How they describe themselves: Founded in 2006, Geezeo is a leading Personal Financial Management (PFM) solutions provider for financial institutions. We help banks and credit unions engage their base, leverage data, reach new market segments, and increase wallet share though our PFM solution and integrated Engagement Banking Marketing Platform. Our API takes this a step further, and allows best-in-class service providers to leverage the features and benefits of PFM via just about any channel. We’re excited to take what we learned from the consumer PFM market and apply our knowledge in a way that FIs can better support the needs of small and mid-size businesses.

How they describe their product/innovation: Small and middle market businesses represent critical markets for FIs. TruBusiness is a white label business financial management tool that helps FIs better engage the market. At the same time, the tool offers robust online financial management to business banking clients, offering business customers and FIs predictive insight and capability beyond the expected.

Product distribution strategy: Like all Geezeo products, we expect our business financial management solution will be offered to financial institutions directly and via channel partners through other fintech companies with a keen interest in the small to mid-size business banking market.

Contacts:

Bus. Dev.: Pete Glyman, President, 866-876-3654

Press: Bryan Clagett, CMO, 757-243-3453

Sales: Steve Nigri, VP, 866-876-3654

How they describe themselves: EyeLock, a leader in iris authentication, provides the highest level of security with EyeLock ID. The company’s proprietary, embeddable technology enables convenient, secure authentication of individuals across physical and logical environments. EyeLock’s software has been integrated across consumer and enterprise platforms, eliminating the need for PINs and passwords. No two irises are alike, and outside DNA, iris is the most accurate human identifier. Corporations across the Fortune 500 recognize the level of security EyeLock provides due to its FAR, ease of use, and scalability. As a sponsor member of the FIDO Alliance, EyeLock is dedicated to providing digital privacy security.

How they describe their product/innovation: Never type a password again— myris is a USB powered Iris Identity Authenticator that grants you access to your digital world.

myris uses patented technology to convert your individual iris characteristics to a code unique only to you, then matches your encrypted code to grant access to your PCs, e-commerce sites, applications, and data – all in less than 1 second.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through other fintech companies and platforms

Contacts:

Bus. Dev.: Anthony Antolino, CMO & Bus. Dev., [email protected]

Press: Jeanne Templeton, Weber Shandwick, [email protected]

Sales: Darlene Crumbaugh, VP Financial Services, [email protected]

How they describe themselves: GREMLN provides software for social media management within the financial services industry. With features such as message archiving, team supervision, message approval, and content filtering, GREMLN enables financial services companies to communicate in networks like Facebook, Twitter, and LinkedIn. Financial firms need much more than just a security tool, however; they need integrated marketing and customer service tools to help them better engage with customers, reach new clients, and track their return on investment. GREMLN provides this additional functionality, making it a full social media marketing, engagement, and customer service tool, wrapped in a security blanket to help maintain compliance with government regulations.

How they describe their product/innovation: GREMLN is demonstrating its latest social media compliance features. Pre-approved Content Libraries enable firms to provide great content to their teams that can circumvent the message approval process. LinkedIn Lead Prospecting enables financial advisors and other employees to find new clients via LinkedIn. And finally, GREMLN is launching a new mobile platform that enables marketing and compliance departments to stay engaged in social media and handle approval processes right from their phone or tablet.

Product distribution strategy: Direct to Business (B2B)

Contacts:

Bus. Dev./ Sales: TJ Tavares, VP Sales 314-492-6445

Press: David Bell, CMO 314-915-8738

How they describe themselves: Financeit is a platform that makes it easy for businesses of any size to boost their sales by offering payment plans to their customers. The company brings point of sale consumer financing tools to main street merchants to increase close rates and transaction size.

How they describe their product/innovation: Financeit, in partnership with FIS, is announcing the launch of and showcasing a USA-compliant platform. Their Finovate demo shows all of the components required to ensure processes are compliant while still providing end users with an amazing product.

