How they describe themselves: Mitek Systems is the award-winning innovator of the Mobile DepositÂŽ and Mobile Photo Bill Pay⢠applications for smartphones that allow users to deposit checks and pay bills via their devices’ cameras. Mobile Deposit is the leading mobile remote deposit capture product for the financial services industry. It’s accurate, secure, easy to use and complies with all banking industry regulations. Users of Mitek apps simply use their iPhone, BlackBerry or Google Android smartphones to 1) initiate mobile-banking sessions with their FIs, 2) align their checks or bills within their devices’ camera-image frames and 3) snap photos. The apps do the rest in enabling check deposits or bill payments in the RDC format that banks and credit unions require.

How they describe their product/innovation: Mobile Balance Transfer is a new, easy, attractive and cost-effective way for a bank to acquire new credit card customers. The mobile application enables a bankâs customer to use a smartphone camera to take a picture of a competitorâs credit card payment coupon. The customer transmits the information to the bank, which then can offer the customer a better interest rate to incent the customer to open a new credit card account and transfer an existing balance. For banks, Mobile Balance Transfer broadens the reach of traditional balance-transfer-marketing programs, enabling the bank to interact with the customer in real time. By accepting the bankâs offer, the consumer simply transfers his or her outstanding credit card balance to a new credit card account offering a more attractive rate. Consumers gain reduced costs on their credit card accounts and the banks offering Mobile Balance Transfer gain new credit card customers more cost-effectively than previous balance-transfer methods. Mobile Balance Transfer is the latest in a rapidly growing family of mobile-banking applications for banks, credit unions, brokerages and payment-management providers that are all rooted in Mitekâs patented mobile image-capture and data-extraction capabilities.

Contacts:

Bus. Dev.: Drew Hyatt, SVP Sales & Business Development, [email protected],

858-503-7810 x356

Media: Sue Huss, [email protected], 619-379-4396

Sales: Jack Dollard, Marketing & Sales Associate, [email protected], 858-503-7810×325

Investors: Bud Leedom, Finance Director, 858-503-7810 x309

How they describe themselves: Modo converts redemptions into payments, and makes payments mobile.

Modo allows people to redeem offers and pay for things at their favorite stores, using only their phone. When people check-in to Modo, they get instant access to offers, promotions, and deals from a wide variety of sources. When they checkout using Modo, everyone in the offer/deal value chain gets immediate verification and payment for the transaction. Plus, the consumer can use any card they want to fund their part of the purchase. The purchase information for payments using Modo improves the value of the next set of offers on both sides of the equation.

How they describe their product/innovation: We are demonstrating the ability to on-board a merchant for Modo, signup some especially great new users for Modo, and distribute an innovative offer to those super fine users, all in the space of 7 minutes. Oh, and we’re also executing a mobile payment using Modo at a local establishment.

Contacts:

General: Bruce Parker, Chief Executive Officer, [email protected], 214-810-5196

Bus. Dev. & Sales: Walter Chen, Chief Revenue Officer, [email protected], 214-558-6255

Press: Jon Buell, Chief Marketing Officer, [email protected], 214-317-1878

How they describe themselves: A software company specialized in mobile information technologies, Mootwin helps financial institutions better deliver content and services to mobile customers. The Mootwin mobile software solutions have two goals: maximize mobile usersâ experience and strengthen clientsâ brand value. The company believes that designing innovative mobile solutions should go beyond information delivery, and empower mobile customers with âAction Takingâ tools in the palms of their hands.

How they describe their product/innovation: Mootwin patented technology offers a âOne Stop Shopâ value-added solution to all centric mobility needs. Its unique technology maximizes the mobile user experience thanks to:

- Ability to execute even in the slowest broadband areas

- Real-time financial content delivery (with cutting-edge âpushâ technologies)

- Highly secured access

- Easy integration to existing enterprise IT

The solution combines one tier of native application on mobile devices, with two tiers of transactional data access on the middleware platform (the Mootwin Foundation), easily integrated into Financial institutionsâ information system. The three-tiered Mootwin application architecture delivers a fast Time-to-Market, a quick ROI âbeyond expectationsâ user experience, encouraging brand loyalty.

