Gradatim’s MFInsure is an out-of-the-box insurance solution that makes it easy to set up, deploy, and manage insurance products. To further enhance the offering, the company leverages AI to predict life events, identify up-sell opportunities, and provide tailored recommendations for clients.

In his FinovateAsia 2016 demo, the company’s CEO and founder, Prakash Viswanathan showed how the system quickly launches an omni-channel insurance product without the need for IT support. Viswanathan concluded the demo by offering social proof when he said, “We have earned the right to be here because in the last 18 months, this system has on-boarded a whopping 50+ million policies across commercial lines of business, retail lines of business, and small ticket insurance products.”

Company facts

- $ 2.5 million in funding

- 40 employees

- Monthly revenue: $100,000 and monthly revenue growth: 3%

Prakash Viswanathan (CEO & Founder) and Siva Kumar (Head of Technology) demo Gradatim MFInsure OnDemand Insurance System at FinovateAsia 2016 in Hong Kong

We chatted with Prakash Viswanathan, Gradatim CEO and founder, to get a closer look at the insurtech solution, Gradatim MFInsure OnDemand Insurance, he launched at FinovateAsia last year.

Finovate: What problem does Gradatim solve?

Finovate: What problem does Gradatim solve?

Viswanathan: Insurance company CXO’s are facing the challenge of delivering new age digital products to consumers. CXO’s also face the challenge of product innovation required to meet the aspirational needs of business consumers and growing middle income consumers.

Gradatim helps insurance company CXO’s focus on optimization of customer service, helps business teams with product and service innovation and improve internal processing efficiencies – specially in this digital age and with emerging products aligned to the growing middle income consumers.

Small to mid-size insurance carriers have many of the same business goals as their larger industry peers—market growth, accelerated speed to market for new products and the ability to tailor services to their consumer’s needs—but not the same budget allocations or access to resources. That means when it comes to choosing and implementing a policy administration system, cost is a big driver. Achieving the balance between affordability and breadth of functionality is often not possible for small to mid-size insurance carriers.

Gradatim implements cloud based, flexible standard systems for the core processes of life and non-life insurance. Gradatim’s on-demand insurance system, Gradatim MFInsure, is a new age policy administration system that helps insurance companies solve these problems.

Finovate: Who are your primary customers?

Viswanathan:: Gradatim primarily works with insurance companies, brokerage firms, insurance intermediaries and fintech companies.

Finovate: How does Gradatim solve the problem better?

Viswanathan: Gradatim MFInsure is an integrated, end-to-end system that supports all primary processes: from quotation to policy issuance; claims to settlement. It is a complete policy administration system.

Gradatim MFInsure is highly configurable and thus provides the benefit of configuration over coding. Products, processes and channels can be setup by configuration without having to code.

Gradatim MFInsure helps build a engagement model with consumers in the digital age. Not just digital products, but also traditional products across life, P&C, and health. The open, unified digital framework makes it possible to deliver products and services, and create a multi-dimensional customer experience across all devices and channels. They enable the insurance companies to develop and deliver services for use by both insurance staff and customers, via any device or channel.

Gradatim MFInsure helps reduce time-to-market up to 300%. The solution also helps achieve cost savings in underwriting and administer policies by up to 50%. This makes it feasible to launch new products across new markets and achieve faster break-even.

Gradatim MFInsure benefits from the use of cloud services. Cloud-based deployment reduces administrative costs associated with managing a dedicated data center. It is also available on transaction pricing model – an innovative approach to reduce capital investment.

