How they describe themselves: The core capability of verifying the identity of a user accessing a system cuts across a wide range of customers. Biometric authentication has traditionally been limited to government and ultra-high security marketplaces. EyeVerify is now bringing eye vein biometrics to the commercial and consumer markets in a manner that is secure, scalable, and convenient. We are targeting the following market segments: MDM and BYOD, Mobile Banking and Payment Platforms, Security Software Providers, Mobile Device OEM’s, Multi Factor User Authentication, and Single Sign On.

How they describe their product/innovation: EyeVerify is the exclusive provider of Eyeprint Verification, a highly accurate and secure biometric for mobile devices. Eyeprint Verification delivers a password-free mobile experience and secure authentication at a glance. This patented solution uses existing cameras on smartphones to image and pattern match the blood vessels in the whites of the eye.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev. & Sales: Chris Barnett, EVP Global Sales & Marketing, [email protected]

Press: Denise Myers, Director of Marketing, [email protected]

How they describe themselves: FinBuddy is an early-stage startup focused on helping individual investors make smarter and confident investment decisions. Whereas Mint.com made it easier for individuals to manage their personal expenditures, FinBuddy transforms rigorous analysis into intuitive and easy-to-use tools to identify, analyze, and monitor investments. Finally, the added portfolio feedback from trusted social networks and community experts sharpen the user’s investment acumen. FinBuddy is the next step in the evolution of personal investing.

How they describe their product/innovation: Currently, retail investors are stifled by the lack of tools that speak the same language at the level they can comprehend. Vast amount of data that is available creates more confusion and does not provide enough actionable information or insight to investors. FinBuddy addresses this gap by providing very easy-to-understand tools that don’t scare investors but engage them without losing depth and rigor. We provide an intuitive stock & fund screener that helps investors discover new investment opportunities similar to how we discover things in the real world. We provide a comprehensive way to evaluate an investment without overwhelming the user. Our portfolio analysis toolset helps individuals understand their portfolios in easy terms and track them better. Finally, trusted friends can provide commentary and feedback on the investor’s portfolio and share tips over FinBuddy’s social network feed. Social collaboration combined with personalized and relevant insights help individuals make sound investment decisions.

Product Distribution Strategy: Direct to Consumer (B2C)

Contacts:

Bus. Dev., Press & Sales: Shyam Maddali, CEO & Founder, [email protected],

408-910-6124

How they describe themselves: Fiserv, Inc. (NASDAQ: FISV) is a leading global provider of information management and electronic commerce systems for the financial services industry, providing integrated technology and services that create value and results for our clients. Fiserv drives innovations that transform experiences for more than 14,500 clients worldwide.

How they describe their product/innovation: The Mobiliti™ mobile banking and payments solution from Fiserv currently offers ubiquitous alerts and notifications through in-session messages, secure messages, e-mail, SMS, and push notifications. This new innovation extends notifications and actionable alerts to wearable computing devices, allowing the user to receive alerts wherever they are, on whatever device they prefer, and to take action on it.

Product Distribution Strategy: Through financial institutions

Contacts:

Bus. Dev.: Kelly Rodriguez, VP Strategy & Bus. Dev., [email protected],

(o) 678-375-1095

Press: Ann Cave, Director of Public Relations, [email protected]

Sales: Joe Christenson, VP Sales & Mobile Solutions, [email protected],

(m) 210-378-0893

How they describe themselves: FlexScore was created by two financial advisors to gameify the financial planning process by giving you a score based on how well you are doing with your money and the financial decisions you make. Using a web-based platform, users receive their score based on unique goals they set for themselves. To improve the score (financial health), users earn points by completing recommended action steps that move them closer toward their own goals.

How they describe their product/innovation: FlexScore gives you total financial clarity wrapped up in a single score. Until now, there has never been a product or service that truly meets the needs of both the financial advising community and your average everyday household that has a need to plan financially and find appropriate (not “sold” with high commissions and kickbacks) products and services to solve its problems. Over the last 3 years we’ve been developing this web-based financial planning service to benefit both consumers and advisors. We are announcing at FinovateSpring 2014 that FlexScore has created an Advisor version.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions

How they describe themselves: efigence specializes in financial markets. We build web & mobile IB platforms with friendly UI/UX, currency trading tools, PFM/BFM tools and social & financial data aggregation tools for credit scoring. efigence combines all these tools within one, complete financial platform that helps banks increase income and customers’ satisfaction at the same time.

