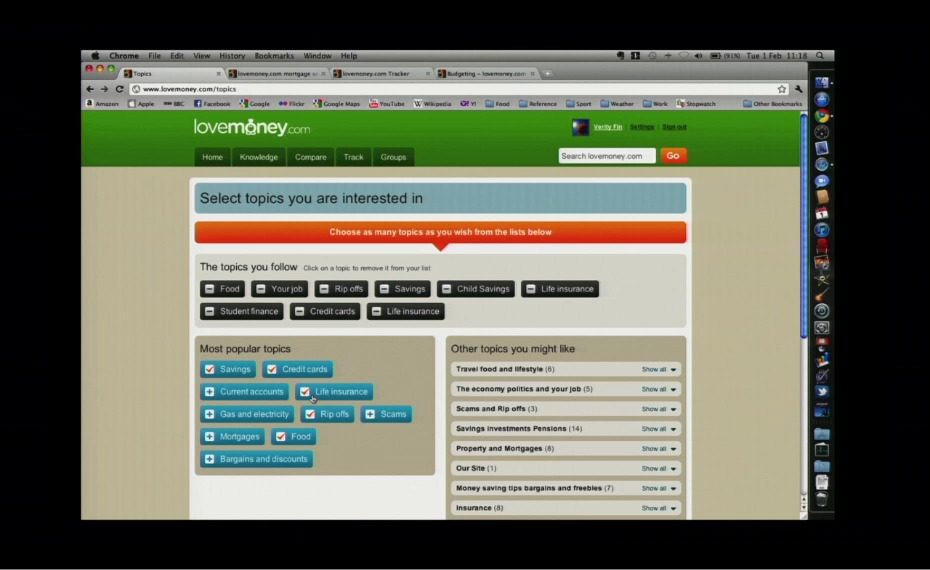

How they describe themselves: lovemoney.com is a personal finance portal at the forefront of user empowerment in the UK money space. It is built around five core content domains: Knowledge, Comparison, PFM, Financial Planning and Social Interaction. Users personalize their experience by tailoring their topic interests, asking questions of the community and interacting with products, experts and advisors. The platform ‘learns’ from group behavior and serves content and products based on profile cohorts. Our innovative product selection, PFM and planning tools complete the offering, placing it at the forefront of cutting edge PF destinations. Put simply, our mission is to make you richer.

How they describe their product/innovation: lovemoney.com has released ‘version 2’ of the portal. We are demoing our freshest features that comprise: streamlined registration and topic selection, “People like you” and “Just you” content filtering, single customer view population of multiple financial services, Money Tracker (PFM in the UK), Plans (our unique asset digitisation service), Q&A, Groups and the all-important Personal Homepage. lovemoney.com is the first personal finance platform in the UK that joins all of these elements up to form a truly integrated money hub. The features demonstrated at Finovate are the output of innovation in a downturn!

Contacts:

Bus. Dev.: Saul Devine, Managing Director, [email protected], +44 (0) 207 297 8181,

Ian Major, Operations Director, [email protected], +44 (0) 207 297 8147

Press, Sales: Ian Major, Operations Director, [email protected], +44 (0) 207 297 8147

How they describe themselves: Ixaris specializes in developing innovative global applications based on open-loop (Visa and MasterCard) prepaid card schemes. Its specialized platform provides both consumers and businesses with convenient access to electronic payments and facilitates the global transfer of funds in real time through the Visa, MasterCard and SWIFT networks. Ixaris currently offers a range of co-branded payment applications to businesses in the healthcare, leisure, financial services, travel and performance marketing industries and currently manages financial transactions exceeding $15M per month.

What they think makes them better: When compared to other “open payment” offerings, Ixaris Opn is a truly “open” payment platform that allows developers to build payment applications over open loop networks such as Visa, MasterCard and SWIFT. Its proprietary paylet technology offers developers far greater control over the look and feel of their applications without sacrificing security and compliance, while third-party financial providers, including issuers and card processors, can participate in Opn as providers of the underlying services. Opn supports payment applications for users both within a shared community as well as private communities where the client retains exclusive access to a group of users.

