On Finovate.com

- The ID Co. Unveils its Income Verification Solution.

- Finicity Partners with Pulte Mortgage to Accelerate Asset Verification.

Around the web

- CBANC hires Mike Snavely as Chief Commercial Officer.

- Congrats to 3rd Eyes, ArthaYantra, aixigo, BaseVenture, Capitalise, Entersekt, eToro, Finantix, Fincite, Finhorizon, ForwardLane, Hydrogen, Scalable Capital, Sentifi, Tradeit, Trizic, WealthWizards, WealthForge, and Xignite on being recognized in the Wealthtech 100.

- Xero’s new invoicing experience available for all Xero customers and partners over the next two weeks

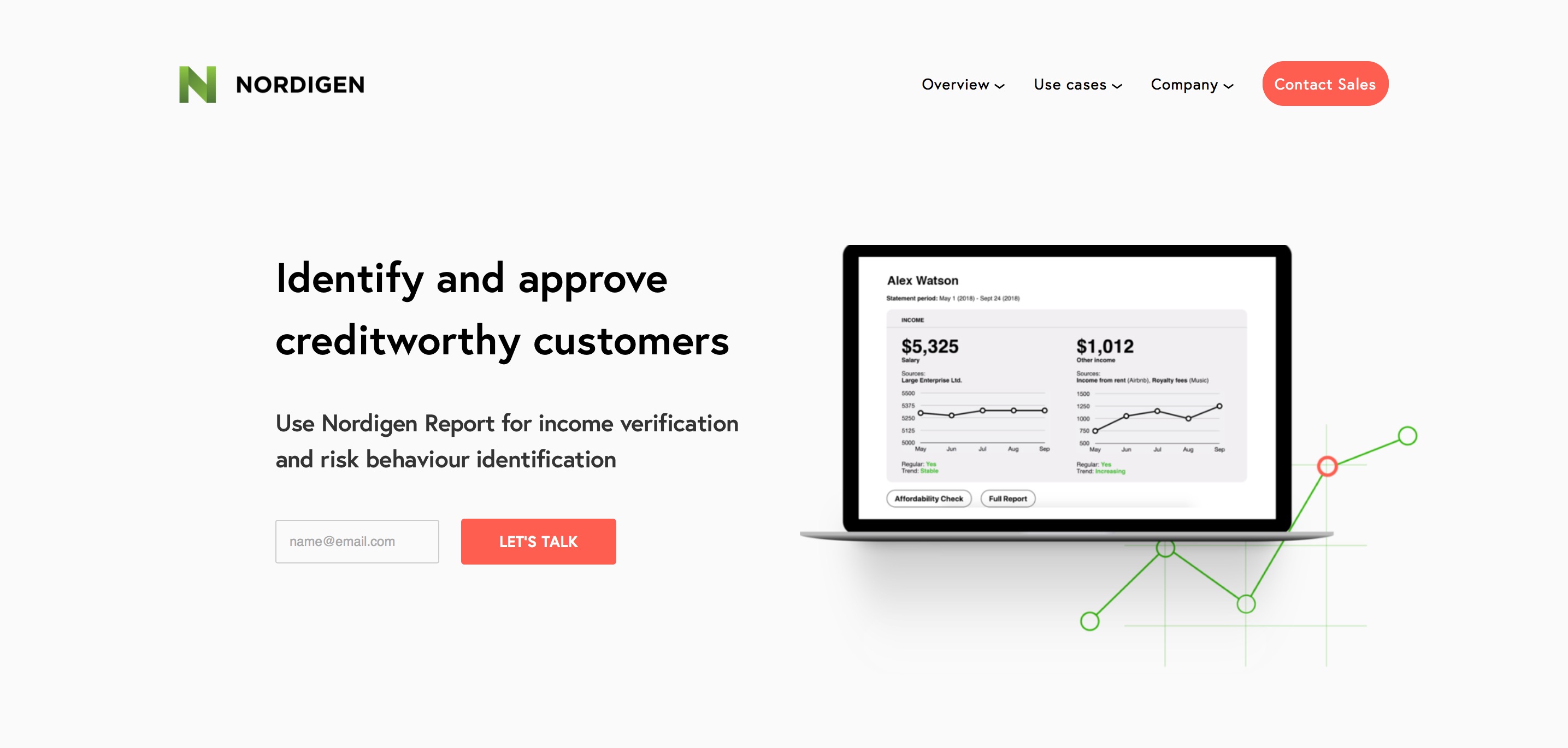

- Nordigen opens new office in Spain to expand operations.

- Yseop’s AI solution for Société Générale wins award for most innovative initiative of the year at this year’s Digital Finance Awards. Come see Yseop at FinovateSpring next month.

- Contovista and NDGIT expand partnership, enabling Contovista to be implemented via the German NDGIT API marketplace.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.