How they describe themselves: Innovation Agency is a leading consultancy firm in the field of innovation with a presence in the United States of America, Europe, Asia, Africa, and Australia. We pride ourselves on our ability to access the untapped wealth of knowledge that resides within an organization’s idea-sharing and problem-solving networks. In the field of organizational network analysis our knowledge and experience are without equal. Using detailed informal network assessments, we are able to accurately map social and organizational networks. This is used to structure innovation initiatives in a way that ensures the greatest possible benefit for our clients’ unique requirements.

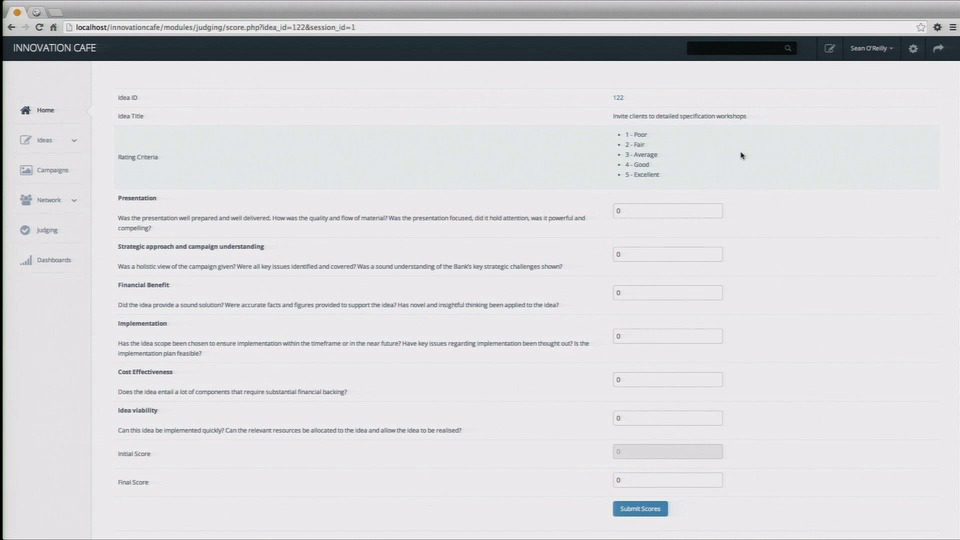

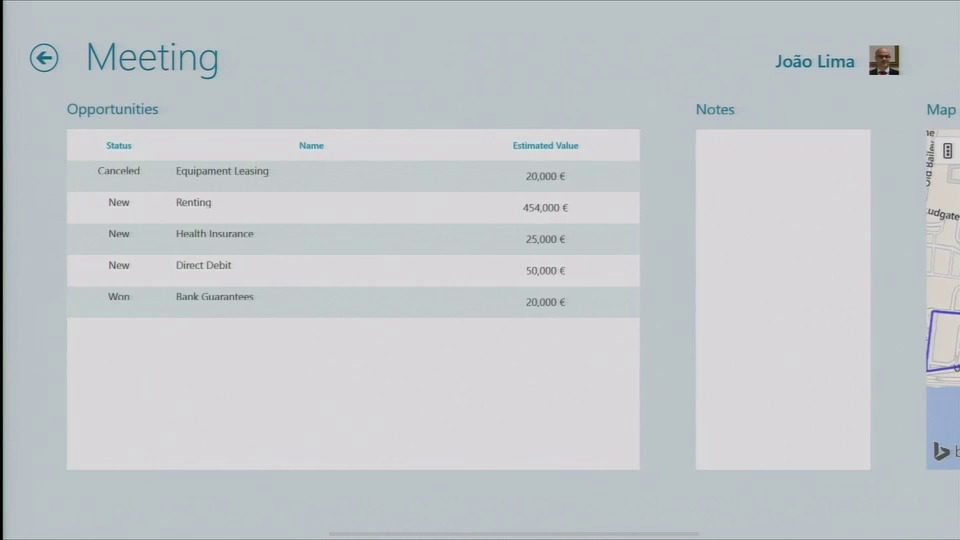

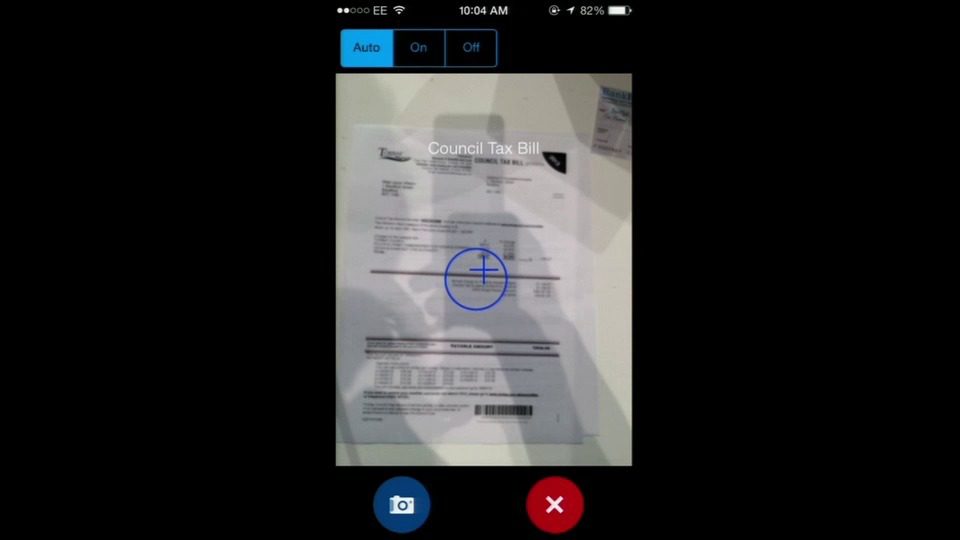

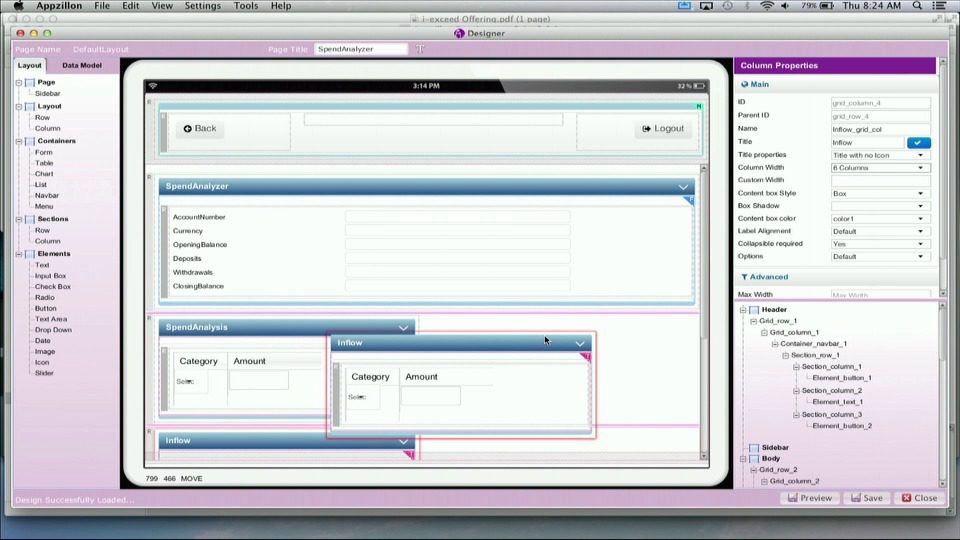

How they describe their product/innovation: Innovation Café is an advanced crowdsourcing innovation platform for companies to engage their innovation communities. It is highly configurable and is able to provide for both private and public ecologies as well as emergent and structured innovation approaches. Innovation Café is a lightweight platform with advanced white labeling and custom theme capabilities and the ability to integrate with SharePoint, HR and other systems to provide detailed reporting. It is able to deal with a high volume of users and ideas and has a sophisticated social ranking and rating mechanism. Crowdsourcing and community collaboration pay attention to business objectives that are focused through idea challenges. Our judging, recognition/reward process, and digital persona releases are our primary focuses at FinovateEurope.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through other fintech companies and platforms

Contacts:

Bus. Dev., Press & Sales: Rory Moore, CEO