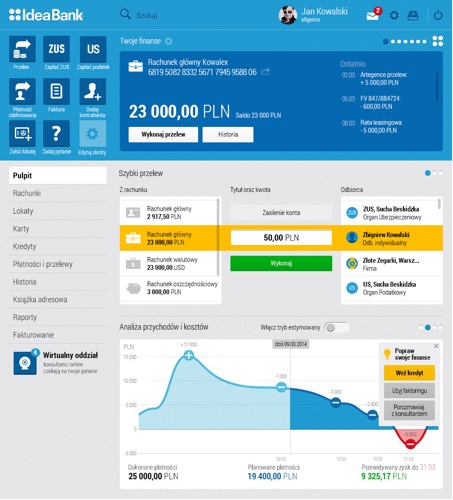

Avoka

What they do

Avoka’s online form-based transaction technology brings the form-filling process to a new level by supporting all channels and creating a seamless transition among them. With this solution, users can begin filling out a form on one channel, leave it, and pick it up on another channel where they left off.

Stats

- 100+ employees

- Offices in Australia, USA, and UK

- Tier 1 & 2 Financial Services clients, government clients in USA, UK, and Australia

The experience

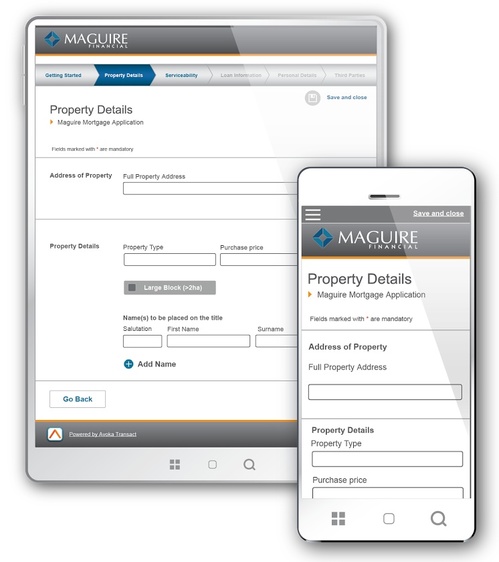

Users can begin their account opening experience on their mobile device. In this case, the user has started filling out a mortgage application. At the top, they are provided a tracking number which they can use to reference their application to a customer service representative.

The graphic below illustrates how the user, who began the application process on an iPhone, can resume filling out their mortgage application on a tablet. Since it picks up in the same spot that they left off, there is no need to enter the same information The phone on the right shows the same application on a smaller sized screen, which demonstrates Avoka’s use of responsive design.

In the event the user has difficulty at a point in the application, they can call a customer service representative or opt to schedule a time for the representative to call them at their convenience. The customer only needs to provide their tracking number located on the screen of their device, and the representative will be able to see their progress and location in the form-filling process.

The customer service reps are given visibility into completely abandoned forms. They can view the customer name, their email address, and at which point they abandoned the form. This gives the CSR the ability tailor the way they follow up with the client, depending on where they abandoned the form.

What they do

BehavioSec is a leading Swedish IT mobile security company that specializes in behavioral biometric authentication. Behavioral biometrics is a way of verifying identity based on how users act and interact with everything from their desktop computers, to websites, to mobile devices.

Stats

Stats

- Raised €1.5 million

- 12 employees

Biometrics as Security’s Cutting Edge

Anyone who fears that fintech professionals don’t take security issues seriously enough would have to explain why BehavioSec continues to be a favorite among Finovate audiences.

In picking up another Best of Show award at FinovateEurope this spring, BehavioSec continues to impress with an argument that what’s good enough for the security professionals at DARPA should be good enough for the consumers of financial products, as well.

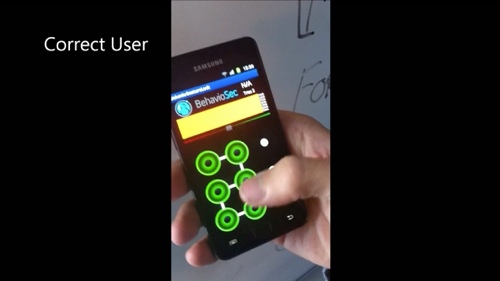

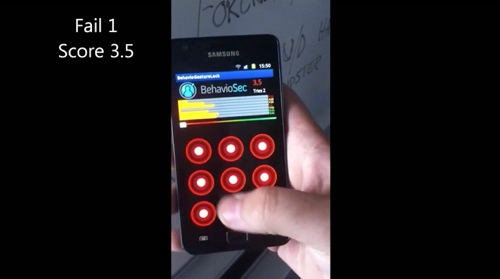

How does BehavioSec’s technology work? Keyboard strokes, swiping patterns and other gesture dynamics (pressure, speed, cadence) are as uniquely identifiable as fingerprints and arguably far more so than passwords and PINs. BehavioSec records these inputs as the user of the PC, website or mobile device goes about her business.

If and when the technology encounters behavior that is inconsistent with how the user has interacted in the past – a different rhythm in the typing of the keys, a different pressure or an uncommon hesitation in the middle of a swipe or gesture, the attempt fails.

All of this security is provided in real-time. BehavioSec also presents its data via a dashboard that makes it easy to monitor transactions as they happen or conduct forensic review afterwards. “If it isn’t you trying to make a particular transaction,” said Neil Costigan, BehavioSec’s CEO, “who is it?” BehavioSec’s platform makes it easier for banks and financial institutions to find out.

