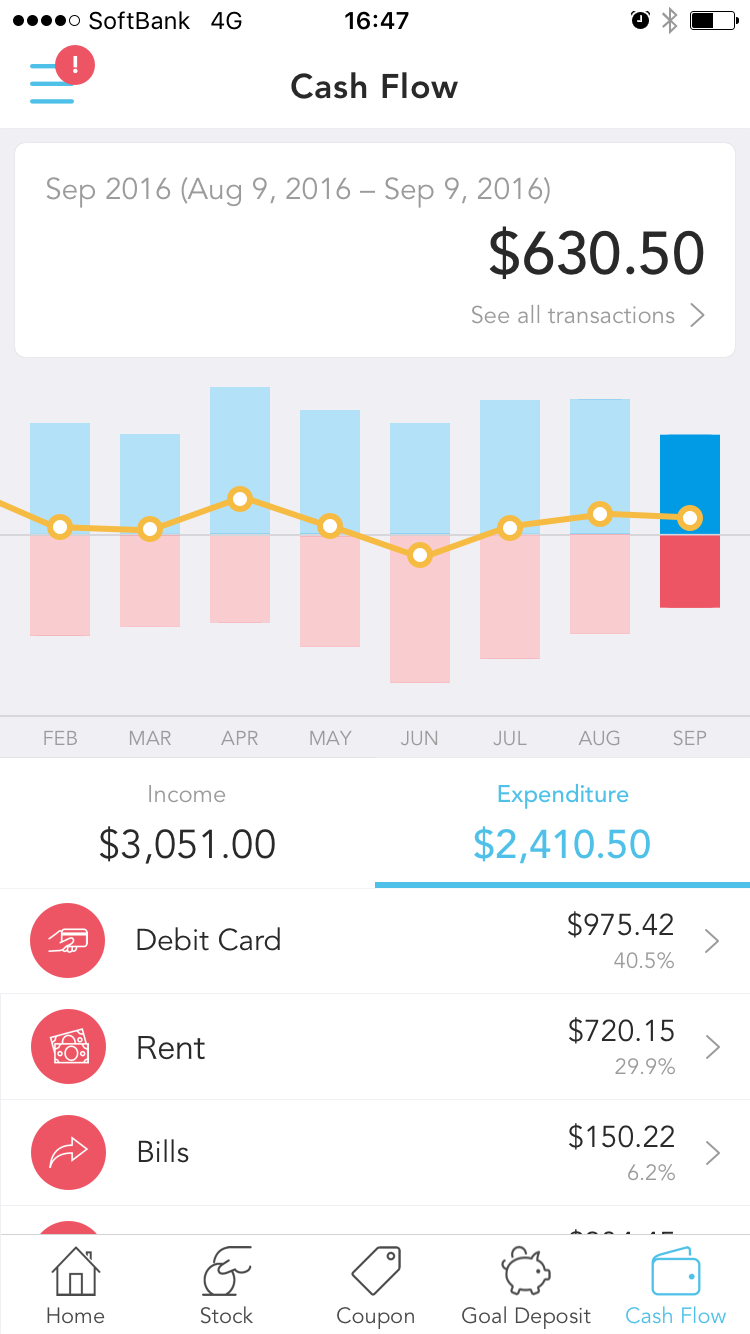

iBank Marketing’s Wallet+ PFM goal-saving platform aims to give banks a tool to help their clients create and achieve their short-term financial goals. During the company’s demo at FinovateFall 2016 in New York, Senior Manager Masato Kubota said, “Wallet+ removes the stress for target achievement and offers a new user experience by creating an ecosystem with your customers and their savings.”

iBank Marketing’s Wallet+ PFM goal-saving platform aims to give banks a tool to help their clients create and achieve their short-term financial goals. During the company’s demo at FinovateFall 2016 in New York, Senior Manager Masato Kubota said, “Wallet+ removes the stress for target achievement and offers a new user experience by creating an ecosystem with your customers and their savings.”