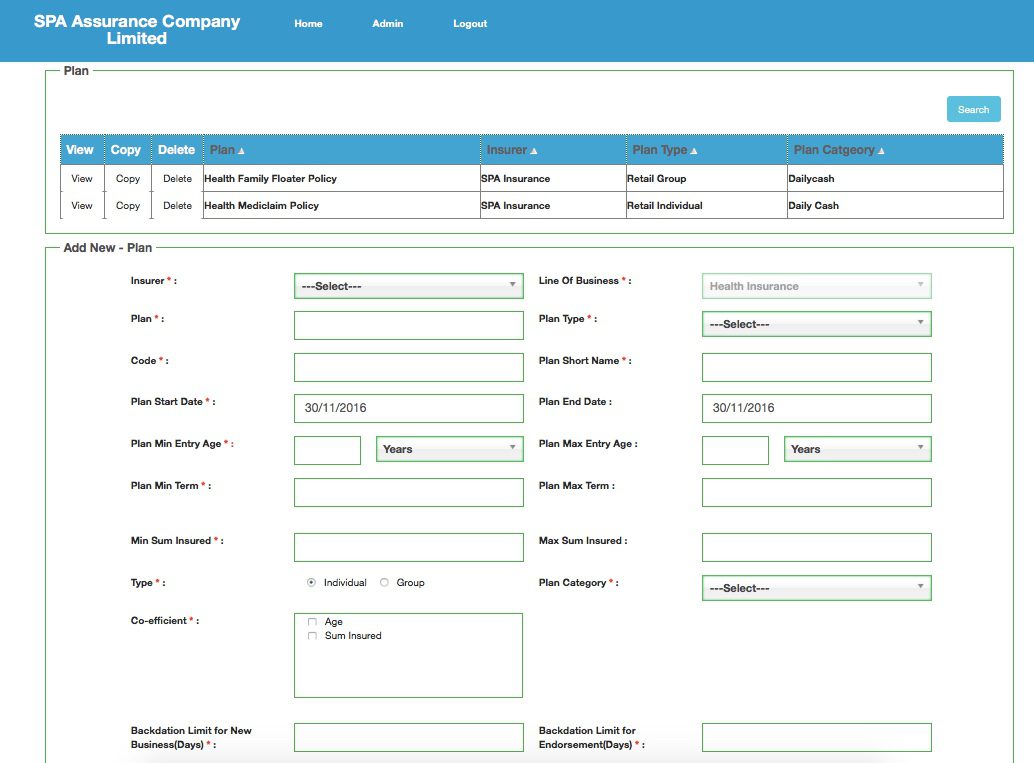

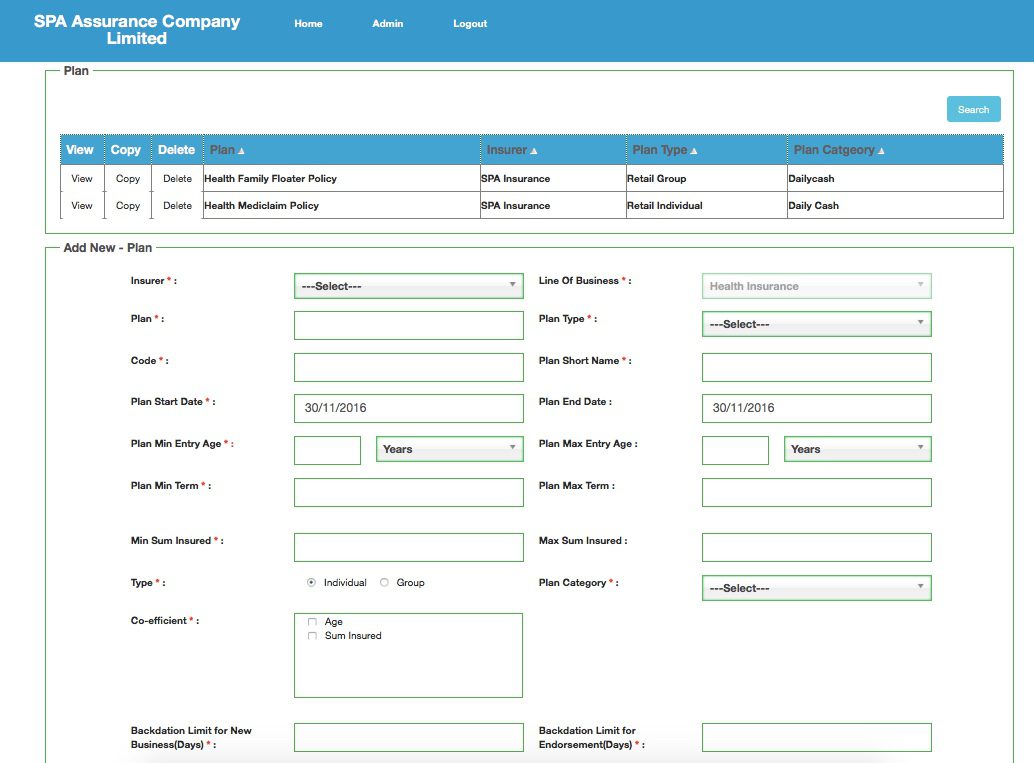

Above: Gradatim’s on-demand administration system portal

Finovate: Tell us about your favorite implementation of your solution.

Viswanathan: If I may, I would like to provide two implementation examples:

1- Customer: Asia’s Second Largest General Insurer:

- Opportunity: Providing a shopping cart to identified and categorized groups – Providing Multiple Insurance Products to the identified group.

- How it started: Public Accountants in India are members of The Institute of Chartered Accountants (ICAI). There are 0.5 Million Public Accountants who are members of the Institute. The Insurer wanted to leverage the relationship with the Institute and provide multiple Insurance products to the Public Accountants. A total of 7 Products were identified and it was decided to create an online portal that can be accessed by the Public Accountants. Once the Public Accountant is validated as a member of the Institute, he / she can benefit from the special discount and special plans and coverages being extended to them by the Insurer.

- Implementation: All Seven Products setup in Gradatim MFInsure with defined rules for Underwriting. “Online” Channel was configured. Payment Gateway integrated to enable Public Accountants to “BUY” Policy Online.

- Timeline to implement: The complete setup was completed in 6 weeks.

- Current Status: More than 3,40,000 health Policies, 72,000 Motor Policies, 2000 Professional Indemnity Policies and 800 Office Protection Policies are Live in the System.

- Benefits to Insurer: Business Users can maintain the system without need to involve IT. Changes to Coverages, Pricing, Process, Underwriting Rules etc. can be managed by business users.

MFInsure is currently live with this customer across 12 such Groups delivering more than US $30 million in premium per year. The Insurer has created a separate web portal branch to expand this model and manage such relationships in the future.

