How they describe themselves: Entrepreneurial Finance Lab (EFL) uses psychometric principles and other non-traditional data to provide credit scores for thin-and no-file small business owners in emerging markets. EFL generates highly personalized credit scores by statistically relating entrepreneurial qualities such as intellect, business acumen, ethics, and attitudes and beliefs to credit screening. EFL empowers financial institutions with the clarity and confidence they need to decrease their reliance on retrospective financial metrics, while carefully controlling risk, in order to approve clients that they may have otherwise rejected due to incomplete credit histories. Among its partners, EFL has increased loan portfolios by over 100% and when integrated into existing lending processes, decreased defaults by over 40%. EFL has partners in Africa, Latin America, and South Asia. EFL was developed at the Harvard Kennedy School and became an independent company in 2010 with offices worldwide.

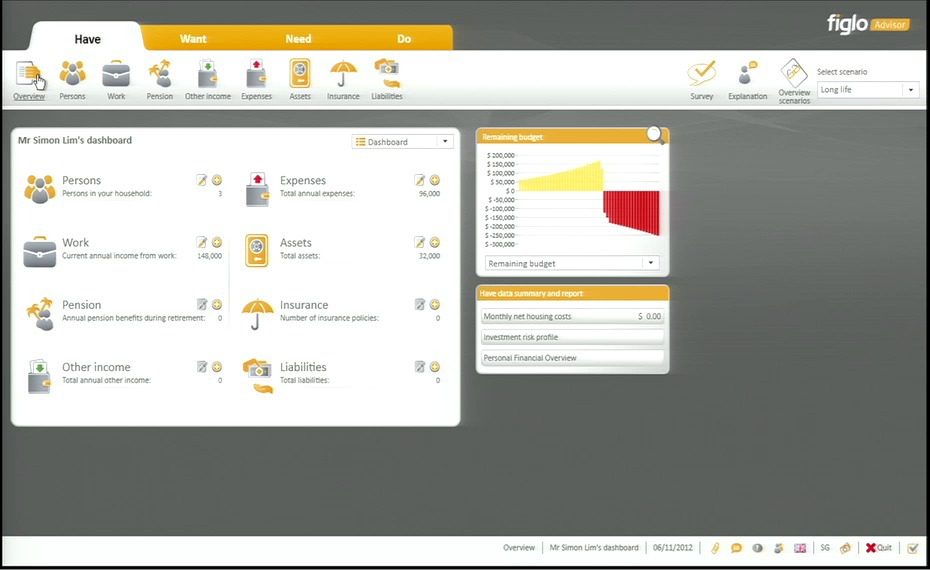

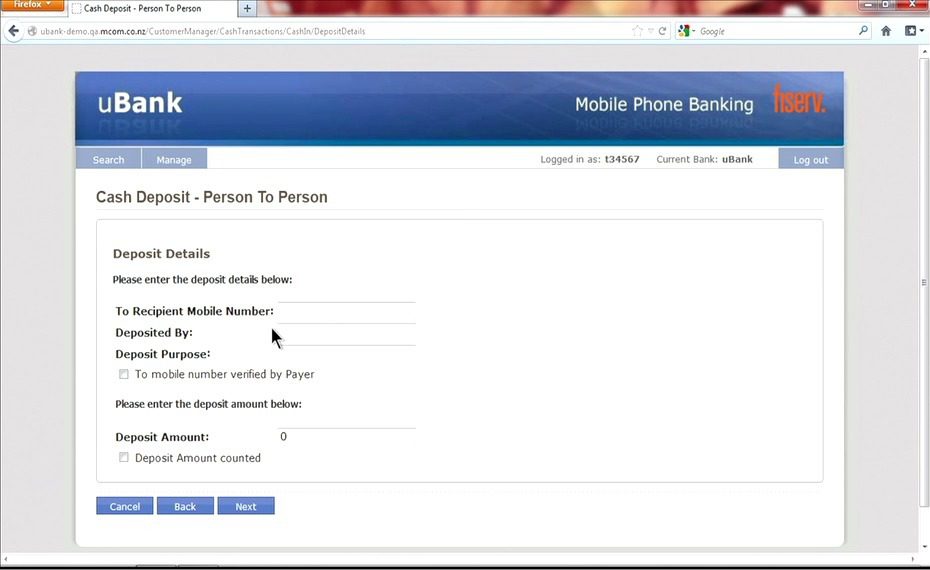

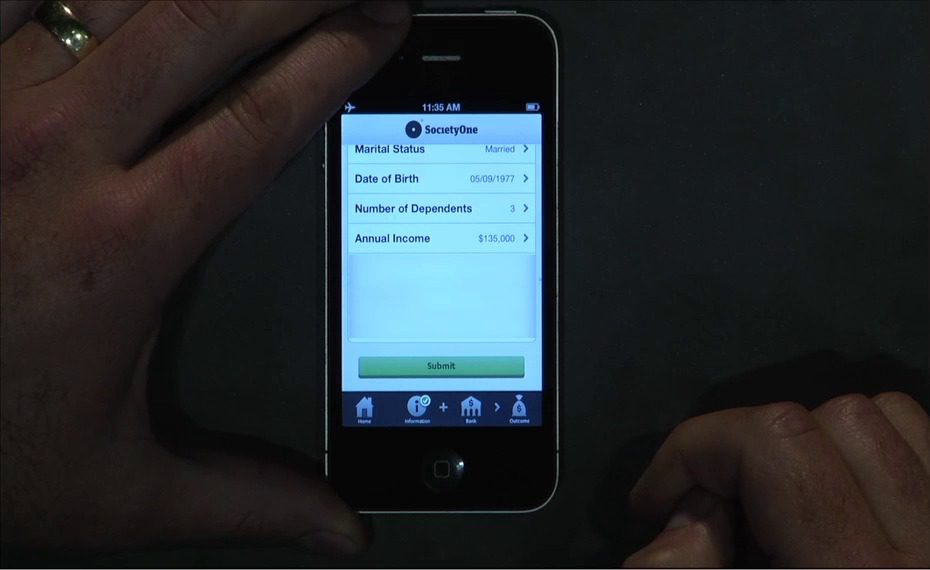

How they describe their product/innovation: The EFL Credit Scoring Tool is a credit scoring and management platform that seamlessly integrates into and expedites existing bank lending processes. EFL’s 45-minute credit application can be taken on a PC or mobile tablet device at a bank branch or in the field. The completed application is processed by EFL within 30 minutes into a 3-digit credit score. The EFL Score is posted on EFL’s Web Suite, allowing the credit team to simply log on to approve or deny the loan. EFL’s Web Suite offers a 365-view of the applicant and loan portfolio, allowing the bank to track loan approvals and disbursements, measure turn-around-times, arrears data, review applicant GPS, photos and biometrics and much more by branch and region. The EFL Credit Scoring Tool provides the simplicity, speed, and insight needed to make informed credit decisions that lead to higher growth and lower risk in information scarce markets.

Contacts:

Bus. Dev. & Sales: Emily Silberstein, Bus. Dev. Manager, [email protected]

Press: Penelope Silva, Communications Manager, [email protected]