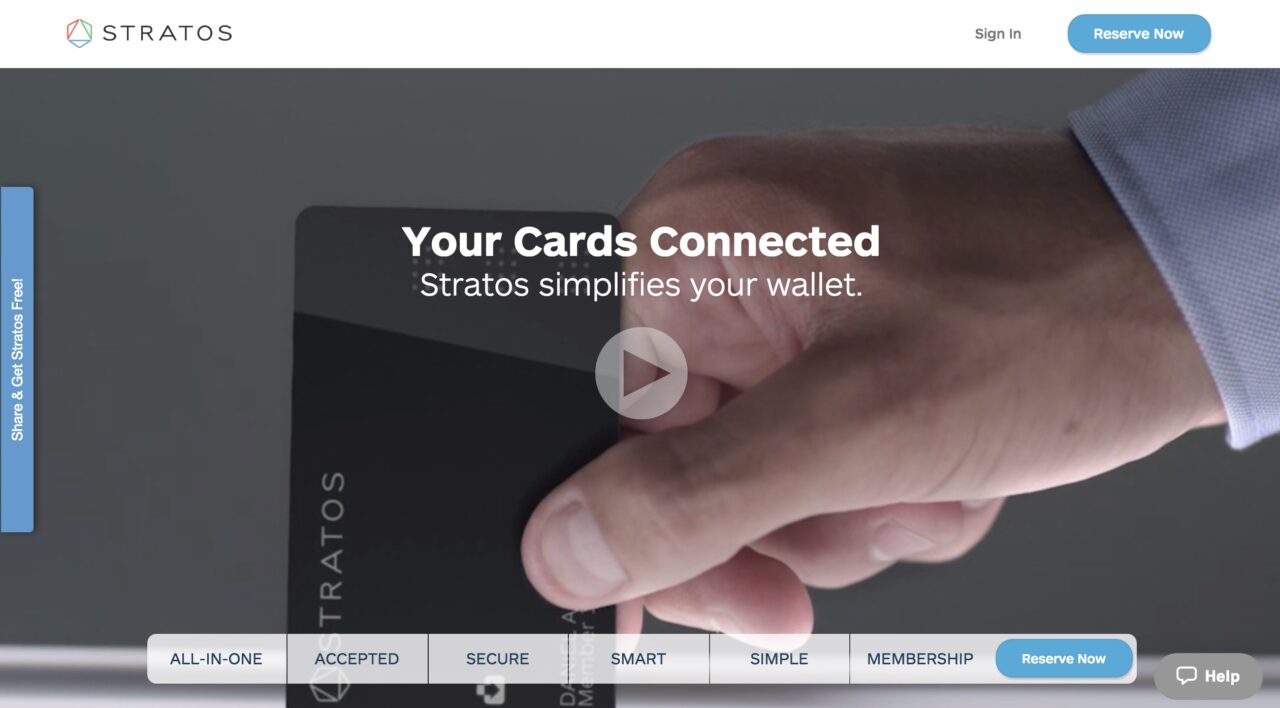

Remember what iPods did for your CD collection? Stratos is doing that for your wallet. That is, the startup takes the information stored on multiple cards, makes it digital, and stores it on a single card.

The Stratos card is a battery-powered, Bluetooth-connected payment, rewards, and access card that—combined with the customer-facing mobile app and backend analytic capabilities for card issuers—offers a holistic solution.

Company facts:

- Raised more than $7 million

- 50+ employees

- Based in Ann Arbor, Michigan

- Stratos card began shipping April 2015

- The card’s non-rechargeable battery lasts two years

For end consumers: the Stratos card

The Stratos card ships with a Square-like dongle (see image below).

Before using the card, the customer loads all of the existing cards in their wallet onto the Stratos platform (the video below offers a glimpse at the user experience). In order to do this, the user opens the Stratos app, swipes all of their magstripe cards through the dongle, and the Stratos app gathers all of the card data.

Consumers use the Stratos card as they would use any of the cards listed below. Stratos works with all types of cards:

- Credit card

- Debit card

- Gift card

- ATM card

- Loyalty/rewards card

- Membership/ authorization card

- Gym access card

The card holds the user’s top-three cards, which they chose by selecting one of three touch sensors on the front to reprogram the magnetic stripe on the back.

To change one or more of their top-three cards, the user needs their smartphone nearby. With their phone in Bluetooth range (3 feet), the user unlocks the card by double tapping it. On their phone, the user receives a push notification that lists which three cards are active on their Stratos card. When they open the app, they use a drag-and-drop interface to swap out and manage their cards (see screenshot below).

For card issuers: digital card-issuance platform

The Digital Card Issuance Platform replaces the physical fulfillment process by issuing a fully digital card, thereby removing the need for card issuers to mail plastic cards to their customers, sending customers a new card instantly. Additionally, the Digital Card Issuance Platform offers analytics about how customers are using their cards.

As a part of this platform, card issuers use a merchant’s geolocation to send the customer a push notification when they prepare to make a purchase. The notification alerts the customer of an incentive to open a credit account with the merchant. For example, while the customer is waiting in line to purchase a new suit at Nordstrom, they double tap their Stratos card to pay, and see a push notification that informs them they can save 15% on their purchase if they open a Nordstrom credit card. To accept the offer, the customer swipes right on the notification, selects Confirm, and double taps their Stratos card. Stratos automatically loads their new Nordstrom credit card into their wallet.

The digital card-issuance platform is relatively frictionless, since it doesn’t require the user to fill out forms or even digitally sign paperwork. The system simply relies on the customers’ identity information that is already on file with Stratos.

Stratos also offers co-branded partnerships that offer issuers control over card branding. It even enables the issuer to set their card as the default payment mechanism. For more visibility into how and where customers use their cards, Stratos provides back-end tools and dashboards to show metrics on how users favor the issuer’s card over others and track virtual top-of-wallet metrics.

Security

To keep things secure, Stratos employs bank-level encryption, and the app never displays card numbers. To view their card information within the Stratos app, users authenticate via a passcode or Touch ID.

To secure the physical card, users set parameters to disable the card if it’s stolen or lost.

What’s next

The startup is hard at work on version 2 of its card, which includes an EMV-capable version to comply with the coming liability shift this October. Also in the works is NFC payment capability and fingerprint authentication directly on the card.

Stratos plans to make the second version available internationally, as well.

Check out the video of Stratos’ live demo at FinovateSpring 2015.

For his part, Rouse called Klarna “the most exciting company in payments.” He pointed to the company’s ability to “leverage data from more than 35 million consumers” as key to Klarna’s ability to develop solutions that will improve the shopping experience for consumers and boost conversion rates for retailers.

For his part, Rouse called Klarna “the most exciting company in payments.” He pointed to the company’s ability to “leverage data from more than 35 million consumers” as key to Klarna’s ability to develop solutions that will improve the shopping experience for consumers and boost conversion rates for retailers.

1) Focus on contactless payment hardware.

1) Focus on contactless payment hardware.