Idea Bank specializes in banking for the SME sector. We are a bank created for small business. Our mission is to develop the enterprising spirit in the Polish market, so we changed a way of thinking about products for business in the banking sector. Our strategy is to build easy and innovative solutions by merging banking with additional services: accountancy, advising, simplifying law and processing.

How they describe their product/innovation: We presented a tool for small and medium enterprises. It is a new transaction system for SMEs that is connected with accountancy systems and a company’s cash flow analysis.

Product Distribution Strategy: Direct to Business (B2B), Direct to Consumer (B2C)

Contacts:

Bus. Dev.:

Dominik Fajbusiewicz, Board Member, Idea Bank, [email protected],

Bartłomiej Wyszyński, VP, efigence, [email protected] &

Andrzej Szewczyk, Managing Director, efigence, [email protected]

Press: Olga Sarzyńska, Communications Manager, [email protected],

+48 508020188

How they describe themselves: Encap Security is the only dedicated software-based banking-grade authentication platform provider, offering simple multi-factor authentication and digital signing for the banking and enterprise sectors. Encap Security turns any personal device into a security credential removing the need for cumbersome and costly SMS codes and hardware. Encap Security makes authentication simple and enabling innovation, reducing risk and driving service adoption for organisations.

How they describe their product/innovation: Smarter Authentication is the world’s only software-based, banking-grade authentication technology that doesn’t compromise between security, user experience and utility.

Product Distribution Strategy: Indirect through System Integrators and Service Providers, Direct to Business (B2B) and through financial institutions/tech companies and licensed platforms

Contacts:

Bus. Dev.: Adam Dolby, VP Biz. Dev, [email protected], +1 413 358 3147

Press: Sarah Wilson, CCgroup PR, [email protected], +44 207 535 7217

Sales: Thomas Bostrøm Jørgensen, CEO, [email protected], +47 92032078

How they describe themselves: We at ETRONIKA are driven by the passion to innovate. Since the founding of the company we have provided innovative, conspicuous solutions for the banking and retail industry, expanding the usage of services over various electronic channels. Our solutions allow our clients to excel in online and mobile services. We try to envision how new technologies, evolving trends, and global changes might come together to improve our client’s businesses and deliver rich customer experiences. Being among the first in the world to present commercial mobile signature solution and Natural User Interface for e-banking, we will continue transforming creative thoughts to reality.

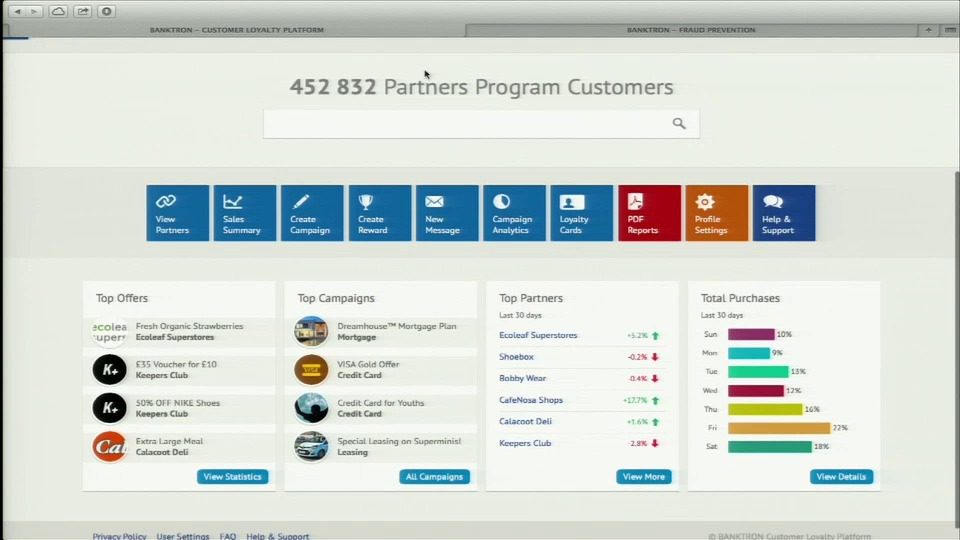

How they describe their product/innovation: BANKTRON introduces a brand new approach to the customer. By combining banking and partners, data analysis, personalization, loyalty, and even fraud prevention, we have laid a whole new ground for better customer interaction and value added product offering. BANKTRON enables the bank to provide personalized, tailored services to the customer via multiple channels, much attention drawn to the mobile. Our flagship product BANKTRON is enriched with data analysis, fraud prevention engines, and a customer loyalty platform, which increases customer engagement and eases the determination of a full customer’s profile based on behavioral patterns. Providing tailored marketing campaigns and enhancing fraud prevention – a way to retain a satisfied customer.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev. & Sales: Kęstutis Gardžiulis, CEO & Co-Founder, [email protected]

