This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.

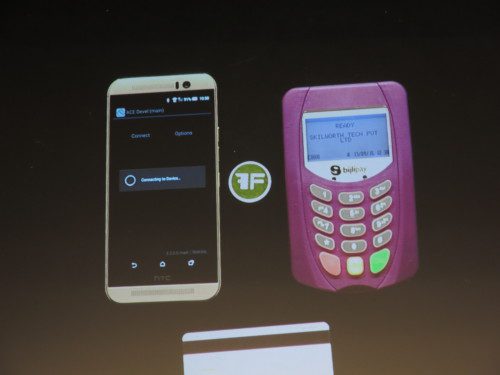

Our final presentation of FinovateFall is up next. Here’s the team from ArcBit.

Your bank in your pocket, and your money safely in your control, that’s the way banking should be. ArcBit Wallet is a mobile application that gives you full control over your bitcoins. With the ArcBit Wallet, you can send and receive bitcoins from anywhere in the world to anywhere in the world. It is basically a bank in your pocket.

Presenters: Tim Lee, founder, and Cameron P., developer

Product launch: June 2015

Metrics: 4 employees, has not yet pursued outside investment

Product distribution strategy: Direct to consumer (B2C)

HQ: New York City, New York

Founded: June 2015

Website: arcbit.io

Twitter: @arc_bit