How they describe themselves: iPay Technologies is the leading independent provider of bill payment services to the community financial institution market. Founded in 2001, iPay develops and fully supports consumer and small business online bill pay platforms for more than 3,600 financial institutions.

What they think makes them better: iPay is revolutionizing the way small businesses

manage their back office. Busy entrepreneurs are replacing shrink-wrapped accounting software with iPay’s small business suite, delivered in a SaaS model, behind a single login at their bank or credit union’s website. For just a few dollars a month a small business can now:

- Create and send invoices electronically

- Track receivables

- Accept online payments at a hosted/branded website

- Transfer funds

- Deposit payroll electronically

- Pay bills

- Delegate tasks to an unlimited number of authorized users

- Have direct and immediate access to unprecedented customer support.

Contacts:

Biz Dev: Kelli Schultz, SVP Bus. Dev., [email protected], 866-851-4729 ext. 9224;

Sales: Alix

Hoffman, SVP Sales, [email protected], 1-866-851-4729 ext 9719;

Press: Tracey Weinberg, SVP Internet

Marketing, [email protected], 1-866-851-4729 ext. 9233

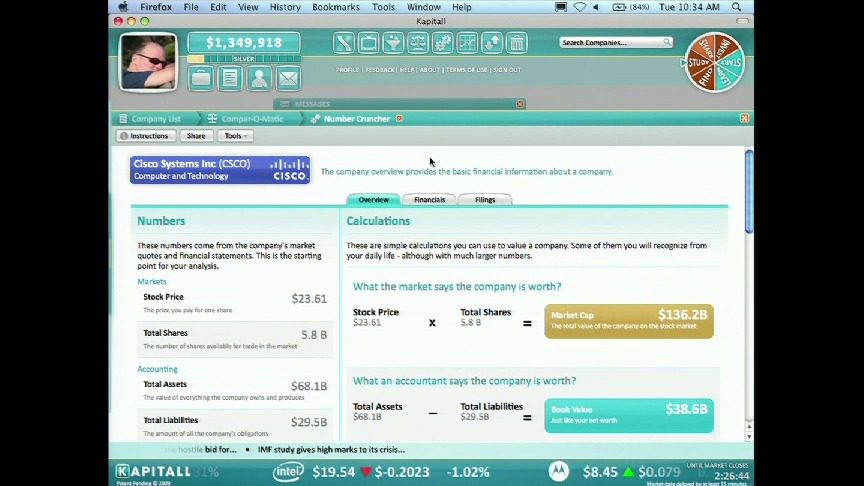

How they describe themselves: Kapitall is a fun way to become a better investor. Modeled after video games, Kapitall combines the world’s friendliest investing experience with powerful yet simple tools to build your skills – and maybe even your portfolio.

We believe investing is an adventure – it’s fun, it’s challenging, and the more you get into it, the more you get out of it. But most investing sites are kind of a drag – they’re confusing, boring or just plain ugly. It’s our mission to make the experience of investing as rewarding as the results.

By combining the first “drag & drop” investing interface with the engaging design of video games, we intend to make the market a fun place to grow for a whole new generation of investors. Much in the way Apple popularized personal computing and the Wii broadened the reach of gaming, we believe this will help more people than ever connect with the world of investing.

What they think makes them better:

- Explore with ease: enjoy the first “drag & drop” investing interface

- Analyze like a pro: find the right investments for you with intuitive research tools

- Share knowledge: collaborate and compete with friends and other Kapitallists

- Track your progress: watch your experience level – and your assets – grow

- Start anytime: no membership fees, minimums or brokerage account required

Contacts:

Biz Dev & Sales: Sally Wood, COO, 212-965-8441, [email protected]

Press: Victoria Alexander, [email protected], 917-238-8912

How they describe themselves: iBear Com. Ltd. is a privately-held self-funded company based in Russia (Barnaul). It is founded by former graduate students of the Altai State Technical University. The team has great background and experience in developing multifunction and multi-platform applications, including solutions for iPhone and Google Android.

iBearMoney is a mobile application for iPhone. It helps manage personal cash flow, track assets and liabilities – all in the palm of the hand. It is developed to satisfy the needs of the rapidly growing mobile-driven society that spends more and more time on the go.

