This week’s edition of Finovate Global looks at recent fintech news from the Kingdom of Saudi Arabia (KSA).

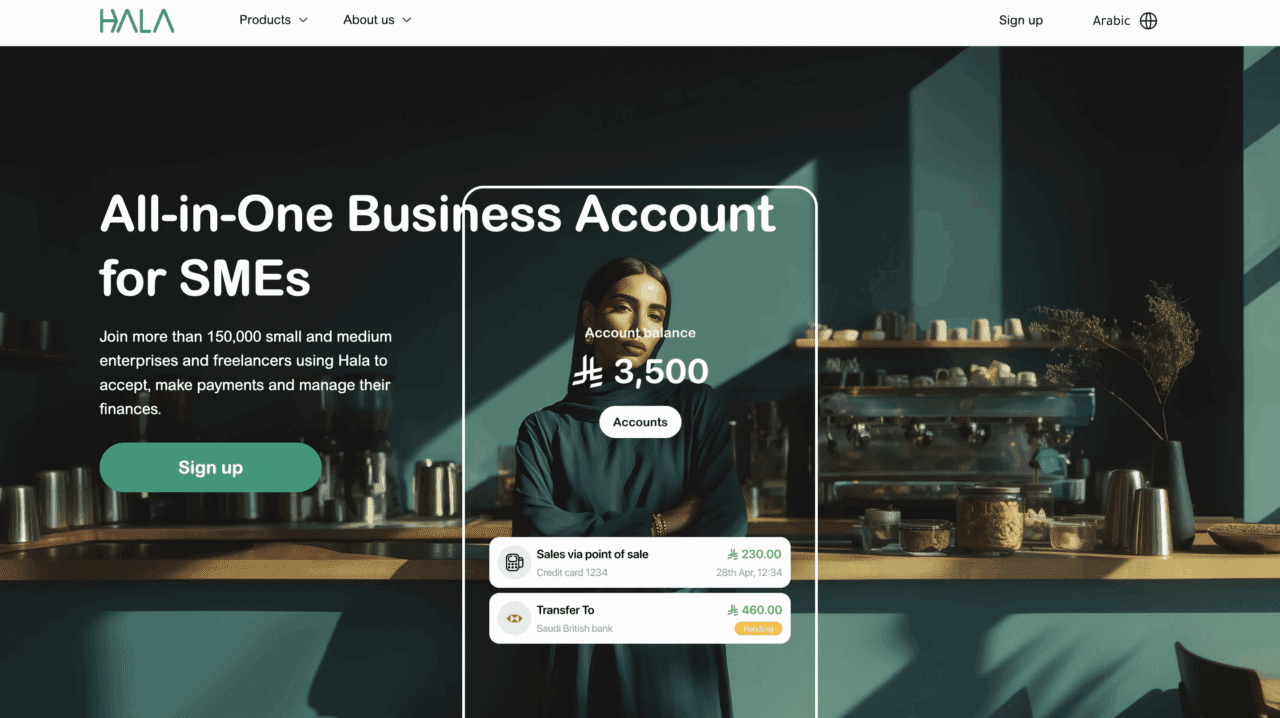

Saudi fintech HALA raises $157 million to fuel embedded finance

Saudi Arabia-based fintech and embedded financial services provider HALA has raised $157 million in Series B funding. The round is being billed as one of the largest fintech Series B rounds to date for a company based in the Middle East. Led by The Rise Fund and Sanabil Investments, the investment will be used to enhance HALA’s position in the Saudi market. This includes empowering the company to launch more embedded financial services and lending products to support micro, small, and medium-sized (MSM) enterprises, as well as freelancers, in the region.

Founded in 2017 and headquartered in Riyadh, HALA offers a comprehensive embedded financial services including business accounts; card issuance, payment and transfer services; POS solutions, financing, and corporate cards. To date, HALA has supported more than 150,000 businesses and processed more than $8 billion in annual transactions.

“This landmark investment is a turning point for HALA, reflecting on our relentless pursuit of innovation and excellence in serving small businesses,” HALA Co-founder and Chairman Esam Alnahdi said. “We are honored that our new investors recognize the potential of our vision and the impact we aspire to make in the MSME landscape. Our journey is just beginning, and this support fuels our drive to create meaningful change.”

Also participating in the investment were QED, Raed Ventures, Impact46, Middle East Venture Partners (MEVP), Isometry Capital, Arzan VC, BNVT Capital, Kaltaire Investments, Endeavor Catalyst, Nour Nouf Ventures, Khwarizmi Ventures, and Wamda Capital.

Paymentology teams up with Enjaz to enhance digital payments in Saudi Arabia

A Memorandum of Understanding (MoU) between international card issuer processor Paymentology and payments solutions company Enjaz is designed to bring advanced digital payments to consumers in Saudi Arabia.

“At Enjaz, our focus has always been on giving our customers speed, convenience, and security, whether they are transferring money abroad or making everyday payments,” Enjaz CEO Bassam AlEidy said. “By collaborating with Paymentology, we can now extend our card services that expand choice and enhance financial freedom. This partnership represents a major step in shaping the future of payments in Saudi Arabia, delivering innovation that is inclusive, dynamic, and tailored to the needs of our market.”

