The money-flow into fintech continued unabated this week with more than a half-billion ($557 million) raised by 24 companies. It was the eighth week this year that total fundings surpassed the $500-million mark. Year-to-date fintech firms have raised $13 billion.

The money-flow into fintech continued unabated this week with more than a half-billion ($557 million) raised by 24 companies. It was the eighth week this year that total fundings surpassed the $500-million mark. Year-to-date fintech firms have raised $13 billion.

The total included one new alum, Praesidio, which will be presenting its security and fraud-control integrations at next month’s FinDEVr. The Seattle-based startup raised $3 million to bring its total funding to $5.3 million. Also, long-time alum Alkami Technology picked up $11 million on Friday to further their e-banking solutions business.

Here are the fundings by size from 12 Sep to 18 Sep 2015:

AvidXchange

Automated billpay and accounts-payables solutions

HQ: Charlotte, North Carolina

Latest round: $225 million Series E

Total raised: $225+ million

Tags: Bill payment, accounting, SMB, payments, billing

Source: Crunchbase

Clover Health

Health insurance targeting seniors

HQ: San Francisco, California

Latest round: $100 million

Total raised: $100 million

Tags: Consumer, health insurance, seniors

Source: Crunchbase

LightSpeed

Point-of-sale system

HQ: Montreal, Canada

Latest round: $61 million

Total raised: $126 million

Tags: SMB, payments, POS, acquiring, merchants

Source: Crunchbase

Compass

Real estate marketplace

HQ: New York City, New York

Latest round: $50 million

Total raised: $123 million

Tags: Consumer, home buying, mortgage

Source: Crunchbase

Oscar

Health insurance

HQ: New York City, New York

Latest round: $32.5 million

Total raised: $327.5 million

Tags: Consumer, health insurance, SMB, Google (investor)