Contacts:

Sales: Claude Lemardeley, CEO, [email protected]

Press: Sophie Renault, Sales & Marketing Assistant, [email protected]

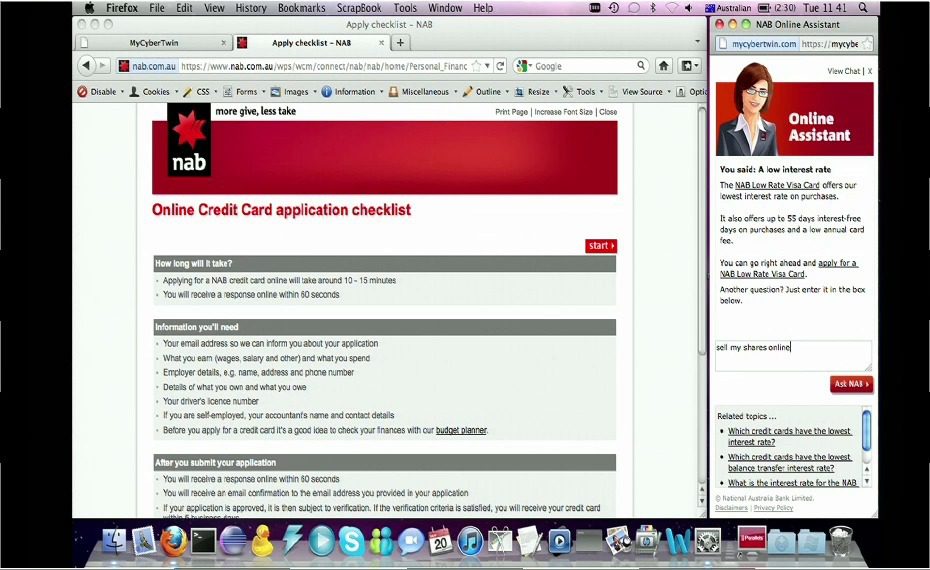

How they describe themselves: MyCyberTwin is a new generation of Artificial Intelligence (AI) technology creating interactive virtual agents.

How they describe their product/innovation: MyCyberTwin will demo its Artificial Intelligence solutions – called virtual agents – and give a detailed explanation about how current leading financial institutions are using the technology today and will use the technology in the future. It is a powerful demo to show an audience how a computer thinks and answers questions in real-time, helping customers get the answers they need while helping companies garner the intelligence of the customers visiting their websites.

Contacts:

Bus. Dev. & Sales: Liesl Capper, CEO, [email protected] & Dr. John Zakos, CIO, [email protected]

Press: Todd Barrish, Indicate Media, [email protected], 646-396-6038

How they describe themselves: Offermatic is pioneering a new model for offers that changes how consumers save money, and how merchants acquire customers.

Consumers register any credit or debit card with our free online service to receive highly targeted offers based on their actual spending history. Customers then shop as they normally would, in any store offline or online. Since the offers and savings are loaded directly to their card, there are no coupons or vouchers to deal with.

For merchants, Offermatic enables them to precisely target customers based on their actual spending history with Smart Offersâ˘. Merchants can acquire guaranteed-new customers – who are already spending in the category â on a 100% pay for performance basis.

How they describe their product/innovation:

Retailers are constantly looking for new ways to increase sales. Over $20 Billion is spent on consumer promotions each year, but while promotions can be effective, they are costly and reduce margins. Offermatic launches “Free Rebate⢔ for merchants – the first model for customer promotions that enables any retailer to increase sales (at zero cost) via FREE automatic rebates from Offermatic.

With Free Rebateâ˘, any merchant â small or large, online or offline â can offer compelling automatic rebates to its customers and grow sales at no cost. No integration is required and it is very easy to set up: you can create your Free Rebate⢠offer in less than 5 minutes!

This model enables merchants to get a great promotion to increase sales from current customers at no cost, while Offermatic gets new customers for its service. Any merchant can get access to FREE automatic $5 rebates to offer to their customers â no strings attached.

Contacts:

Bus. Dev. & Sales: Tim Welch, VP Sales, [email protected], 650-549-4348

Press: Arnaud Collin, VP Marketing & Product, [email protected], 408-772-9316

How they describe themselves: oFlows takes the paper out of paperwork.

oFlows powers complex transactions, such as opening new deposit, loan and insurance products through our completely paperless end-to-end multi-channel originations platform.  With the oFlows Mobilize app, you can take all of the power of the oFlows platform with you anywhere on an iPad or Android tablet. Mobilize also lets your customers transact through their smartphone â including âwet digitalâ signatures on the agreements and digital supporting documents uploaded directly from the phoneâs camera. Customers can also move between all of your delivery channels seamlessly so an application started on the web can be completed in person or on a smartphone.

With oFlows, all of the hassles of printing, signing, mailing and sorting through illegible faxes are a thing of the past. And that adds up to better results for your customers, staff and bottom line.

How they describe their product/innovation: This year we have expanded beyond financial institutions and have made the oFlows technology platform available to everyone. So if you are still using paper for your applications, purchase orders, order forms or just about any other kind of transaction, oFlows can help. We take your products, forms and rules and put them into a completely paperless mobile platform that will run the rules, make offers, fill the forms, get them signed and manage all of the required supporting documentation – all from iPads, Android tablets and smartphones.  And because oFlows seamlessly integrates with payments systems, you can complete complex transactions or take deposits on the spot.  So now you can transact anywhere, anytime without having to lug around a clipboard full of paper forms.

