Tonik, a digital neobank based in the Philippines, has secured $131 million in a Series B round that will help the institution expand in the Philippines, as well as throughout Asia. The investment was led by Mizuho Bank of Japan, and gives the company $175 million in total funding.

Also participating in this week’s Series B funding round were Prosus Ventures, Sixteenth Street Capital, Nuri Group, and individual investor Rahul Mehta, co-founder of DST Partners. Valuation estimates were not immediately available.

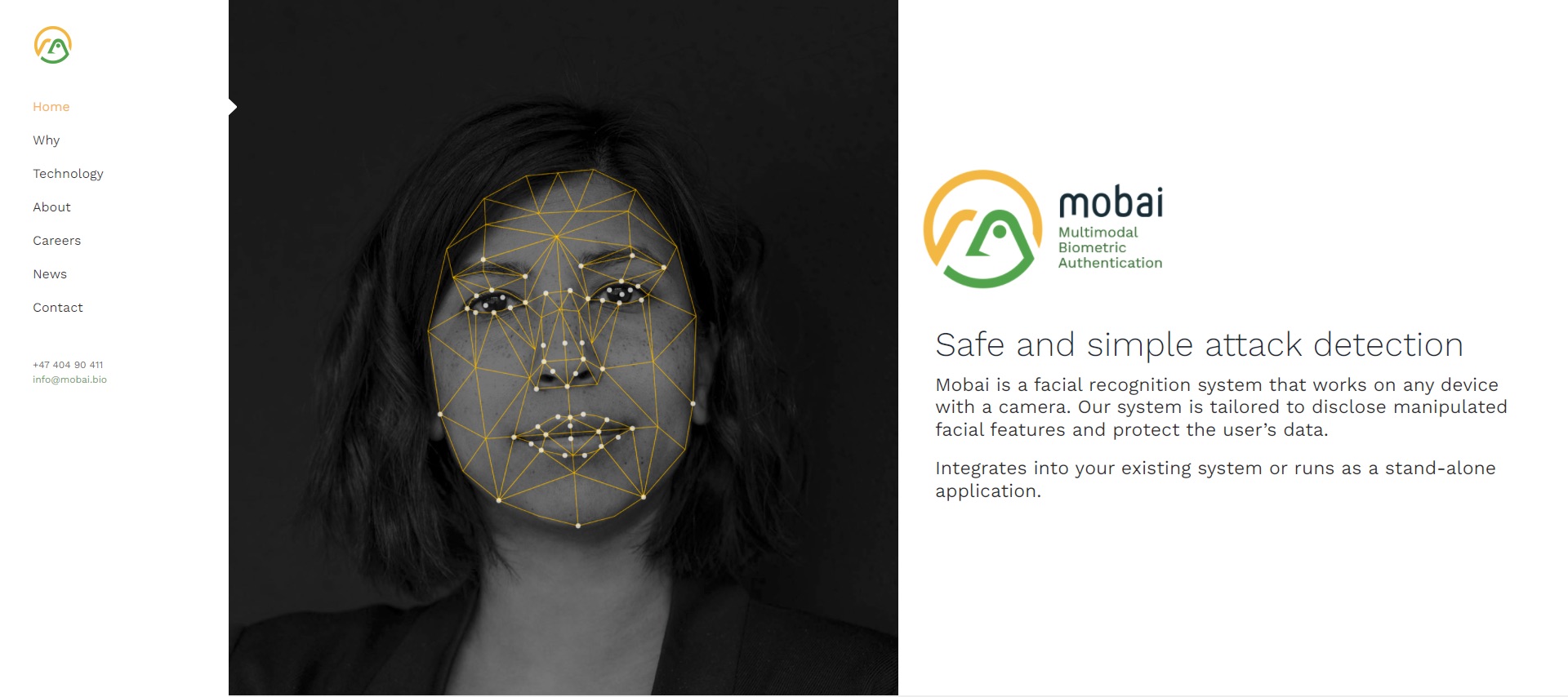

Launched in the Philippines in the spring of 2021, Tonik has been one of of the fastest growing new banks, topping $100 million in consumer deposits in its first eight months of operation. The neobank has partnered with Finovate alums Finastra for its cloud-based core banking proposition, NICE Actimize for its AML technology, and Daon for its biometric authentication solutions. In the Philippines, where more than 70% of the population is unbanked, Tonik sees a $140 billion retail deposit market and an unsecured lending opportunity of $100 billion.

