Despite being AARP-eligible (50+), it took a conversation at Finovate with Theo Lau of AARP (see her guest post last month), to understand how poorly banks market to the older population (a demographic that controls 83% of the country’s household wealth).

Problem 1: Let’s start with the name. What’s the most common name for accounts geared towards older customers? Senior checking. When I was a 30-something bank product manager, that sounded reasonable to me. But guess what, more than half of

Problem 1: Let’s start with the name. What’s the most common name for accounts geared towards older customers? Senior checking. When I was a 30-something bank product manager, that sounded reasonable to me. But guess what, more than half of

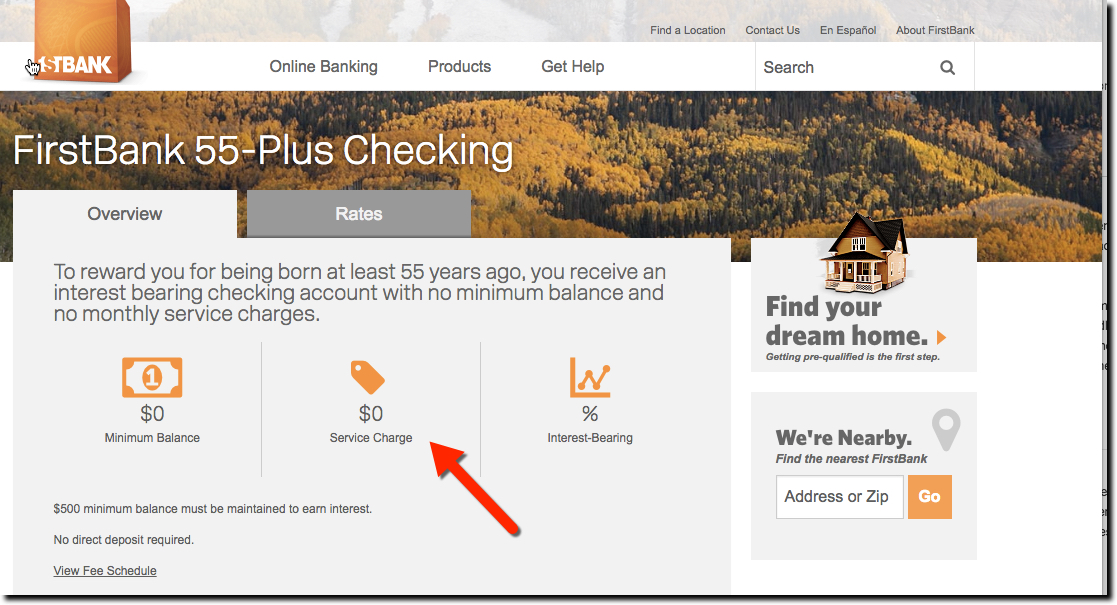

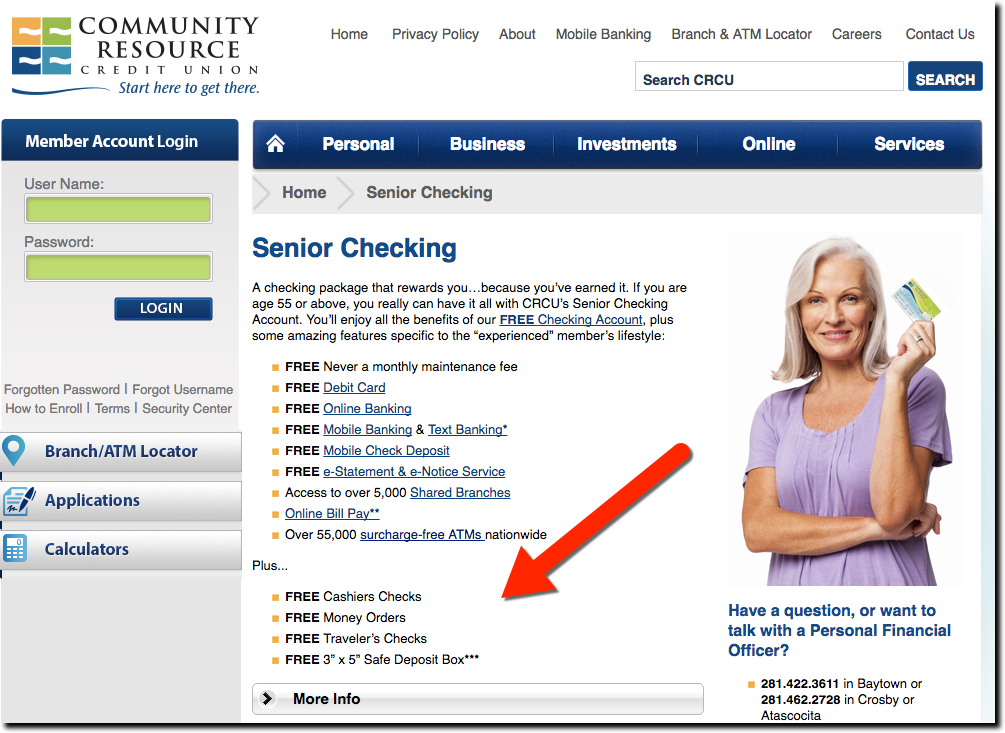

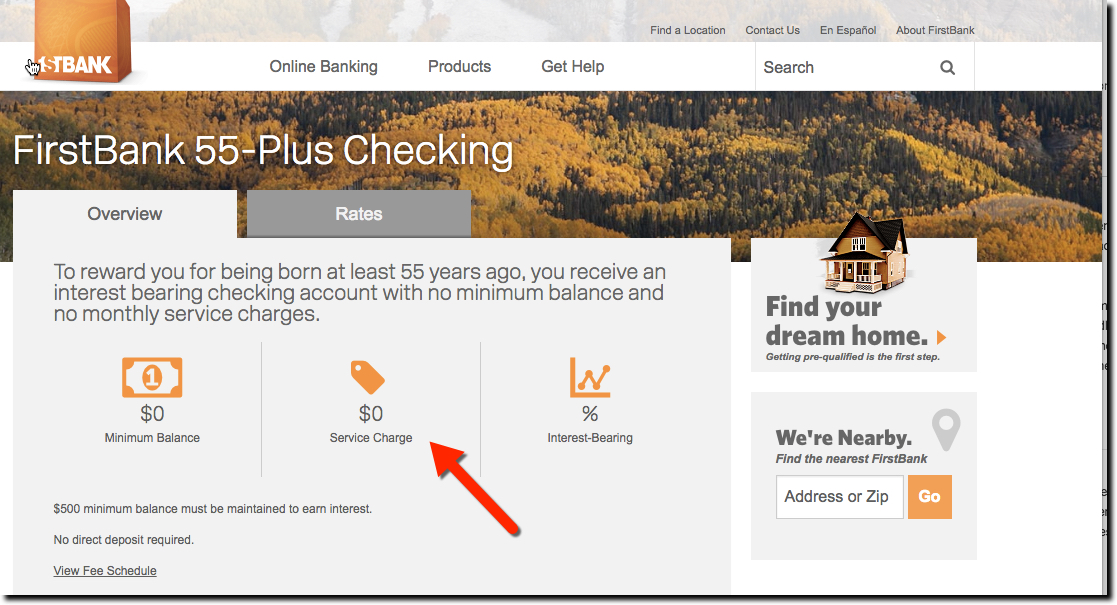

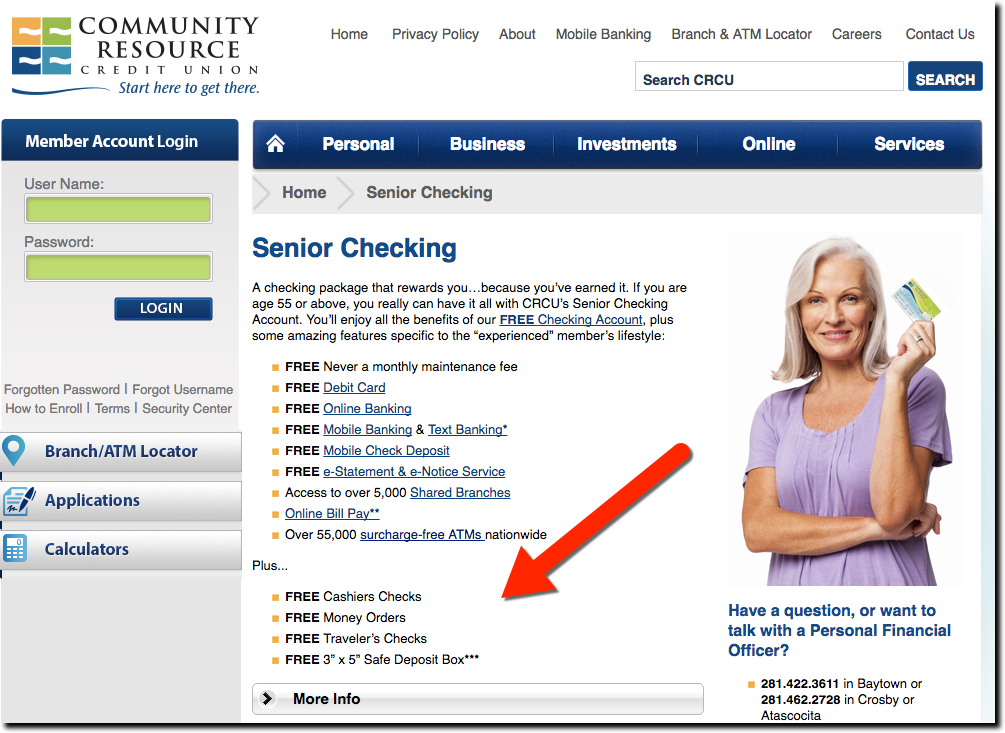

Problem 2: What’s worse than seeing the word Senior splashed across the top of the page? The clip art (sample above). It generally shows a smiling couple looking bewildered at a computer screen, or looking like they are having way too much fun on