The first card-linked offers company, Cardlytics, launched in 2008. The fintech community started paying attention to the linked-offers trend around 2012, but by that time, so many players had entered into the market that it had become fragmented, making it difficult to compete.

The CardLinx Association launched to unite retailers, advertisers, publishers, payment networks, payment processors and technology providers in the space; enhancing the interoperability of loyalty programs to create a better customer shopping and merchant experience. The collaborative platform brings cohesiveness by developing standards for the industry.

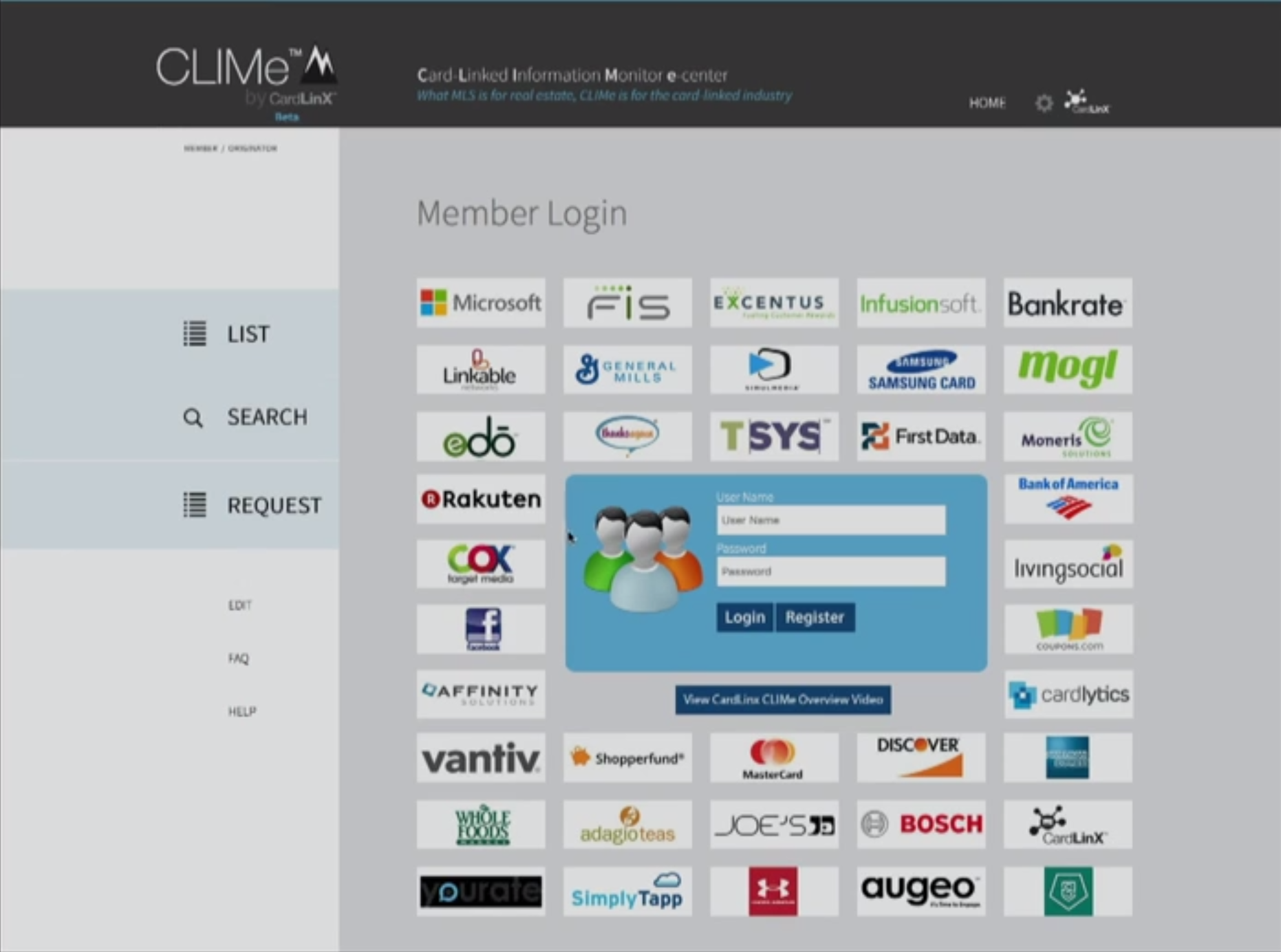

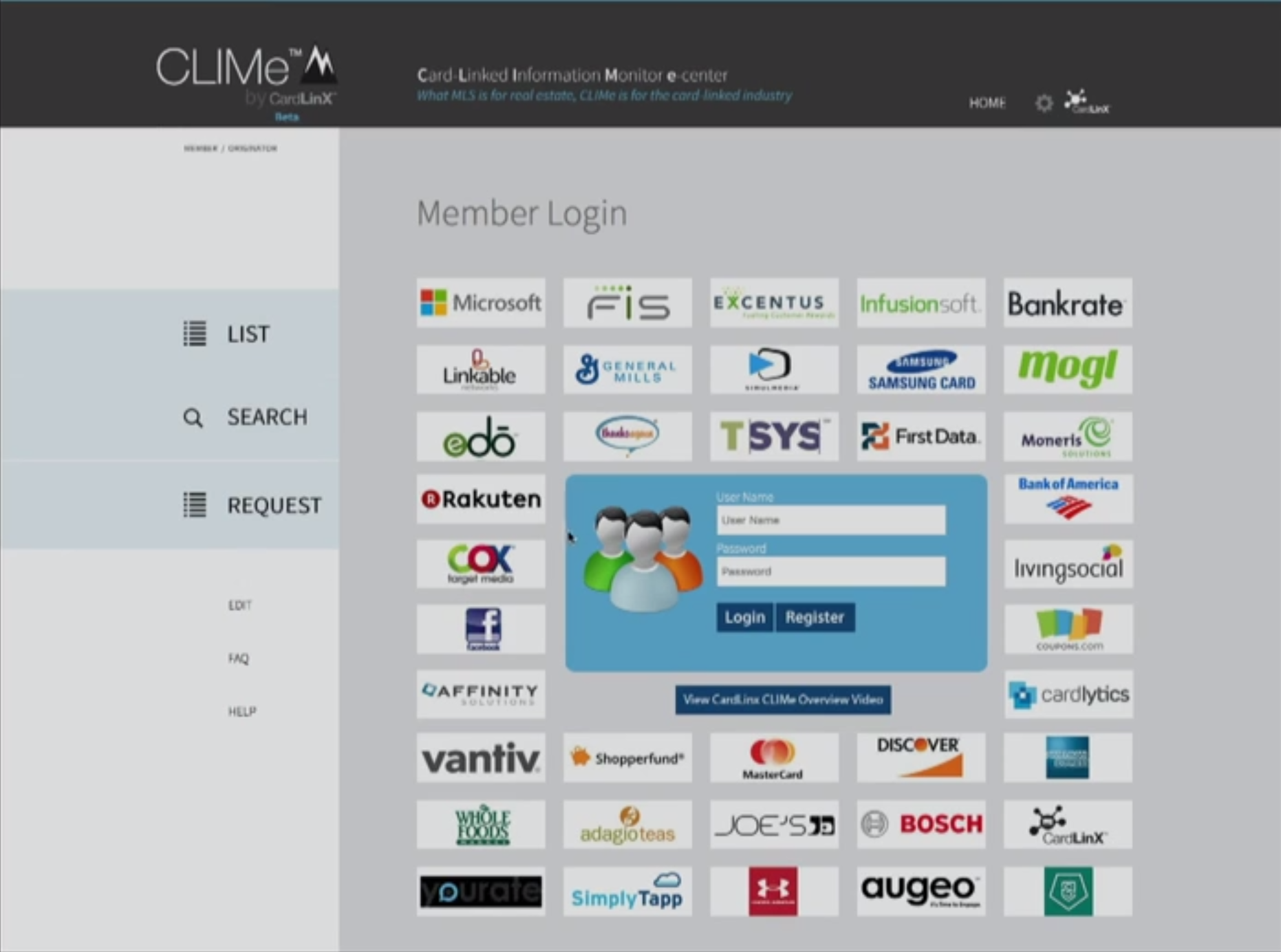

At FinovateSpring 2016, The CardLinx Association debuted Listing Information Monitor eCenter (CLIMe). “How do you get all of these companies to work together?” the company’s CEO and founder, Silvio Tavares, asked in his demo. He addressed the question by showing the logos of the companies that have partnered under The CardLinx Association.

