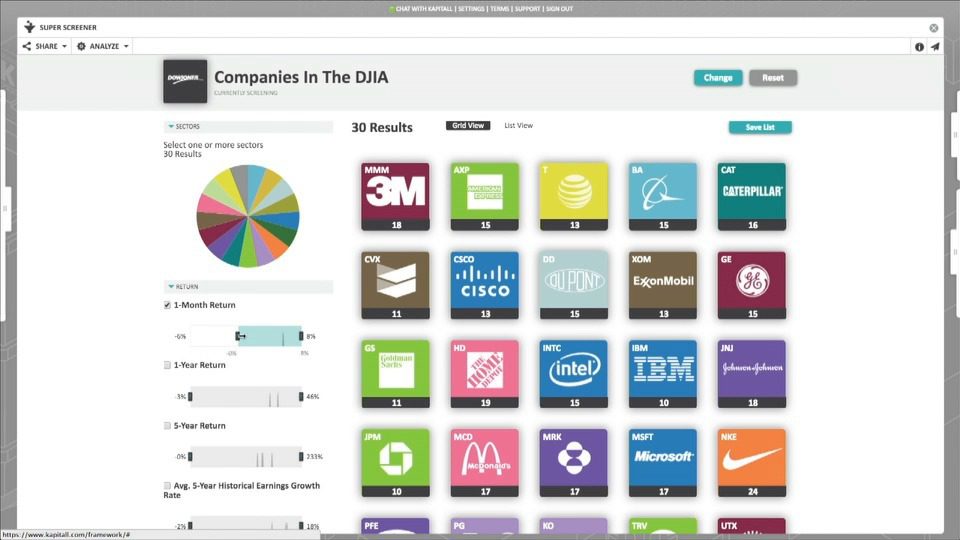

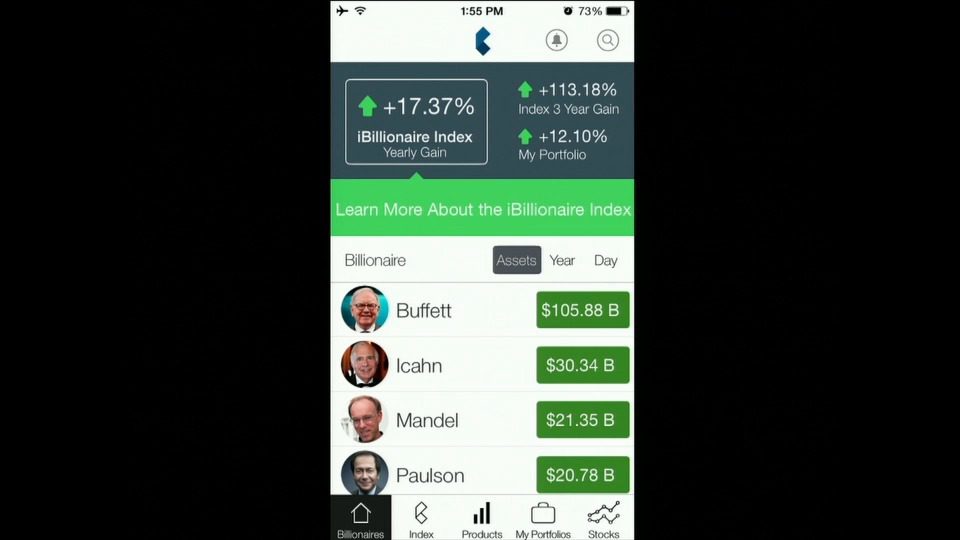

How they describe themselves: : iBillionaire taps into the investment strategies of Wall Street billionaires and provides key insights into the financial data and investment decisions of leading US hedge fund managers. It provides access to unique and exclusive data on billionaire investors and their stock portfolios.

The company offers a comprehensive suite of technology and investment products and solutions including a mobile app, web platform, and market index, the iBillionaire Index. The iBillionaire Index has been licensed to Direxion for the creation of the iBillionaire Index ETF, launched August 1, 2014.

How they describe their product/innovation: The iBillionaire app was born out of a mission to democratize Wall Street by providing users access to the investment strategies and financial data of those who have, historically, played the market best: billionaires.

iBillionaire provides access to billionaire investment portfolios, strategies, and stock picks and is a source of unique and exclusive data on trading activity and investment trends. It sends real-time alerts of buys, sells, and prices and is a source of up-to-the-moment billionaire news.

With iBillionaire, users can create their own portfolios and compare with billionaires. They can also access the iBillionaire Index, which tracks the 30 stocks in which billionaire investors have allocated the most funds.

Product distribution strategy: Direct to Consumer (B2C), through financial institutions, through other fintech companies and platforms

Contacts:

Bus. Dev. & Sales: Raul Moreno, CEO & Co-Founder, [email protected]

Press: Emily Stewart, Head of Communications & Content Strategy, [email protected]