We hope you have been enjoying our “behind the scenes” look back at FinovateEurope 2014.

In our first installment, we shared with you some insights from our conversations with AdviceGames, Nous, and Yseop. We followed that with a peek at how CRIF, Mobino, and SaaS Markets were helping bring fintech innovation to businesses and consumers alike. And just last week, we presented a behind the scenes look at NF Innova, Vaamo, and Best of Show winner, Tink.

This week we bring you another handful of companies from FinovateEurope 2014. First up for today are three innovators from the fields of mobile app security, big data analytics, and lending to the underbanked in emerging markets.

What They Do:

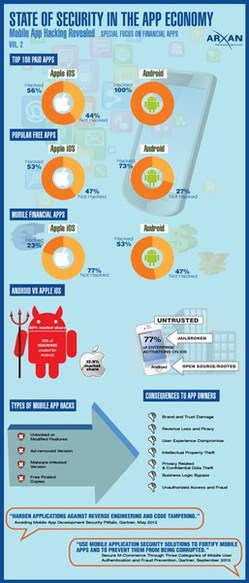

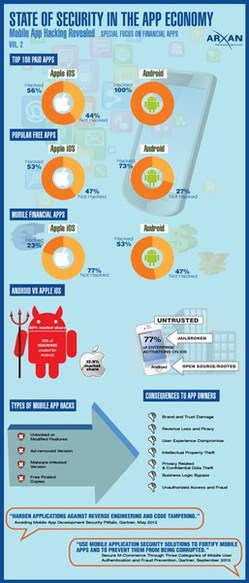

Arxan Technologies specializes in mobile app security, providing solutions that make it more difficult for fraudsters and criminals to tamper with apps.

The company’s technology deploys small units of object code called “Guards” that work at the application layer to defend against a variety of attacks ranging from malware and data breach repackaging to fraud and IP theft.

Stats:

- Technology is deployed on more than 300 million devices

- Revenue for 2013 increased by 95%

- Enterprise adoption grew by 146% in 2013

- First and only IBM partner to offer validated app hardening, tamper proofing for mobile channel

Building Better App Awareness:

Having learned a little about Arxan Technologies via a conversation with CTO Kevin Morgan in January, I was looking forward to spending more time talking with the folks from Arxan Technologies at FinovateEurope.

What was particularly interesting about my conversation with Vince Arneja, who is Vice President for Product Management for Arxan, and the rest of the team was how the company has begun to expand beyond the “app hardening” technology that has served as a key concept in their recently released report on the state of app security.

Now, as Vince tells it, the company is moving beyond simply making apps tougher and is focusing on making them more sensitive, as well.

“Apps need to be able to know more about the environment they are in,” Arneja explained.

Mobile security is where Internet security was in 2003. There is a lot of emphasis on policy and configuration, “but that’s not really security,” he said. “That’s enforcement and locking down with certain policies. You’re not really securing your assets.”

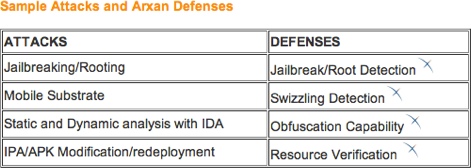

Arxan’s innovation involves “environmental guarding,” reflecting a trend toward providing more visibility for the app itself into the environment in which it is running.

The means the ability, for example, for the app to determine whether it is operating on a jailbroken device (i.e., an iOS device that has been altered to allow root access to the operating system)

“Some folks call it a ‘health check’ or just providing visibility via the application,” Arneja said. In addition to being able to detect jailbreaking, Arxan is developing technology that will help apps ferret out patching or “swizzling” attacks that are more iOS run-time sensitive. This is visibility that is embedded into the application.

A smarter app is a good thing for the user and the enterprise. Banks that do not want jailbroken devices accessing their systems can have a tool embedded in their mobile app that helps them accomplish this level of protection.

The prognosis for adoption of this technology? The bad news is that the company is not yet seeing the kind of adoption they would like to see among mid to low tier banks and financial institutions. The issues here are at least threefold: (a) cost is first, (b) a lack of technical ability or know-how is second, and (c) a failure to recognize that app security is an issue. How is that possible?

“They’re just trying to get the app out,” said Arneja. “They aren’t at the point where they’ve already had the app for the year. They’re just trying to get the app out and satisfy their small set of consumers, and aren’t even thinking about security at this point.”

The good news is that the team from Arxan Technologies is seeing “tremendous” adoption globally, in Japan and Korea, for example, particularly among Type A enterprises and large institutions. Arneja reported that about 42% of Arxan Technologies’ business is in EMEA (Europe, Middle East, Africa) and APAC (Asia- Pacific).

What They Do:

Kensho is the company behind Warren, technology that uses big data analytics to help institutions do quantitative analysis on financial markets. Warren uses natural language processing technology to provide real-time answers to more than one million financially-oriented queries such as “which sectors are most impacted by hurricanes?” and “how does unrest in the Middle East effect energy stocks?”

Stats:

- Raised $10 million in funding

- Capable of responding intelligently to more than one million financial queries (expected to reach 100 million by end of 2014)

Warren: Big Data, Natural Language, Actionable Insights

Kensho is democratizing big data analytics for the capital markets, said Kensho Head of Strategy and Business Development, Adam Broun during a conversation at FinovateEurope in London in February. Most data providers were built years ago, he explained. And while they remain effective at providing data, they have not kept up with many of the computing advances that have been embraced by, first, the world of personal computing and, more recently, the growing market of consumer computing devices from smartphones to tablets.