These companies represent some of the members that share data on CLIMe. Companies use the database to search offers and offer requests; card-linked technology providers list offers, and banks and digital publishers request offers.

Company facts:

- Headquartered in San Bruno, CA

- Founded in 2013

- Membership has doubled every year

The CardLinx Association’s Silvio Tavares, CEO and president, demoed at FinovateSpring 2016 in San Jose

The CardLinx Association’s Silvio Tavares, CEO and president, demoed at FinovateSpring 2016 in San Jose

We interviewed Silvio Tavares, the company’s CEO and president, after his FinovateSpring 2016 demo in San Jose.

We interviewed Silvio Tavares, the company’s CEO and president, after his FinovateSpring 2016 demo in San Jose.

Finovate: What problem does CLIMe solve?

Tavares: Card-linked offers enable merchants to deliver targeted discounts and loyalty benefits through mobile apps hosted by banks and digital publishers. The cool thing for consumers is that the offers can be used without a paper coupon or promo code. All they need to do is pay with their existing card. Prior to CLIMe, the CardLinx Listing Information Monitor eCenter, digital publishers had often found it cumbersome to consistently source high-quality merchant card-linked offers. Merchants and retailers have also found it difficult to find the broadest possible audience for their card-linked offers and card-linked loyalty programs. CLIMe solves both of these problems by providing a central online platform for merchants and their card-linked technology partners to publish the availability of their card-linked offers to large-scale digital publishers and payment card issuers.

Finovate: Who are your primary customers?

Tavares: The CardLinx Association is a global multi-industry association focused on growing the card-linking industry. Our members include companies from the entire digital commerce ecosystem from digital publishers to payment systems to payment processors to card-linking technology companies to retailers and advertisers. For example, Facebook, Microsoft, Samsung, MasterCard, American Express, Airbnb, Whole Foods and Sears are all members. Our members are interested in developing the card-linking industry through developing common standards and industry services to minimize and eliminate friction in the sourcing, serving, publishing, redeeming, and cross syndicating of card-linked offers and loyalty programs.

Finovate: How does CLIMe solve the problem better?

Tavares: As a multi-industry association, CardLinx has the reach to make sure all participants in the card-linking ecosystem can access and distribute the latest offers and benefits through CLIMe. Before CLIMe, a central database for card-linking offers was unavailable.

Finovate: Tell us about your favorite implementation of your solution.

Tavares: Go Daddy, a leading hosting company recently joined CardLinx and used CLIMe to publish an offer for their web-hosting services. Using CLIMe enabled them to get their offer to multiple banks and digital publishers. This enabled them to get a much broader reach for their offer in a very short amount of time.

Finovate: What in your background gave you the confidence to tackle this challenge?

Tavares: When I listened to our members and others in the card-linking industry, a central repository of offers and benefits like CLIMe was a recurring item on the wishlist to help propel the growth of the industry. By the time I was at CardLinx, I had the mandate from our board and feedback from others in the industry that a centralized database would ease the sourcing of card-linked offers with the end result of bringing card-linking to more consumers.

Additionally, before starting the CardLinx Association over two years ago, I was in the payments industry for many years first at Visa and First Data. Before that I was an investment banker and attorney in the field so I’ve seen the payments industry develop over the years and was able to identify areas where collaboration among companies and industries would benefit all.

Finovate: What are some upcoming initiatives from CardLinX that we can look forward to over the next few months?

Tavares: CardLinx is working on our next set of industry standards. In the past we have addressed common card-linked insertion orders, fraud reporting and prevention, priority of offer redemptions and standard reporting metrics. We are currently working on standards to enable uniform opt-in consents for consumers and also new standards for SKU/Item level offers.

Finovate: Where do you see CardLinX a year or two from now?