Integrating Paymentology’s issuing and processing platform will enable Enjaz to offer prepaid, debit, and virtual cards, all of which will seamlessly integrate with the company’s current services. The partnership will also bring functionalities such as international and domestic scheme enablement; tokenization for Apple Pay, Google Pay, Samsung Pay, and Mada Pay, as well as tools to boost security and enable real-time decisioning. Enjaz will also be able to leverage its new relationship with Paymentology to offer features such as loyalty programs and multi-currency wallets.

“Saudi Arabia is building one of the world’s most dynamic payments ecosystems under Vision 2030. Enjaz’s ambition adds to that momentum, and Paymentology’s role is to power innovators with secure, scalable issuing. Together with Enjaz, we’ll expand choice, accelerate time-to-market, and raise the bar for customer experience in the region,” Paymentology CEO Jeff Parker said.

Enjaz was established in 2022 as a wholly-owned payments arm of Bank Albilad. The firm is licensed by the Saudi Central Bank as a Major Electronic Money Institution (EMI). The partnership with Paymentology comes at a time when the Saudi Central Bank is reporting that electronic payments represented 79% of total retail transactions in 2024, up from 70% in the previous year.

Riyadh-based financial services enabler Abwab.ai forges strategic partnership with Tuum

Abwab.ai, a financial services company that specializes in credit decisioning, risk management, and customer engagement solutions, has announced a strategic partnership with core banking platform provider and Finovate Best of Show winner Tuum. The partnership will enable Abwab.ai to deliver a seamless, end-to-end digital lending solution for small and medium enterprises (SMEs) throughout the Gulf Cooperation Council (GCC).

“SMEs are the backbone of every economy, yet they remain underserved by traditional lenders,” Abwab.ai Founder and CEO Baraa Koshak said. “By combining Abwab.ai’s AI-driven intelligence with Tuum’s next-generation core banking capabilities, we are empowering financial institutions to unlock SME growth at scale.”

Founded in 2022 by a team that includes technology veterans from companies like NVIDIA and HALA, Abwab.ai offers an underwriting automation platform that helps lenders make better decisions by transforming unstructured data into actionable insights. The combination of Abwab.ai’s credit decisioning and analytics capabilities with Tuum’s modular core banking and lending platform will help financial institutions launch, scale, and optimize their SME lending products faster, more efficiently, and with greater transparency.

“Our mission at Tuum is to modernize financial services with modular technology,” Tuum Chief Revenue Officer Miljan Stamenkovic said. “Partnering with Abwab.ai allows us to bring a truly end-to-end, AI-enhanced SME lending solution to the region, one that addresses a real market need and accelerates digital transformation.”

UK-based Tuum won Best of Show in its Finovate debut at FinovateEurope 2024. At the conference, the company showed how its modular, cloud-native, API-first banking platform leveraged its microservices architecture to deliver high scalability and flexibility, as well as lower maintenance costs.

Here is our look at fintech innovation around the world.

Asia-Pacific

- Tech in Asia discussed the profitability of a trio of South Korean fintechs: KakaoPay, Naver Financial, and Toss.

- UnionPay International (UPI) piloted a cross-border QR payment connection between China and Indonesia.

- Philippine credit-led fintech Salmon announced an additional $50 million raised in an oversubscribed Nordic bond issue.

Sub-Saharan Africa

- Premier Credit Uganda raised $1.5 million from Swiss-based investor, Enabling Qapital.

- EBANX announced an integration with South Africa-based, real-time, open banking payment method, Capitec Pay

- South African fintech Street Wallet acquired Digitip, a South African startup that enabled informal works to receive tips digitally.

Central and Eastern Europe

- A strategic partnership between Mastercard and Redington will bring advanced cybersecurity solutions to companies in Azerbaijan.

- German fintech Trade Republic has launched operations in Poland.

- Estonian fintech Creem locked in €1.8 million in pre-seed funding as it builds its financial infrastructure for AI-focused startups.

Middle East and Northern Africa

- valU introduced Egypt’s first licensed Buy Now, Pay Later service, on digital marketplace Noon.

- MENA-based financial infrastructure provider Lean Technologies teamed up with Know Your Payee (KYP) solutions company iPiD.

- UAE-based fintech Kamel Pay secured In-Principle Approval from the country’s central bank for both Stored Value Facilities (SVF) and Retail Payment Services (RPS) licenses.

Central and Southern Asia

- TechCrunch profiled Jar, an India-based fintech that enables its users to invest in gold via its app, that recently announced reaching profitability.

- Kazakhstan’s third-largest bank, Bank CenterCredit (BCC) turned to core banking provider Tuum to power its new Banking-as-a-Service (BaaS) proposition.

- Bank of India launched its BOI Trade Easy instant loan offering in partnership with Cashinvoice.

Latin America and the Caribbean

- Mexican fintech Klar acquired digital bank Bineo from Grupo Financiero Banorte.

- Mercado Pago, the financial arm of Latin American e-commerce company Mercado Libre, acquired Brazil-based distributor of investment products Nikos DTVM.

- Cryptocurrency exchange Binance launched its Mexican entity Medá to help advance demand for the company’s services throughout Latin America.

Photo by backer Sha on Unsplash