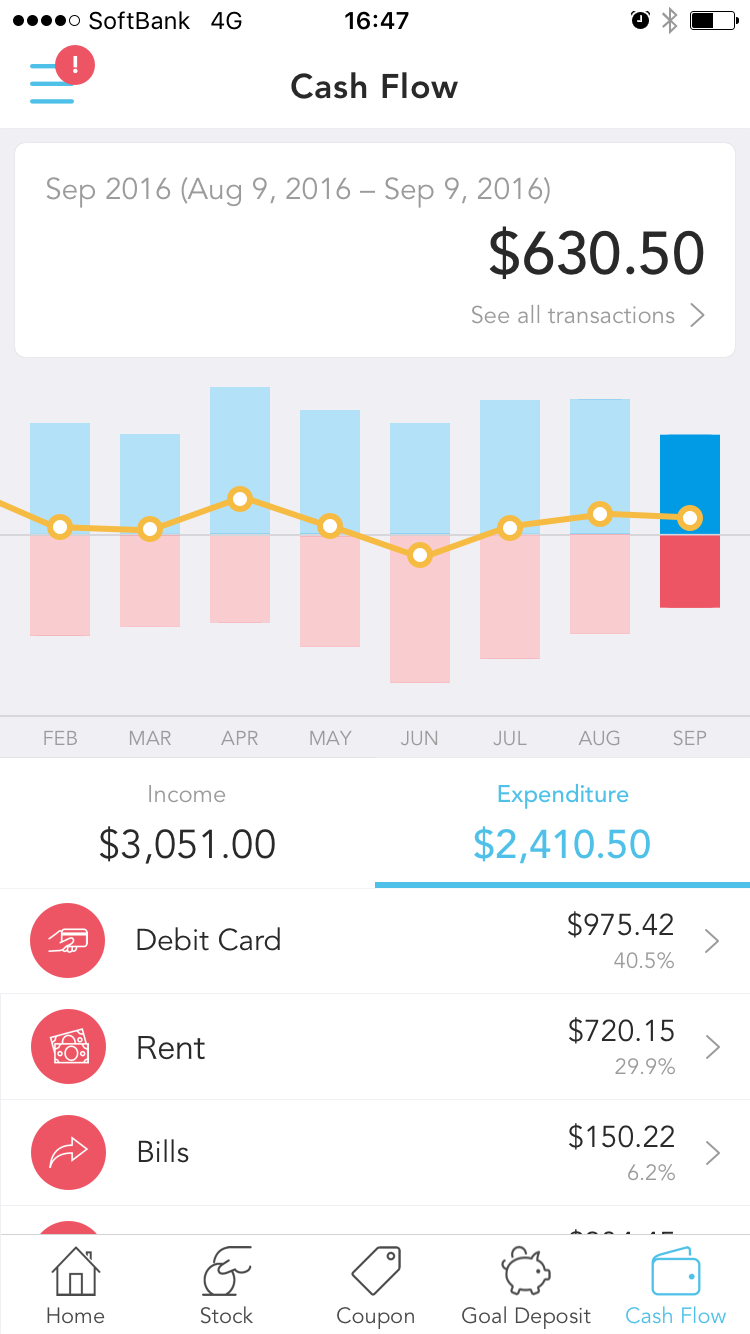

Using popup notifications, Wallet+ offers users suggestions to help them reach their savings targets. The app also shares special offers in the form of coupons to help customers save extra money toward their goals. By offering financial and non-financial services, Wallet+ creates a new marketing channel to reach customers.

