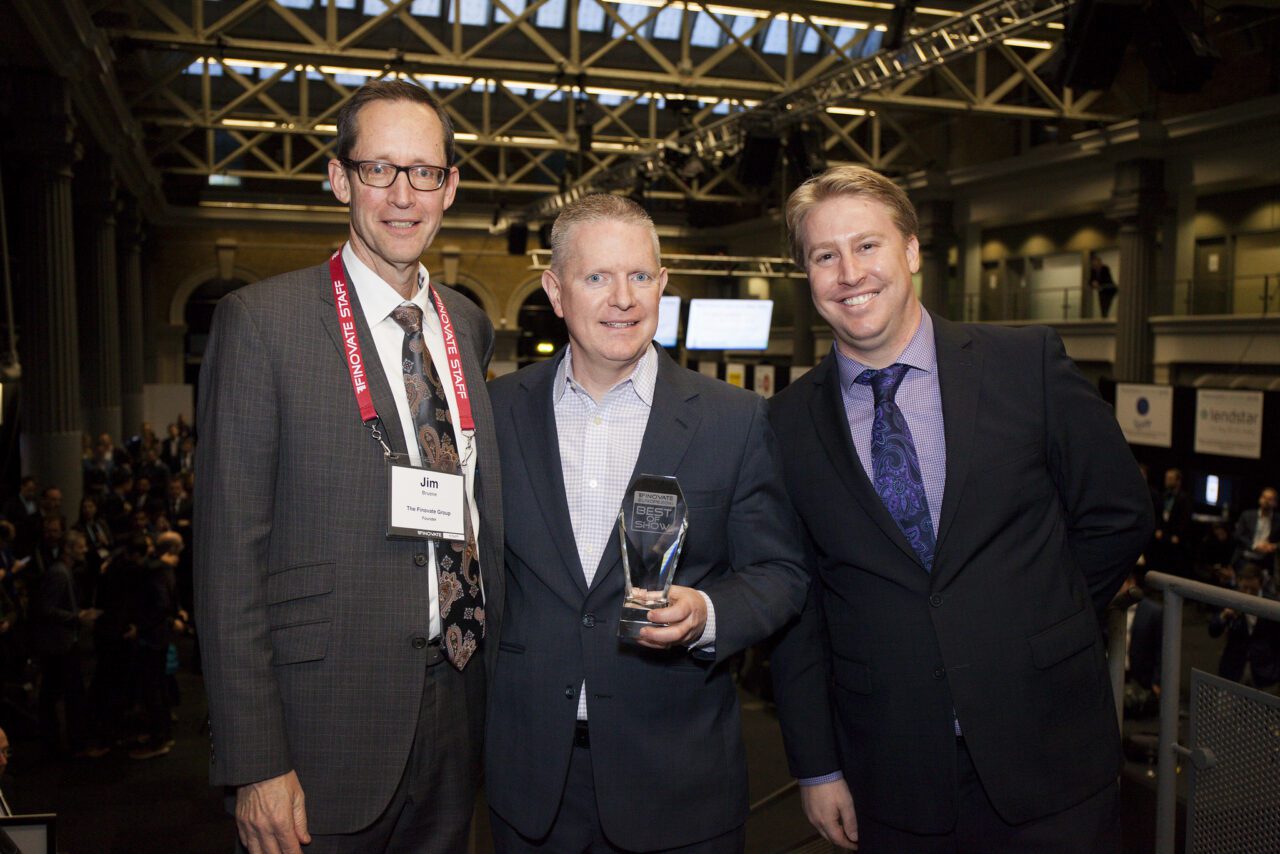

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

A look at the companies demoing live at FinovateEurope on the 7 and 8 of February 2017 in London. Pick up your tickets today and save your spot.

Moven is an engagement platform that brings value to customers while driving positive, measurable business outcomes for banks.

Features

- Innovation to prepare for PSD2

- Moving from history to advice through Impulse Savings

- Surprise – trust Moven, it’ll be exciting!