2- Customer: fast-growing life insurer

- Opportunity: launch new life insurance products, including term, endowment and annuity products.

- Channel: post of sale (POS) defined as POS sales persons, individual agents, intermediaries and direct consumer.

- How it started: approval for products by insurance regulator.

- Implementation: Gradatim MFInsure for life insurance system was deployed by the insurer to write, underwrite, manage the POS products and issue electronic certificates as a stand-alone policy system. Provision to register and setup agents with a well-defined approval process. It gives the ability to manage agent business, process new business opportunities generated by agents, process payment from agents account and issue policies to customers directly. The system also was enabled to be operated on field using any standard smartphone.

- Timeline to implement: The complete setup was completed in 12 weeks.

- Benefits to Insurer: Rapid deployment and be the first to market the POS products. It required an arrangement with Telco to distribute products through the Telco’s agents. It was set up independent from legacy core but having the functionality to update business information and regulatory reporting from legacy core.

Above: template for quick insurance policy creation

Finovate: What in your background gave you the confidence to tackle this challenge?

Viswanathan: I have an entrepreneurial background, having started and scaled multiple businesses in the past and a team that is more than ready to walk-the-talk. “The proof is in the pudding” and it is no wonder that we have been able to help insurers create new markets, build new products and deploy them faster than anyone else can. Over 52 million insurance policies are currently live and active in Gradatim MFInsure.

Finovate: What are some upcoming initiatives from Gradatim that we can look forward to over the next few months?