Press: Kęstutis Gardžiulis, CEO & Co-Founder, [email protected] & Asta Sabaitė, Head of Marketing, [email protected]

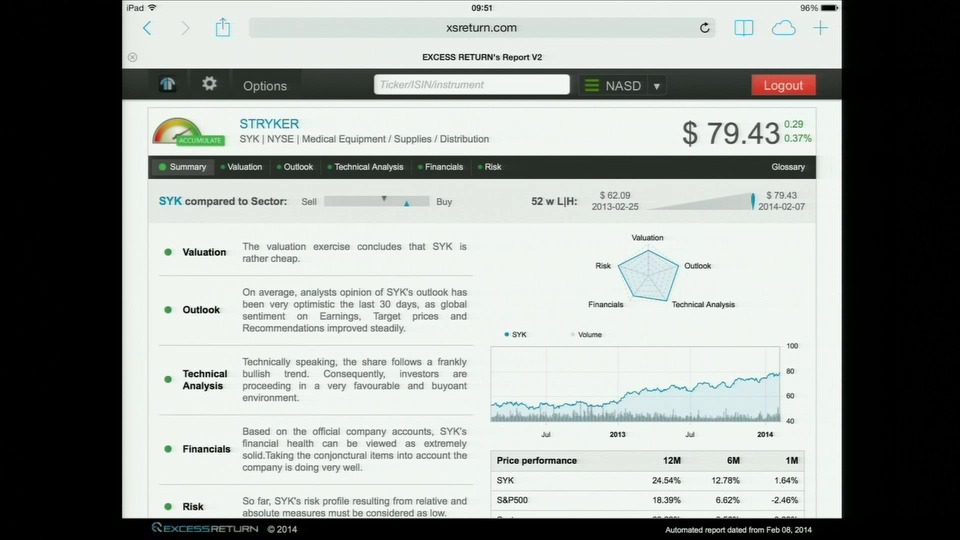

How they describe themselves: EXCESS RETURN develops new generation investment tools for the financial community. The concept dates back to 2005, and the original idea was to generate automatic research notes (REPORTS) on any company listed on the stock market, worldwide, without human intervention. Far from being a simple summary of boring raw financial data, this REPORT had to interpret the figures in a clear language. The REPORT had to reach the same degree of professionalism than one being written by a financial analyst. SCREENER/REPORT is an automatic tool that brings an immediate and crystal clear diagnosis on a trading opportunity.

How they describe their product/innovation:

- SCREENER

Open the trading ideas box. Find the most promising stocks thanks to our SCREENER module.

- REPORT

Buy? Hold? Sell? Easy to use decision tool, our REPORT module.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev., Press & Sales: Frederic Liefferinckx, Founder, [email protected] &

Omar Taoufik, Founder, [email protected]

How they describe themselves: EZBOB is the first web based and fully automated lending platform for SMEs in the UK backed by the UK government’s Angel Co-Fund and appointed as financial intermediary for Project Microfinance by the EU. EZBOB is a profitable alternative lender changing the way business owners can access the funding they need for working capital, growth, or other business opportunities.

The company’s proprietary lending platform is an industry leader, providing for a simplified, customer centric, web based application process. Any UK business is able to apply online, in under 10 minutes with no paperwork and no face-to-face meetings. EZBOB algorithms are able to analyse the business and its directors’ creditworthiness and affordability in real time. Once a funding decision has been made, borrowers can choose their repayment schedule exact funding amount; funds transferred directly to the business account within 30 minutes or less.

How they describe their product/innovation: EZBOB’s lending platform was initially designed to provide an automated funding solution for online retailers, such a people operating online shops on eBay, Amazon, or those using PayPal.

At Finovate EZBOB launched their new proprietary platform (EZ10.1), which allows for any of the 5 million SMEs in the UK to apply online in minutes and find out how much funding is available to them.

Now, all business applicants will enjoy EZBOB’s USP, which is a short online application with an automated lending decision and instant funding of up to £50,000.

Product Distribution Strategy: Direct to Business (B2B)

Contacts:

Bus. Dev.: Sharone Perlstein, [email protected], +972546965599

How they describe themselves: fastacash™ provides a global social platform which allows users to transfer value (money, airtime, other tokens of value, etc.) along with content (photos, videos, audio, messages, etc.) through social networks and messaging platforms. The company has developed a patent pending link generation technology that enables the value transfer with a secure link.