Contacts:

Bus. Dev. & Sales: Mike Anderson, Business Development Director, 206-453-0026, [email protected]

Press: Matt Lloyd, Founder, M2L2 Communications, 617-834-3146, [email protected]

How they describe themselves: Jack Henry & Associates, Inc. encompasses three primary brands. JHA Banking provides mid-tier and community banks with enterprise-wide information and transaction processing solutions that are available for in-house and outsourced implementation; Symitar provides credit unions of all sizes with industry-leading information and transaction processing solutions that are also available for in-house and outsourced implementation; and ProfitStars provides best-of-breed solutions that enhance the performance of domestic and international financial institutions of all asset sizes and charters using any core processing system, as well as diverse corporate entities.

What they think makes them better: Jack Henry’s primary and sustainable competitive advantage is its company-wide commitment to provide premier service levels. Jack Henry is driven by a fundamental commitment to provide service levels that consistently exceed its clients’ expectations, and generate industry-leading client satisfaction and retention rates.

Jack Henry maintains the focused work ethic and fundamental ideals fostered by its co-founders – Jack Henry and Jerry Hall: 1) Do the right thing, 2) Do whatever it takes, and 3) Have fun.

These simple but powerful tenets have enabled Jack Henry to prosper in an extremely competitive business environment, to provide rewarding professional opportunities for its more than 4,400 associates, to generate an impressive rate-of-return for its shareholders, and to establish a corporate culture that generates rewarding levels of client satisfaction and retention.

Contacts:

Bus. Dev.: Steve Tomson, Director of Sales, [email protected], 972-354-5108

Sales: Martin Webster, ProfitStars Sales Manager, [email protected], 800-356-9099

Press: Jacquie Scheider, Marketing Manager, [email protected], 770-752-6410

How they describe themselves: Kapitall is a whole new way to invest online and play the market. With our intuitive “drag-and-drop” interface, anyone can explore the market, build their skills with practice portfolios, analyze their choices with powerful yet easy-to-use tools, and share their ideas with like-minded investors, including their Facebook friends. And via a partnership with TD AMERITRADE, Kapitall users can now import “live” portfolios to track their holdings and make trades directly from Kapitall.

What they think makes them better: By making investing a more intuitive and social experience, Kapitall engages and empowers a far broader audience of online investors – particularly younger people who aren’t well-served by the tedium and complexity of established choices. To achieve this, Kapitall has transformed online investing from information-heavy, static webpages into a highly-interactive, visual experience inspired by social gaming – the way the next generation of investors prefers to learn, play and connect with others.

Contacts:

Bus. Dev. & Sales: Sally Wood, VP Business Development & Marketing, [email protected], 212-965-8441