Source: Crunchbase

Aspiration

Online investment platform

HQ: Marina Del Rey, California

Latest round: $15.5 million

Total raised: $20 million

Tags: Consumer, investing, socially conscious, low-fee, wealth management

Source: FT Partners

Lumity

Health insurance selection for enterprises

HQ: San Mateo, California

Latest round: $14 million

Total raised: $14 million

Tags: Enterprise, SMB, insurance, benefits, human resources, HR

Source: Crunchbase

Fundera

Small-business loan marketplace

HQ: New York City, New York

Latest round: $11.5 million Series B

Total raised: $14.9 million

Tags: SMB, lending, commercial loans, lead gen

Source: Crunchbase

Alkami Technology

Digital banking solutions

HQ: Oklahoma City, Oklahoma

Latest round: $11 million

Total raised: $54 million

Tags: Online banking, mobile, Finovate alum

Source: FT Partners

Compte Nickel

French neo-bank

HQ: France

Latest round: $11.5 million

Total raised: $11.5 million

Tags: Consumer, debit card, banking, transaction account

Source: FT Partners

MarketInvoice

Receivables financing marketplace lender

HQ: London, England, United Kingdom

Latest round: $7.7 million

Total raised: $28.1 million

Tags: SMB, lending, underwriting, P2P, peer-to-peer, investing

Source: Crunchbase

Mighty

Financing to plaintiffs awaiting legal settlments

HQ: New York City, New York

Latest round: $5.3 million Series A

Total raised: $5.3 million

Tags: Consumer, legal, lending, loans, credit

Source: Crunchbase

Auger

Open-source predictions marketplace

HQ: San Francisco, California

Latest round: $4.7 million

Total raised: $4.7 million

Tags: Cryptocurrency, blockchain, Ethereum, security, payments

Source: Crunchbase

Satispay

Mobile payments

HQ: Milan, Italy

Latest round: $3.5 million

Total raised: $11.2 million

Tags: Consumer, payments, mobile, SMB

Source: Crunchbase

Praesidio

Cloud-based security for financial institutions

HQ: Seattle, Washington

Latest round: $3 million

Total raised: $5.3 million

Tags: Enterprise, security, fraud, risk management, FinDevR 2015 presenter

Source: Crunchbase

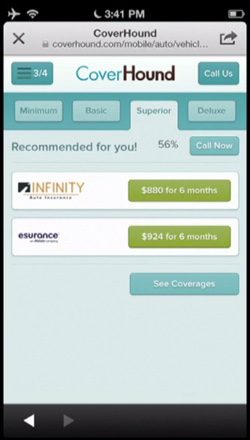

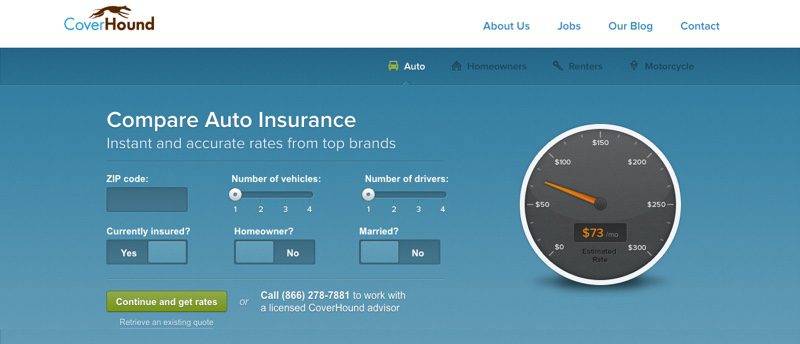

CompareIt4Me

Financial services comparison site

HQ: Dubai

Latest round: $3 million

Total raised: $3.3 million

Tags: Consumer, personal finance, price comparison, lead generation

Source: Crunchbase

PeerIQ

Risk management for P2P lending

HQ: New York City, New York

Latest round: $2.5 million

Total raised: $8.5 million

Tags: Enterprise, lending, credit, underwriting, peer-to-peer

Source: Crunchbase

AlphaClone

Stock trading strategies

HQ: San Francisco, California

Latest round: $2.3 million Series A

Total raised: $4.6 million

Tags: Consumer, advisers, investing, trading, wealth management

Source: Crunchbase

Bux

Simple mobile-trading app

HQ: Amsterdam, Netherlands

Latest round: $1.9 million

Total raised: $3.8 million

Tags: Consumer, trading, mobile, investing

Source: Crunchbase

Advizr

Financial planning software

HQ: New York City, New York

Latest round: $1.7 million Seed

Total raised: $1.7 million

Tags: Advisers, wealth management, personal financial management

Source: Crunchbase

Besepa

Direct debit management services

HQ: Madrid, Spain

Latest round: $200,000

Total raised: $300,000

Tags: Payments, billpay, SMB, accounts receivables, invoicing, billing

Source: Crunchbase

EquityZen

Secondary market for private equity

HQ: New York City, New York

Latest round: Undisclosed

Total raised: Unknown

Tags: Investing, private companies, trading, SMB

Source: Crunchbase

Mubble

Automatic bill payment for prepaid cards

HQ: Bangalore, India

Latest round: Undisclosed

Total raised: Unknown

Tags: Consumer, prepaid, debit cards, payments, billpay

Source: Crunchbase

RateGator

Mortgage marketplace

HQ: Saratoga Springs, New York

Latest round: Undisclosed

Total raised: Unknown

Tags: Consumer, lead gen, lending, mortgage

Source: Crunchbase

—–

Graphic image licensed from 123rf.com

The round was led by ACE Group and featured participation by existing investors, American Family Ventures, Blumberg Capital, Core Innovation Capital, Route 66 Ventures, and RRE Ventures.

The round was led by ACE Group and featured participation by existing investors, American Family Ventures, Blumberg Capital, Core Innovation Capital, Route 66 Ventures, and RRE Ventures.

FinDEVr Previews

FinDEVr Previews