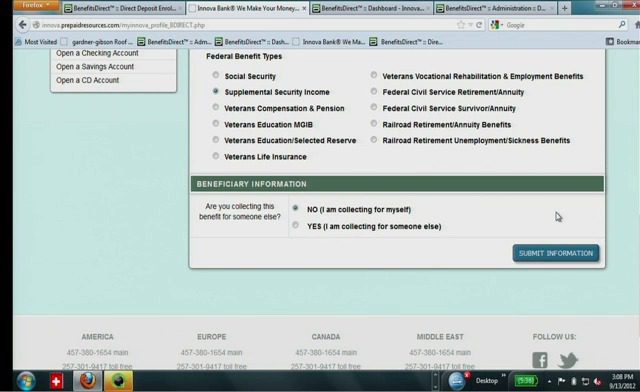

How they describe themselves: Prepaid Resources has established itself as a technology specialist for the prepaid debit and banking industry. The technology centers on our PORTABLES™ PaaS platform: a multi-user ecosystem that connects banks and prepaid card providers to processors and account-related third-party applications and services. BenefitsDirect™, the showcase PORTABLES application, pioneers the technology of ‘Direct Deposit Management’. Paybefore™, a leading industry resource for prepaid and stored value, awarded BenefitsDirect its 2012 Award for Best Government-Funded Program. Prepaid Resources is headquartered in New York City.

How they describe their product/innovation: BenefitsDirect provides the most effective and comprehensive direct deposit solution to deliver recurring revenue. Easily capture Federal benefits, State benefits and payroll deposits on your accountholder website, in-branch, at retail, by mobile app or live agent. Track enrollment success and utilize direct deposit analytics to pro-actively personalize accountholder relationships.

Contacts:

Bus. Dev. & Sales: Barry Kessler, [email protected], (646) 588-0300 x101

Press: Andy Savitt, [email protected], (646) 588-0300 x104

How they describe themselves: Headquartered in San Diego, California, Mitek Systems (Nasdaq:MITK – News) is a mobile imaging software solutions provider that allows users to remotely deposit checks, pay their bills, get insurance quotes, and transfer credit card balances by snapping a picture with their smartphone or tablet cameras instead of using the device keyboard. Mitek’s technology increases convenience for consumers by eliminating the need to go to a bank branch or automated teller machine and dramatically reduces processing and customer acquisition costs while increasing customer retention. With a strong patent portfolio, Mitek is positioned as the leading innovator in mobile imaging software and currently provides its solutions to Fortune 500 financial services companies. For more information about Mitek Systems, please visit www.miteksystems.com.

Contacts:

Bus. Dev. & Sales: Drew Hyatt, SVP Sales & Business Development, [email protected], 858-309-1756

Media: Ann Reichert, [email protected], 858-309-1730

Investors: Julie Cunningham, VP Investor Relations & Corporate Communication, 858-309-1780

How they describe themselves: MoneyDesktop is a leader in developing software technologies that drive the financial engagement between account holders and financial institutions and, through its award-winning PFM, is the fastest-growing provider of its kind. By integrating directly into online banking, core, and payment platforms, MoneyDesktop positions its clients as primary financial institutions with tools that drive loan volume, user acquisition, and wallet-share.

How they describe their product/innovation: Deals™ by MoneyDesktop rises above the noise of other untargeted, complex offers platforms by fully integrating into MoneyDesktop’s PFM backbone and using anonymized user transaction data to deliver a three-pronged value proposition:

Value to Financial Institutions (FI’s) – With compelling offers pushed daily to acct. holders, FI’s will:

- Drive loan growth from increased PFM adoption, account aggregation and transaction data

- Acquire new acct. holders faster and at lower costs with Deals™ viral sharing capabilities

- Acquire new merchant accounts as the result of relationships built with local merchants

Value To Merchants – Deals™ leverages actual transaction data and empowers Merchants to:

- Target consumers that are buying in their category but not from them

- Track and measure actual customer acquisition and customer spending data

- Implement an automatic and paperless redemption tool without complicating operations

Value To End-Users – Via the Deals™ app, Users receive unprecedented value through:

- Offers, individually tailored from personal transaction data, for items they’re already buying

- An automatic redemption process that eliminates cumbersome coupons and promo codes

- Automatically issued electronic cash-back for Deals™ that have been redeemed

MoneyDesktop combines all the best practices in the offers space with its award-winning PFM and eliminates the huge value disconnect of other offers programs. This puts MoneyDesktop in a whole different category with a game-changing solution for FI’s and Merchants that will positively impact the lives of millions of consumers.

