Business solutions company VASCO is making a major pivot today, along with a fully-fledged rebrand, as well as an acquisition to support the company’s new objectives.

VASCO, now known as OneSpan, has narrowed its focus to become an anti-fraud platform. OneSpan will trade on NASDAQ under the ticker symbol “OSPN.” It is expected to begin trading on Monday, June 4.

OneSpan offers a Trusted Identity platform (TID), an API-based solution that aims to reduce fraud associated with onboarding and transactions while offering an enhanced experience for the end user. TID’s new Intelligent Adaptive Authentication reviews and scores data pulled from user behavior, devices, and transactions to offer a real-time view of user security without interfering with the user experience.

“The launch of our Trusted Identity platform provides a single foundation that spans the needs of our customers today and into the future while our name change underscores a generational evolution in our strategy,” said OneSpan CEO Scott Clements. “We listened closely to the challenges our customers are facing and identified a significant gap between customer needs and solutions available in the market. OneSpan is addressing this gap by delivering a much needed and innovative approach to reducing the billions of dollars banks are losing annually to fraud.”

Bolstering today’s transition is OneSpan’s acquisition of Dealflo for $54.5 million (£41 million). Founded in 2009 and headquartered in the U.K., Dealflo offers configurable onboarding solutions to financial services clients. The company has partnerships with Equifax, TransUnion’s iovation, Mitek, and VASCO’s eSignLive (now OneSpan Sign).

“This acquisition will enable us to grow our subscription revenue and Dealflo’s technology will be a major differentiator for our eSignLive solution,” said Clements. “In addition, Dealflo’s identity verification capabilities will allow us to accelerate the launch of our TID platform based onboarding, identity and anti-fraud solutions.”

Dealflo has operations across North America and EMEA, and is headquartered in London. The Dealflo team will join OpenSpan, working to bring Dealflo’s solutions into new geographic markets.

OneSpan presented as VASCO at FinovateFall 2017 in New York. The company debuted the OneSpan Sign (then eSignLive) Digital Lending Solution. The solution leverages the blockchain and e-signature capabilities to offer a compliant, digital lending solution. Last month, the company teamed up with Finovate alum nCino to offer nCino clients access to an electronic signature solution.

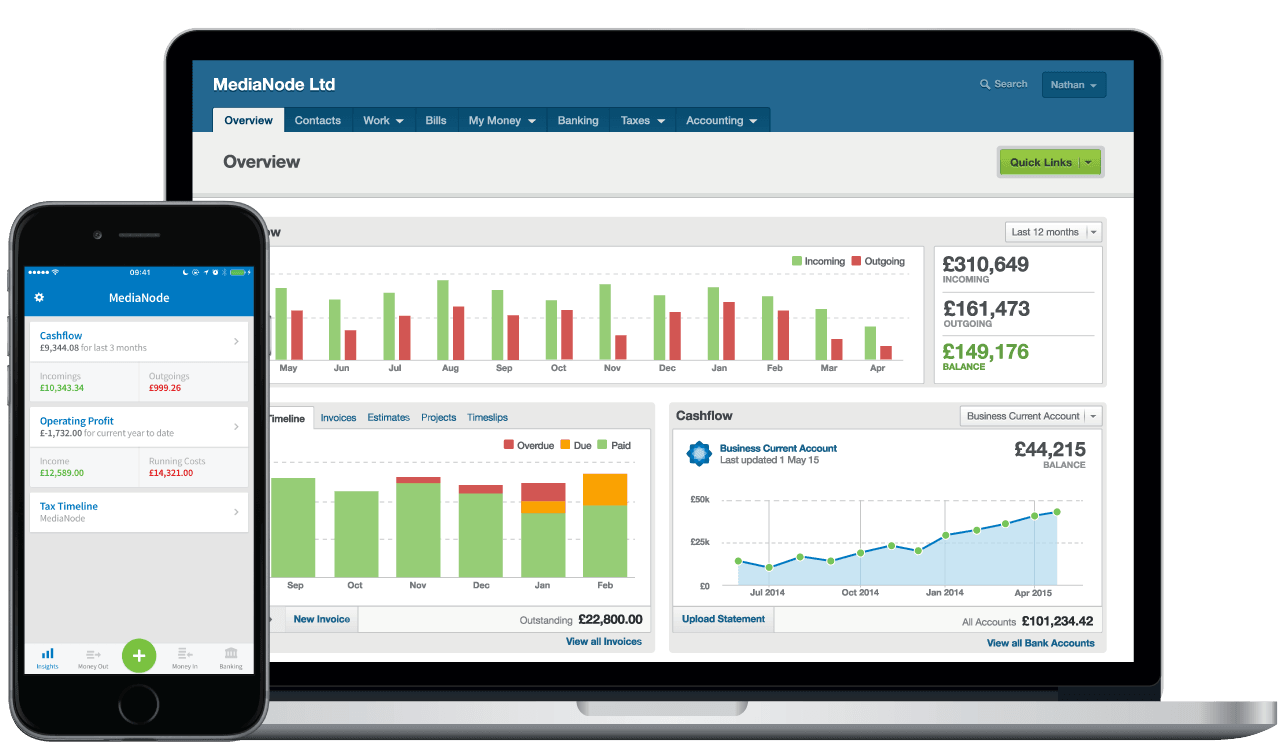

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”

This agreement comes just over a year after FreeAgent began working with RBS. The two formed a distribution partnership last January in which RBS offered FreeAgent’s accounting software services to its small business clients. The deal will help both parties leverage new opportunities to offer a more integrated banking and accounting experience for small businesses since, as Molyneux said, “the lines between banking, accounting and tax are becoming increasingly blurred.”