the golf course. Those images do not make your product more attractive to older customers. They are just tired cliches. We are all for artwork on webpages, but for older adults, we think it’s better to try something other than mature faces. For example, 1st Bank uses a graphic that appeals to all ages and demographic: $0.

Problem 3: What’s the incremental value? If you are going to market a special account to me, it better have something special. As much as I like 1st Bank’s graphics, there’s really no significant benefits over the bank’s plain old checking account, which are also fee-free. The one difference is interest, but at the current rate of 1 basis point, that’s more of an insult than a benefit (seriously, don’t call it interest-bearing if my after-tax gain is just a nickel per month per $10,000). You can add something simple, even a T-shirt, water bottle, or 2-for-1 dinner coupon. But there has to be something to set it apart.

But adding value for the older segment seems rare these days. It took 30 minutes of searching before I found a “seniors” checking account with a tangible benefit compared to the FI’s other checking accounts. Community Resource Credit Union gives its 55-and-older members a free safe deposit box, money orders, travelers, and cashiers checks (see below).

Bottom line: Don’t bother offering Senior checking that differs from your other accounts by name only. It’s disingenuous, off-putting to customers, and embarrassing to your staff who have to explain it. But DO offer an account targeted to your older customers, a Baby Boomer account, that includes SOMETHING that sets it apart. Preferably something your older customers truly value, such as extra security or a dedicated customer service support line.

BBVA’s Shamir Karkal and Diego Blanco presentied the bank’s API Market

BBVA’s Shamir Karkal and Diego Blanco presentied the bank’s API Market

Not to be outdone by the notoriously clever Tweeters of Finovate, the attendees of

Not to be outdone by the notoriously clever Tweeters of Finovate, the attendees of

Presenters

Presenters Ervin Ukaj, R&D Software Director

Ervin Ukaj, R&D Software Director

Presenters

Presenters Bhavana Mallesh, Director of Product Engineering

Bhavana Mallesh, Director of Product Engineering

Presenter

Presenter