-thumb-100x96-11879.jpg) FinovateEurope is almost a month away, and we’re well into preparing for the show, to be held in London on February 11 and 12 at the historic Old Billingsgate Market Hall.

FinovateEurope is almost a month away, and we’re well into preparing for the show, to be held in London on February 11 and 12 at the historic Old Billingsgate Market Hall.

Before we all gather around the demo stage, we wanted to give you a preview of what to expect. Below are the first six companies in our sneak peek series. Stay tuned for more!

to compete for your business transfers.

Features:

- Compare low-cost currency quotes, and book trades in one independent venue

- 100% cost transparency, displaying side-by-side ‘sell’ and ‘market’ quotes

- Post trade analysis; no more paper trails

Why it’s great:

Access foreign-exchange quotes from all your providers in one place. Execute your business trades at the best price at the click of a button.

Daniel Abrahams

Co-Founder and Head of Partnerships at CurrencyTransfer.com. Half Israeli, Daniel divides his time between offices in London and Tel Aviv. Mentor at Startup ABC & Personal Finance blogger.

LinkedIn

Stevan Litobac

Co-Founder and Head of Product at CurrencyTransfer. Stevan has advised a number of early stage startups. Loves making things.

fastacash transfers value through social networks globally.

Features:

- Addresses intersection of payments, social and mobile

- Transfer monetary value and content across any social or messaging platform

- Technology easily customized and embedded into partners’ solutions

Why it’s great:

Enables transfer of money, airtime, coupons and any other value across any social network or messaging platform.

Vince Tallent

Vince has extensive experience in the TMT industry with a global focus on mobile and payments.

LinkedIn

Gilberto Arredondo

Throughout his career, Gilberto has been involved with new technologies and innovation by driving commercial and operational activities for telecommunications companies.

LinkedIn

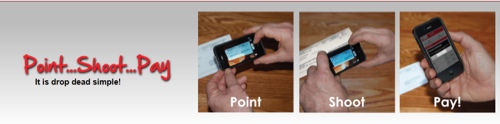

Jack Henry & Associates & Luminous helps banks solve problems. It’s the ultimate financial innovations company with visionary products that are breakthroughs in sheer simplicity.

Features:

- Virtual safety-deposit box

- Banking customers can upload, sort and store personal and business documents

- Customers can automatically save and back up the latest version of important documents

Why it’s great:

Customers can easily bank online with important documents automatically filed after just one click

Andrew Teversham

As Chief Technology Officer for Luminous, Andrew heads up the development and implementation teams at Luminous and has gained extensive experience with SAP implementations over a number of years.

LinkedIn

Phillip Wood

Phillip is a business development leader with 17 years’ experience in direct sales, business development and strategy in B2C and B2B across EMEA.

Matchi is an innovation-matchmaking platform for banks and innovators.

Features:

- Unprecedented collaboration opportunities for banks

- Marketing platform for innovators to showcase their latest innovations to banks

- A go-to-destination for market-ready, banking innovations online

Why it’s great:

It’s an innovation-matchmaking site for banks and innovators globally.

Warren Bond

Warren Bond, CEO of Matchi, is constantly looking for new ideas and ways to drive innovation and change in the banking industry.

LinkedIn

Gerrit Hoekstra

Gerrit Hoekstra, CTO of Matchi, has been delivering embedded mobile and strategic enterprise-grade, big-data solutions for more than 25 years and is passionate about innovative technologies at all levels.

LinkedIn

Tink is an innovative personal finance-management app which allows users to better understand how their money is spent.

Features:

- Making personal finance effortless

- Consume data in a personalized feed

- Insights into your personal finance

Why it’s great:

Makes personal finance fun, beautiful and convenient for the first time!

Daniel Kjellén, CEO and Founder

LinkedIn

Fredrik Hedberg, CTO and Founder

Toshl Finance Making finance fun. Helping people shake their finance-management indifference.

Features:

- Funtastic finance management UI

- Fully featured apps on phones, the desktop and everything in between

- Available worldwide

Why it’s great: Making finance fun.

Matic Bitenc

CEO, background in UX, international relations.

Miha Hribar

CTO, co-created numerous high-profile IT projects.

LinkedIn

eToro to allow its members to invest and trade in bitcoin.

eToro to allow its members to invest and trade in bitcoin.

customer to date in the ecommerce sector. It will directly provide convenient and secure payment methods online for customers of seven banks:

customer to date in the ecommerce sector. It will directly provide convenient and secure payment methods online for customers of seven banks:

KBC Bank Ireland

KBC Bank Ireland