Contacts:

Bus. Dev.: Charles Bae, VP Business Development, [email protected]

Press: Jeff Kukesh, [email protected]

How they describe themselves: Cash Transaction network.

How they describe their product/innovation: How consumers can easily and conveniently pay their rent and auto-loans with cash at their local store, such as 7-Eleven.

Contacts:

Bus. Dev.: Mike Kaplan, [email protected], 908-902-0497

Press: Stephanie Gnibus, GMK Comm., [email protected], 408-776-9727

Sales: Dave Litwak, [email protected], 817-421-9990

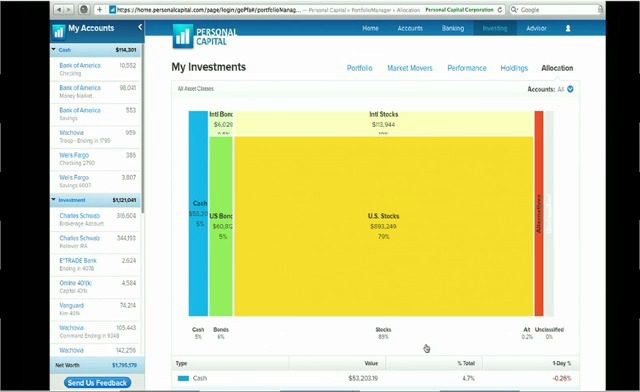

How they describe themselves: Personal Capital is America’s next-generation financial advisor, giving individuals with complex financial lives a better way to manage their investments. Turning the traditional advisor model on its head, Personal Capital is creating a new category in financial services centered on the customer, enabling individuals to view their complete financial picture in one place and receive personalized investment advice at a low fee. The company will offer a full suite of customer-centric retail banking, payments and investment services previously only available to the ultra wealthy. The founding team is comprised of some of the nation’s leading financial technology executives.

How they describe their product/innovation: Today’s traditional financial advisory system is broken. Brokerage firms operate under a “one size fits all” approach that marginalizes investment returns and diminishes the client’s visibility and control. Personal Capital addresses the need for a holistic, convenient, affordable and highly customized investment service for today’s investor. At Finovate, the company will demonstrate the full suite of services that will enable investors to view their complete financial picture and work with a financial advisor to create personalized investment solutions.

Contacts:

Bus. Dev.: Robert Foregger (CSO & Co-Founder), [email protected],

802-760-8436

Press: Jesse Odell & Tessa Greenwood, LaunchSquad PR, [email protected], 415-625-8555

Sales: Kyle Ryan, Sales & Service Director, [email protected], 925-817-9966

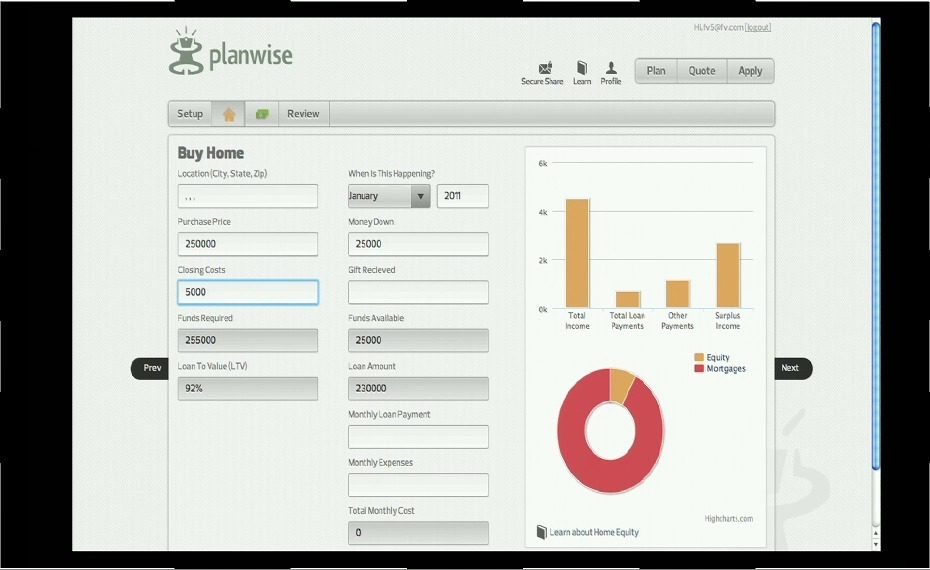

How they describe themselves: planwise has created a set of content & tools to help consumers better understand how the plans they make today affect their finances in the future. We enable consumers across a range of transactions and products including mortgages, auto-loans and personal loans. planwise then helps consumers to connect with the adviser or product provider of their choice to complete the application for credit.