Contacts:

Press: Nate Gardner, [email protected], 801-669-5534

Sales: Matt West, [email protected], 801-669-5652

How they describe themselves: MShift has been empowering financial institutions with mobile banking, payment, and commerce solutions for over 10 years. As a pure-play provider, we are solely focused on delivering state-of-the-art mobile banking technologies to the financial services industry. Our current focus is helping financial institutions transition mobile banking solutions into mobile payment and wallet solutions.

How they describe their product/innovation: Welcome to Mobile Banking 2.0 – where financial institutions drive mobile commerce through a community of local businesses and consumers. We’re building FI-branded mobile wallet solutions that, in partnership with local businesses, enables mobile offer, loyalty, and payment solutions directly to consumers.

Contacts:

Bus. Dev. & Sales: Jeff Chen, [email protected], 408-466-0278

Press: Catherine Ptak, [email protected]

How they describe themselves: NICE is the worldwide leader of intent-based solutions that capture and analyze customer interactions and transactions, realize intent, and extract and leverage insights to impact customer interactions in real time. NICE solutions enable organizations to improve customer experience, expand their business, increase operational efficiency, prevent financial crime, ensure compliance, and enhance safety and security. NICE serves over 25,000 organizations in more than 150 countries, including over 80 of the Fortune 100 companies and many of the top world financial institutions.

How they describe their product/innovation: NICE Mobile Reach complements mobile banking by intelligently bridging mobile self-service and assisted service, creating a customer service experience that is as smart as customers’ devices.

- ENGAGE: It understands customer intent in real-time and recommends, just at the right time, the right channel for fulfilling the customer need.

- CONNECT: When needed, it seamlessly connects the customer with the right agent, bypassing the IVR and transferring the context from the mobile device to the agent desktop.

- COLLABORATE: During a call with an agent, it adds multimedia collaboration tools allowing the customer and agent to exchange text, images, and documents.

The results: great customer experience, boost in mobile banking adoption, higher revenue, and lower service cost.

Contacts:

Press: Erik Snider, Director of Corporate Communication, [email protected],

+972-9-775-3252

Sales: Bill Staunton, Manager, Demand Generation, [email protected], 201-964-2600

Additional Information about NICE Mobile Reach: Assaf Frenkel, Head of Mobile Customer Service, [email protected], 303-249-3045

How they describe themselves: Nomis enables best-in-class Pricing and Profitability Management for financial services companies. Through a combination of advanced analytics, innovative technology, and tailored business processes, the Pricing and Profitability Management™ Suite enables banking executives to make more intelligent, data-driven decisions to align their pricing practices with customer needs and business goals.

How they describe their product/innovation: Nomis is launching the next gen Pricing and Profitability Management platform for retail banks. The new platform builds on the success and reputation of the Nomis Price Optimizer and Nomis’ experience in delivering sustainable, strategic, financial, and operational returns to 35+ customers. By marrying insightful data streams, cutting-edge predictive analytics & behavioral science, and powerful decision-making capabilities within an engaging user experience, the platform enables CFOs, Portfolio Owners, Product Managers, and Pricing Analysts to understand their customers and make profitable, customer-sensitive decisions regardless of market and competitive dynamics.

Contacts:

Sales: Jennifer Horn, Esq., [email protected], 650-588-9800 x248

How they describe themselves: On Deck uses data aggregation and electronic payment technology to evaluate the financial health of small businesses and to efficiently deliver capital to a market underserved by traditional bank loans. Through the On Deck platform, millions of small businesses can obtain affordable loans to meet their daily operating and long-term goals. The company’s proprietary platform looks deeper into the health of small businesses, focusing on the overall business performance, rather than the owner’s personal credit history. The platform also provides a critically needed mechanism for commercial institutions to efficiently reach and serve the historically underserved Main Street market.

How they describe their product/innovation: On Deck’s technology is now available to third parties who want to leverage their own capital to reach small businesses. Third parties can connect their capital to the On Deck Platform to underwrite and service small business loans. Our technology will also harness small businesses’ digital information – such as online banking and cash flow information – in order to calibrate an appropriate loan amount. With our technology, these organizations will be able to vastly increase the number of small businesses they are able to service, while significantly decreasing the time required of small business owners to obtain capital.