Tavares: The CardLinx Association has been doubling in size every year since we started. We see our membership continuing to grow, especially with retailers and advertisers as well as internationally. In the past year, we have added members from South Korea, Japan, Germany and as far away as Iceland. Card-linking is becoming the technology of choice for digital commerce.

Also, we see card-linking moving beyond just cards and mobile phones to what we call the Internet of Commerce Things or IoCT. The IoCT is using card-linking to enable everyday objects to pay and be used for commerce. These things include watches that can pay, fitness trackers that can pay, refrigerators that can pay and even cars that can pay. The CardLinx Association will play a central role in standardizing and facilitating the growth of the Internet of Commerce Things.

Finovate: What kind of metrics or facts about CardLinX can we share with our readers?

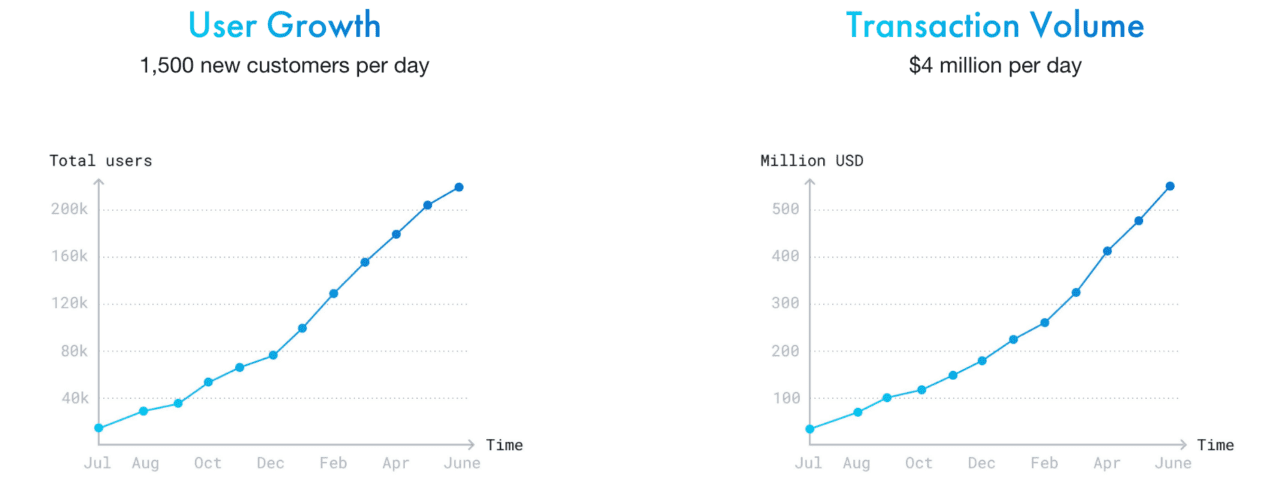

Tavares: In our annual survey sourced from the largest merchants, payment companies, publishers and card-linked technology companies, over 50% of respondents noted that card-linking transactions have grown by at least 50% in the last 12 months. This compares to last year’s February survey when the majority of respondents reported growth of at least 10%. So card-linking offers and loyalty programs are still growing at a rapid pace because innovations to create branded purchases are on the rise as is consumer awareness of card-linking. Additionally, over 60% of respondents say that card-linking has the potential to grow to over a $10 billion revenue industry in the U.S. alone. So there is a lot of room for new entrants to the card-linking industry.

The CardLinx Association’s Silvio Tavares, CEO and president, demoed at FinovateSpring 2016 in San Jose

The CardLinx Association’s Silvio Tavares, CEO and president, demoed at FinovateSpring 2016 in San Jose We interviewed Silvio Tavares, the company’s CEO and president, after his FinovateSpring 2016 demo in San Jose.

We interviewed Silvio Tavares, the company’s CEO and president, after his FinovateSpring 2016 demo in San Jose.

