Dundings cooled down a bit over the record-setting pace of early August. But 15 companies still raised almost $150 million ($146.6 million including $2.5 million in debt) this week.

Dundings cooled down a bit over the record-setting pace of early August. But 15 companies still raised almost $150 million ($146.6 million including $2.5 million in debt) this week.

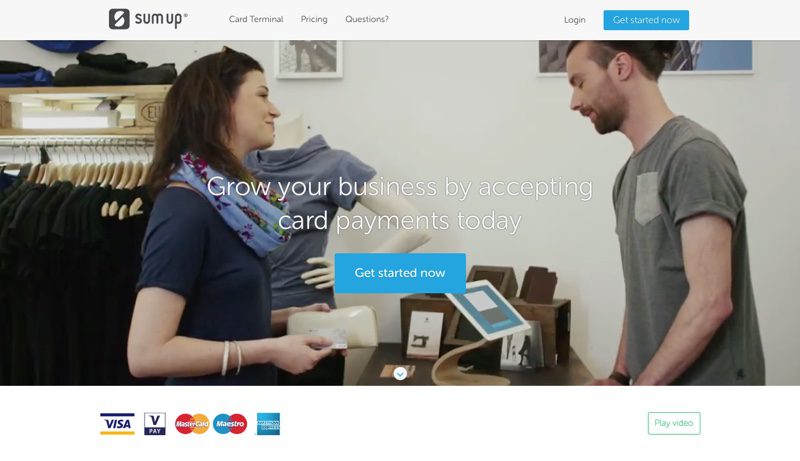

It was an especially lucrative week at the checkout counter in Europe as its two leading mPOS providers, iZettle ($67 million) and SumUp ($11.3 million), raised big rounds.

Three Finovate alums received large checks this week:

- FutureAdvisor, one of the early robo-advisers which had raised $24 million, was acquired by Blackrock for an undisclosed sum

- SumUp, the London mPOS provider, raised $11.3 million

- Socure, a social biometrics provider and FinovateFall 2015 presenter, raised $2.5 million in venture debt

August fundings ended up totaling $2.3 billion, almost a 6x increase over $410 million raised in August 2014. YTD, the fintech sector has raised $12 billion.

Here are the deals by size from 22 August through 28 August 2015:

iZettle

Mobile point-of-sale solution

HQ: Stockholm, Sweden

Latest round: $67 million Series D

Total raised: $181 million

Tags: Payments, mobile, point-of-sale, acquiring, merchants, SMB, hardware, mPOS

Source: Crunchbase

Freee

Automated online accounting

HQ: Tokyo, Japan

Latest round: $30 million Series C

Total raised: $47.2 million

Tags: SMB, small business, enterprise, accounts receivable/payable, payments, metrics

Source: Crunchbase

Nok Nok Labs

Authentication solutions

HQ: Palo Alto, California

Latest round: $16.3 million

Total raised: $47.8 million

Tags: Payments, security, ID verification

Source: FT Partners

SumUp

Mobile point of sale system

HQ: London, England, United Kingdom

Latest round: $11.3 million Series D

Total raised: $44.3 million

Tags: Payments, mobile, point-of-sale, acquiring, merchants, SMB, hardware, mPOS (investor), American Express (investor), Finovate alum

Source: Finovate

Able Lending

Debt crowdfunding platform for small businesses

HQ: Austin, Texas

Latest round: $6 million Series B

Total raised: $12.5 million

Tags: Lending, credit, underwriting, SMB, investing, loans

Source: Crunchbase

SelfWealth

Online tools for self-directed investors

HQ: Surrey Hills, Australia

Latest round: $4.3 million

Total raised: $4.3 million

Tags: Investing, wealth management, advisers

Source: Crunchbase

Socure

Social biometrics

HQ: New York City, New York

Latest round: $2.5 million Debt

Total raised: $7.2 million ($4.7 million equity, $2.5 million debt)

Tags: Security, SaaS, authentication, Finovate alum

Source: Finovate

MagicCube

Mobile transaction security

HQ: Sunnyvale, California

Latest round: $2.2 million Seed

Total raised: $2.2 million

Tags: Security, fraud, mobile, payments

Source: Crunchbase

PredictSpring

Ecommerce gateway

HQ: Los Altos, California

Latest round: $2.0 million

Total raised: $2.85 million

Tags: Payments, mobile, social media

Source: FT Partners

Chronicled

Blockchain-based system to prove ownership

HQ: San Francisco, California

Latest round: $1.4 million

Total raised: $1.4 million

Tags: Blockchain, assets, authentication, ID verification

Source: Crunchbase

TopCheck

Financial services price comparisons in Africa

HQ: Berlin, Germany

Latest round: $1.1 million

Total raised: $1.3 million

Tags: Lead generation, insurance, automobile

Source: Crunchbase

Angels Den

Equity crowdfunding

HQ: London, England, United Kingdom

Latest round: $1 million

Total raised: $1 million

Tags: Investing, P2P, equity, SMB, seed investing

Source: Crunchbase

ChartMogul

Payment analytics for small businesses

HQ: Berlin, Germany

Latest round: $900,000

Total raised: $1.5 million

Tags: Analytics, card processing, SMB

Source: Crunchbase

Crowdhouse.ch

Real estate crowdfunding platform for Switzerland

HQ: California

Latest round: $320,000 Seed

Total raised: $640,000

Tags: P2P, lending, mortgage, loans, peer-to-peer

Source: Crunchbase

Prepaid Online Systems (aka CashPinSafe)

Ecommerce payments

HQ: Kennesaw, Georgia

Latest round: $20,000 Angel

Total raised: $20,000

Tags: Payments, ecommerce, prepaid, cards

Source: Crunchbase

—-

Image licensed from 123rf.com

Today begins our FinDEVr Preview blog series. On 6/7 October in San Francisco, 60 companies will present their latest developer tools, tips, and integrations. Register today and don’t miss out.

If you’ve been keeping up with the blog, you’ve seen enough

If you’ve been keeping up with the blog, you’ve seen enough

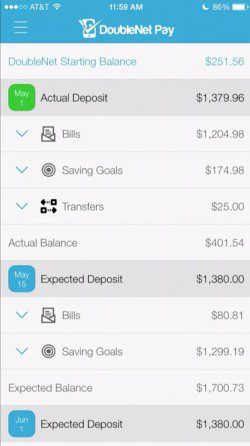

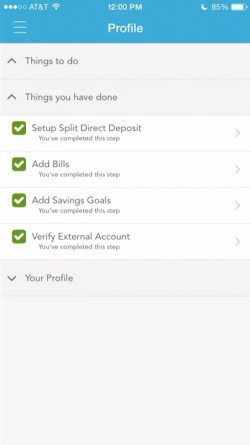

How it works

How it works DoubleNet Pay is built to help consumers manage savings as well as spending. Users can set savings goals to set aside a pre-set amount on a regular basis. This helps users “pay themselves first.”

DoubleNet Pay is built to help consumers manage savings as well as spending. Users can set savings goals to set aside a pre-set amount on a regular basis. This helps users “pay themselves first.”