You won’t hear us refer to collectAI’s innovative approach to outstanding payments as “Debt Tech.” But the Hamburg, Germany-based fintech startup does have a different idea of what matters most when it comes to accounts receivables management, the art of dunning, and debt collection.

You won’t hear us refer to collectAI’s innovative approach to outstanding payments as “Debt Tech.” But the Hamburg, Germany-based fintech startup does have a different idea of what matters most when it comes to accounts receivables management, the art of dunning, and debt collection.

During the company’s Finovate debut at FinovateEurope in February, CEO Mirko Krauel pointed out that while other A/R specialists focused solely on boosting collection rates (“which, of course, are very important,” he noted), default rates are only part of the picture. “It’s also about securing a potentially good customer relationship. It’s also about having low cost,” Krauel said, adding “We at collectAI want a perfect balance between those three goals.”

Pictured: collectAI CEO Mirko Krauel demonstrating collectAI Claims Management at FinovateEurope 2017.

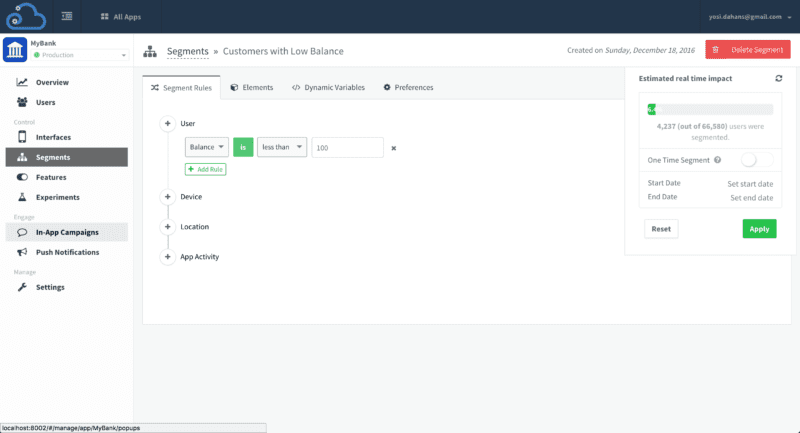

The fact that Krauel refers to the debtor as “the consumer” is a tip-off to the way the company believes is the best way to resolve outstanding payments more efficiently. The collectAI platform leverages artificial intelligence, for example, not only to determine the best communication channel to use to reach the debtor, but also to figure out the best time and the best tone to take. This is part of the platform’s “baseline strategy” creation which is followed by content engineering to add what collectAI managing director Michael Backes explained as “the behavioral economics, the psychology to help the debtor resolve the issue more quickly.”

After demonstrating a number of examples of personalized messages from collectAI including text and email, Krauel highlighted a handful of ways he believed collectAI would “reinvent the topic of debt collection and A/R management.”

First of all, we are not doing just debt collection. We do it very early in the process, we do the invoicing and also the dunning part. Number two, we are supporting a large variety of channels, digital and analog. Number three, we have the landing pages and payment pages to increase the payment conversion rate. Number four, we are a fintech startup. Of course, we have an API. And last, but not least, we have the AI and the AI is very important to really optimize every aspect of our product.

Following the company’s Finovate debut, collectAI was featured in Euro Finance Tech and in Digitale Leute, and discussed the “magic of AI” in the context of accounts receivable at the Retail Banking Forum in Vienna. This week, the company bested 47 rivals to win first place at the EXEC Conference pitch contest in Berlin, Germany.

Company facts

- Founded in 2016

- Headquartered in Hamburg, Germany

- Maintains 30 employees

We met with collectAI Chief Commercial Officer Steve Emecz at FinovateEurope and followed up with a few questions by e-mail. Here are his responses.

We met with collectAI Chief Commercial Officer Steve Emecz at FinovateEurope and followed up with a few questions by e-mail. Here are his responses.

Finovate: What problem does your technology solve?

Steve Emecz: collectAI helps customers digitize and optimize their receivables. We digitize with new ways to communicate like email, SMS, and messaging apps. We optimize using integrated digital payments – all supported by an artificial intelligence platform that automates and enhances the processes to make the receivables process much more efficient. collectAI provides everything from traditional mass invoicing to personalized and optimized service – i.e. getting your money faster, at lower operations cost and reducing service issues.

Finovate: Who are your primary customers?

Emecz: Any organization that sends bills to their clients (consumers or business) can benefit from enhancing the receivables process. Our main clients are those with lots of bills like utilities, banks, lending companies, e-commerce retail and digital clients, and insurance companies. It’s a white label service so the person receiving the bill simply sees the process improving from their supplier.