Press: Ellen Edelman, Spark PR, 908-322-8998

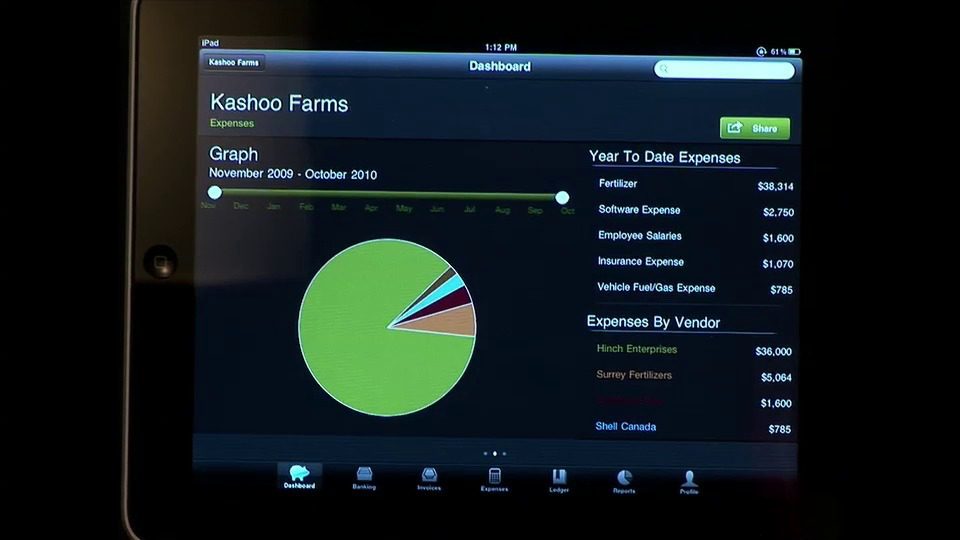

How they describe themselves: Kashoo.com transforms how small businesses manage their finances. At its core, Kashoo.com is a powerful yet affordable online accounting solution designed specifically for small business. With no accounting experience, the business owner can quickly and efficiently “do the books” and move on to the business of running the business. With the help of powerful visualization dashboards, business owners keep on top of the numbers impacting business, make better strategic decisions, and proactively take action. Financial goals are met and disasters are avoided. With powerful insight into the operational performance of the company, business owners rely on Kashoo.com for more than accounting.

What they think makes them better: Unlike desktop accounting applications, Kashoo.com was built from the ground up to leverage cloud computing to enable collaboration, mobility, and data sharing in a simple, secure, affordable solution. Accessible over the Internet and on mobile devices like the iPhone, Android, and iPad, Kashoo gives the business owner control to manage the company’s finances anytime, anywhere. And because Kashoo.com is designed specifically for the small business owner, no knowledge of accounting is required. Kashoo.com goes beyond “doing the books” giving the business owner the power to collaborate in real-time with partners, to stay on top of key metrics, and to optimize business performance.

Contacts:

Bus. Dev. & Press: Jim Secord, CEO, 778-919-3771, [email protected]

Sales: Scott Pledger, VP Marketing, 604-754-7979, [email protected]

How they describe themselves: Kiboo is an alternative banking/payment platform designed for teenagers, young adults, and their parents that combines real-time access to checking and savings accounts with rich, customizable tools for budgeting; access to our retail partnerships; participation in social causes and philanthropy; and a vast library of targeted personal finance information.

Kiboo empowers young people (representing $200b in spend annually) and their parents to reach and retain financial independence. Blending social media tools with personalized information and a secure system that both learns and teaches, Kiboo is a values-based alternative for this transitional demographic.

What they think makes them better: Kiboo will convert and retain this coveted but elusive demographic by offering services, tools, and information which has been wholly customized for them based on their world view, social values, vernacular, and aspirations of independence.

Whereas conventional banks have offered few targeted products for this customer group, and other financial websites provide advice but few real-world services, Kiboo leverages both competitors’ missed opportunities.

Kiboo benefits our bank partners with sticky core deposits; we mitigate interchange fees and prevent fraud losses for our retail partners; and we provide our users with safe, secure access to their money and relevant financial information.

Contacts:

Bus. Dev. & Sales: Meredith Fogel, VP Business Development, [email protected], 917-757-3999

Press: Lisa Halpern, Founder & CEO, [email protected], 917-576-7582

How they describe themselves: Kony Solutions provides a suite of products and support services that enable Fortune 500 companies to offer consumers feature-rich mobile applications in less time and at lower costs than any other solution available. The Kony Mobile Application Platform provides a complete mobile development, deployment and production platform, which supports all mobile systems on the market today, including every major device, operating system, and mobile browser. Kony’s Write Once, Run Everywhere technology allows businesses to engage with customers anywhere, anytime via any mobile device, operating system (OS) or channel.

