Canadian Crypto Combo: A trio of Canada-based cryptocurrency exchanges announced plans to merge into a single entity. Vancouver-based WonderFi, along with Toronto-based Coinsquare and Coin Smart Financial, are the firms involved. Together, they represent more than $600 million CAD in assets under custody and more than 1.65 million users. The merger will create what the companies are calling “Canada’s largest regulated crypto asset trading platform.”

The road to the three-way union had its complications. At one point, Coinsquare had been poised to acquire CoinSmart. At another point, a merger with WonderFi was allegedly on the table. CoinSmart had been both cold and hot to an acquisition by Coinsquare and reportedly was prepared to seek monetary damages in court when the acquisition deal did not work out. But those days are gone, and the three companies have decided they are better off serving cryptocurrency customers together than they are on their own.

UAE and ANZ Get Busy with CBDCs: There have been a few CBDC-oriented stories in fintech and crypto headlines in recent days. First up is news that the UAE has selected technology and legal partners ahead of the launch of its CBDC strategy. The country’s central bank has picked Clifford Chance to provide legal oversight. R3 and G42 Cloud will serve as technology and infrastructure providers. This will enable the central bank to begin Phase 1 of its CBDC project. This initial phase has three components: initiating real-value cross-border CBDC transactions for international trade settlement, proof-of-concept work for bilateral CBDC bridges with India, and proof-of-concept work for domestic CBDC issuance covering wholesale and retail use. Phase 1 is expected to take place over the next 12 to 15 months.

Meanwhile in Australia, ANZ bank reported that it had concluded one of its projects in the country’s CBDC trials. The project involved using the ANZ stablecoin to settle tokenized carbon credit transactions. ANZ Bank is involved in four of the 15 use cases and projects in the country’s CBDC pilot. With regard to this specific use case – applying tokenization to the carbon markets – ANZ Banking Services Lead Nigel Dobson expressed optimism. He highlighted the potential to improve both efficiency and transparency, as well as “preserve the unique characteristics of underlying projects to incentivize investment in climate solutions.”

Speaking of the relationship between crypto and the climate, SEB and Crédit Agricole announced this week that they are jointly launching so|bond, a sustainable and open platform for digital bonds built on blockchain technology. The platform enables issuers in capital markets to issue digital bonds onto a blockchain network in an effort to enhance efficiency and support real-time data synchronization between participants. Additionally, the network is using a validation protocol, Proof of Climate awaReness, that encourages participants to minimize their carbon footprint.

“CrĂ©dit Agricole CIB is proud to contribute to the emerging market of digital assets,” CrĂ©dit Agricole CIB Head of Innovation and Digital Transformation Romaric Rollet said. “The platform’s innovative approach, both to the blockchain infrastructure and to the securities market, is coupled with the strong commitment to green and sustainable finance that is at the center of our Societal Project.”