Company facts:

- Founded in 2016

- Headquartered in Japan

- Wallet+ is available in the Apple app and Google Play stores

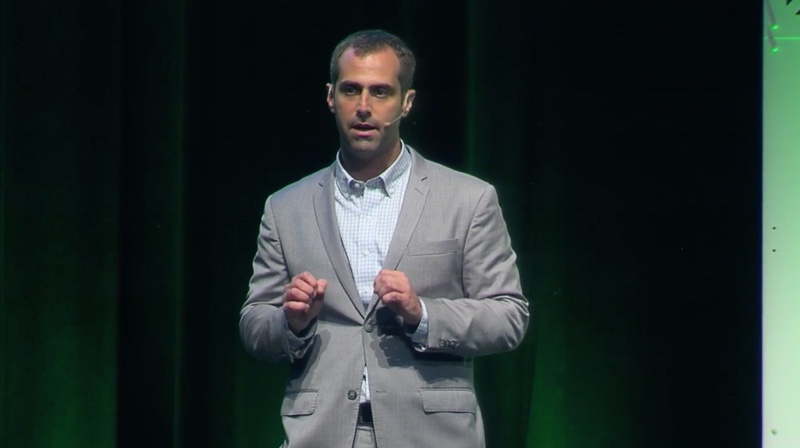

iBank Marketing’s Kenichi Nagayoshi, CEO; Masato Kubota, senior manager; and Teppei Fujiwara, manager, presented Wallet+, an app for goal savers, at FinovateFall 2016 in New York

iBank Marketing’s Kenichi Nagayoshi, CEO; Masato Kubota, senior manager; and Teppei Fujiwara, manager, presented Wallet+, an app for goal savers, at FinovateFall 2016 in New York

I spoke with iBank Marketing CEO Kenichi Nagayoshi after FinovateFall for a closer look at the mobile app and insight into the company’s future plans.

I spoke with iBank Marketing CEO Kenichi Nagayoshi after FinovateFall for a closer look at the mobile app and insight into the company’s future plans.

Finovate: What problem does iBank Marketing solve?

Nagayoshi: Our product— Wallet+ —improves the efficiency of the saving process. Almost all people have saving experiences for their own goals. However, it is not easy to save and achieve goals due to various stresses in the saving process. Some may spend too much money; others may forget and fail to save on schedule. The motivation to achieve their goal might be decreasing. Wallet+ removes the stress for target achievement and offers a new user experience by creating an ecosystem with customers of banks, consumers and SMEs.

