By most measures, Y Combinator (YC) is far and away the most important incubator in the technology space. Graduating from there is like facing the job market with a resume boasting summer internships at Google, Facebook AND Goldman Sachs. You are almost guaranteed a multi-million funding.

By most measures, Y Combinator (YC) is far and away the most important incubator in the technology space. Graduating from there is like facing the job market with a resume boasting summer internships at Google, Facebook AND Goldman Sachs. You are almost guaranteed a multi-million funding.

Fintech (note 1) has been part of YC from the beginning. The first class (Summer 2005) included one fintech startup, TextPayMe, among the eight companies. TextPayMe was acquired shortly thereafter by Amazon for a rumored $3 million.

But as YC grew from 2005 to 2009, the number of fintech companies stayed at roughly 1 per year. During those five years, YC graduated 5 fintech companies out of a total of 139 (3.5%). Suddenly in 2010, the fintech number grew dramatically, average of more than 7 per year. During the past 4.5 years, there have been 35 fintech startups out of a total of 406 (8.6%) (see note 2).

Table: YC Fintech Companies by Year

| Class |

Total Companies |

# Fintech Companies |

% Fintech |

| 2014 (half year) |

56 |

5 |

9% |

| 2013 |

83 |

9 |

9% |

| 2012 |

117 |

8 |

7% |

| 2011 |

89 |

7 |

8% |

| 2010 |

61 |

6 |

10% |

| 2009 |

39 |

1 |

3% |

| 2008 |

43 |

1 |

2% |

| 2007 |

32 |

2 |

6% |

| 2006 |

17 |

0 |

0% |

| 2005 |

8 |

1 |

13% |

| Total |

545 |

40 |

7.4% |

Source: Y-Combinator (yclist.com), Finovate analysis

(see note 1 for Fintech definition)

_________________________________________

List of fintech YC alums by year

_________________________________________

2014 (Winter class only)

Abacus

abacus.com

Say goodbye to expense reports.

TradeBlock

http://tradeblock.com

Digital currency data and analysis. TradeBlock’s digital currency tools and research are trusted by hundreds of thousands of traders and enthusiasts across the globe.

Two Tap

http://twotap.com

Users can now order any product directly in your app with Two Tap.

Zidisha

http://www.zidisha.org

We are pioneering the first online microlending community to connect lenders and borrowers directly across international borders – overcoming previously insurmountable barriers of geography, wealth and circumstance.

Zinc

http://www.zincsave.com

Zinc is the best way to buy. Pay with with Dwolla or Bitcoin, and manage all your orders in one place.

2013

Buttercoin

http://buttercoin.com

Trade bitcoin with ease.

PayTango

http://www.paytango.com

PayTango links the cards in your wallet to your fingerprints.

RealCrowd

http://realcrowd.com

Featured investments available for funding.

SimplyInsured

http://www.simplyinsured.com

Simple health insurance for small businesses.

Standard Treasury

http://standardtreasury.com

APIs for commercial banks.

Swish

http://www.swish.com

Swish is a dynamic, specialized mobile payment company that has developed a ground breaking new card reader and application which provides a complete mobile point of sale solution to any size business.

True Link Financial

http://www.truelinkcard.com

We keep a watchful eye out for fraud and spending mishaps so you can spend your time doing what matters.

WeFunder

https://wefunder.com

We aim to give everyone – regardless of wealth – the opportunity to invest in startups.

Zenefits

http://www.zenefits.com

Zenefits runs your benefits, so you can run your business. Get affordable benefits for your company in minutes. Then set and forget them.

2012

Airbrite

http://airbritelabs.com

Exited

Airbrite is a cloud-enabled platform that powers mobile commerce We are the next generation of e-commerce. Our mobile-firs

t API powers modern shopping.

Coinbase

http://coinbase.com

Your Hosted Bitcoin Wallet. Coinbase is the easiest way to get started with Bitcoin.

Crowdtilt

http://www.crowdtilt.com

Crowdtilt allows users to pool funds for objectives in a simple, social, and frictionless way online.

Eligible

eligibleapi.com

Real Time Eligibility Checks for Health Insurance.

FundersClub

thefundersclub.com

FundersClub is a web service that gives investors unprecedented access to investment opportunities and the tools to review and invest online with ease and speed.

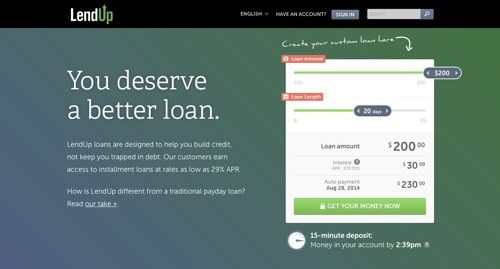

LendUp

lendup.com

LendUp is reinventing the payday lending industry

SmartAsset

http://www.smartasset.com

SmartAsset makes life’s biggest decisions easier by bringing full transparency to the financial decision making process.

ZenPayroll

http://zenpayroll.com

We are creating beautiful, modern payroll.

2011

DebtEye

http://www.debteye.com

We are an automated credit counseling solution to help customers get out of debt, a little like a “turbo tax” for those who need debt relief.

Giftrocket

http://www.giftrocket.com

GiftRocket sells a new type of gift card that works at any location.

GoCardless

https://gocardless.com

GoCardless is a UK-based service that allows smaller merchants to easily set up interbank transfers for customers.

Leaky

http://leaky.com

Leaky helps consumers make better decisions about insurance.

OrderAhead

http://orderaheadapp.com

OrderAhead is the easiest way to order from local merchants on your phone.

TrustEgg

http://trustegg.com

The simplest way to save for a child’s future.

SwipeGood

https://swipegood.com

SwipeGood allows users to enroll their credit or debit cards and automatically round up every purchase to the nearest dollar for charity.

2010

CardPool

http://www.cardpool.com

EXITED

Cardpool is a gift card exchange marketplace where anybody can buy, sell, or trade their new or pre-owned gift cards.

E la Carte

http://elacarte.com

E la Carte develops tablets for restaurant tables so guests can order, pay and play games from their seats

FutureAdvisor

https://www.futureadvisor.com

FutureAdvisor was founded in 2010 on the premise that investing for your future does not have to be difficult or expensive.

Indinero

http://indinero.com

Accounting, taxes & payroll. One solution. inDinero is your company’s accounting department.

ReadyForZero

https://www.readyforzero.com

ReadyForZero creates online financial software that helps people control and reduce debt.

Stripe

https://stripe.com

Stripe is a simple, developer-friendly way to accept payments online.

2009

WePay

https://www.wepay.com

WePay is an online payments platform for individuals, organizations, and businesses.

2008

Tipjoy

DEAD

Tipjoy was a simple, social payments engine that allows merchants to sell digital content and features, charities to raise money for causes, and individuals to give money to one another.

2007

Buxfer

http://www.buxfer.com

Buxfer is the next-generation personal finance solution, taking money management to the web.

SocialPicks

http://www.socialpicks.com

EXITED

SocialPicks provides individual investors with a trusted online investing community where they can invest smarter together.

2005

TextPayMe

http://www.textpayme.com

EXITED

TextPayMe was an SMS payment service that lets you send money to other people using cell phone text messaging.

—————————

Note:

1. We are using a broad definition of fintech including payments, insurance, investments, gift cards and even a few that are ecommerce focused such as E la Carte which is an order entry and payments play for restaurants.

2. Some YC companies are in stealth mode, so this public list is not 100% complete.

Fiserv and DBS win Asian Banker Technology Implementation award.

Fiserv and DBS win Asian Banker Technology Implementation award.

TransferWise

TransferWise