This is the third part in our continuing Sneak Peek series that gives a glimpse into what each company will demo live on stage at FinovateSpring.

Don’t miss part 1 and part 2 published earlier this month.

See the full demos live at FinovateSpring next month. Get your ticket here.

_______________________________________________

Better ATM Services’ groundbreaking technology enables ATMs to dispense new, flexible prepaid cards just like cash, opening the world’s fleet of 2.3 million ATMs to the prepaid marketplace.

marketplace.

Features:

- Visa and others are adopting this new distribution channel

- Consumers love the 24/7 convenience of ATMs for prepaids

Why it’s great: Financial institutions can recapture 50%+ of customers now going elsewhere for prepaids, increasing their share of the $549 billion prepaid market.

Bright Funds is a solution for effective charitable giving management, combining the sophistication of investing with the intuitive, engaging experience of modern web services.

Features:

- The Bright Funds Charitable Giving Portfolio

- The Bright Funds Impact Timeline

- Bright Funds Public Profiles for Giving

Why it’s great: Bright Funds brings an investment approach to charitable giving.

FamZoo’s online family banking system helps parents teach kids good money habits.

Features:

- Family pack of affordable, widely accepted prepaid cards

- Integrated family finance tools build good habits

- Co-branded option delivers targeted offers

Why it’s great: FamZoo solves the “kids and money” problem for parents: prepaid cards that work together, not alone.

Intuit delivers banking software and technology solutions for financial institutions.

Features:

- Gives banks better insight to serve customers

- Blurs lines between PFM/banking

- Learn what Mint has in store for personal business

Why it’s great: Intuit now offers the best PFM solution for all users – whether it is through Mint.com or financial institutions.

LeapScore is financial advice for the rest of us.

Features:

- Tailored help and advice for each individual

- Empowers people to take more control over finances

- Sets meaningful goals

Why it’s great: a comprehensive score that, for the first time, represents “who” you are financially.

MicroStrategy provides

online banking without usernames or passwords, instant identity validation over the phone:

Usher radically changes the way IDs, cards, and keys are issued and carried.

Features:

- Mobile phone-based digital credentials

- Multi-factor verification including voiceprints

- Secure out-of-band authentication

Why it’s great: Usher: an extraordinary array of identity-management services that reduce fraud, protect identities and improve customer experience.

MoneyDesktop redefines the way millions of people interact with their finances by developing technologies that drive financial engagement between account holders and financial institutions.

Features:

- Leverage aggregated PFM user data

- Segment and target your user base

- Increase conversion rates and loan volume

Why it’s great: Insight and Target provide financial institutions with a groundbreaking new way to market and drive adoption of their most valuable services.

OneID eliminates the need for usernames and

passwords, while delivering a secure, compliant identity system that’s easy for your customers to use.

Features:

- Secure, one-click login with no password

- Customizable two-factor authentication

- Easy cross-selling with automatic form-fill

Why it’s great: Convenience of one-click login. Security of public key cryptography. Flexibility to meet financial institutions’

needs. Identity as it should be.

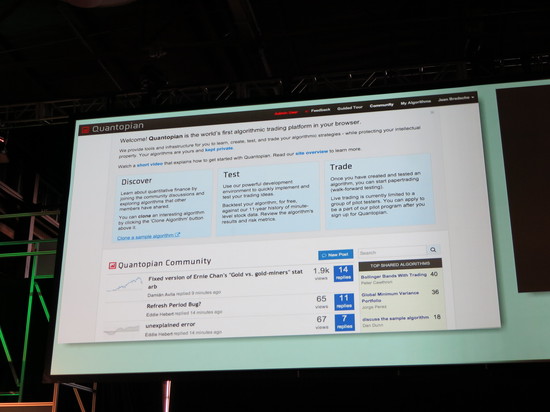

Quantopian is the world’s only browser-based algorithmic trading platform, democratizing finance by reducing barriers to entry and providing quants the tools and support needed to profit from their ideas

Feature:

- Combines historical data, algo simulation, live market data, brokerage integration and algo development into a simple workflow

Why it’s great: Allows quants to put their ideas and algorithms to work and profit from them with the click of a button

Refundo is

designed to revolutionize the way people do banking and extend mainstream banking advantages to underbanked and unbanked communities across the nation.

Features:

- Open an FDIC-insured bank account in seconds using your smartphone.

- Send money to your friends and family quickly and securely.

Why it’s great: Finally a new way to manage your money. And by new, we mean better.

Yandex.Money’s Twym is a quick and convenient way to send money via Twitter.

Features:

- Easy-to-use interface for collecting money

- You don’t have to leave Twitter

- Other users can repeat payments in one click

Why it’s great: Twym makes transferring money simple and fun.

Yseop’s artificial intelligence software writes just like a human being, but at a speed of over a thousand pages per second and in multiple languages.

Feature:

- Yseop boosts the productivity of your business teams by automating the delivery of best practices and personalized expertise.

Why it’s great: Yseop creates a new age where financial services delivered to customers are driven by artificial intelligence and human collaboration.

_____________________________________________________________

For more information on being a part of FinovateSpring 2013,

see our FAQ. To register, visit out FinovateSpring page

here.

![]() This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

Heckyl Technologies

Heckyl Technologies

marketplace.

marketplace.

Silicon Republic

Silicon Republic