As expected, the year ended on a relatively quiet note with just eight companies raising $71.5 million. More than half the total ($46 million) went to Chinese P2P lender Weijinsuo.

As expected, the year ended on a relatively quiet note with just eight companies raising $71.5 million. More than half the total ($46 million) went to Chinese P2P lender Weijinsuo.

The year ends with a total of about $19 billion invested into private fintech companies (includes debt and equity). If you add the $6 billion in new capital raised in the IPOs of Worldpay, Square and First Data, the 2015 total is a nicely even $25 billion.

It is unlikely we’ll see that much in 2016, but the fintech sector is vast, and there are fascinating opportunities for newcomers and existing brands alike.

Here are the deals by size from 26 Dec to 31 Dec 2015:

Weijinsuo

Person-to-person lender

Latest round: $46 million Series A

Total raised: $46 million

HQ: Bejing, China

Tags: Consumer, credit, lending, loans, underwriting, investing, P2P

Source: Crunchbase

Roofstock

Enabling investments in rental real estate

Latest round: $7 million Series

Total raised: $7 million

HQ: Oakland, California

Tags: Consumer, investing, real estate, rental properties

Source: Crunchbase

MobiKwik

Mobile wallet

Latest round: $6.6 million Series B

Total raised: $36.9 million

HQ: Gurgaon, India

Tags: Consumer, payments, mobile wallet, billpay, P2P payments

Source: Crunchbase

Ayannah

Payments and commerce solutions for unbanked in emerging markets

Latest round: $3 million Series B

Total raised: $7.5 million

HQ: Laguna Hills, California

Tags: Enterprise, payments, underbanked, financial inclusion

Source: Crunchbase

Picwell

Health insurance selection tools

Latest round: $3.03 million

Total raised: $7.05 million

HQ: Philadelphia, Pennsylvania

Tags: Consumer, insurance, healthcare, benefits, HR

Source: Crunchbase

DipJar

Tipping system for retail point of sale

Latest round: $2.4 million Seed

Total raised: $2.82 million

HQ: New York City, New York

Tags: Consumer, payments, POS, merchants, acquiring, credit/debit cards

Source: Crunchbase

Nxt-ID

Mobile wallet and biometric solutions

Latest round: $2.1 million (at least $1.5 million debt)

Total raised: $2.9 million (includes at least $1.5 million debt)

HQ: Shelton, Connecticut

Tags: Enterprise, payments, mobile, security, Wocket Wallet (product name), hardware, credit/debit cards

Source: WhoGotFunded

ModeFinance

Credit risk management

Latest round: $1.4 million Seed

Total raised: $1.4 million

HQ: Trieste, Italy

Tags: SMB, credit, lending, trade financing, underwriting, commerce

Source: Crunchbase

—–

Image licensed from 123rf.com

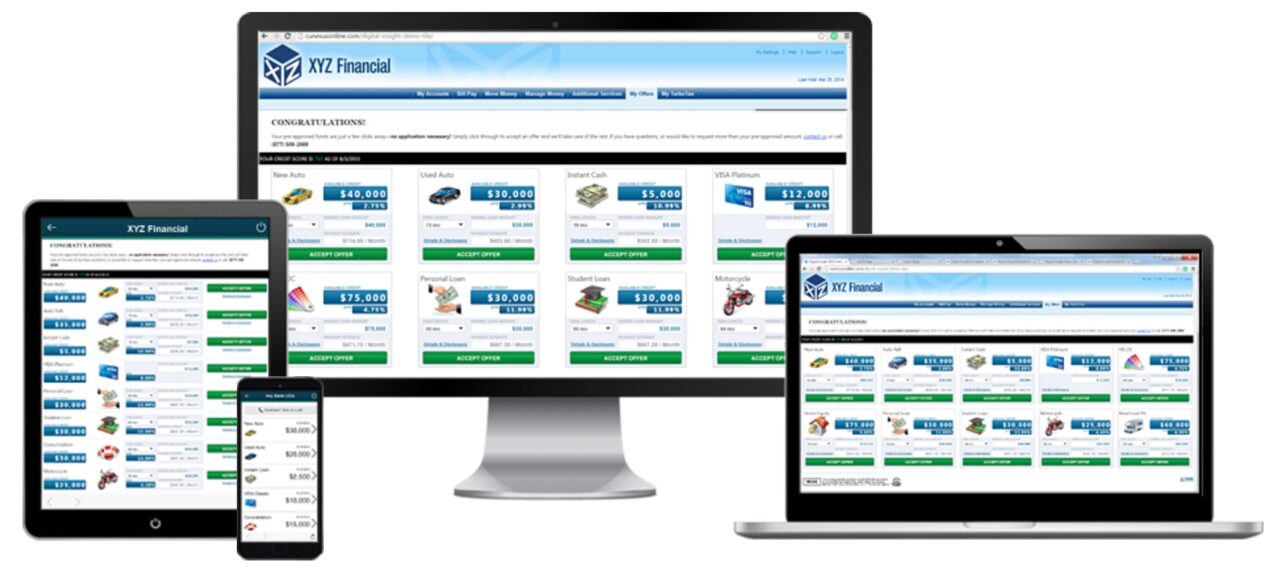

CUneXus

CUneXus

Are you building new financial technology? Be sure to

Are you building new financial technology? Be sure to

Carl-Nicolai Wessmann, CEO, Founder

Carl-Nicolai Wessmann, CEO, Founder Kristin Juland Moller, Social Media and Communication Manager

Kristin Juland Moller, Social Media and Communication Manager

Ian Dunbar, Country Manager, Australia

Ian Dunbar, Country Manager, Australia Richard Mannell, CEO, Founder

Richard Mannell, CEO, Founder

Paulo Oliveira, Omnichannel Specialist

Paulo Oliveira, Omnichannel Specialist Diana Winstanley, Business Developer

Diana Winstanley, Business Developer