Contacts:

Bus. Dev.: James Hobson, SVP Strategic Partnerships & Platform Solutions, [email protected], 646-405-5933

Press: Jonathan Cutler, JCUTLER media group, [email protected], 323-969-9904

Sales: Charles Deutsch, Platform Solutions, [email protected], 917-677-7073

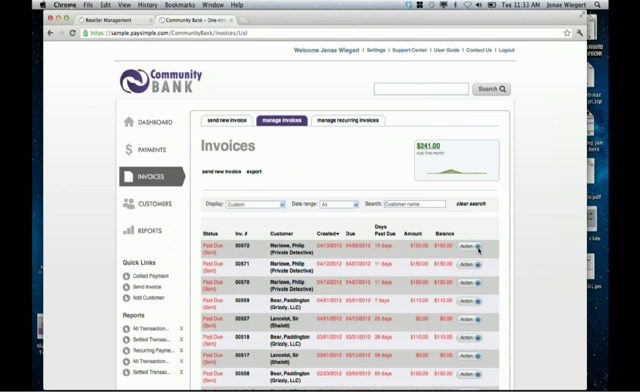

How they describe themselves: PaySimple provides a cloud-based accounts receivable management solution for small business. With PaySimple, businesses can accept credit card and ach payments and automate billing across channels including recurring billing, electronic invoicing, and web, mail, phone, and mobile payments. This is integrated with customer management and smart reporting to help small businesses not only save time and get paid faster, but also grow their business. Additionally, PaySimple is available as a turn-key, custom-branded solution for large institutions looking to provide their members with a value-added offering. Partners with custom-branded products in the market today include American Express, Chase, Western Union, and Vantiv.

How they describe their product/innovation: PaySimple is demoing our one-of-a-kind system showing the absolute simplicity of how integrating customer management and payment acceptance across multiple channels provides small businesses with spectacular results. This brand new technology makes it incredibly easy for a smaller bank to set up their own custom-branded version and then immediately provide the solution to their small business members.

Contacts:

Bus. Dev.: David Sharp, SVP Business Development, [email protected], 720-544-6130

Press: Jenae Wiegert, VP Product & Marketing, [email protected]

Sales: Kevin Brown, VP Customer Acquisition & Experience, [email protected],

303-928-8564

How they describe themselves: Personal Capital is wealth management for the Internet Age. The company’s online platform combines digital technology with highly personalized service to provide a holistic view of your unique financial picture. The free online dashboard presents all of your financial data in one place, including an assessment of your allocation, investment risk and fees. Clients with a minimum of $100,000 in investable assets are eligible to receive highly customized financial advice for a low fee. The company recently launched its iPad app with revolutionary features such FaceTime video chat and a Stock Options Tracker. The company will launch its iPhone app this spring.

How they describe their product/innovation: Personal Capital is demoing its iPad app and previewing its iPhone app at FinovateSpring. Personal Capital believes that individuals should be able to access their financial information anywhere, anytime. The iPad and iPhone apps include never-seen-before features: 1) FaceTime allows the unique ability to communicate “face-to-face” with your financial advisor; 2) the Stock Options Tracker enables entrepreneurs, start-ups, and private investors to monitor private company stock and restricted public equity values, helping them to better understand stock options. The apps are secure, free, and interactive, while allowing for real-time financial updates and asset allocation monitoring, all on-the-go.

Contacts:

Bus. Dev.: Robert Foregger, Co-Founder & Chief Strategy Officer, [email protected]

Press: Emma Starks or Matt Calderone, [email protected], 415-625-8555

Sales: Kyle Ryan, Sales & Service Director, [email protected]