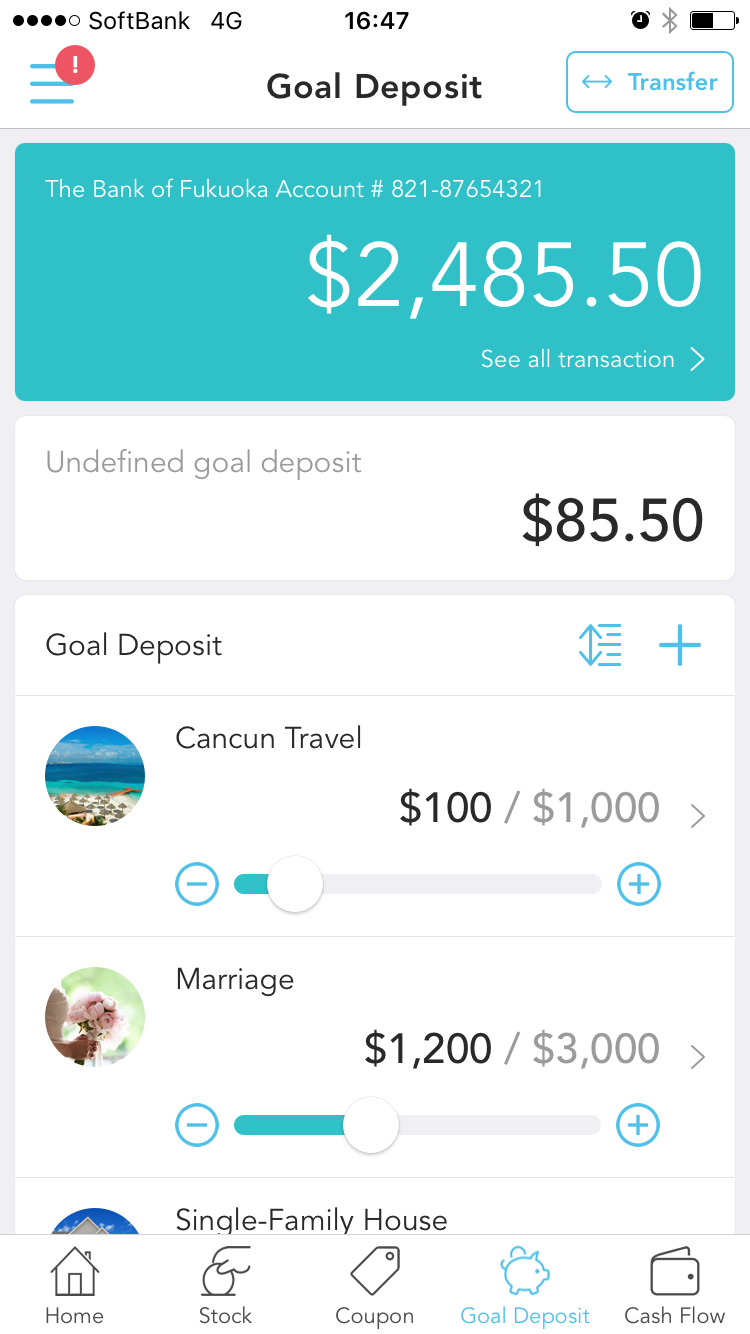

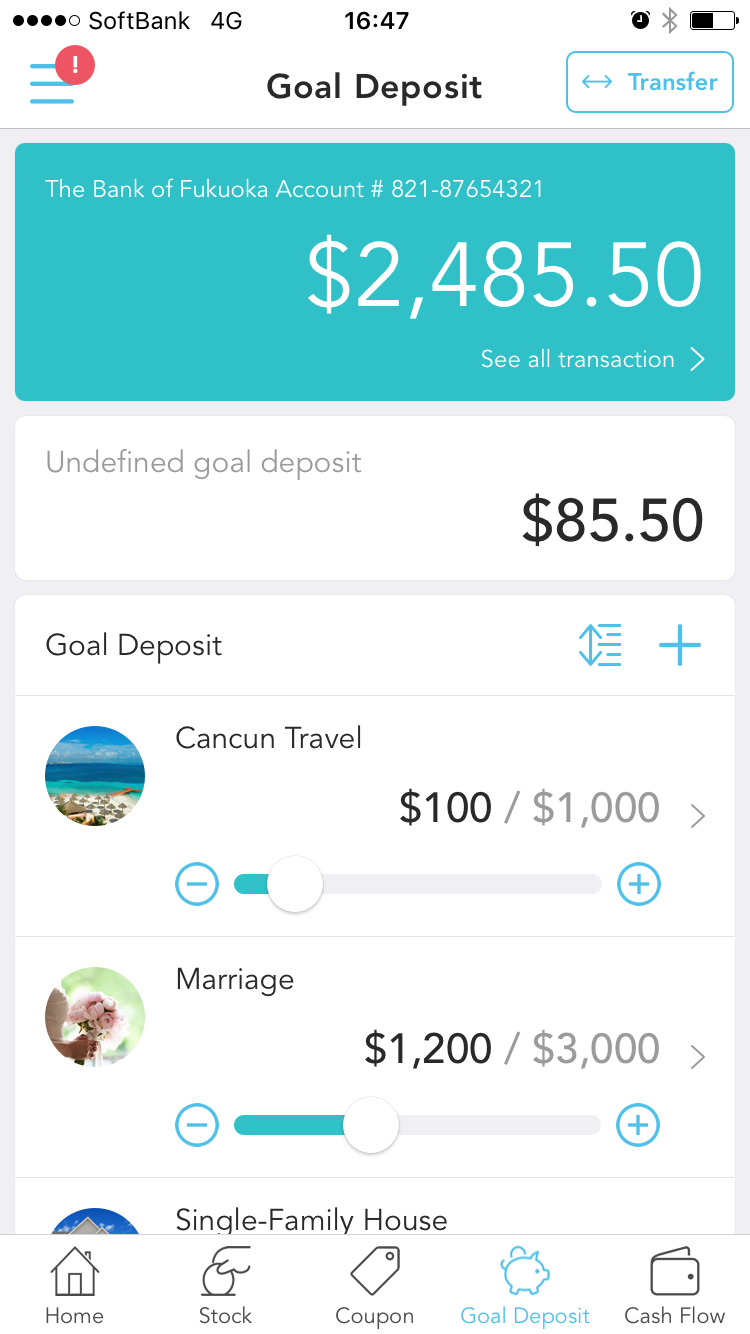

Wallet+ shows the progress of an account with multiple goals

Wallet+ shows the progress of an account with multiple goals

Finovate: Who are your primary customers?

Nagayoshi: iBank Marketing is seeking partnerships with banking corporations. Banks these days, especially ones in local areas, face an aging population and decreasing birthrates similar to Japanese banks. Banking corporations are unable to maintain their revenue with only their traditional business services, deposit and lending. However, a regional bank has many consumers and SMEs which have long-term business relationships with the bank. They might be great assets in the next business model. It’s time for banks to change their business model by offering new value to their customers. If a bank can make a local ecosystem that connects the individual customers and SMEs, regional banks will be able to change, and iBank can establish the local ecosystem.

Finovate: How does iBank Marketing solve the problem better?

Nagayoshi: iBank Marketing offers a new experience driven by combining financial and nonfinancial services (informational content and coupons) to retail customers, and new marketing opportunities to corporate customers, by developing and expanding a new ecosystem based on a business model driven by collaborating with business partners from various sectors and industries.

Finovate: Tell us about your favorite aspect of your solution.

Nagayoshi: Informational content. Wallet+ aims to offer seamless services combining financial and nonfinancial services. One of them includes information which is related to life events, travel, car, marriage, education and so on. Our financial service such as PFM [can] capture consumers’ behavior and identify customer preference, which is input to customize the informational content, stimulating the customer’s needs. Customers are guided through necessary financial support and recommendation on products and coupons.

Wallet+ features special offers and coupons to help users save money toward their goals