Product distribution strategy: B2B Marketing, Sales and Partnerships

Contacts:

Bus. Dev.: Casper Wong, COO, [email protected]

Press: Braden Rosner, PR & Communications Manager, [email protected]

Sales: Craig Haynes, VP Sales, [email protected]

How they describe themselves: Created by two financial advisors, FlexScore is a web-based platform that “gamifies” financial planning by giving you a score based on your overall economic health. After aggregating your financial data, FlexScore assigns you a score and provides a list of recommended Action Steps to improve your financial wellbeing. Each time you complete an Action Step, you earn points as your FlexScore gets ever closer to a perfect 1000, which represents financial independence. FlexScore makes financial planning easy, objective, and even fun. Financial institutions love our digital platform for its ability to engage customers in a unique and profitable way.

How they describe their product/innovation: FlexScore is now available in a mobile version, allowing users to take FlexScore with them wherever they go. FlexScore maintains its core features – the scoring engine, the Action Steps, the Peer Ranking feature – while empowering the user further through our new pocket-sized, accessible format. Just as with our desktop version, the user interface is spacious, simple, and easy to understand, all while retaining the full power of automated financial advice.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions

Contacts:

Bus. Dev., Press & Sales: Jason Gordo, CEO, [email protected], 415-967-1173

How they describe themselves: Hoyos Labs is a digital infrastructure security company with security, computer vision, and biometrics and big data experts. The goal of Hoyos Labs is developing and deploying enterprise and consumer identity assertion technology platforms that will conveniently and securely address the identity assertion challenges of today. Hoyos Labs currently has offices in New York, Boston, Bucharest, Beijing, Oxford, and Puerto Rico.

How they describe their product/innovation: Our mobile app is finally putting an end to the frustration that comes with usernames, passwords, and PINS. This app leverages a user’s smartphone to acquire his or her biometrics, which conveniently and securely replaces log-in information for all their favorite websites.

The app acquires various biometrics, including facial, periocular, fingerprint, and iris. Additionally, the app utilizes a unique, state-of-the-art “liveness” detection system that is capable of distinguishing a real person from an image or video in order to authenticate your identity and log you into sites, from social media to your online banking account and beyond.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev. & Sales: Vincent Endres, [email protected]

Press: Caitlin Kasunich, Senior Account Executive, [email protected], 212-896-1241

How they describe themselves: Businesses of all sizes choose e-SignLive™ by Silanis when e-signatures matter. Thousands of organizations, including the leading banks, credit providers, insurers, and government agencies trust e-SignLive™ as their electronic signature platform.

How they describe their product/innovation: The e-SignLive™ Use Your Own Device (UYOD) capability solves a fundamental problem in financial services and banking: how to capture a customer’s handwritten signature electronically, without asking the customer to come into the branch. This innovation enables the customer’s smartphone or tablet to be used as a signature capture device. It does not require an app or any in-branch hardware. Banks can now make remote customer onboarding convenient and secure with any smartphone.

Product distribution strategy: Direct to Business (B2B), via fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Ilene Vogt, SVP Sales & Marketing, [email protected]

(o) 310-937-9853, (m) 310-710-6465

Press: Sarah Milner, PR Relations & Social Media Manager, [email protected]

