For all the innovations in the ways alternative lenders connect borrowers with capital, it’s nice to see a little innovation on the side of lenders getting their money back.

LendUp announced this morning that it had inked two service arrangements with global money transfer and payments company, MoneyGram. The partnership will let LendUp borrowers use MoneyGram’s Express Payment Service to repay their loans. The service is available at 39,000 agent locations across the United States.

The goals, said LendUp CEO and co-founder, Sasha Orloff, was to provide “new payment options exactly where many of our customers prefer to do business.” In a statement, LendUp shared research that indicated that among “small dollar credit” consumers, “store location convenience” was a major factor.

Echoing this fact was MoneyGram’s executive vice president of U.S. and Canada, Pete Ohser, who highlighted both innovation and convenience in celebrating the new relationship with LendUp.

And “new relationship” sounds like the proper way to think of LendUp and Moneygram going forward. Rather than a one-off deal, LendUp sees its relationship with MoneyGram growing to include additional products and services enabling access to credit via LendUp. Payment services are also under consideration going forward.

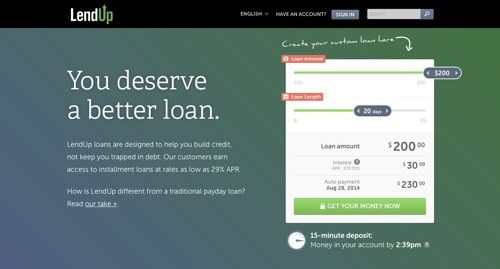

Founded in 2011, LendUp is based in San Francisco, California. The company demoed its RESTful API platform at FinovateSpring 2014 in San Jose, having won Best of Show honors the previous year at FinovateSpring 2013 in San Francisco. LendUp also made headlines in May with news that the company had raised a $50 million credit facility thanks to Victory Park Capital.