How they describe themselves: Finect offers compliant social media… simplified:

- Instantly connect with clients and prospects

- In minutes, create and control a unified social strategy

- Remain compliant with easy-to-use employee tracking, archiving, and reporting

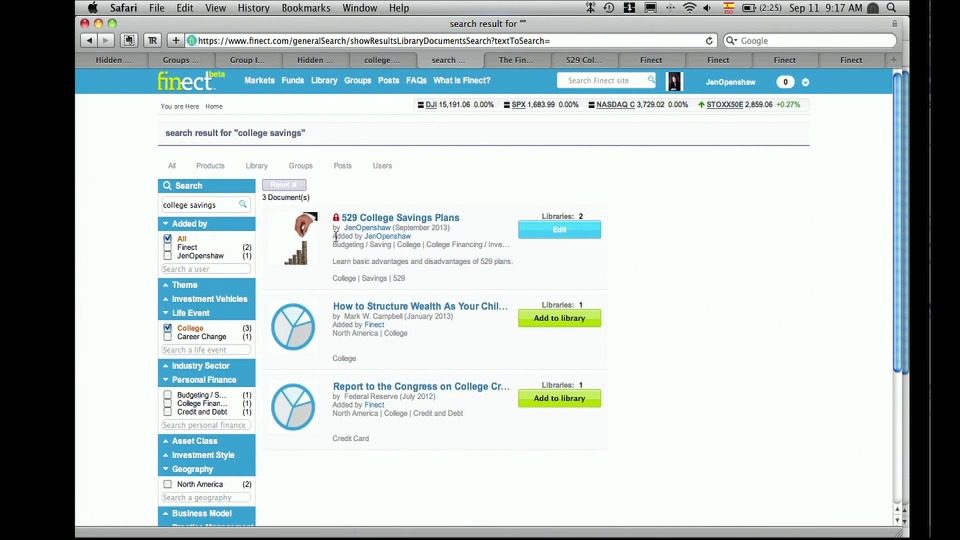

How they describe their product/innovation: Global Library – The financial industry’s broadest, smartest, and yet simplest library provides for the first truly open exchange of content without boundaries. This library helps advisors, asset managers and others:

- Share, upload, and access content for client meetings, education, investment updates and more

- Share content with clients and prospects in their own groups or “rooms”

- Follow and get instant library editions without worry

Pros on Products – Investment products can now be followed on Finect, with a single location for reviewing peer opinions, real-time news, and Twitter comments.

Product Distribution Strategy: Direct to Business (B2B) & through financial institutions

Contacts:

Bus. Dev. & Sales: Jennifer Openshaw, President, [email protected],

203-769-5630

Press: John LaMela, [email protected], 845-549-3593