- Finzly launched Agentic Galaxy, a new addition to its Galaxy suite that embeds deployable AI agents into the core of payments and operations.

- The platform’s built-in AI modules automate payment processing, enhance compliance through human-in-the-loop oversight, and reduce complexity by integrating intelligence natively rather than bolting it on.

- Finzly’s move reflects the broader rise of agentic and generative AI, as financial institutions adopt the same kind of intelligent automation and personalization transforming consumer shopping experiences.

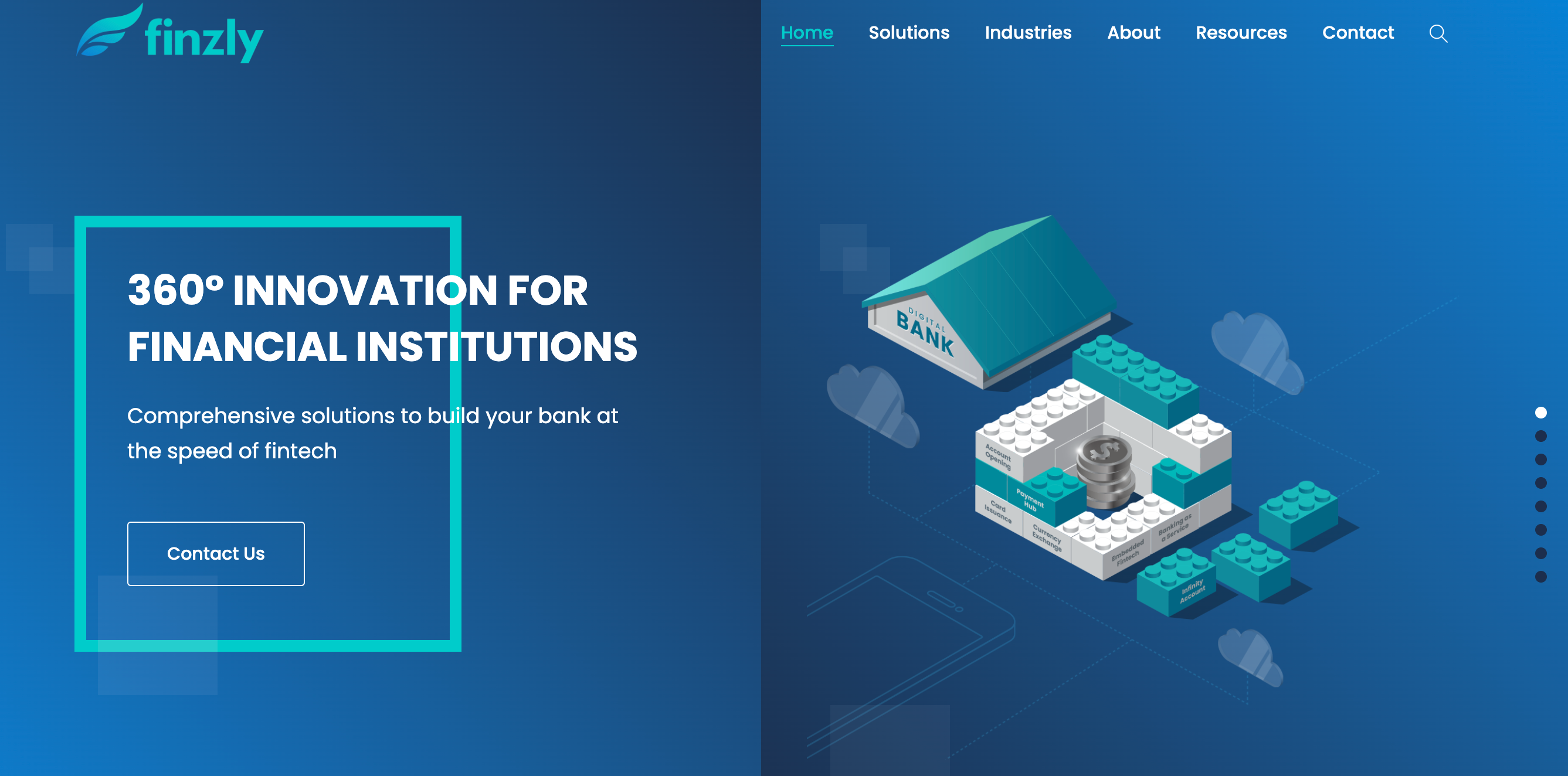

Banking-as-a-Service provider Finzly announced it is adding to its Galaxy suite. The North Carolina-based company is launching Agentic Galaxy to offer deployable AI agents that help banks bring ideas to market faster, simplify their operations, and deliver seamless customer experiences.

The new tool will leverage Finzly’s suite of specialized AI modules that offer payment processing intelligence, automate workflows, and enhance user experiences. Agentic Galaxy’s AI-powered agents help streamline operations and enable financial institutions to offer new services that integrate human-in-the-loop oversight, ensuring compliance. And because the AI agents are integrated into the product instead of being bolted on, there is less complexity and it is easier for firms to measure efficiency gains.

“Finzly’s approach to agentic AI goes beyond surface-level automation—it focuses on how intelligence can live deep within the core of payments and operations and enable new forms of modernization,” said Datos Insights Strategic Advisor, Commercial Banking & Payments Practice Gilles Ubaghs. “These are the kind of capabilities that help banks move from a defensive and reactive positioning to a more proactive form of continuous evolution.”

The AI agents can help complete tasks, resolve exceptions, and make informed decisions faster. “With agentic AI built into payments and operations,” explained Finzly Founder and CEO Booshan Rengachari, “banks can operate at speed with confidence, maintain strong governance, and focus on delivering exceptional customer experiences.”

The new tool is designed for firms looking to replace legacy systems. Agentic Galaxy offers an intelligent payment-processing core that supports multiple rails. The platform can also help non-banks in search of smarter, faster payment operations and virtual accounts.

Finzly’s flagship offering, Finzly OS, enables clients to launch a modern bank from scratch. The company’s API connects to all US payment rails, including Fed ACH, Fedwire, RTP, SWIFT, and FedNow. Founded in 2012 under the name SwapsTech, Finzly is a two-time Best of Show winner and has built its reputation on unifying payment systems and digital banking capabilities into a single, intelligent operating system for financial institutions.

This launch comes at a time when generative and agentic AI are reshaping how value is created across financial services. A recent report from Adobe for Business highlighted that traffic from Gen AI-powered tools to retail sites spiked by 4,700% year-over-year by July 2025, and that AI-driven visits are now far more engaged than traditional ones. Finzly’s new tool in its Agentic Galaxy suite aligns with this shift because it embeds AI agents into the payments and operations core, which enables banks and fintechs to act with the same agility and intention that consumer brands are exercising when they plug AI into discovery, recommendation, and checkout flows.