What they think makes them better: Most of the basic mobile financial applications track expenses only, more advanced ones track income and expense transactions, but none of them analyze “why” and “how” cash flow is generated. With iBearMoney it becomes possible. It is a complete personal finance management tool available anytime and anywhere with the user data protected and stored on the device only.

iBearMoney has an intelligent analysis component, which helps analyze relations between income-expenses and assets-liabilities. The “What-if” modeling component allows the user to try different strategies to improve the cash flow and balance.

Contacts:

Bus. Dev. & Press: Andrey Pilyugin, CEO/Founder, [email protected], +7.3852.430717, +7.3852.223978

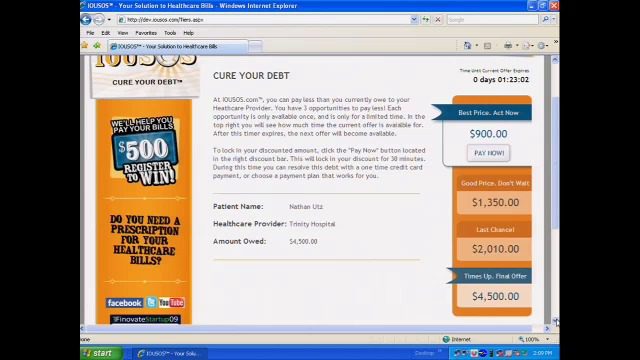

How they describe themselves: Partnerships are in deployment with the launch of our patient discount platform, www.IOUSOS.com. Our healthcare solutions enhance caregiver’s abilities to drive revenues from patient self-pay accounts. We are processing more than $20MM in patient account receivable volume currently. With more healthcare partnerships closing within 60 days, we anticipate patient account receivable volume exceeding $35MM this quarter. The patient self-pay market exceeds $200B annually in the US (US healthcare is a $2.2 trillion annual market), and with our existing pipeline of clients, we forecast approximately 75 healthcare partnership clients by the end of 2009, with annual patient payment volume approaching $75MM.

What they think makes them better: IOUSOS.com addresses the crisis confronting consumers and healthcare providers today. 21% of Americans today report problems with medical bills according to Gallup. 20,000 people in the US die each year due to inadequate health coverage. 700,000 Americans enter bankruptcy each year due to unpaid medical bills, with more financial problems for consumers anticipated due to rising unemployment, underinsured consumers and escalating healthcare costs. Our unique financial solutions focus on helping tens of millions of Americans increase the affordability of their healthcare costs which are spiraling out of control today, posing a major social and economic crisis in this country today.

Contacts:

Bus. Dev. & Sales: Chris Utz, VP/Director of Bus. Dev., [email protected], 312-810-0620

Press: Brian Mullally, CEO and Co-Founder, [email protected], 269-488-1565

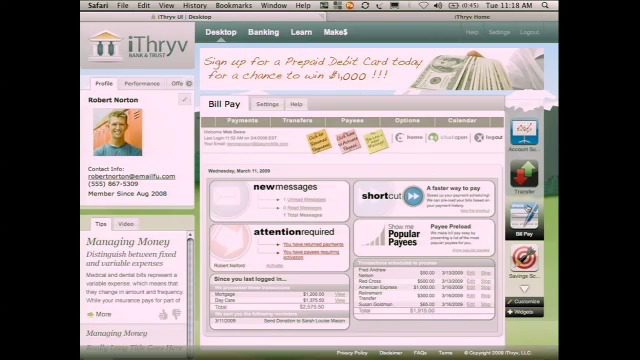

How they describe themselves: iThryv, LLC is a socially conscious technology company founded to provide a unique solution to help people gain financial literacy. iThryv was developed as an extension of the current online banking system and is aimed at offering people a new tool to manage money and simultaneously increase their financial awareness. The iThryv platform was constructed with many patented capabilities that extend what financial institutions now deliver through online banking. Instead of just delivering transactional capabilities, we have built in intelligent content delivery, a frequent flyer mile like incentive system, a savings score, a Widget based model or feature delivery, and many other unique capabilities. Our technology also allows us to create flavors that are specifically targeted to constituent groups. For instance, our first three flavors are for young people – ages 5 to 11, 12 to 17 and 18 to 24.

What they think makes them better: Providing a single Web service that can aggregate content and services from all over the financial space, onto one platform supplied through online banking.

Contacts:

Bus. Dev. & Sales: Donielle Nyland, Partner, 214.557.2571, [email protected]

Press: Scott Klososky, 405.226.9897, [email protected]

How they describe themselves: Jwaala’s award winning MoneyTracker, online-banking enhancement solution is changing the face of Internet banking with integrated account aggregation, natural language searching, personal financial management, consumer remote deposit, secure document repository, widgets, and infinitely customizable alerting options. Jwaala is simply Better Online Banking!