As a technology enabler, fastacash™ partners with companies and brands in the payments, remittance, consumer products, social, and gaming industries to bring its technology to end-users. The company recently launched its showcase service in the United Kingdom (international remittances from the UK to Kenya) through a partnership with VFX Financial. It also launched in Indonesia (domestic money transfers) in November, with partner, DOKU, a leading PSP. The company is preparing to launch in Russia with UNISTREAM.

Product Distribution Strategy: Direct to Business to Consumer (B2B2C)

Contacts:

Bus. Dev. & Sales: Gilberto Arredondo, CCO, [email protected]

Press: Radhika Angara, CMO, [email protected]

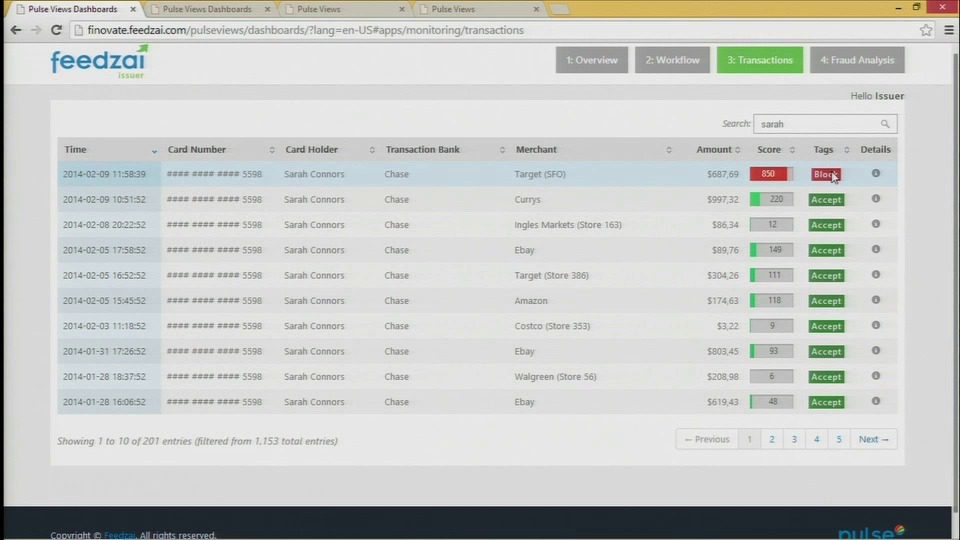

How they describe themselves: Feedzai makes omnichannel commerce safe. Our fraud prevention software blocks payment fraud using Big Data. Banks, payment networks, and retailers rely on our sophisticated algorithms to predict and block more fraud earlier. By combining today’s technology, data science, and fraud expertise, we’ve built from scratch the most modern and fastest fraud-scoring platform on the planet.

Founded by data scientists and aerospace engineers in Europe, we expanded to the United States in 2013.

How they describe their product/innovation: Feedzai Fraud Prevention™ blocks payment fraud in real time – online, in store, mobile, and wherever customers shop. Built with the latest Big Data technology, Feedzai Fraud Prevention™ works transparently to risk score every single checkout transaction in under 25 milliseconds. Machine-learning models reduce the false alarms that overload order review staff. Individual 1-1 behavioral profiling detects more fraud than possible before. White-box scoring techniques provide clear, human readable explanations to enable a rich customer experience.

Feedzai is Fraud Prevention That Learns.

Product Distribution Strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, licensed

Contacts:

Bus. Dev., Press & Sales: Loc Nguyen, Marketing and Partnerships, [email protected], 415-535-7749

How they describe themselves: Fiserv is the world’s leading provider of digital banking and payment solutions. We have the #1 ranked products in various spheres of financial technology: online banking, tablet banking, mobile banking, electronic bill payment/presentment and person-to-person payments. Our entire focus is helping financial institutions attain best-in-class outcomes from world-class technology.

How they describe their product/innovation: We demonstrated the next version of Mobiliti – our flagship mobile and tablet banking platform, with a focus on its completeness, intuitive design and disruptive capabilities.

Product Distribution Strategy: Direct to Business (B2B), reaching consumers through financial institutions (licensed or SaaS)

Contacts:

Bus. Dev.: Serge van Dam, Segment Leader, Digital Channels, [email protected],

+44 208 133 1246

Press: Teana Baker, Marketing Manager, [email protected], +44 208 833 3152

Sales: Denis Zelenskiy, Sales Executive, Digital Channels, [email protected],

+44 7741 706 814