Wallet+ features special offers and coupons to help users save money toward their goals

Finovate: What in your background gave you the confidence to tackle this challenge?

Nagayoshi: I worked for a Japanese regional bank, mainly responsible for corporate planning. In my 20 years of experience, I felt that the banking service was very dull and traditional. Banks are bound by many regulations and a traditional internal process, so they are unable to develop innovative services. Isn’t this situation what has happened in many countries as well as Japan? From such background I researched and developed the service the user really asks of a financial institution, hence a new banking platform, Wallet+.

Finovate: What are some upcoming initiatives from iBank Marketing to look forward to over the next few months?

Nagayoshi: We will launch a points-based service called myCoin this autumn. Wallet+ users are able to store myCoin by using not only Wallet+ but also other banking services. myCoin is exchangeable for cash and other popular points provided by Japanese famous companies. These points can be used in various nonfinancial services, convenience stores, gas stations and so on. Therefore Wallet+ users and banking customers are able to have seamless experiences between financial and nonfinancial services.

Finovate: Where do you see iBank Marketing a year or two from now?

Nagayoshi: iBank Marketing aims to be a platform for banking corporations. We commenced the provision of products and services which suit customers’ preferences based on their attributes and status by leveraging the capabilities of a regional bank in influencing various local businesses and collaborating with them. Additionally, collaboration with other Japanese local financial institutions, which are facing the same kind of issues, will be established aiming to expand the services horizontally; some of the banks start demonstrating an intention to participate in the development of an ecosystem, and the business system might be launched in other regions.

