What does it take to thrive in a world of rapid technological change?

What does it take to thrive in a world of rapid technological change?

Augmented: Life in the Smart Lane, the new book by Moven founder and CEO Brett King, marks the latest addition to a growing literature of futurism and prognostication on technology. And while King calls himself “ultimately an optimist,” Augmented threads the needle between the tech utopianism of a Ray Kurzweil, and the more anxious voices (at least where technologies like artificial intelligence are concerned) of visionaries ranging from Elon Musk to Neil Bostrom.

Augmented puts the current boom in the context of previous periods of rapid technological change. King dissents from the view that our current wave pales in comparison with other eras. Instead, he refers to the impact of the smartphone on personal finance (“Only 40% of the world had access to banking before mobile,” he points out) and talks about the transformative power of innovations like 3D printing in medicine and meta-materials in energy.

These innovations will force people to ask new ethical questions, such as “Should it be legal for a person to have an otherwise healthy limb amputated in favor of an enhanced prosthetic one?” But many of the thorniest questions in King’s view will revolve around what to do with all those workers displaced by increasingly productive “labor-saving” solutions. Augmented features a sobering table of jobs likely to survive the transition he believes is already underway, and those that are not. “Every business with a traditional business model that has resisted technological change has failed,” King says.

So what are 21st century technological revolutions made of? King sees four key disruptors that will define the way we will live in the decades to come: artificial intelligence, smart infrastructure, healthcare technology, and what he calls embedded and distributed experiences. This last category includes the sort of virtual technologies that companies like Facebook have made major investments in, as well as the “Internet of Things” concept that King describes as a world in which “everything is able to give feedback.”

So what are 21st century technological revolutions made of? King sees four key disruptors that will define the way we will live in the decades to come: artificial intelligence, smart infrastructure, healthcare technology, and what he calls embedded and distributed experiences. This last category includes the sort of virtual technologies that companies like Facebook have made major investments in, as well as the “Internet of Things” concept that King describes as a world in which “everything is able to give feedback.”

And while there will be some who will have none of this noisy, intrusive world, King is betting that most of us will find our place in it. Consider his take on privacy. For King, social media like Instagram and LinkedIn (to say nothing of what we’ll have by mid-century) provide something equally as valuable in the augmented age: validation. “Lack of a digital identity may make you less trustworthy in the new world,” King suggested. In a world in which privacy and security remain important—if not even more so than today—the ability to quickly and accurately establish identity also becomes important, even if all that means is having an accurate and up-to-date Facebook page.

The inevitability of change is a key takeaway. And the irony may be that the technology will be the easy part. “There will have to be a mindset shift from the traditional values of baby boomers to the acceptance of change-mentality of millennials,” King says. And it is his own generation X, currently entering middle age, that will be key in making that transition happen.

Much of King’s message, however, is that as inevitable as the discomfort of disruption is, we’ve been through this before and tended to like what we found on the other side. “It is important to help people get ready for this,” he said, summing up his reason for writing Augmented. And to the extent his predictions prove prescient, forewarned is forearmed.

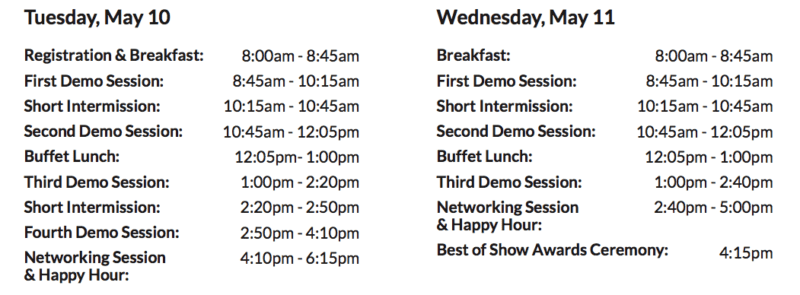

Meet Brett King in San Jose next month as his company, Moven, demonstrates its latest technology live on stage at FinovateSpring, May 10 and 11.

Our

Our

So what are 21st century technological revolutions made of? King sees four key disruptors that will define the way we will live in the decades to come: artificial intelligence, smart infrastructure, healthcare technology, and what he calls embedded and distributed experiences. This last category includes the sort of virtual technologies that companies like Facebook have made major investments in, as well as the “Internet of Things” concept that King describes as a world in which “everything is able to give feedback.”

So what are 21st century technological revolutions made of? King sees four key disruptors that will define the way we will live in the decades to come: artificial intelligence, smart infrastructure, healthcare technology, and what he calls embedded and distributed experiences. This last category includes the sort of virtual technologies that companies like Facebook have made major investments in, as well as the “Internet of Things” concept that King describes as a world in which “everything is able to give feedback.”

Ashley Luke, Director, Data Science

Ashley Luke, Director, Data Science James De Cicco, Head of Sales, Banking and Financial Services

James De Cicco, Head of Sales, Banking and Financial Services Gaurav Mistry, Manager, Business Development, Banking and Financial Services

Gaurav Mistry, Manager, Business Development, Banking and Financial Services

Ryan Wilk, VP of Customer Success

Ryan Wilk, VP of Customer Success Robert Capps, VP of Business Development

Robert Capps, VP of Business Development

Andreas Baumhof, Chief Technology Officer

Andreas Baumhof, Chief Technology Officer

Pete Myers, CEO

Pete Myers, CEO