The new partnership between advanced natural language generation specialist, Narrative Science, and investment analytics service provider, FactSet, will add automated portfolio commentary to the latter’s analytics and client-reporting platform.

Calling FactSet’s platform an “ideal match” for advanced NLG technology, Narrative Science COO Nick Beil said the integration would “reduce time-to-market, streamline client reporting, and raise the bar for prompt and comprehensive service.” Vice President of Analytics for FactSet, Ali Stewart added that with client reporting being a “rapidly evolving area of the market,” technologies such as those developed by Narrative Science are providing what Stewart called “a truly client-centric, cost-effective customer reporting solution.” Empowering investment managers with automated portfolio commentary, the new integration will enable companies to scale their reporting efforts to serve a larger and broader client base – and to do so within the monthly and/or quarterly reporting cycles customers and regulators demand.

In an infographic at the Narrative Science website, the company compares the current practice of creating portfolio commentary – from sourcing internal talent or finding able freelancers through the process of data access, drafting and reviewing, and publishing and distribution – to the process as run by the combination of solutions from Narrative Science and FactSet technology. What takes a team of human authors and editors as much as four work-weeks to accomplish is completed by FactSet Portfolio Analysis and Narrative Science’s Quill Portfolio Commentary in a matter of seconds.

Founded in 2010 and headquartered in Chicago, Illinois, Narrative Science demonstrated Quill Financial at FinovateFall 2013. Forging partnerships with Deloitte last October and with Franklin Templeton Investments last September, Narrative Science launched Narratives for Tableau back in August. The company has raised more than $29 million in funding and includes Battery Ventures, In-Q-Tel, Jump Capital, and Sapphire Ventures among its investors. We highlighted Narrative Science’s technology in our overview of artificial intelligence and fintech last month. Stuart Frankel is founder and CEO.