Watch iBank Marketing’s Kenichi Nagayoshi, CEO; Masato Kubota, senior manager; and Teppei Fujiwara, manager, debut Wallet+ in their live demo at FinovateFall 2016:

Founded in 2012 and headquartered in Germany, figo demonstrated its cloud banking API at FinovateEurope 2013. Europe’s first banking service provider, figo provides a banking API that enables third parties to connect apps and services to more than 3,000 FIs and financial service organizations. Operating in Germany and Austria, figo specializes in solutions to help companies with their Payments Services Directive strategies (PSD2). This, according to some, has been key to renewed investment interest in the company and was highlighted by Deutsche Börse’s Kamalia. “The figo team led by André Bajorat has made clear the opportunities that exist for virtually every player in the financial sector and the enormous potential that PSD2 implementation offers to European industry,” Kamalia said.

Founded in 2012 and headquartered in Germany, figo demonstrated its cloud banking API at FinovateEurope 2013. Europe’s first banking service provider, figo provides a banking API that enables third parties to connect apps and services to more than 3,000 FIs and financial service organizations. Operating in Germany and Austria, figo specializes in solutions to help companies with their Payments Services Directive strategies (PSD2). This, according to some, has been key to renewed investment interest in the company and was highlighted by Deutsche Börse’s Kamalia. “The figo team led by André Bajorat has made clear the opportunities that exist for virtually every player in the financial sector and the enormous potential that PSD2 implementation offers to European industry,” Kamalia said.