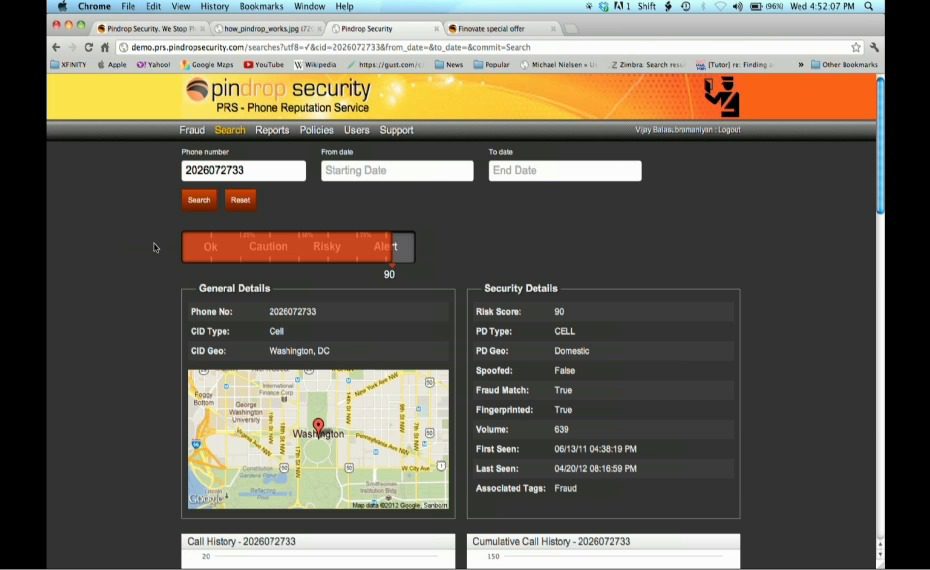

How they describe themselves: Pindrop Security provides enterprise solutions that help prevent phone-based fraud. Its acoustical fingerprinting technology detects fraudulent calls and authenticates legitimate callers, helping customers eliminate financial losses and reduce operational costs. Pindrop’s breakthrough technology is the first of its kind to fingerprint individual phone calls, providing verification of caller provenance. Recently named one of the 10 Most Innovative Companies at the 2012 RSA conference, Pindrop’s solutions help companies feel more confident in the security of phone-based financial transactions.

How they describe their product/innovation: Pindrop Security’s Phone Fraud Call Analyzer is the first technology of its kind to uniquely identify callers, regardless of spoofed Caller ID data or other deception attempts. Pindrop is able to provide a “call thumbprint” based on over 160 characteristics of the call to provide accurate and actionable information on where the call is coming from and the type of device. In addition, the call is matched against Pindrop’s database of over 40,000 known fraud callers. This information can allow financial institutions to improve identification of fraud callers, block or reroute calls and save time and money in call centers.

Pindrop Security’s Phone Fraud Intelligence Service (PFIS) provides access to the most accurate and complete database of phone numbers associated with fraud. The PFIS is used by Fraud investigation teams, law enforcement, and intelligence to quickly evaluate call provenance as part of their anti-fraud decision process, including supporting caller validation, caller investigations and fraud forensics. This allows organizations to look for ongoing attacks from known fraudsters as well as to prevent future attacks.

The data is accessed via the PFIS portal, which provides detailed information both on specific number queries and on the worst offenders on a variety of criteria. PFIS can be accessed via a web-based portal or integrated into your systems through our API.

Contacts:

Bus. Dev. & Sales: Johnny Baker, VP Sales & Business Development, [email protected]

Marketing & PR: Matt Anthony, VP Marketing, [email protected]

How they describe themselves: Our goal is to address financial management and literacy through “Gamification” and our flagship product, Portfolio Football, is a true “game changer.” A first of its kind, Portfolio Football plays on the popularity of football and the adoption of fantasy sports into the lives of millions. It makes financial management competitive, fun, and easy to understand, while providing users with a powerful tool for personal finance and portfolio management.

How they describe their product/innovation: Portfolio Football is a personal finance and portfolio management application based on the game of American football. Portfolio Football utilizes patent-pending technology and is the first financial management system to fully-integrate the concepts of football (or any team sport) with the concepts of finance. Portfolio Football relates a user’s personal financial situation to the scoreboard in a football game, thus enabling them to better understand and manage their personal finances. It also provides users with an easy-to-use tool that allows them to build and manage a fully diversified portfolio in the same way one would manage a fantasy football team.

Contacts:

Bus. Dev.: Aaron M. Barman, SVP Business Development, [email protected],

917-519-3224

Press: Courtney Harkness, Harkness Consulting, [email protected],

404-379-3496

How they describe themselves: ProfitStars is a leading software, solution, and technology innovator. Offering unmatched expertise, support, and customer service, we strive to meet you at the cross-section of your business challenges with solutions that address your unique needs. Our people and our solutions power the performance of the largest financial institutions in the world to the smallest community institutions, in addition to a wide variety of businesses. As a diverse, global division of Jack Henry & Associates (JHA), ProfitStars combines JHA’s solid technology background with the latest breakthroughs in four performance-boosting solution groups – Financial Performance, Imaging & Payments Processing, Information Security & Risk Management, and Retail Delivery. Trusted by more than 11,000 clients worldwide and ranked #1 in Remote Deposit Capture and #1 in Branch Image Capture by Celent, ProfitStars has been recognized again and again for leadership and innovation throughout the industry.

How they describe their product/innovation: Budget Manager is a distributed budgeting tool that allows budget administrators to easily obtain budget input from the front line and seamlessly incorporate those inputs into the PROFITstar ALM/Budgeting application. This newly redesigned browser based version enables users to construct and manage a more efficient budgeting process, including how to tackle more difficult items like salaries and fixed assets. Budget Manager provides for ongoing accountability and buy-in from all individuals throughout the organization. The application has reporting capabilities that allow for sharing of actual results throughout the budget year.

Contacts:

Bus. Dev.: Steve Tomson, Director of Sales, [email protected], 972-359-5108

Press: Jacquie Scheider, Sr. Marketing Manager, [email protected], 770-752-6410

Sales: Martin Webster, Sales Director, [email protected], 800-356-909