I caught up with Neil late in the day on Wednesday. The final networking period of the day was already underway and most attendees and presenters alike were milling around, drinks in hand, waiting for the Best of Show announcements later that evening.

We didn’t have a lot of time, but it’s always great to catch up with Neil and find out about the prospects of further behavioral biometric adoption by more banks and financial institutions.

“The takeaway? That’s it’s cool and it works,” Neil said in response to a question about his technology’s enduring appeal. He admits there is still a little mystique surrounding behavioral biometrics (“James Bond stuff”), and it cuts both ways, by impressing some and making others a little more cautious.”

BehavioSec continues to have great success in the Nordic countries, where the company was founded, and Neil pointed to the 2.5 million people who will be using the technology at Denmark-based Danske Bank. And the company continues to be close with the U.S. defense industry. Stay tuned for news on that front in the months to come.

But the company is not resting on its laurels, looking to expand into more markets – and more kinds of markets – around the world. “The technology is proven,” Neil said, “we don’t need to invest in R&D.” Instead he mentioned new fields, suggesting that the company has moved beyond investment on research and development to focus on new areas of business such as the account sharing problem for software licensing.

And expansion into London is another option, particularly given the strong reputation many of the Nordic banks have in the U.K. “We’re looking at offices and interviewing people for a UK presence,” Neil said.”It’s an easy next step from the Nordics. We are similar in customer profile.”

“Also our references carry weight here,” Neil said with a smile. “You walk around San Diego and say, ‘I’ve got a bank in Norway’ and they say, uh, what part of Wisconsin is that?”

What they do

The Currency Cloud helps businesses make international payments faster, more affordable, more transparent, and more secure. The company’s Payment Engine technology takes over and automates the entire process, from initial receipt of funds, through conversion to final payment.

Stats

- Employs 42 staff members

- Raised $8 million in funding

- Has 50 new direct clients and more than 1,000 indirect clients on boarded since January 2013

- Has 40,000 end customers

- Processes payments in 40 currencies in more than 200 countries

- Delivers 95% of payments within 24 hours

- Processes $400 million in payments monthly

- Clients include Finovate alums:

- azimo

- CurrencyTransfer

- Fidor Bank

- TransferWise

Giving Companies “Global ACH”

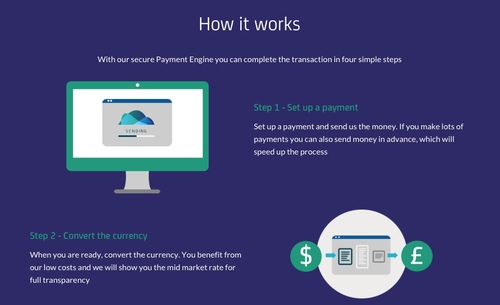

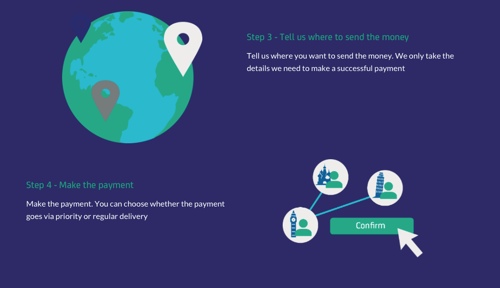

The Currency Cloud considers itself a technology company rather than a FX company, at heart. The company specializes in providing the infrastructure that makes it not only for businesses to make international payments, but for international payments companies themselves to do their business better. “We are very much in the background,” explained Todd Lathan, Vice President of Marketing for the company, “We’re B2B2C. We enable companies to have a global ACH.”

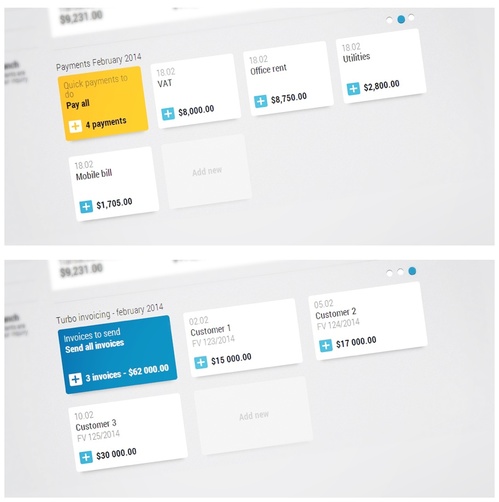

This year at Finovate, the company showcased a new feature, Cash Manager, which allows customers to send payments in advance. This turns what is often a 5-6 day process using traditional methods, into a far shorter process for companies that make sizable, regular international payments.

The idea of the Cash Manager came from customers. As CEO Michael Laven explains it, The Currency Cloud’s customers seek help with two primary issues: speed and transparency. In the name of speed, the company’s Cash Manager enables customers with predictable, end-of-month payment runs to pay in advance, taking days out of the payment cycle.

And in the name of transparency, the Currency Cloud has built a new notification facility that shows a complete chain of payments, the location of the funds and what transactions have been executed. From the Finovate stage, Laven cited a conversation with an attendee who said that “the major thing missing from their payment world” was precisely this kind of functionality. “We solved this problem and made it very, very easy,” Michael said.

Fiserv digital banking solutions to be

Fiserv digital banking solutions to be