, before implementing and actively managing a personalised investment portfolio that is diversified across geographies and asset classes. Crucially, the user has control over the target level of volatility by considering probable outcomes on illustrations that demonstrate expected returns. Nutmeg offers a high class saving and investing experience and comprehensive user support, even for users with limited wealth. Regular portfolio rebalancing, a rewards scheme that improves returns by lowering fees, and intuitive data providing a clear portfolio breakdown allows anyone from the most experienced to the novice investor to take control. No longer will personal investing solely be the domain of the rich. Nutmeg offers a true alternative to expensive trading or being forced into a low-interest bearing bank account.

Contacts:

Bus. Dev and sales.: Nick Hungerford, CEO, [email protected]

Press: Jack Tavistock, [email protected]

How they describe themselves: PayPal is the faster, safer way to pay and get paid online. The service allows people to send money without sharing financial information, with the flexibility to pay using their account balances, bank accounts, credit cards, or promotional financing. With 103 million active accounts in 190 markets and 25 currencies around the world, PayPal enables global commerce. PayPal is an eBay (Nasdaq:EBAY) company. PayPal is headquartered in San Jose, Calif. and its international headquarters is located in Singapore. More information about the company can be found at www.paypal.com.

How they describe their product/innovation: You can open a PayPal account in 30 seconds from the secure environment of la Caixaâs home banking. We use our combined APIs to leverage the verified customer information that la Caixa has from its clients to speed customers through the PayPal account creation flow. All you need to do is choose your email address and decide on a password and with a couple of clicks, you can have your PayPal account up and running with a verified card linked to it.

Contacts:

Bus. Dev.: Estanis Martin de Nicolas, General Manager, PayPal Spain & Portugal, [email protected]

Press: Paco Moreno, Content Manager & PR, PayPal Spain & Portugal, [email protected]

Sales: Susana Voces, Head of Merchant Services, PayPal Spain & Portugal, [email protected]

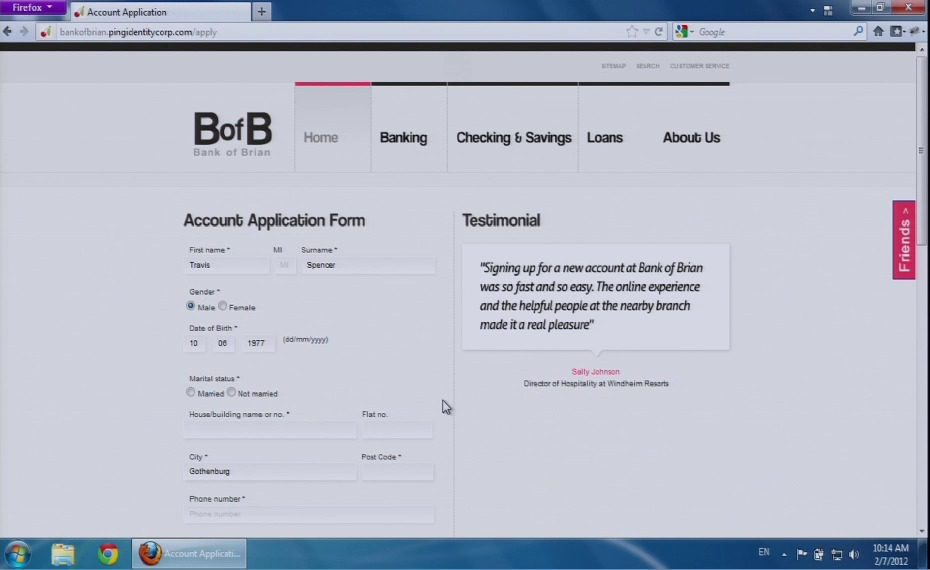

How they describe themselves: Ping Identity | The Cloud Identity Security Leader

Ping Identity provides cloud identity security solutions to more than 700 of the world’s largest companies, government organizations, and cloud businesses. With a 99% customer satisfaction rating, Ping Identity empowers more than 40 of the Fortune 100 to secure tens of millions of employees, customers, consumers and partners, using secure, open, standards like SAML, OpenID and OAuth. Businesses that depend on the Cloud rely on Ping Identity to deliver simple, proven, and secure Cloud Identity Management for cloud single sign-on, mobile app identity security, API security, centralized IT control of Cloud access, and customer and employee identity and access management.

How they describe their product/innovation: Leveraging Social Networking in Online Banking

Ping Identity will show how it is possible to use social networking logins to increase customer conversion rates, reduce and simplify risk management, reuse existing infrastructures and technology investments, and increase business agility.

Contacts:

Bus. Dev.: Andrew Hindle, International Business Development Director

Press: Clare Rees, EMEA Marketing Director, [email protected], 0203 286 4489 & Gemma Rowlan, Hotwire PR, [email protected]

Sales: Jason Goode, EMEA Regional Director

How they describe themselves: MasterCard is a global payments and technology company. It operates the worldâs fastest payments processing network, connecting consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. MasterCard’s products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone.