What they think makes them better: Not all PFM products are created equally! MoneyTracker PFM is the most powerful, feature rich and intuitive application available for financial institutions to add capabilities to their existing online banking platforms. Launched in 2006, it was also the first! And continues to be an innovator in the online banking space.

Contacts:

Bus. Dev. & Press: Kelly Dowell, COO, 512-845-3142

Sales: Eric Fisher, Director of Sales, [email protected]

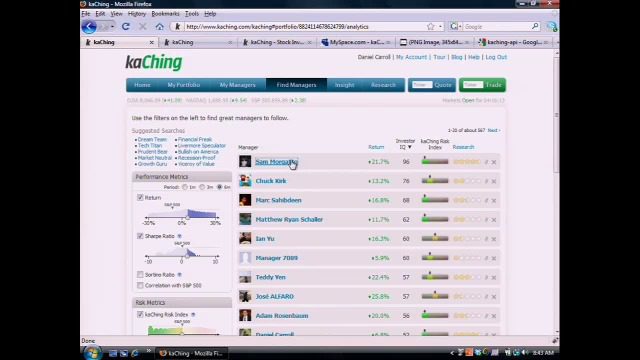

How they describe themselves: kaChing is a virtual investing environment where anyone can prove they’re a great investor, or find a great investor to follow. Out of nearly 375,000 portfolios on the site, 25,000 had positive returns in 2008 (while a single mutual fund managed to avoid losses). Later this year, kaChing will allow its members to use their own brokerage accounts to automatically mirror the site’s certified best investors.

What they think makes them better: With its proprietary supercrunching technology and open source strategy, kaChing has built the largest investment platform on the web with over 375,000 portfolios.

Having received groundbreaking status as a registered investment advisor with the SEC, kaChing is offering a fresh, new alternative to mutual funds by launching mirrored trading later this year. Users will be able to mirror their favorite certified investors in their brokerage accounts.

Contacts:

Bus. Dev.: Dan Carroll, Founder, [email protected], 630-930-7353

Press: Cynthia Sterling, [email protected], 650-868-6832

How they describe themselves: Kapitall is a rich web application that makes investing easy for everyone. Inspired by game design, Kapitall combines an intuitive and engaging graphic user interface with powerful tools that make it easier than ever to research companies, build portfolios, share ideas and get smarter about the market.

What they think makes them better:

- It’s visual: Read less, know more. See the market come to life in a colorful, interactive “playground.”

- It’s intuitive: No user manual required. Perform basic tasks or advanced analytics with drag & drop simplicity.

- It’s social: You are not alone! Collaborate or even compete with a community of like-minded investors.

- It’s powerful: Master the market. Easy-to-use analytical tools turn complex information into actionable intelligence.

- It’s free to join: Don’t worry about the minimums & fees. Watch skills grow as you try ideas and test-drive portfolios.

Contacts:

Bus. Dev. & Sales: Sally Wood, COO, [email protected], 212-965-8441

Press: Victoria Alexander, PR for Kapitall, [email protected], 917-238-8912

How they describe themselves: Lending Club brings together investors and creditworthy borrowers to provide value beyond traditional banks for both. Premium borrowers can get personal loans from $1,000 to $25,000 at fixed rates often significantly better than those offered by conventional sources. Investors (our lenders) are empowered to build a portfolio of Notes based on their specific criteria. Most investors spread their investment across tens or hundreds of qualified borrowers.

What they think makes them better: Lending Club provides superior value and control to both investors and borrowers. Creditworthy borrowers can take advantage of a streamlined, online process, competitive fixed rates, easy monthly payments, and no hidden fees. For lenders, money invested goes directly to approved borrowers. Over the past 20 months, Lending Club investors have earned an average annual return of 9.05% (based on a report by independent research company, Javelin Research), after a low 1% fee.