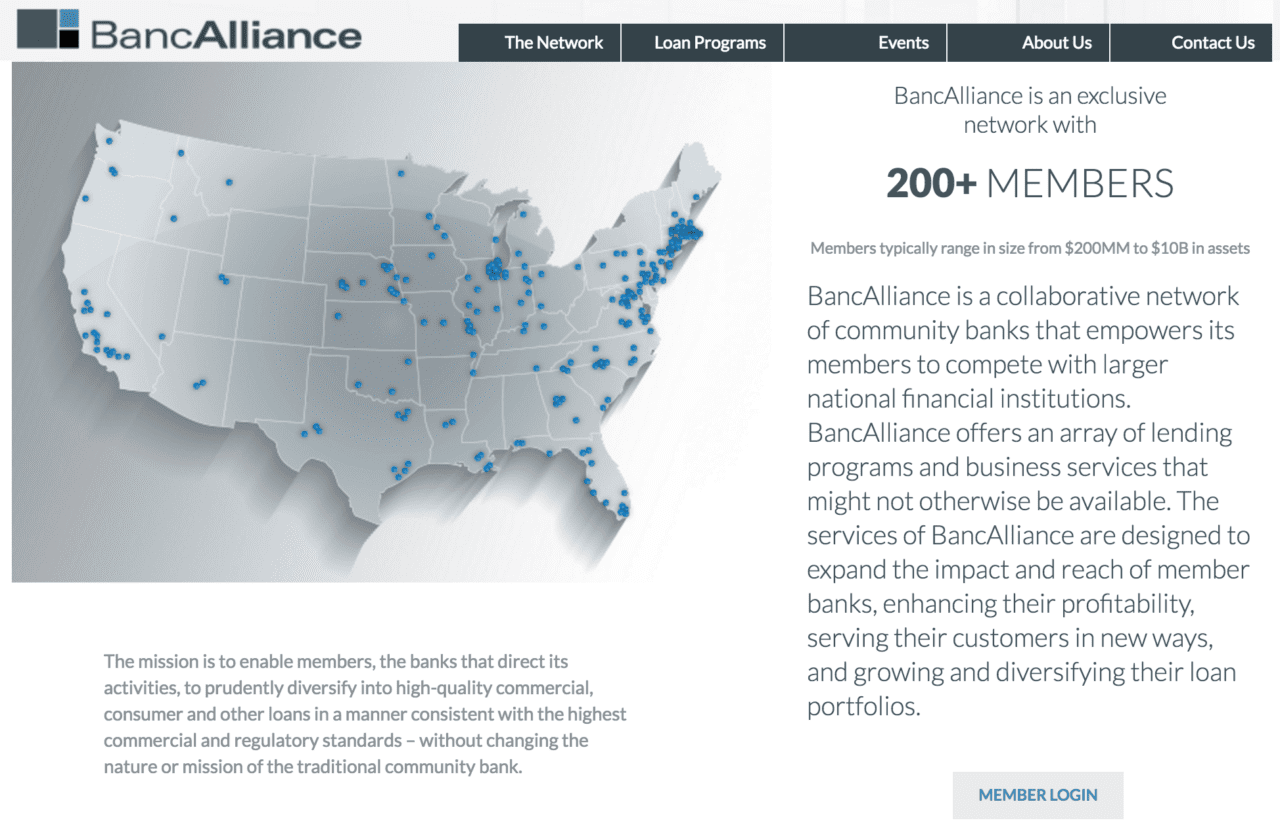

BancAlliance’s member banks—ranging in size from $200 million to $10 billion AUM across 40 U.S. states—receive access to programs and services that help them compete against larger financial institutions. The member banks can now offer co-branded personal finance and wealth-management tools powered by Personal Capital.

BancAlliance’s member banks—ranging in size from $200 million to $10 billion AUM across 40 U.S. states—receive access to programs and services that help them compete against larger financial institutions. The member banks can now offer co-branded personal finance and wealth-management tools powered by Personal Capital.

CEO Nikolay Storonsky, founder, and CTO Vlad Yatsenko debuted Revolut at FinovateEurope 2015 in London.

CEO Nikolay Storonsky, founder, and CTO Vlad Yatsenko debuted Revolut at FinovateEurope 2015 in London.

Neustar’s Andrew Artemenko, senior director of digital strategy, debuted PlatformOne at FinovateSpring 2016

Neustar’s Andrew Artemenko, senior director of digital strategy, debuted PlatformOne at FinovateSpring 2016