What they think makes them better: It’s our Write Once, Run Everywhere technology. A single application definition enables mobile offerings to be designed and developed just once, in a device independent manner, and deployed across multiple channels, including:

- Smartphones and tablets

- Device-optimized mobile websites

- SMS/MMS

- Web gadgets (iGoogle, Facebook, Twitter, etc.)

- Desktop applications

Kony currently supports more than 8,000 mobile devices and popular operating systems.

Kony also “future-proofs” its client’s mobile investment by allowing for simultaneous upgrades to all native applications via its singular application definition. This Change Once, Change Everywhere ability reduces maintenance, upgrade and future development costs.

Contacts:

Bus. Dev.: Jim Lambert, Vice President, Business Development, 650-375-2550, [email protected]

Sales: Sophie Vu, Director, Marketing and Business Development, 650-375-2549, [email protected]

Press: Julia Gaynor, 212-398-9680, [email protected]

How they describe themselves: A consumer’s online experience is one of the most important factors in their decision to conduct business with a financial institution. Leadfusion delivers the unique combination of solutions necessary to create compelling, interactive experiences for the financial consumer while minimizing the need for expensive and risky development projects. Leadfusion is the industry source for Financial Experience Management™ (FEM). Patent-pending FEM tools help financial institutions produce an authentic online and mobile experience that delivers personal value for consumers and enhances the corporate brand. Leadfusion solutions accelerate conversion, turning prospects into customers and customers into loyal advocates. Leadfusion’s FEM suite consists of Researching, Marketing, and new Selling Solutions designed to operate independently or as a single integrated platform.

What they think makes them better: Leadfusion’s new Guided Selling product is a next generation CRM accelerator that provides a goal-oriented consumer workbench for use on financial institution websites. Guided Selling helps financial institutions move beyond online brochure-ware, to quickly deploy an engaging and interactive consumer experience. Guided Selling is the first product to offer a robust platform that allows consumers to explore financial products across lines of business. Guided Selling leverages data-driven decisioning and user interaction to present relevant educational materials and product information for mortgages, home equity, savings, checking and consumer finance. This innovative SaaS platform enables a financial institution to deliver a consistent and fully branded, self-selling website experience built upon an established framework in a fraction of the time and cost required to build similar functionality from the ground up.

Contacts:

Bus. Dev. & Press: Kara Greenwell, Director of Marketing, [email protected], 858-259-2134

Sales: Ronan Winter, Director of Sales, [email protected], 858-259-2122

How they describe themselves: Ideon is the leading product innovation partner for top financial institutions in North America and Europe. One of our flagship solutions is Choice Savings. Choice Savings generates significant value to retail bank customers and the bank itself, and is targeted at those banks whose objectives are to grow deposit volume, lower deposit costs, increase deposit maturities, increase customer satisfaction, and increase penetration in new customer segments, while improving operational efficiency. Choice Savings is an easy to implement, end-to-end solution that can be deployed within your bank in record time – integrated with your operations as either a hosted or custom installation.

What they think makes them better: In these turbulent times Main Street retail bank

customers are looking for ways to save with safety, liquidity, and upside. These combined needs go largely unmet by current deposit products and their “one-size-fits-all” approach. That is why we invented Choice Savings — a bank account 100% customized to the retail client’s individual needs – powered by Ideon’s patent pending solution.

Choice Savings allows bank customers to build their own time deposits by selecting their desired levels of safety, liquidity, and upside – from either guaranteed interest rates or potential stock market-based reward rates.

Are you meeting your customers’ needs? We invite you to Experience the Power of Choice.

Contacts:

Bus. Dev., Sales, & Press: Matt Murphy, Managing Director – North America,

210-667-0942, [email protected]

How they describe themselves: Jemstep helps individual investors pinpoint the best investments according to their preferences, and describes why each investment is a good fit for them. Investors answer a few profile questions, and Jemstep’s unbiased, proprietary technology sifts through the myriad of investment choices to find their optimal investments. Whether investors are selecting their very first investment, or managing the asset allocation of an established portfolio, Jemstep enables them to make better financial decisions with confidence.