Viswanathan: We are excited about the algorithmic engine that has the ability to understand what consumers are interested in — it has more than 13 top-level interest clusters and 450+ detailed clusters!

The algorithmic engine also drives sales to an insurer: imagine if an insurance company can reach out to a consumer when he or she is about to create a travel plan that best suits their upcoming travel.

The introduction of algorithmic engine would be a game-changer for Gradatim and for our insurance customers.

Finovate: Where do you see Gradatim a year or two from now?

Viswanathan: We believe Gradatim is poised to be a category leader – in the on-demand, cloud-based policy systems, managing tens of millions of insurance policies – for a cost far lesser than what insurers currently spend and addressing emerging market needs of consumers who can be categorized as the aspirational class.

Prakash Viswanathan (CEO & Founder) and Siva Kumar (Head of Technology) demo Gradatim MFInsure OnDemand Insurance System at FinovateAsia 2016 in Hong Kong

Before joining

Before joining  digitizing the credit decisioning process, making it faster, simpler, more secure and more accurate — while also making it a better experience for lenders and consumers. It really will be transformational.

digitizing the credit decisioning process, making it faster, simpler, more secure and more accurate — while also making it a better experience for lenders and consumers. It really will be transformational. I’m a software engineer at heart but started my career at Morgan Stanley where I advised technology, media, and telecommunications companies on M&A and equity/debt financings. I spent a lot of time covering internet infrastructure

I’m a software engineer at heart but started my career at Morgan Stanley where I advised technology, media, and telecommunications companies on M&A and equity/debt financings. I spent a lot of time covering internet infrastructure From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?

Of the dozens of implementations, a few of my favorite include: A) a global payments provider that processes millions of RPS, B) the world’s largest e-commerce and retail stores – you can imagine the threat landscape and scale during Cyber Monday, and C) an innovative health care provider (

Of the dozens of implementations, a few of my favorite include: A) a global payments provider that processes millions of RPS, B) the world’s largest e-commerce and retail stores – you can imagine the threat landscape and scale during Cyber Monday, and C) an innovative health care provider ( Where did you start your career and how did you gain the experience needed to run the tech side of your company?

Where did you start your career and how did you gain the experience needed to run the tech side of your company?

Finovate: What problem does Gradatim solve?

Finovate: What problem does Gradatim solve?

I started my career as a researcher working on automation and artificial intelligence systems, controlled by neural networks. That quickly evolved into a system architect role in software development, leading teams to develop tailor-made solutions for a multitude of enterprise-level customers.

I started my career as a researcher working on automation and artificial intelligence systems, controlled by neural networks. That quickly evolved into a system architect role in software development, leading teams to develop tailor-made solutions for a multitude of enterprise-level customers.

It’s hard to pick a single favorite implementation when there are so many cases that are unique in terms of innovation. If I have to pick one, my choice would be Visa Europe. A typical non-relational database environment, Visa Europe processed more than 18.9 billion transactions in 2015, peaking in excess of 2,000 transactions per second, with service levels and standards for authorized and cleared transactions at 99.999%. The Visa Europe network has maintained 100% availability for more than 100 months in a row, relying on our database technology to achieve such levels of reliability and performance. This would not be achievable with a relational-only database, mainly because a typical payment transaction requires zero relationship checks. We are very proud of this implementation, which is running and constantly expanding for several years already.

It’s hard to pick a single favorite implementation when there are so many cases that are unique in terms of innovation. If I have to pick one, my choice would be Visa Europe. A typical non-relational database environment, Visa Europe processed more than 18.9 billion transactions in 2015, peaking in excess of 2,000 transactions per second, with service levels and standards for authorized and cleared transactions at 99.999%. The Visa Europe network has maintained 100% availability for more than 100 months in a row, relying on our database technology to achieve such levels of reliability and performance. This would not be achievable with a relational-only database, mainly because a typical payment transaction requires zero relationship checks. We are very proud of this implementation, which is running and constantly expanding for several years already.