Two years ago the above headline would have sounded suspiciously like an April Fool’s post. But it’s no joke, we really are seeing banks offering no-login options and I hope it spreads. The latest innovator: Bank of the West.

Two years ago the above headline would have sounded suspiciously like an April Fool’s post. But it’s no joke, we really are seeing banks offering no-login options and I hope it spreads. The latest innovator: Bank of the West.

Last week, the bank’s mobile exec Matt Krogstad gave me a behind-the-scenes look at their new mobile banking service. In February, the bank replaced its previous mobile banking service with a new one powered by Fiserv (formerly M-com, see note 1). In the process, the bank added four important new features:

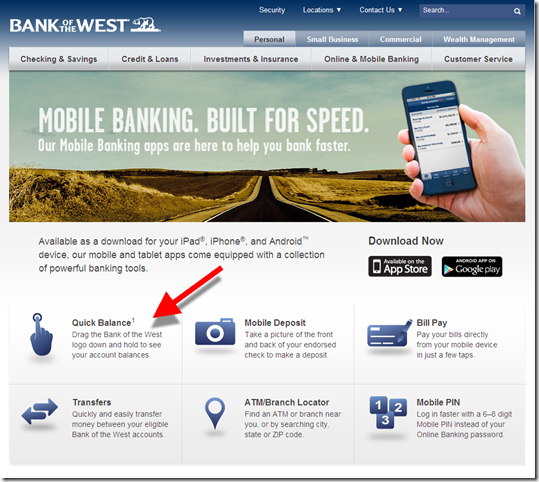

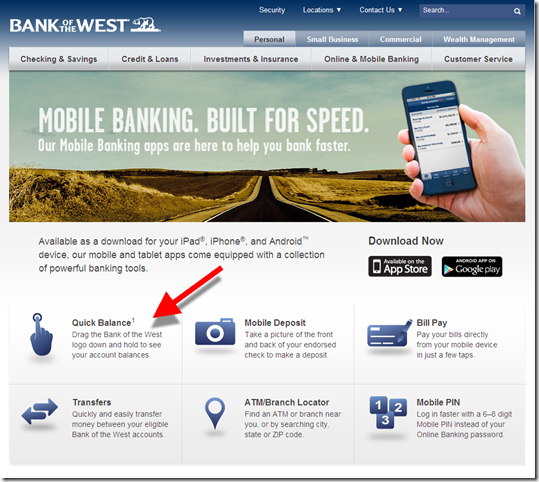

- Mobile remote check deposit: A mobile requirement in 2013.

- Bill payment: Another needed feature for users who prefer go mobile only, a number approaching 30% at first movers such as BofA and Chase

- Single PIN login option: Users have the option of logging in with their full online banking credentials or selecting a six-digit PIN to replace both the username and password

- No-login "pulldown" balance option: Swiping the Bank of the West logo down reveals the account balance of up to two accounts (see next section).

The bank also increased its mobile presence with Android and iPad versions.

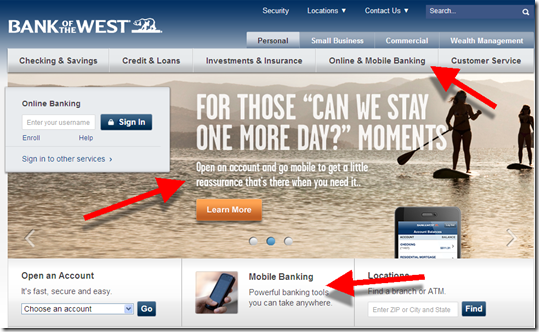

The initial results are impressive. In less than two months, Bank of the West has had a 70% increase in active mobile users and a tripling of logins per day. And that was before the bank began pushing it last week (see website screenshots below).

Bank of the West pioneers no-login option in USA

Bank of the West is the first U.S. bank with a no-login mobile balance lookup option (see others who have it here). After it’s been enabled, users can simple pull down the logo at the  top of the home screen. Within 1 to 3 seconds (depending on connection speeds), the balance from up to two accounts is revealed at the top of the page.

top of the home screen. Within 1 to 3 seconds (depending on connection speeds), the balance from up to two accounts is revealed at the top of the page.

Requiring users to swipe before showing the balance provides a nice mix between privacy and usability. It is super simple to use, yet it leaves your balance "hidden" if your kids, or friends, pick up your phone.

Since, no-login lookup is basically the same as an SMS balance inquiry (something the bank already offered), the bank’s security folks were able to approve it. Naturally, it’s turned off by default. Users must enable it within mobile banking, something that about 5% of mobile users have done in the first month or so.

————————————

Bank of the West mobile users "pull" the logo down to reveal account balances (1 April 2013)

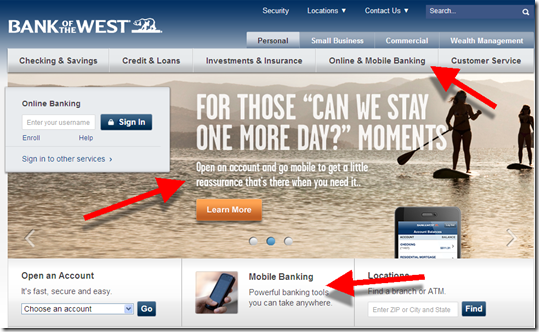

Bank of the West’s homepage has strong mobile branding (1 April 2013)

Note: Surprisingly few banks or credit unions have elevated mobile banking (or online banking for that matter), to the primary navigation

Bank of the West mobile banking landing page (link)

————————————–

Note:

1. Matt Krogstad was an early employee at M-com, which Fiserv acquired several years ago. He was involved in biz dev at Fiserv until his move to Bank of the West a year ago.