How they describe their product/innovation: We are to demo the core proposition of planwise, which enables the consumer to > Learn > Plan > Quote > Apply > Get Advice around any life plans they may have and the credit products that would be required to make them happen. The tools enable any consumer from all range of demographic, age, financial or computer knowledge to better understand how the plans they make today affect their finances in the future, so they can make better decisions. We will be launching with demoing mortgage products.

Contacts:

Bus. Dev. & Sales: Vincent Turner, CEO & Founder, [email protected] & John Alexander, VP Sales & Partnerships, [email protected]

Press: Vincent Turner, CEO & Founder, [email protected] & Ilana Zalika, PR, Resound Marketing, [email protected]

How they describe themselves: We deliver premium banking at everyone’s fingertips. Plastyc provides PC+Mobile access to FDIC insured depository accounts linked to a Visa prepaid card with on-demand paper checks and a cash-back reward program. Customers are both the traditionally under-banked and youth (teens and students).

How they describe their product/innovation: Savings service allowing account holders to set money aside for a rainy day or for specific future purchases with exceptional rewards. Saving is easily turned into a habit thanks to automated daily, weekly or monthly deposits. No new account needs to be opened: the savings account resides right inside an existing prepaid card account.

Contacts:

Bus. Dev. & Sales: Patrice Peyret, [email protected], 415-203-2650

Press: Lynda Radosevich, [email protected]

How they describe themselves: Mint.com is a leading free online personal finance software service from Intuit Inc. (Nasdaq: INTU), providing nearly 6 million users a fresh, easy and intelligent way to manage their money. Launched in September 2007, Mint.com has quickly grown to track nearly $200 billion in transactions and $50 billion in assets and has identified more than $300 million in potential savings for its users. Mint.comâs innovation is in applying advanced technology to deliver breakthrough ease-of-use. Using patent-pending technology and proprietary algorithms, Mint.com allows users to see all their financial accounts in one place, makes it easy to set and keep to budgets, and helps identify money-saving ideas. Mint.com is so effective that more than 90% of users say they have changed their financial habits as a result of using the service.

How they describe their product/innovation: Mint.com’s award-winning iPhone and Android apps have proven to be extremely engaging, with more than 50% of users active with the mobile app. In addition, Mint has found that 20% of users only interact with the product through their smartphone, and mobile app users are more likely to actively use Mint’s web app. Since Mint.comâs launch in 2007, its Ways to Save feature has analyzed users’ spending habits and current accounts to offer personalized recommendations on checking, savings, credit card, brokerage, CD and IRA rollover accounts. Based on Mint’s mobile use data, expanding this feature’s availability to Mint’s iPhone and Android apps was a clear progression. Ways to Save on mobile benefits users’ bottom lines while giving financial institutions direct exposure to targeted new customers â plus, partners have seen extremely high conversion rates to date.

Contacts:

Bus Dev: Carrie Cronkey, Director, Business Development and Strategy, [email protected]

Sales: [email protected], 888-344-4674 Option 6

Press: Martha Shaughnessy, VP, Atomic PR, [email protected], 415-593-1400 x235

How they describe themselves: Mitek Systems is the award-winning innovator of the Mobile DepositÂŽ and Mobile Photo Bill Pay⢠applications for smartphones that allow users to deposit checks and pay bills via their devicesâ cameras. Mobile Deposit is the leading mobile remote deposit capture product for the financial services industry. Itâs accurate, secure, easy to use and complies with all banking industry regulations. Users of Mitek apps simply use their iPhone, BlackBerry or Google Android smartphones to 1) initiate mobile-banking sessions with their FIs, 2) align their checks or bills within their devicesâ camera-image frames and 3) snap photos. The apps do the rest in enabling check deposits or bill payments in the RDC format banks and credit unions require.

How they describe their product/innovation: With Mitekâs new Mobile Photo Bill Pay⢠app, users submit electronic payments from their smartphones without writing checks, visiting payment locations or using their computers. They simply take pictures of the bills and Mobile Photo Bill Pay (MPBP) does the rest. It is highly secure, accurate, fast, easy to use, eliminates the hassle of setting up information for individual payee accounts, corrects image distortions, accurately reads data, processes transactions through the usersâ banks, and payee information is automatically saved. In the absence of standard invoice formats, MPBP employs sophisticated new technologies to find the bill pay data in mobile images.

Contacts:

Bus. Dev.: Drew Hyatt, SVP Sales & Business Development, [email protected], 858-503-7810×356

Press: Sue Huss, [email protected], 619-379-4396

Sales: Jack Dollard, Marketing & Sales Associate, [email protected], 858-503-7810×325