In contrast, Warren expresses these ideas by using:

- Natural language interface that lowers barriers to participation

- Cloud computing infrastructure that lowers implementation time to zero

- Software that works “as is” across a variety of channels including tablets and laptops

- Visualization (“we are visual beings. Colors and shapes help you get what the graphs are telling you”)

With all the functionality of a financial platform like Warren, the question of competition with the 800 pound gorilla in the room is inevitable. And to that point, Kensho is quick to say that it has no intention of taking on Bloomberg, the financial information leviathan whose terminals have been a staple of professional trading desks for decades. “Warren is complimentary with Bloomberg,” Adam said. “We serve different purposes. We don’t want to do everything.”

That said, Adam added, he wouldn’t mind a little bit of what Bloomberg has. “You go and visit a trading desk and you look at a trader and he’s got six screens going. All of them Bloomberg. I’d like two of them to be us at some point in time,” he said with a laugh.

As a company, Kensho has raised $10 million in funding from General Catalyst, NEA Venture Capital, Accel Partners, Google Ventures, and Devonshire Investors. Accolades and positive press have flowed from all the right places like CNBC, the Wall Street Journal, Business Insider and Institutional Investor. “People think it’s very cool,” Adam said. “People get it, and are very positive.”

What’s next for Warren? Broadly speaking, Kensho is considering expanding beyond U.S. equities to include other popular markets such as fixed income, global commodities, futures, and FX. As for the technology itself, Kensho anticipates that Warren will be able to respond intelligently to more than 100 million financial queries by the end of 2014 (Warren can handle about 1 million questions as of February).

At this time, the idea of expanding to broader audiences is not front of mind. Future versions with modified functionality may effectively serve a less professionally-oriented clientele of retail traders and investors. But for now, Warren is a product – or rather a tool set – for professionals.

So the next time some wise guy says something along the lines of “Oh yeah? Well, what does that have to do with the price of tea in China?” you can now respond, thanks to Kensho, “Ask Warren.”

What They Do:

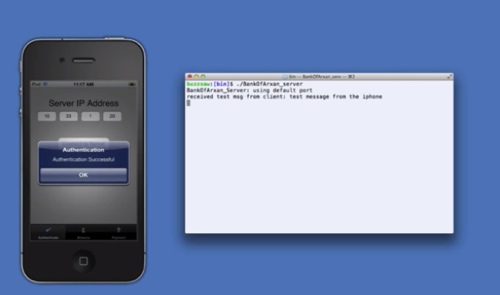

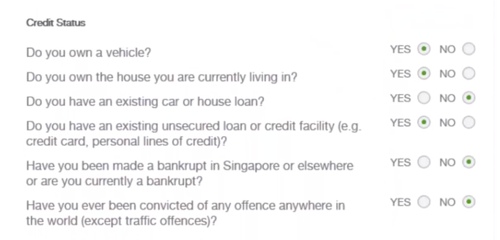

Kredit Aja is the name of the online and mobile marketplace developed by Plutus Software and deployed in the Indonesia market that helps traditionally underbanked borrowers connect with potential lenders.

Kredit Aja is based on the same technology, LoanGarage, that Plutus Software successfully introduced in Singapore. Says the company “Kredit Aja is LoanGarage for Indonesia.”

Stats:

- Raised S$700,000 in seed funding

- More than $5 million in approved loans

From Bias Against Borrowing to Helping People Meet Goals:

It’s one thing to be a growing company in a growing market. It’s quite another to be a growing company in a growing market in a part of the world that itself is synonymous with growth.

That’s the environment Plutus Software operates in. Focused in Singapore, but moving aggressively into the Indonesia market with Kredit Aja, the company’s innovation lies in understanding how to make credit decisions in markets where traditional markets like credit scores are not available or not especially accurate.

The core proposition for Kredit Aja is that credit has been difficult to get in regions like South Asia. There are at least two factors behind this. One is the relative lack of interest on the part of many of the big brands in what are still emerging economies. A second factor is cultural. In many countries in South Asia, the idea of asking for a loan has had historically negative connotations.

Fortunately for these countries, and for innovators like Kredit Aja, this sentiment is changing. “The feeling has changed from ‘it’s a bad thing to borrow’ to ‘we’re going to help people meet their goals.'”

And the breadth of these goals – from financing for a consumer purchase like a refrigerator to education funding and home mortgages – reflects the kind of business lines Plutus Software is growing into. In the company’s experience, many banks historically didn’t see the value, which is why Plutus Software added fe

atures like credit scoring, document verification – precisely the kind of functionality that is now helping attract banks to the company’s platform.

As a first mover in a market in which only 20% of the population have a bank account, what makes Kredit Aja unique is as much its technology as it is their innovative attitude toward credit scoring. “Traditionally banks look at past transactions,” the team from Plutus Software explained. “We look at social behavior, as well” and included everything from Facebook and Twitter activity to mobile recharge behavior.

Looking out over the balance of 2014, Plutus Software plans to improve its current portfolio of products, adding credit cards and other financial instruments (“more verticals”). Accomplishing this, in large part will mean building the Kredit Aja brand in Indonesia or “putting more boots on the ground” as the company puts it.

Another interesting challenge is that idea of branding. Growing interest in Plutus Software’s Loan Garage and Kredit Aja platforms has caused “top tier banks” to begin inquiring about white label opportunities. And this high quality problem is something that the multi-monikered company hasn’t entirely figured out how to deal with. “The main thing is that every conversation we have externally leads to another opportunity or another route,” said company CTO, Jagannathan Janagyraman.

Update: A previous version of this article incorrectly described the current funding status for Plutus Software.

Views: 785

![]()