250-216-1762

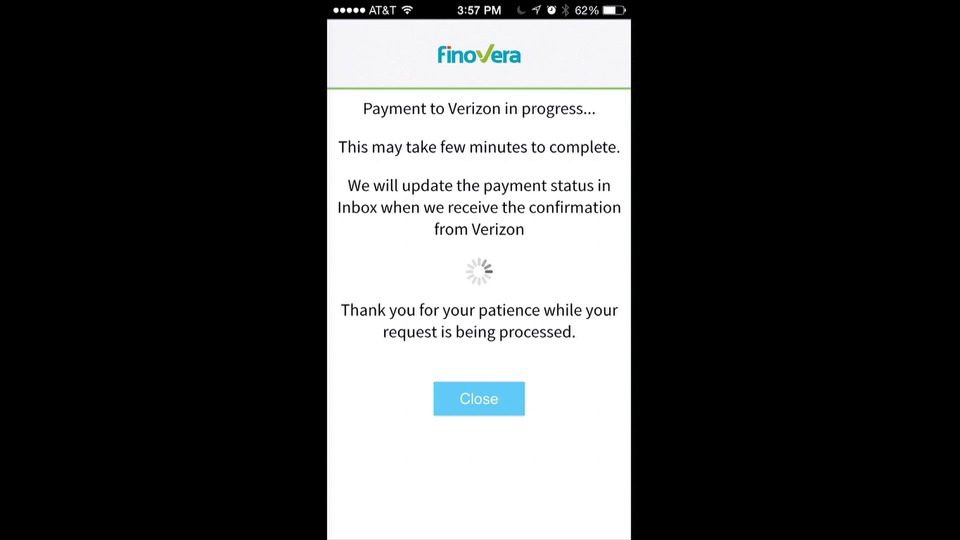

How they describe themselves: Finovera is redefining how people receive and pay bills and manage their finances online and on mobile. Online Bill Pay growth is flat and the eBill view is disappointing in its current state. However, research has shown that eBill users are nearly 40% less likely to switch their bank and are worth 25% more than just the bill pay customers. Finovera helps banks and credit unions to build a loyal customer base by bringing simplicity, efficiency, and convenience to household bill and account management. Now consumers can say goodbye to late fees, forgotten passwords, and a disorganized bill pile.

How they describe their product/innovation: Imagine Bill Management the way you have always dreamed it could be: simple, attractive, convenient, and mobile. Imagine all your bills automatically delivered to you every month in a neatly organized Inbox on your bank site so you can pay them with the click of a button effortlessly from your checking account or on the biller site with a credit card. Now if you are a banker, imagine being able to transform your bank site into a customer’s Financial Hub that lowers attrition, increases revenue, and reduces cost.

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev.: Purna Pareek, CEO, [email protected]

Press & Sales: Amanda Zepeda, Marketing Manager, [email protected]

How they describe themselves: FamDoo is a new allowance system focused on developing life-ready kids, one task at a time. We use technology to connect parents and their kids in a way that encourages positive communication and measurable achievement. Armed with strategic partnerships and current technology, we apply proven loyalty-based methods to create a family rewards system with real-value points. Points earned can be saved, donated, or spent at numerous merchants including iTunes®, Target®, Best Buy® and Amazon.com®.

How they describe their product/innovation: FamDoo allows parents to buy FamDoo Points or transfer their existing bank and/or loyalty points to our platform, then use those points to reward kids for completed tasks. This family rewards system is The Modern Allowance, an applied learning approach to fiscal management and financial literacy. Earned points can be saved, donated, and/or redeemed for a partner’s reloadable debit card product. FamDoo is actively seeking loyalty program and banking partners.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B) through financial institutions other FinTech companies and family-oriented platforms

Contacts:

Bus. Dev. & Sales: Michele Landis, VP Bus. Dev., [email protected], 612-709-1724

Press: Mardi Larson, [email protected], 612-928-2020

How they describe themselves: Global Debt Registry is the clearinghouse for the debt market, providing the definitive independent source of debt ownership information. Our process standardizes and digitizes chain of title tracking in a secure, cost-effective manner. The many benefits from our debt titling services include providing resale controls and transparency into debt ownership, agency placement, maintenance of debt extinguishment records, and providing consumers a way to independently validate debt ownership and collection activity – post charge off. This helps banks manage risks and meet growing regulatory requirements.

How they describe their product/innovation: Global Debt Registry’s client application empowers banks and debt buyers with a revolutionary suite of cutting edge controls that support the sale or placement of distressed consumer receivables. Debt owners can download account reports and request legal affidavits to demonstrate proof of ownership. Members have access to a customizable dashboard to analyze, track, and control relevant delinquent accounts. Our consumer application is the first-ever consumer resource empowering consumers to access account information and ownership history to avoid fraud, costly errors, and cases of mistaken identity by independently validating claims from a debt collector.

