Nobody needs a manual to use FaceBook, or a handbook to guide them through an Uber app. Why should enterprise software be any different?

Capriza turns complicated business processes into efficient, secure, mobile apps designed around the user’s workflow, not the other way around. The “mobilization” process, as the company calls it, can be finished “in a matter of days” and does not rely on coding, APIs, or integration to turn both packaged and custom solutions into technologies accessible via mobile device as readily as the desktop.

Capriza VP of Regional Business Development Ivan Prafder demonstrated Capriza at FinovateFall 2015.

“We think of this efficiency that users have come to expect as the ‘one-minute experience,’ Ivan Prafder, Capriza VP of regional business development, said. “By this we mean those who can deliver necessary information in one minute are the winners in today’s technology economy.”

“Examples of this at the retail level abound,” he continued. “But no company today really focuses on enterprise software with this perspective in mind: an SaaS platform that enables businesses to deliver these one-minute experiences,” Prafder said. Until now.

Company facts:

- Founded in July 2011

- Headquartered in Palo Alto, California

- Raised more than $53 million in funding

- Maintains offices in North America and Europe

- Yuval Scarlatt is CEO and co-founder

How it works

Capriza considers simplicity, personalization, and intelligence to be key factors in building the enterprise software of the future. Pointing out that training on enterprise software often takes a month or more, Capriza rejects the idea of having to “train” users to operate the software.

Capriza considers simplicity, personalization, and intelligence to be key factors in building the enterprise software of the future. Pointing out that training on enterprise software often takes a month or more, Capriza rejects the idea of having to “train” users to operate the software.

The technology also should be personal. “No more one-size-fits-all,” says Prafder. “SAP has 15,000 different business processes. Salesforce has 2,000,” he explained. “But in terms of the actual workflows people use, there are probably only fifteen or twenty different processes.” For Capriza, personalization is about “extracting and delivering” the workflows that are relevant to end-users.

“We all use the same app. But we use it differently and rely on different metrics,” Prafder explained. “We allow end-users to determine the metrics that matter to them.”

And finally, Prafder says, the technology has to be smart. “Legacy applications are like having to press refresh over and over just to see if you’ve got new email.”

