And if you missed the previous two installments of our Sneak Peek preview, check out the links below.

FinovateAsia 2013 Sneak Peek: Part 1

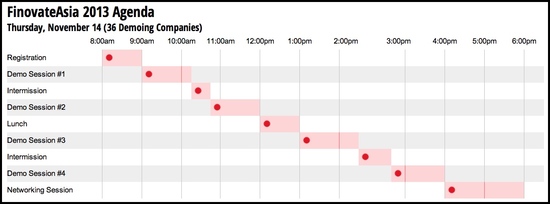

Our final event of 2013 is only a few weeks away. For more information about how to join us in Singapore, visit our FinovateAsia 2013 page

here.

____________________________________________________________________

Arkalogic’s latest innovation,

Moneta, enables customers to have a seamless and secure payment system that caters to their key daily transaction needs, in one platform.

Features:

- Mobile payments and banking platform

- Seamless and secure transaction experience

- Comprehensive end-to-end solution for cashless transactions

Why its great:

Transactions and life should be simple and secure. Always. With Arkalogic’s latest innovation, Moneta, it’s as if carrying your ATM and wallet in your mobile device.

Aryo Karbhawomo

Visionary Entrepreneur, Founder and CEO, Arkalogic

PhD in Computer Science, University of California, Berkeley

John Subroto Chard (pictured)

Strategy & Finance Advisor, Arkalogic

MBA, New York University. Expertise in corporate development, start-ups and corporate strategy. Previously with McKinsey.

____________________________________________________________________

BRIDGEi2i Analytics Solutions‘ cloud-based application,

Surveyi2i, enables business users to unearth hidden patterns and share holistic insights from survey data in just a few clicks.

Features:

- Zero in to key insights in matter of hours

- Single tool for analyzing both quantitative and unstructured textual inputs

- Design, automate and share dashboards without a single line of script

Why it’s great:

It makes the process of analyzing survey data incredibly faster, easier and cheaper.

Prithvijit Roy

CEO and Co-founder, Bridgei2i

Known among the pioneers of the analytics industry in India, Prithvijit has experience building and leading large scale analytics centers for Hewlett-Packard and GENPACT.

Pritam Kanti Paul

Business Analytics Entrepreneur, Bridgei2i

Known as an innovative thinker, Pritam has led development and implementation of several high impact and cutting edge analytical solutions for Hewlett-Packard and General Electric.

____________________________________________________________________

Luminous is the ultimate financial innovations company with visionary products that are breakthrough in sheer simplicity.

Features:

- Electronic safety deposit box

- Banking customers can upload, sort and store personal and business documents

- Ability to back up and save the most recent version of important documents

Why it’s great:

Banking customers can upload, sort and store personal and business documents.

Warren Bond

CEO, Luminous

Andrew Teversham

Chief Technology Officer, Luminous

Andrew heads up the development and implementation teams at Luminous and has gained extensive experience with SAP implementations over a number of years.

____________________________________________________________________

Matchi is a global community innovation platform for the banking industry that offers market ready innovations from across the globe.

Features:

- Unprecedented collaboration opportunities for banks

- Marketing platform for innovators to showcase their innovations to banks

- A go-to-destination for market-ready, banking innovations online

Why it’s great:

An innovation matchmaking site for banks globally

Paul Steenkamp

Head of Innovation, First National Bank

Warren Bond

CEO, Matchi

Warren is constantly looking for new ideas and ways to drive innovation and change in the banking industry.

Gerrit Hoekstra

CTO, Matchi

_________________________________________________________________

Mobino aims to enable mobile payments for 5 billion people. The company was founded by J.F. Groff, one of the creators of Web technology.

Features:

- Total independence from credit cards and telcos

- Local and international payments, in-shop, peer-to-peer and e-commerce

- Universal access from smartphones and dumbphones

Why it’s great:

Banked or unbanked, online or offline, privately or for business, Mobino lets everybody move money simply and efficiently.

Jean-Francois Groff

CEO, Mobino

Jean-Francois was one of the architects of the Web firm CERN. Mobino, his fourth startup, is guided by a lifelong passion: making technology serve humanity, not vice versa.

____________________________________________________________________

Be sure to catch the fourth installment of our Sneak Peek preview of FinovateAsia 2013 next week.