“The partnership with Mizuho will provide Tonik with enhanced access to the international wholesale funding markets and world-class managerial talent, as well as serve as a fantastic platform for our future international expansion,” Krasnov said.

Tonik offers a variety of retail financial products, including deposits, loans, current accounts, payments, and cards. The first licensed, digital-only bank in Southeast Asia, Tonik began this year with a partnership with Google Cloud. The neobank will leverage Google Cloud’s platform as part of its strategic to boost financial inclusion and open banking in the Philippines.

EBANX Emerges from its First Decade

Last month we highlighted Latin American payments company EBANX and its expanded operations in Mexico. This month, we congratulate the Brazil-based fintech on its 10-year anniversary.

“In these 10 years, we have been able to witness important transformations in the digital market, in the payments industry, and in innovation ecosystems around the world,” EBANX co-founder and CEO João Del Valle said in a statement. “We are pleased to have actively participated in these movements in Brazil and Latin America, using cutting-edge technology and local knowledge.”

With nearly a billion total payments processed and offices in ten countries, EBANX notched more than 110 percent in processed volume last year. Also in 2021, EBANX launched its EBANX One payments platform that unites all of its payment solutions via a single integration, acquired a pair of Brazilian fintechs Juno and Remessa Online, and raised $430 million in Series B funding. Already in 2022, EBANX has opened new offices in Mexico City and appointed former Google VP Paula Bellizia as its new president of Global Payments.

“Today is the day to celebrate all the achievements so far,” Del Valle said, “but, above all, to outline the new challenges ahead, always with the clear mission of creating more access between people and companies from all over the world.”

FinovateEurope 2022 is just one month away. If you are an innovative fintech company with new technology to show, then there’s no better time than now and no better forum than FinovateEurope. To learn more about how to demo your latest innovation at FinovateEurope 2022 in London, March 22-23, visit our FinovateEurope hub today!

Here is our look at fintech innovation around the world.

Asia-Pacific

- ZDNet reported on fintech investment in Singapore and the role of cryptocurrency in driving the sector.

- Australian BNPL company Zip teamed up with Singapore telecommunications firm Singtel.

- Singapore-based fintech TranSwap secured an EMI license in the U.K.

Sub-Saharan Africa

- South Africa-based fintech Entersekt partners with Capitec to support its launch of its new P2P account-based payment solution.

- Micro insurer aYo Côte d’Ivoire awarded Best SME in Digital Insurance” at AVATAR-AFRICA awards.

- Business Insider Africa featured “fintech moguls” Iyin Aboyeji, founder of Future Africa, and Olugbenga Agboola, CEO of Flutterwave.

Central and Eastern Europe

- German digital money management coach Fabit announced a partnership with digital financial education company Stiftung Rechnen.

- Bulgaria’s TBI Bank inked a five-year collaboration with Visa’s Fast Track program.

- U.K.-based loyalty platform Network B teamed up with Latvian open banking platform Nordigen.

Middle East and Northern Africa

- Mastercard inked five-year partnership with Egyptian fintech Kashat.

- UAE-based blockchain financial services company Pyypl completed a $11 million Series A funding round.

- Egyptian digital investment platform Thndr announced a $20 million Series A investment co-led by Tiger Global, BECO Capital, and Prosus Ventures.

Central and Southern Asia

- India’s Axis Bank launched its Digital Fixed Deposit solution.

- Bangalore-based neobank Coupl went live this week.

- SME Futures looked at the pace of fintech investment in India.

Latin America and the Caribbean

- El Salvador announced plans to issue a Bitcoin bond in March of this year.

- PYMNTS.com featured Mexico-based lender delt.ai and its move into DeFi borrowing.

- Square led a $17 million investment in Latin American financial services company Movii.

Photo by Mel Casipit from Pexels