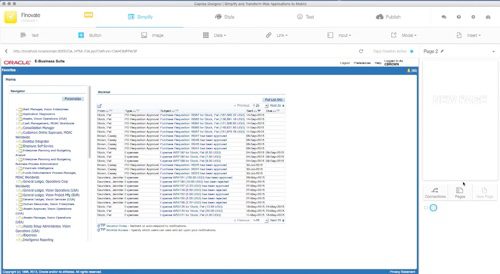

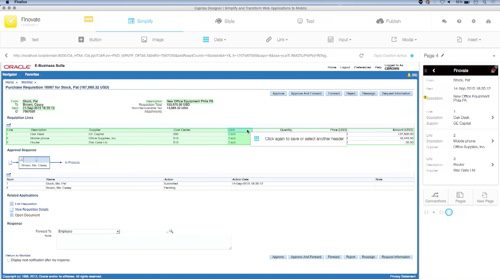

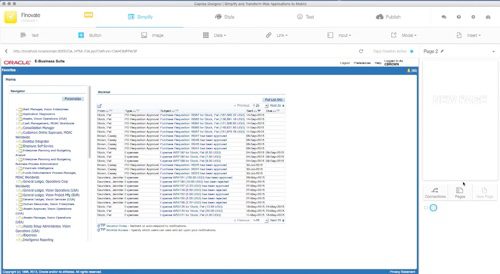

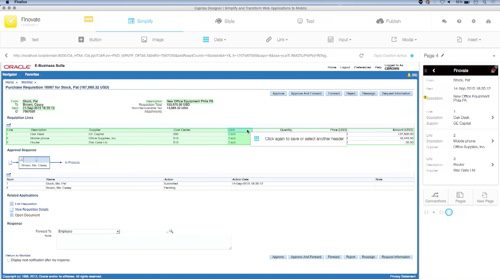

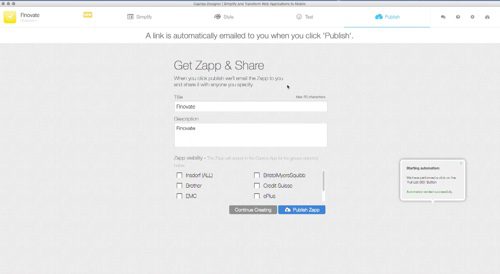

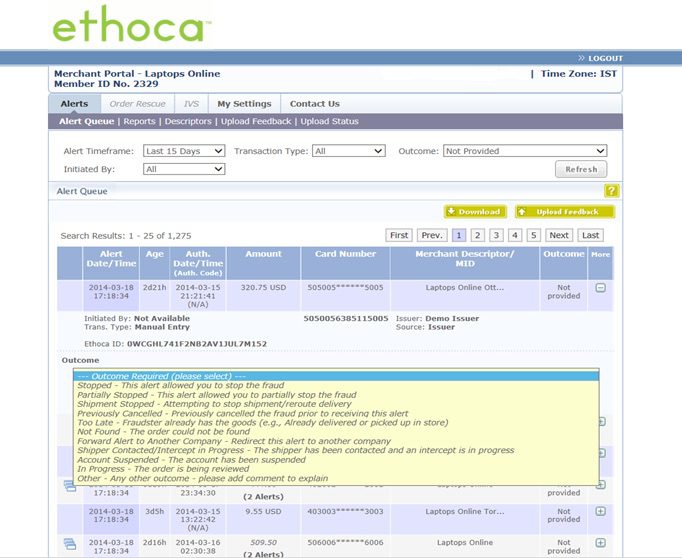

During their Finovate demo, Capriza Senior Solutions Engineer Stephen Insdorf showed how a CEO or manager of a business could use a Capriza-powered app to perform executive functions like requisition approval by mobile device. But the majority of the company’s presentation was dedicated to proving how easy and quick it was to build, test, and deploy a “mobilized app” with Capriza.

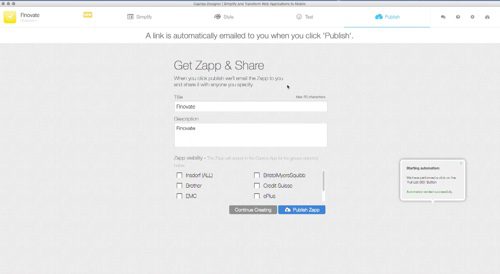

Insdorf showed how, with a simple combination of pull-down menus and drag-and-drop options, a designer creates features like login and approval pages. Capriza’s real-time access allows designers to work on both sides of the screen for speed and accuracy. Designers can select and automate processes on a single page as well as across pages, and individual records can be used to quickly build a template or to set fields for the entire dataset.

“Having the functionality is great,” Insdorf said. “But delivering a crisp experience for the user is essential.” To that end, Insdorf showed how the platform’s style-tools enabled him to reconfigure data and tables in order to create different user experiences. “However you want to curate this ability for the user, you are absolutely within your capability to do this quickly and easily with our platform,” Insdorf said. Designers test their completed apps on the platform for quality assurance before using the platform to distribute it to users.

