How they describe themselves: LifePay mPOS EMV chip&pin is a start point of the LifePay ecosystem for a customer. LifePay is the largest mPOS EMV chip&pin company in Russia providing revolutionary technology that allows SMEs to accept payments by plastic cards via a smartphone, mobile application, and small secure reader.

LifePay also offers the LifePay Stand solution with a printer and cashbox as a next-gen Cash Register.

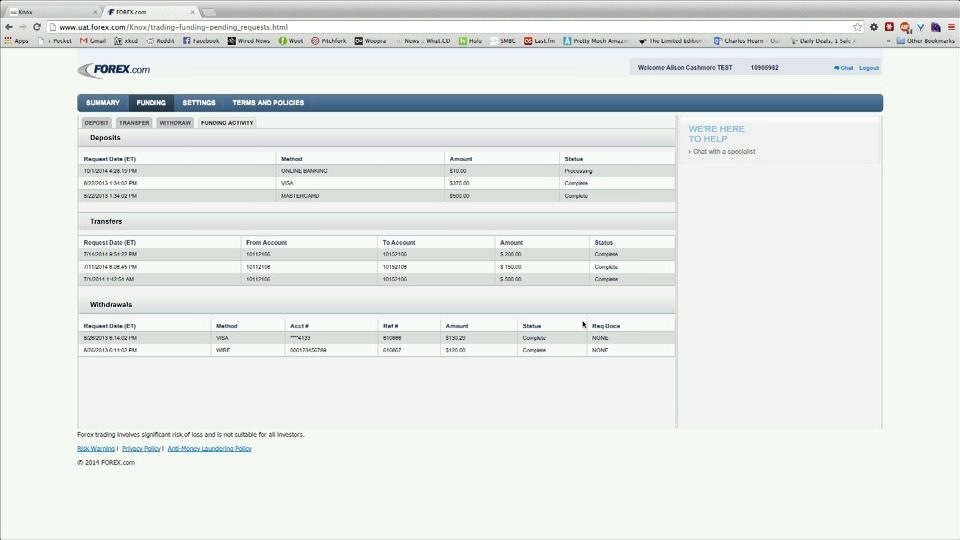

All merchants have access to their metrics via merchant portal to get ideas about the improvement of their business.

How they describe their product/innovation: We created LifePay to merge all of our products into one ecosystem that will support B2B and B2C financial services through the entire customer journey for both merchants and individuals.

LifePay is rolling out business solutions to new markets in Asia and Europe, including:

- mPOS

- Cash Register with LifePAD and MDM-system

- Merchant portal with CRM and sales analytics

- Online acquiring

- Credits for merchants

- POS credits for individuals

Product distribution strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions

Contacts:

Bus. Dev. & Sales: Igor Pesin, CFO, [email protected], (m) +7 917 500 46 37

Press: Anna Yanchevskaya, PR Director, [email protected], +7 906 778 21 26

How they describe themselves: Jumio is a fast-growing credentials management company that utilises proprietary computer vision technology to authenticate customer ID credentials in real time web and mobile transactions.

How they describe themselves: Jumio is a fast-growing credentials management company that utilises proprietary computer vision technology to authenticate customer ID credentials in real time web and mobile transactions.