What they think makes them better: Jemstep’s patent-pending technology uses an

individual’s profile to score investments and present them in order of best fit for that individual. While traditional screeners and investment tools present laundry lists of potential investments, they offer little help to individuals in deciding which investments best suit their needs. Jemstep’s unique “Jemscore” helps users understand why certain investments are a better fit than others. Our powerful algorithms rank thousands of funds, stocks, and ETF’s across hundreds of metrics to derive the “Jemscore” for that user. Jemstep’s personalized results enable investors to quickly and easily identify the investments that are right for them.

Contacts:

Bus. Dev.: Kevin Cimring, COO, [email protected],

Simon Roy, EVP Corporate Development, [email protected]

Sales: Michael Blumenthal, CEO, [email protected],

Simon Roy, EVP Corporate Development, [email protected]

Press: Jennifer De Laura, Allison & Partners, [email protected]

How they describe themselves: Liqpay.com is the simplest global payment system for end-users. It is an open platform, which allows the creation of a global “ecosystem” of different services, based on the phone # as a global open ID (as opposed to a card number, passport, login, etc). Liqpay.com provides money-send services for end users allowing money transfers in the easiest and most secure manner possible, with the help of only a mobile phone, the internet, and cards all over the world. Liqpay.com offers a rich set of APIs (for developers), and is available for anybody. Liqpay.com’s vision for their customers is that in principle if you have a mobile phone, you already own an account in Liqpay.com – i.e. all 4 billion mobile phone owners already have them.

What they think makes them better: Simply put, Liqpay.com is the most simple payment system in the world. To make a money transfer you only need to know an individual’s phone number. Our key competitive advantages are: 1) openness of the system – no need to be registered before-hand, 2) independence with both mobile operators and banks, 3) highest level of security (thanks to one-time password technology), 4) worldwide usage – no limits in countries, mobile operators and banks, 5) simple and cost effective business model (per transaction basis), 6) all-in-one solution for online business (set of APIs), and 7) possibility of using online technology on the “ground” to withdraw cash from ATMs and pay at POS’s without using payment cards (already launched in Russia and Ukraine at about 10,000 ATMs). No other tool in the global market currently approaches online payments with such security and comfort.

Contacts:

Bus. Dev. & Sales: Kristina Chaykovskaya, Vice President, +79261383528, +380676319830,

[email protected], skype: kristina_chaykovskaya

Press: Alexander Vityaz, Founder & CEO, [email protected], skype: alexander.vityaz

How they describe themselves: Infosys defines designs and delivers technology-enabled business solutions that help Global 2000 companies win in a Flat World. Infosys also provides a complete range of services by leveraging its domain and business expertise and strategic alliances with leading technology providers. Infosys’ offerings span business and technology consulting, application services, systems integration, product engineering, custom software development, maintenance, re-engineering, independent testing and validation services, IT infrastructure services and business process outsourcing. Infosys has a global footprint with over 50 offices in 26 countries.

What they think makes them better: Infosys mConnect, one of the key products of Infosys, is ‘one technology platform for all new channels’ for service delivery to financial organizations’ customers. This approach substantially reduces the cost of development and maintaining applications across different channels even while increasing the agility to respond to emerging market demands. This innovation paves way for organizations to deliver bigger and newer customer experiences without the risks of big investments. Using this technology and approach organizations can significantly lower the TCO for delivering services across the key emerging deliver channels as compared to the current channel specific costs of development and maintenance.

Contacts:

Biz Dev and Sales: Mr. Krishnan Narayanan, Business Manager, [email protected];

Press: Mr. Sujeet Pramanik, Marketing Manager, [email protected], or Ms. Preethi Bashyam, Preethi_

[email protected]