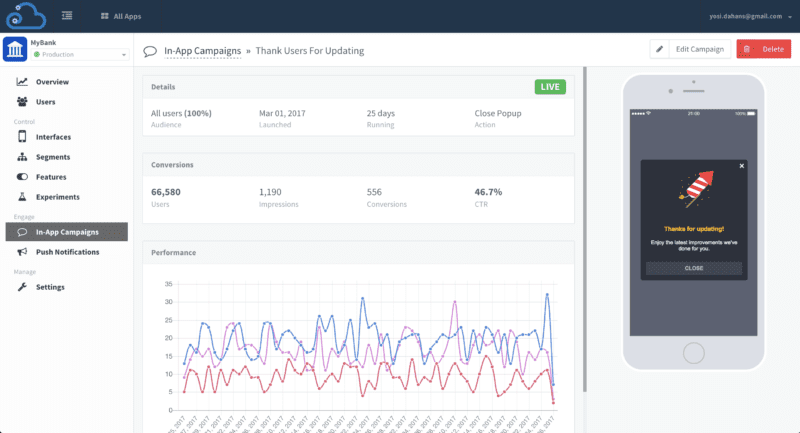

Pictured: collectAI’s Virtual Agent algorithms determine the channel, time of day, and other factors to enable greater personalization when building effective messages to debtors.

Finovate: How does your solution solve the problem better?

Emecz: Our platform helps select the best way to communicate to the client by channel (e.g. email, SMS, etc), time and content of message. We then enrich this with fast and efficient digital payment methods to settle the bills quickly and, if there is an issue, we provide a structured dispute resolution process to optimize client feedback. Finally, this is all supported by an artificial intelligence (AI) platform that learns from the behavior of the client and optimizes everything on its own.

Finovate: Tell us about your favorite implementation of your technology.

Emecz: We have a large payments client who has multiple retail brands within their portfolio where their invoices and reminders were all sent by post. For them, we have made three big impacts. First, adding in email and SMS reminders replacing some of the letters has reduced costs in their dunning process. Second, some of the amounts have been paid earlier. Third, we introduced a structured feedback process. Until now, all disputes came in via email or their call centre (and sometimes social media) at random in response to letters. We helped them free up valuable time and effort.

Pictured (left to right): collectAI’s Michael Backes (MD) and Mirko Krauel (CEO) demonstrating the Health Card feature of the outstanding payments portfolio.

Finovate: What in your background gave you the confidence to tackle this challenge?

Emecz: We have a rather unique setup. Our lead investor the Otto Group (turnover €12 billion) has over 100 businesses in the group with a long history of receivables, combined with an agile fintech company builder (Liquid Labs) with experience in artificial intelligence (AI). This means in our first year, alongside building a market-leading AI platform specifically for receivables, we have gained first-hand experience of the processes we are enhancing, with both internal and external customers.

Finovate: What are some upcoming initiatives from collectAI that we can look forward to over the next few months?

Emecz: Although we will continue to add things you can see, like more payment methods or communication channels, the real magic will be in the things you don’t notice: AI, self-learning landing pages, more backend services, and simpler integration.

Finovate: Where do you see your company a year or two from now?

Emecz: We plan to be the leading provider of receivables digitization and optimization services in Europe, expanding through partners into several new territories.

collectAI CEO Mirko Krauel and Managing Director Michael Backes demonstrating collectAI Claims Management platform at FinovateEurope 2017.

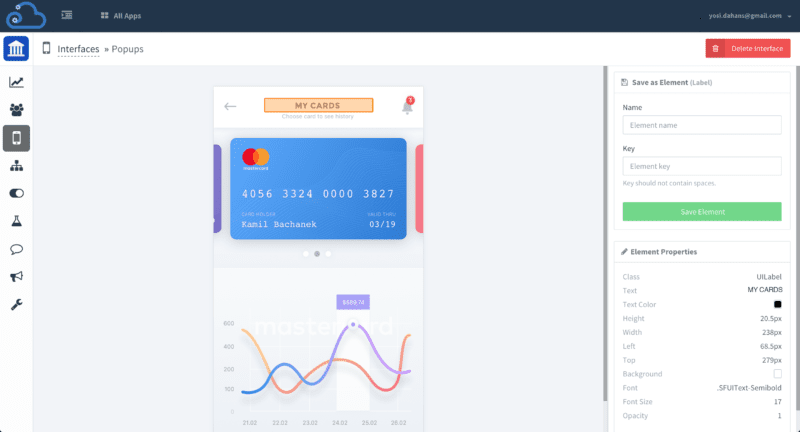

A look at the companies demoing live at FinovateSpring on April 26 & 27 in San Jose. Pick up your tickets today and save your spot.

few questions for Dahan by e-mail. Here are his responses.

few questions for Dahan by e-mail. Here are his responses.

We met with collectAI Chief Commercial Officer Steve Emecz at FinovateEurope and followed up with a few questions by e-mail. Here are his responses.

We met with collectAI Chief Commercial Officer Steve Emecz at FinovateEurope and followed up with a few questions by e-mail. Here are his responses.

Presenter

Presenter