The future

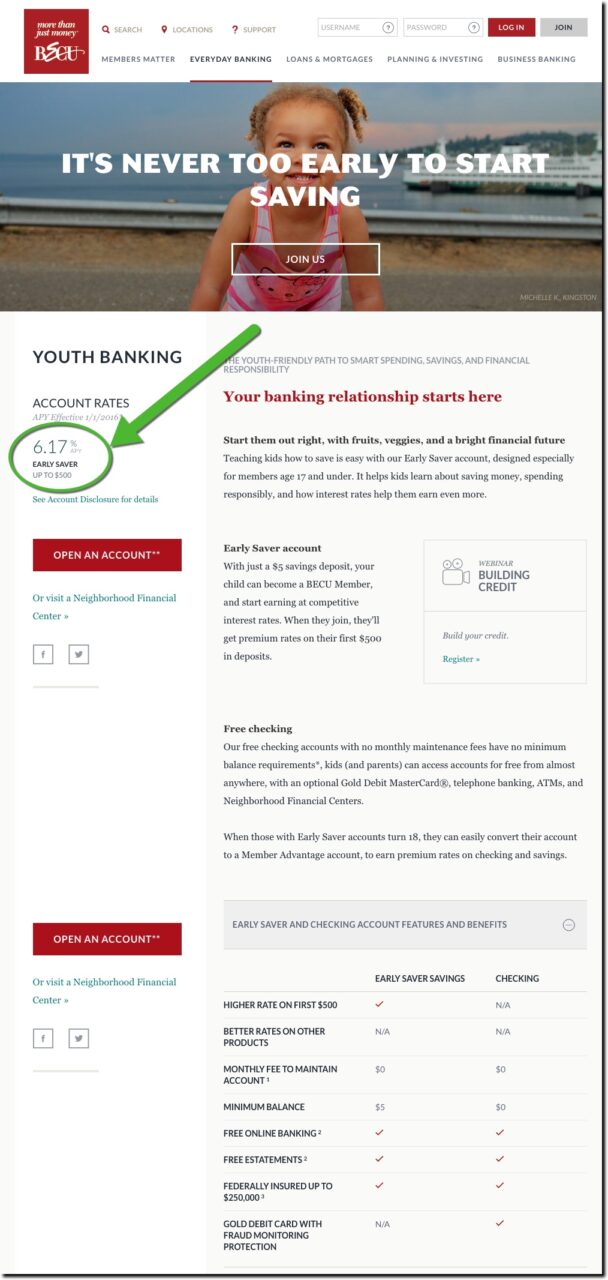

Capriza has enjoyed “enormous traction” in financial services, banking, and insurance. They credit this mostly to the strict regulatory environment and the shift away from both cash and brick-and-mortar. In the first case, Capriza helps financial service professionals operate more efficiently by reducing complexity. In the second case, Capriza helps FIs and other businesses take advantage of the growth of the mobile channel and the willingness of consumers to deal more directly with technology. “In the last five to seven years, users have become true information consumers who want to interact directly with the software—without a middleman,” Prafder said.

Over the last quarter, Capriza has signed 12 customers in the financial services industry. One company in Europe has a “$3 billion transformation agenda” for which Capriza is a “key piece.” A variety of other industries have also shown interest in the technology, including government and technology, media, entertainment, and hospitality.

Prafder said the company’s vision for the future remains centered around “delivering user-centric apps for the enterprise” without making dramatic asks on enterprise IT structure. “It’s a huge win for them,” he said. “The pain of migration isn’t there. No rip and replace.” According to Prafder, Capriza sits on top of the enterprise-application stack, focused on the 5% of critical workflows that can drive 80% to 85% of missed productivity gains. He added that Capriza is helping enterprises “leverage the richness they have already built.”

Check out Capriza’s demo video from FinovateFall 2015

![]() A look at the companies demoing live to 1,500 fintech professionals. Register today.

A look at the companies demoing live to 1,500 fintech professionals. Register today. Presenter

Presenter

Presenters

Presenters Tom Martin, Head of PMO

Tom Martin, Head of PMO

Presenters

Presenters Chris Edgington, Global Industry Solutions, Financial Services

Chris Edgington, Global Industry Solutions, Financial Services

Capriza considers simplicity, personalization, and intelligence to be key factors in building the enterprise software of the future. Pointing out that training on enterprise software often takes a month or more, Capriza rejects the idea of having to “train” users to operate the software.

Capriza considers simplicity, personalization, and intelligence to be key factors in building the enterprise software of the future. Pointing out that training on enterprise software often takes a month or more, Capriza rejects the idea of having to “train” users to operate the software.