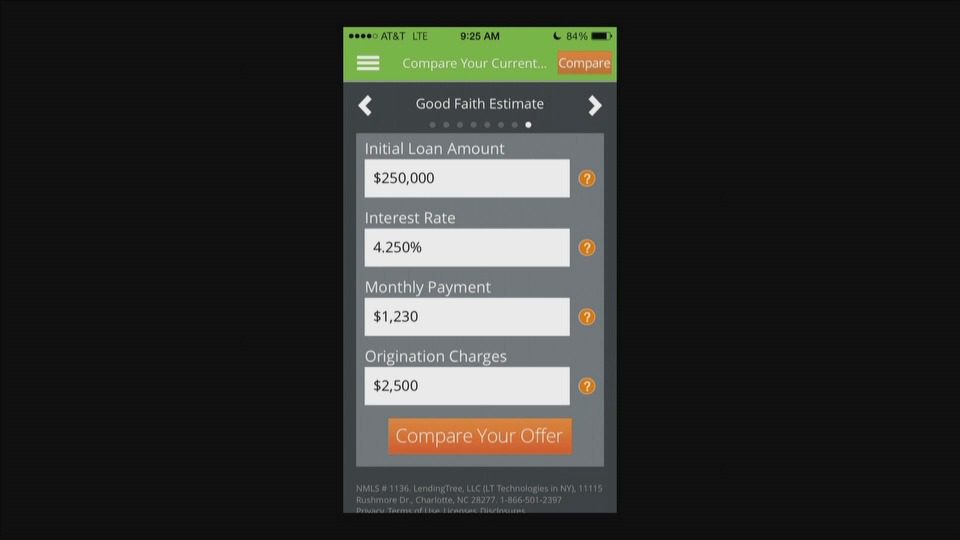

How they describe themselves: Insuritas delivers virtual private-label insurance agencies that are completely integrated into bank, credit union, and ecommerce technology platforms. E-InsuranceAISLE™, launched in Q3 2013, is integrated inside financial institutions’ online banking ecosystems and is generating over 2 million free product impressions per month and growing over 10% per month. LoanINSURE™ automatically generates insurance quotes from competing carriers when customers apply for a car, home, or small business loan. Insuritas is a revolutionary ecommerce solution monetizing online banking services, repositioning insurance distribution to be consumer facing and frictionless, producing critical annuitizing non-cyclical fee income, and transforming bank websites from brochureware into ecommerce engines.

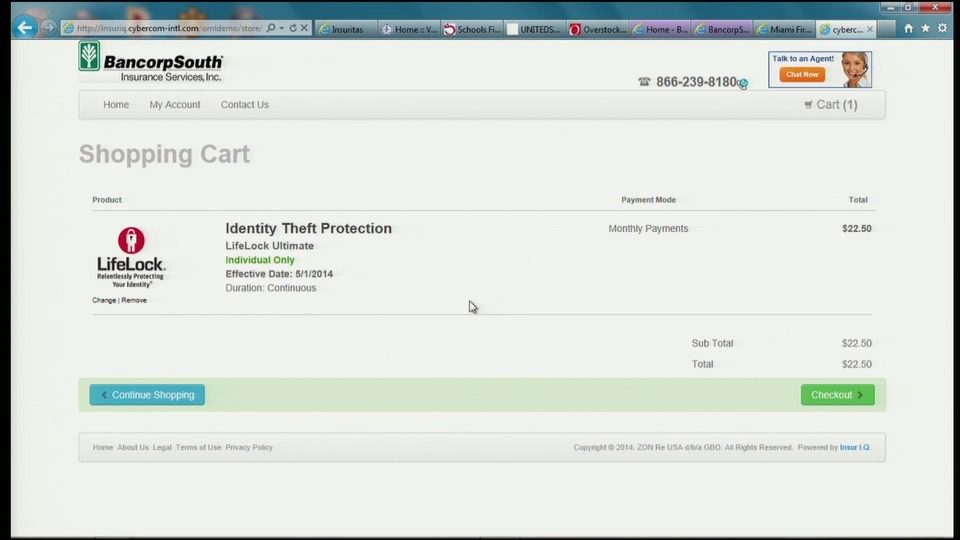

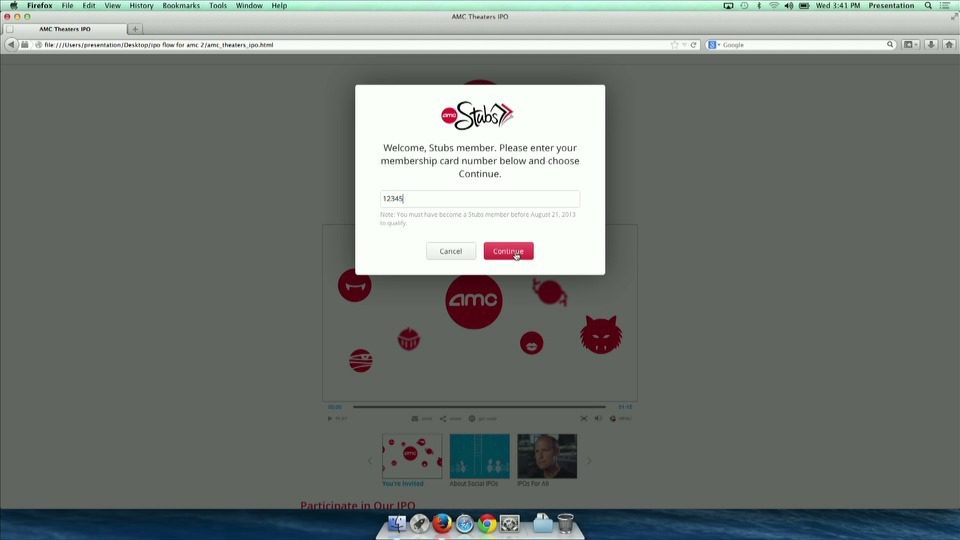

How they describe their product/innovation: The SmartCART Technology™ platform allows millions of online banking customers to access a supermarket for financial products entirely inside a bank’s online ecosystem. SmartCART provides the same shop, compare, buy, single-checkout, and post-sale online account management experience as Amazon.com but features consumer and small business insurance products from multiple carriers who use SmartCART to compete on coverage. SmartCART features buy online, instant issue, online fulfillment for all purchases, takes a single payment from the consumer, reconciles to all carriers providing coverage, and creates an online “Insurance Account” that is available to the customer through the bank’s or e-tailer’s web portal.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B)

Contacts:

Bus. Dev.: Jeffrey Chesky, CEO & President, [email protected], 860-653-1112

Press: Jennifer Vasseur, Director of Marketing, [email protected], 860-653-1114

Sales: Matthew Chesky, SVP Corporate Sales, [email protected], 860-653-1182