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: James Ryan, Bus. Dev. Director, [email protected],

302-333-7758

Press & Sales: Charlie Moore, CCO, [email protected], 203-461-4941

How they describe themselves: Encap Security is the only in-app banking-grade authentication solution that creates an omnichannel experience for financial institutions and customers alike. We offer Smarter Authentication – a truly user-friendly, seamless, and scalable way to create the same experience for the customer regardless of how they are currently interacting with their financial institution. Smarter Authentication combines uncompromising speed, security, and simplicity to boost the adoption of financial services and applications, allowing for the application of security to previously unexplored areas of the customer experience.

How they describe their product/innovation: In the wake of Target and other large retail breaches, Encap has the first solution that can be used to combat CNP fraud – the way most compromised cards are used. Encap is demoing our authentication solution with an emphasis on the importance of thinking outside of the traditional “authentication box.” Because Smarter Authentication is complex, secure, and provides a simple and seamless user experience, it is ideally suited to address not only mobile and online banking transactions, but also CNP transaction approval.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Adam Dolby, VP US Bus. Dev., [email protected],

413-358-3147

Press: Candice Eng, PR+Brand+Social, INK, [email protected], 512-382-8989

How they describe themselves: Endeavour is an exclusive Mobility Integrator with a focus on building secure and compliant mobile solutions across several industries including banking, capital markets, and insurance. Endeavour recently launched a mobile banking program with a powerful set of capabilities, strategic alliances, and thought leadership to deliver strategic consulting services, mobile UI & UX design, mobile application development, and mobile enterprise integration services to our largest financial services customers. Founded in 2002, Endeavour is now a CMMi level 3 company, is backed by a leading private equity firm, and employs 300+ mobility experts across Austin, London, Bangalore, and Singapore.

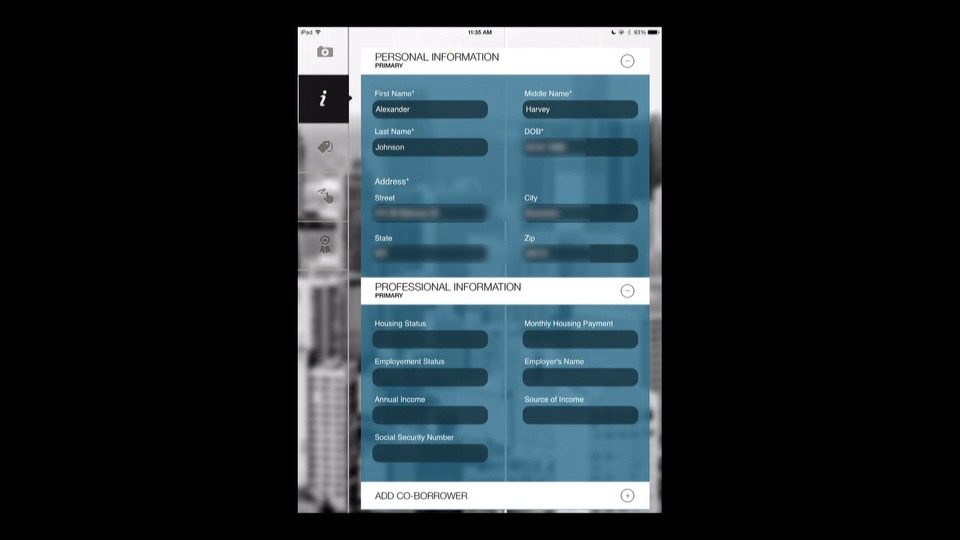

How they describe their product/innovation: Endeavour has partnered with Zoot and Jumio to create a best-of-breed mobile account-opening solution − MobileAO. This unique, powerful, and flexible solution is capable of meeting the complex and evolving business requirements of large financial institutions regarding security, ID verification, and risk management; all while delivering a simple and intuitive mobile experience to the customer. Endeavour has integrated Jumio’s innovative ID validation and prefill capability along with Zoot’s real-time decision engine into a single mobile application and web portal, which empowers banks to open new deposit and credit accounts seamlessly and instantaneously.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, licensed