eToro

eToro Memento

Memento

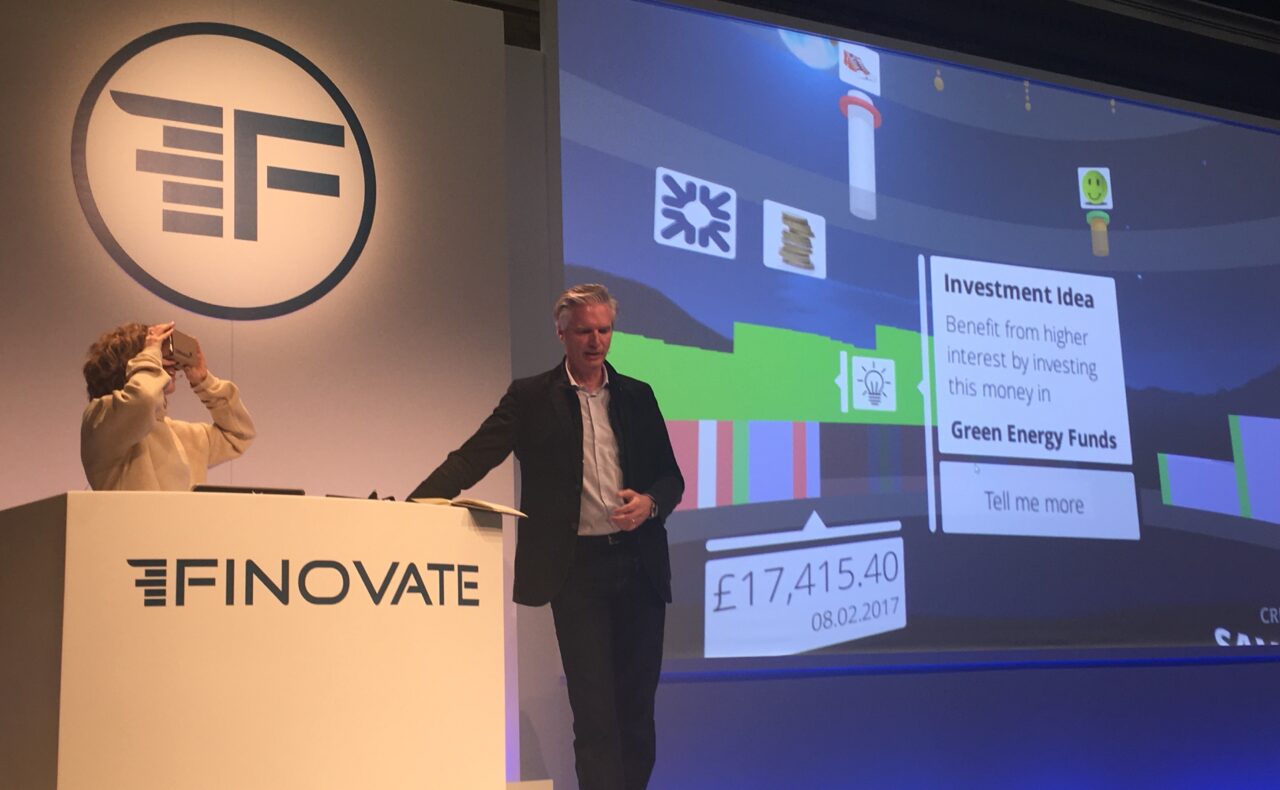

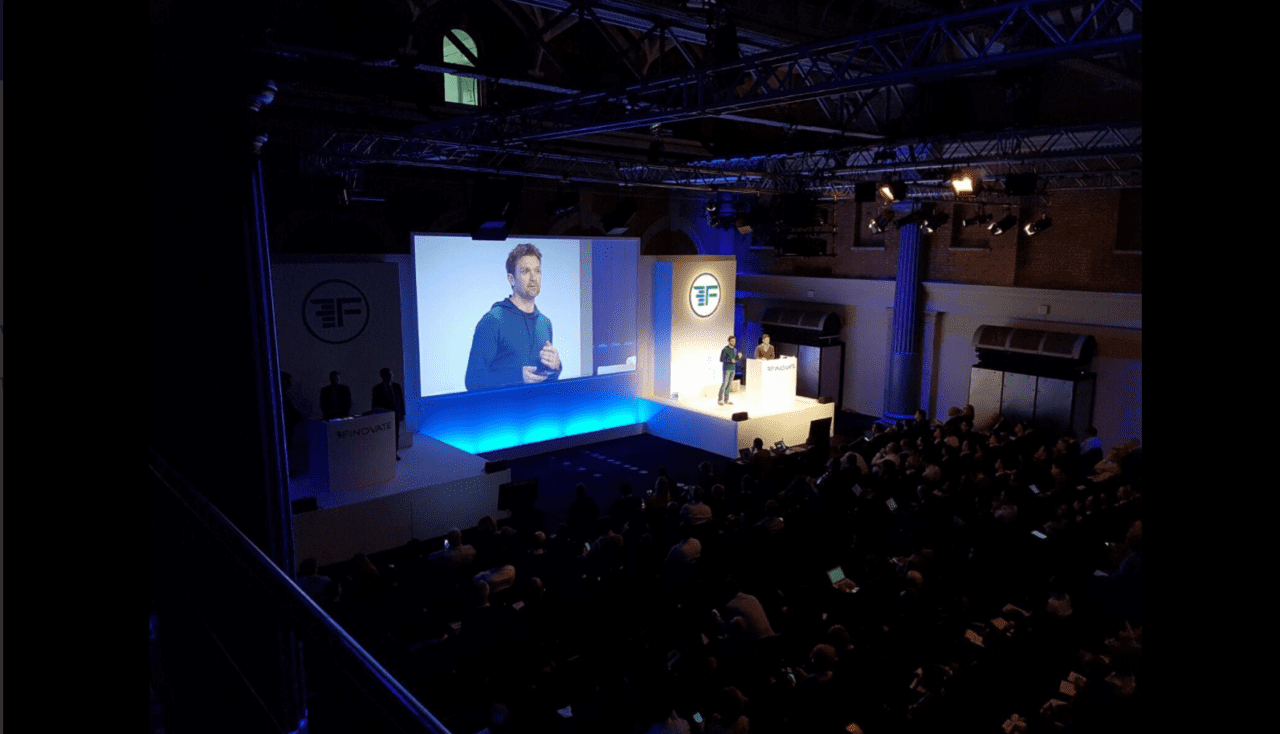

Leveris demoing its lending platform on the first day of FinovateEurope 2017 (photo credit: Paul Brennan @paulbrennan_3)

Leveris demoing its lending platform on the first day of FinovateEurope 2017 (photo credit: Paul Brennan @paulbrennan_3)