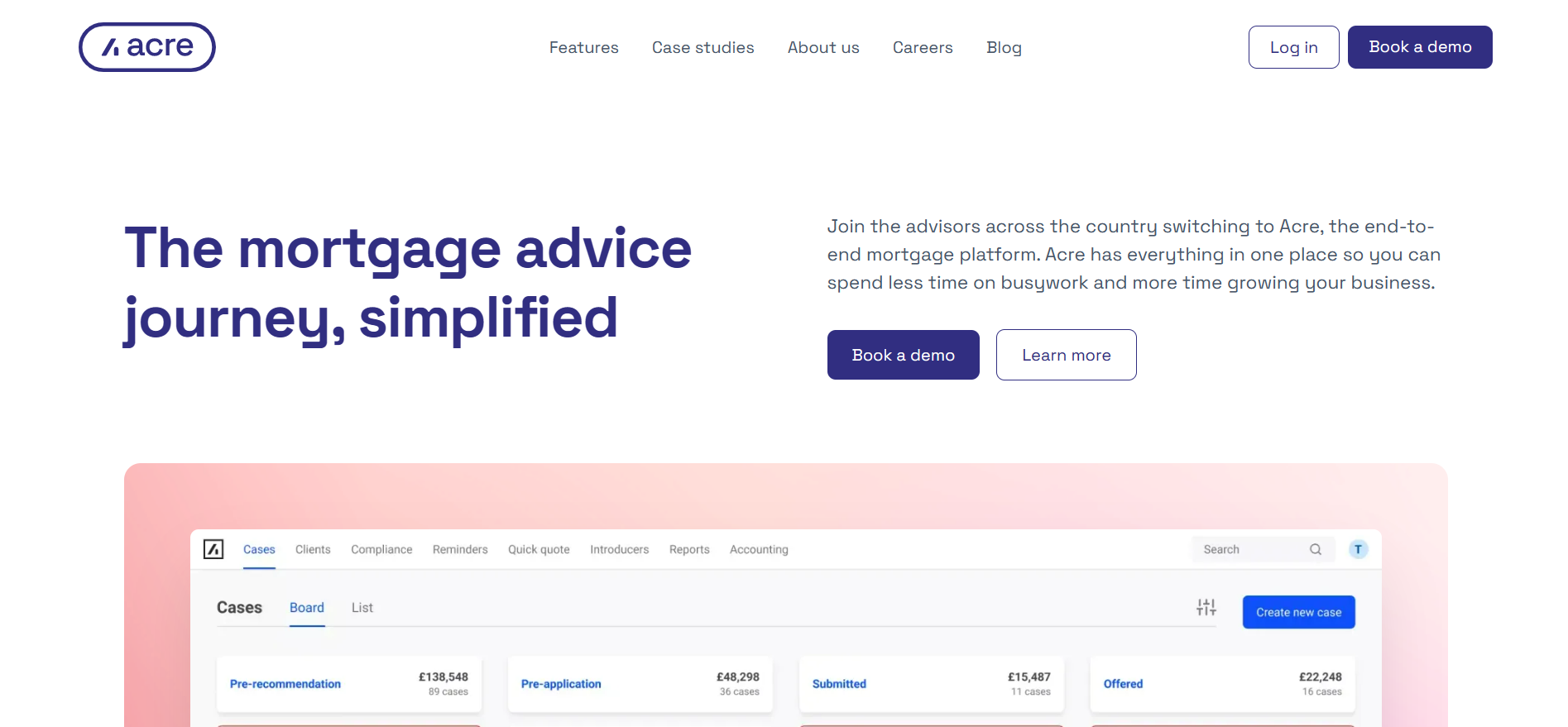

And while on the topic of the blockchain use cases, we report that Acre, a blockchain-based mortgage platform, has raised $8.1 million (ÂŁ6.5 million). The fundraising is the second major capital infusion for the London-based company and brings the firm’s total equity funding to $14.3 million (ÂŁ14.3 million). The round was led by McPike, an investor in Starling Bank, as well as Aviva and Founders Factory.

Acre helps traditional brokers compete with their digital counterparts by using blockchain technology to enhance the mortgage and insurance application process for advisers. The company’s technology brings together all aspects of the process into a single “record of the transaction.” This, according to Acre founder and CEO Justus Brown, helps brokers deliver “speedy, efficient advice that meets the individual requirements of each case in a dynamic market.”

Acre was founded in 2017. Brown reports that the company grew by 10x in 2022, and processes ÂŁ10 billion in annual mortgage volume. In the wake of the latest investment, Acre will focus on forging new partnerships with lenders and insurers to enable brokers to recommend the most competitive financial products and services for their clients.

Coinbase Announces Derivatives Exchange Upgrade: Last up for this edition of 5 Tales from the Crypto is news from one of the industry’s banner companies, Coinbase. The firm announced this week that it had partnered with Transaction Network Services (TNS). The partnership is designed to enable faster, more efficient transactions on its derivatives exchange (CDE).

“Crypto has witnessed both volatile and liquid markets, and with institutional adoption remaining strong, we believe the time is right for the offering that TNS brings to the table,” Coinbase Derivatives Exchange CEO Boris Ilyevsky said. “Dedicated cloud infrastructure connectivity coupled with our derivatives exchange represents a mission-critical step toward supporting and maintaining a vibrant and reliable crypto derivatives market.”

Coinbase launched its Derivatives Exchange in June of last year with the goal of attracting more retail traders to its platform. This week’s news shows that the company recognizes the potential attraction its exchange could have for institutional investors, as well. Regulated by the Commodity Futures Trading Commission (CFTC), the CDE will leverage its new TNS-provided financial trading infrastructure to enable institutional investors to grow their storage capabilities and process large data sets with less delay.