How they describe their product/innovation: MasterCard inControl is an innovative, flexible service, which enables issuers to easily introduce payment products that offer unparalleled controls and real-time alerts to both consumer and commercial cardholders. The suite of inControl offerings satisfies strong end-user needs for high security and controlled access to spending accounts, while providing cost-efficiencies and speed-to-market for issuers without the need for any changes in the payment process at the merchant.

Contacts:

Bus. Dev.: Dana Duman, VP MasterCard inControl, Emerging Payments, [email protected]

Press: Joanne Trout, Senior Business Leader, MasterCard Worldwide Communications, [email protected]

Sales: Chris Benedict, Senior Business Leader, Expert Sales, [email protected]

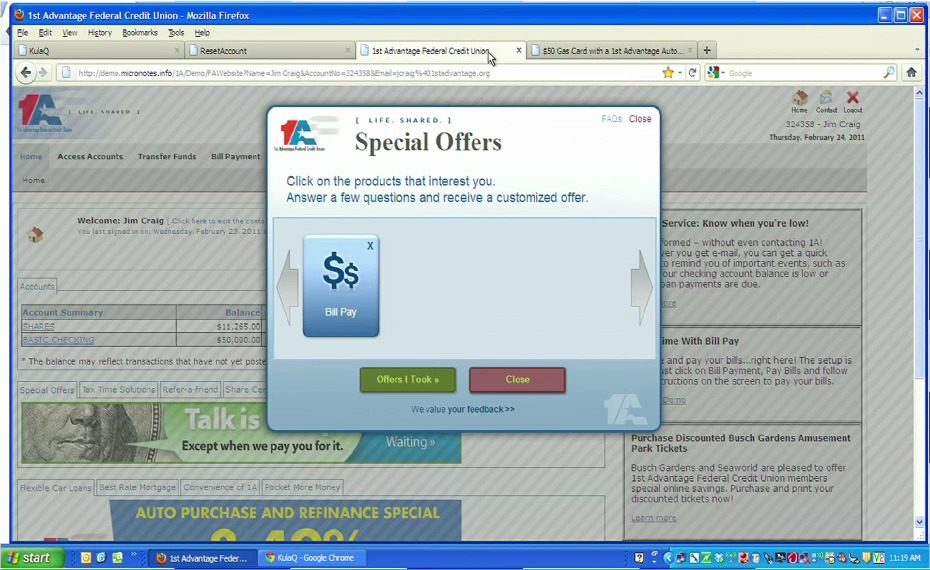

How they describe themselves: Micronotes is a digital marketing company that partners with financial institutions to bring relevant high-value promotions to bank customers. Micronotes targets bank and merchant promotions algorithmically, and for high consideration products like auto loans and mortgages, conducts one-on-one online interviews to get the right promotion for the right product to the right customer. Micronotes’ products include:

- Yodlee Offersâ˘, a private-label merchant-funded offer application, featuring 500+ brands, for financial institutions

- KulaXâ˘, a radically productive cross-sell platform for financial institutions that delivers more leads faster.

How they describe their product/innovation: KulaX⢠is a cross-sell engine that enables financial institutions to leverage their online banking platform to generate more leads faster without interfering with core banking functions. Online banking customers are targeted with the “next best product” where they are invited, at logout, to engage in an automated one-on-one microinterview with their financial institution about their financial products’ needs and preferences. Upon interview completion, customers are presented with special offers for the FI’s products and services that have been tailored based on interview responses; requested offers are emailed to the customers. KulaX⢠has generated 5 leads per 1000 online customers per week in field application.

Contacts:

Bus. Dev., Press & Sales: Christian Klacko, SVP Field Operations, [email protected],

617-401-2175

How they describe themselves: miiCardâs digital passport allows a consumer to prove that âI am who I say I amâ purely online and in real-time, to an Anti-Money Laundering standard, without the need for a physical ID check. Â Owned and managed by the individual, miiCard allows the consumer to track, monitor and thus take control of their online identity. Â For businesses selling online to consumers, miiCard improves conversion rates, cuts operational cost and fights internet fraud.

How they describe their product/innovation: Simply put, we have a catalyst for change in miiCard â a user-centric federated identity that can truly change the way we transact online. Â A new proposition in the Electronic Identity and Verification (eID&V) marketplace, miiCard for the first time offers the capability to establish online trust purely online and in real time. Â Whilst other identity providers and credit reference agencies validate information about someone â such as their address, credit rating and, more recently, some have introduced behavioral aspects such as questions about transaction history, miiCard validates that a customer is who they say they are. Equally important to the vendors, benefits to the consumer are:

- Security and control of personal data

- Convenience, consistency and simplicity

- Trust between parties in a purely online environment

miiCard is a federated identity service which means it sits between the consumer and the vendor (or other consumer) and provides a level of trust between parties. miiCard can support not only the UK but North America, Western Europe, India, Australia, New Zealand and soon South Africa.

Contacts:

Press: Sarah Lee, [email protected]