Contacts:

Bus. Dev.: Rob Garcia, Director of Product Strategy, [email protected], 408-524-1539

Sales: Meredith Kramon, Lending Services, Lending Club, [email protected], 408-524-3069

Press: Pamela Kramer, CMO, [email protected], 408-524-1535; or Patty Treadway, Antenna Group, 415-977-1933, [email protected]

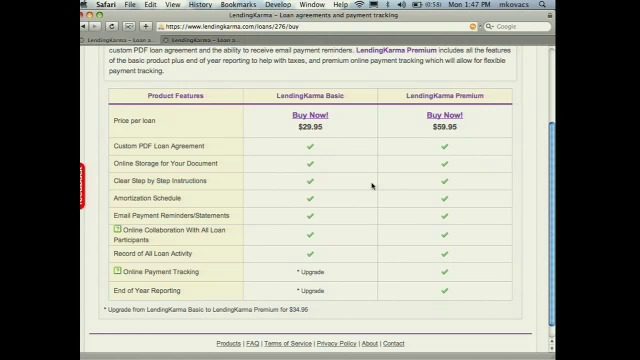

How they describe themselves: LendingKarma is a person-to-person lending site that makes it easy for parties that know each other to create loans and provides borrowers and lenders with tools to help service the loan and see it through to repayment.

What they think makes them better: There are two main types of person-to-person lending solutions out there today. First there is the low cost, sometimes hard to use, and often incomplete services that either generate a promissory note or sell a blank promissory note. The relationship ends after the promissory note purchase and you are left to deal with the realities of tracking your loan to completion. In addition to sending payment reminders LendingKarma can help manage variations such as overpayments to pay down principal, late payments, and underpayments.

On the opposite end there are services that ask you to let them manage the entire process, but are expensive. LendingKarma aims to offer the best of both worlds — an easy to use, reliable, and convenient service for creating and tracking your personal loan from inception to final repayment — at a cost effective price point. We will continue to add features to make the person-to-person lending process easier and more convenient.

For financial/legal advisors and organizations that wish to provide a high quality, custom branded web based loan creation and tracking solution for their clients, the LendingKarma platform can be deployed as a ‘white label’ solution.

At a time when Americans have lost faith in corporate banks, person-to-person lending has emerged to restore integrity and transparency to this process. LendingKarma hopes to be part of this shift

Contacts:

Bus. Dev., Press and Sales: Michael Kovacs, [email protected]

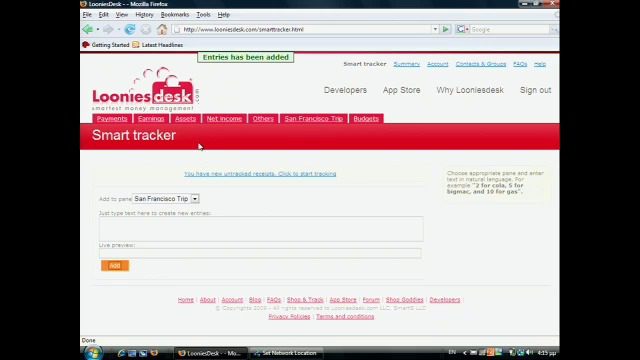

How they describe themselves: Looniesdesk.com is an open source financial platform allowing users to enable smart third party applications in order to give them more power to manage their accounts and take wiser financial decisions.

What they think makes them better: Looniesdesk.com is the only online open source financial platform that will allow its users to enable third party applications based on the functions they want to have available.

How they describe themselves: In the current economic climate residential properties (1-4 family) often remain assessed at levels significantly higher than the true market value. The tax assessment cycle can take considerable time to correct to current market conditions. Our proprietary FairValue Calculator guides site visitors to enter a property address and click “Check Your Value for Free”. Within seconds their property’s market value is compared to property tax assessment records to determine if the property is fairly, over, or under-assessed. Qualified property owners register, answer several questions, and purchase our FairValue Report using our secure check-out. The report provides the completed forms required by their taxing authority and a market-approach based valuation report. In most cases the client simply reviews, sign/dates and mails the forms to their local assessor or board of equalization to obtain a review and/or hearing.

What they think makes them better: Competing sites offer blank forms or kits that require the user do much of the research and prep work while navigating a complicated appeals process. We include a customized value report which can save the customer $300 to $500. We deliver everything needed to appeal your property tax: an AVM based appraisal, instructions, forms required by the taxing authority (filled out) and appendix. We even include a pre-addressed envelope to send to their local property tax authority. Simple, Accurate, Fast, Economical.

Contacts:

Bus. Dev., Sales & Press: James E. Deanne, 877-908-7191 ext 210, 206-459-8401 mobile, [email protected]

Greg Hauth, 877-908-7191 ext 212, 425-359-5498 mobile, [email protected]