In the networking hall at PMQ

In the networking hall at PMQ Taking a break for a selfie

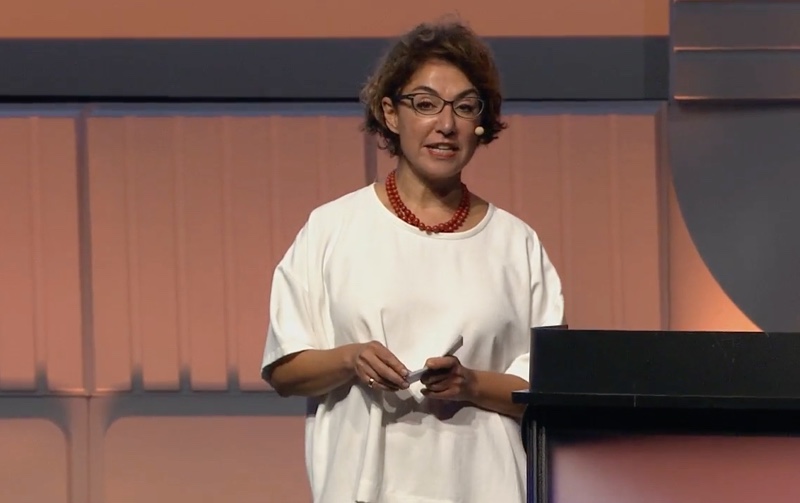

Taking a break for a selfie Sentifi presenter Tran Huyen preps for her live demo

Sentifi presenter Tran Huyen preps for her live demo

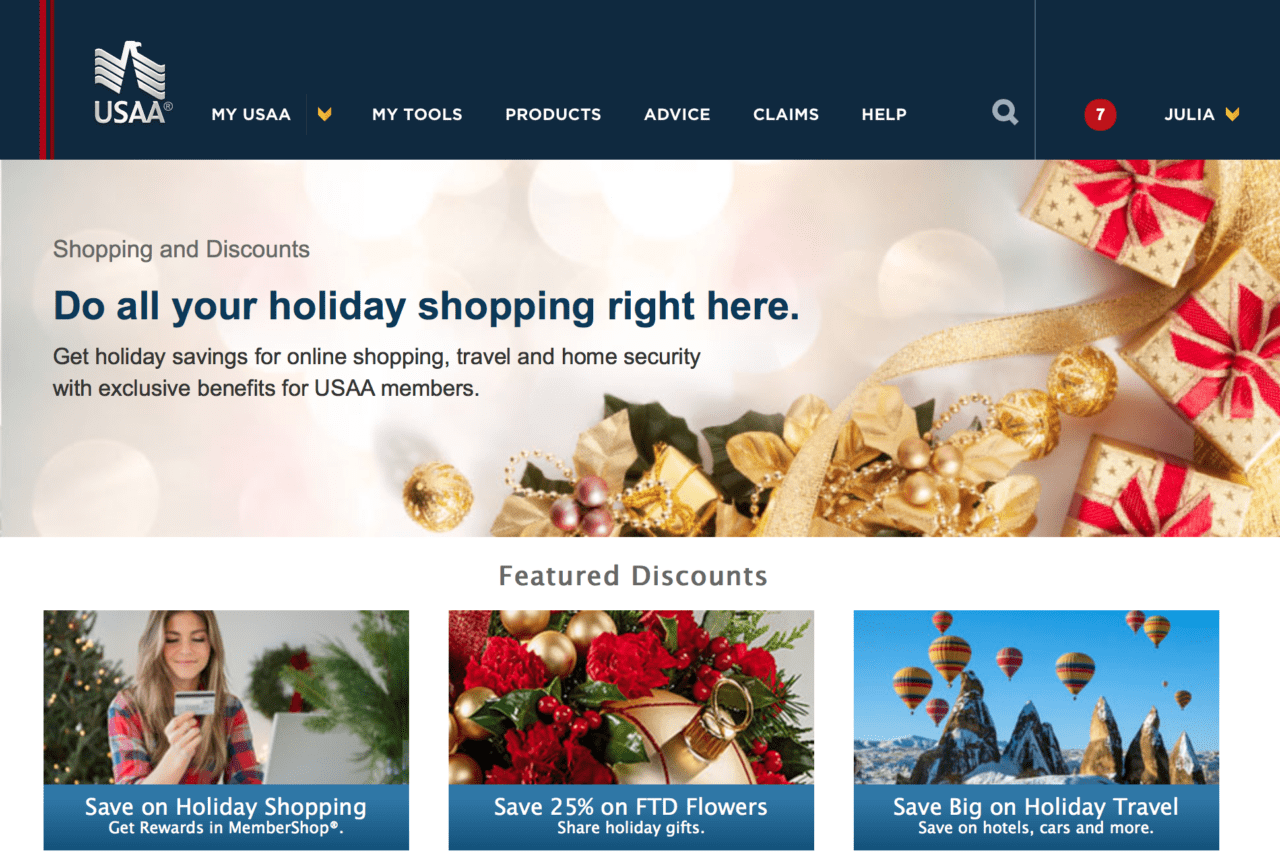

USAA positions itself as a one-stop-shop for clients’ holiday needs.

USAA positions itself as a one-stop-shop for clients’ holiday needs.

iBank Marketing’s

iBank Marketing’s iBank Marketing’s Kenichi Nagayoshi, CEO; Masato Kubota, senior manager; and Teppei Fujiwara, manager, presented Wallet+, an app for goal savers, at FinovateFall 2016 in New York

iBank Marketing’s Kenichi Nagayoshi, CEO; Masato Kubota, senior manager; and Teppei Fujiwara, manager, presented Wallet+, an app for goal savers, at FinovateFall 2016 in New York I spoke with iBank Marketing CEO Kenichi Nagayoshi after FinovateFall for a closer look at the mobile app and insight into the company’s future plans.

I spoke with iBank Marketing CEO Kenichi Nagayoshi after FinovateFall for a closer look at the mobile app and insight into the company’s future plans. Wallet+ shows the progress of an account with multiple goals

Wallet+ shows the progress of an account with multiple goals Wallet+ features special offers and coupons to help users save money toward their goals

Wallet+ features special offers and coupons to help users save money toward their goals