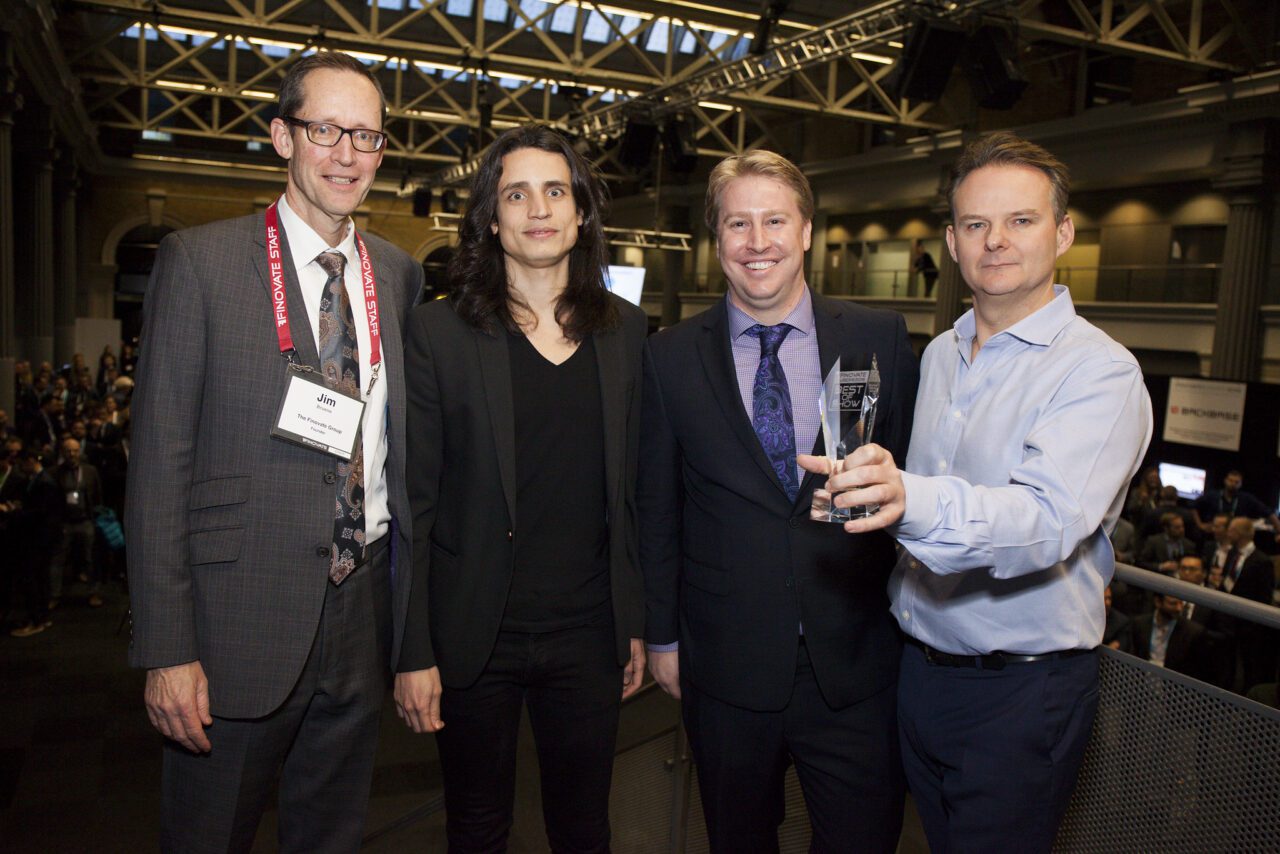

Presenters

Brett King, Founder & CEO

King is a five time Amazon bestselling author, a renowned commentator, a globally respected speaker on the future of business, and the CEO of a $100m startup called Moven.

Greg Midtbo, CRO

Midtbo has 30 years of experience helping global financial institutions transition through disruption. He is currently responsible for the Enterprise line of business at Moven.

Presenters

Presenters Szymon Mitoraj, Director of Internet and Mobile Banking Department, Head of Digital

Szymon Mitoraj, Director of Internet and Mobile Banking Department, Head of Digital

EyeVerify

EyeVerify IDScan Biometrics

IDScan Biometrics